❗️ Palantir in the Danger Zone

↳ The price of expectations #79

Editor: Emanuele Marabella

PLTR 0.00%↑ stock is up ~150% YTD as the narrative shifted abruptly due to GAAP profitability and the spike in AI interest.

The current price is ~44% above the analysts’ consensus target of $11 per share.

Only Bank of America, after a recent update to an $18 price target (from $13) has an optimistic view, offering ~14% further upside from the current price.

This naturally raises a question:

Can Palantir’s stock keep growing or at least sustain the current valuation?

By assessing the valuation by Bank of America and its implied assumptions we can have a better sense of the degree of optimism of the proposed valuation and adjust our expectations accordingly.

Hi, I’m Arny. Thank you for joining 2.175 investors who receive the deepest Palantir research. Please hit the ❤️ button if you enjoy today’s article.

AI lift to $18

BofA rerated Palantir from $13 to $18 due to the emergence of the AI opportunity that consists of a positive tailwind for the business and the stock rather than specific business developments.

In other words, Palantir stock has become more appealing just for belonging to the “AI wave.”

In order to reach an $18 valuation, BofA used a Sum-of-the-Parts valuation similar to the one we performed last year. BofA’s valuation seems quite optimistic:

Bofa applies a 0.7x EV/Sales/Growth which is generous compared with the 0.4x Median SaaS multiple reported by Clouded Judgement.

The Sum-of-the-Parts method doesn’t include the effect of dilution, which should have at least a ~2-3% negative impact per year on the per-share metrics.

The Sum-of-the-Parts method is better to assess the “least valuation” when the stock is depressed rather than a target when the stock is already appreciated.

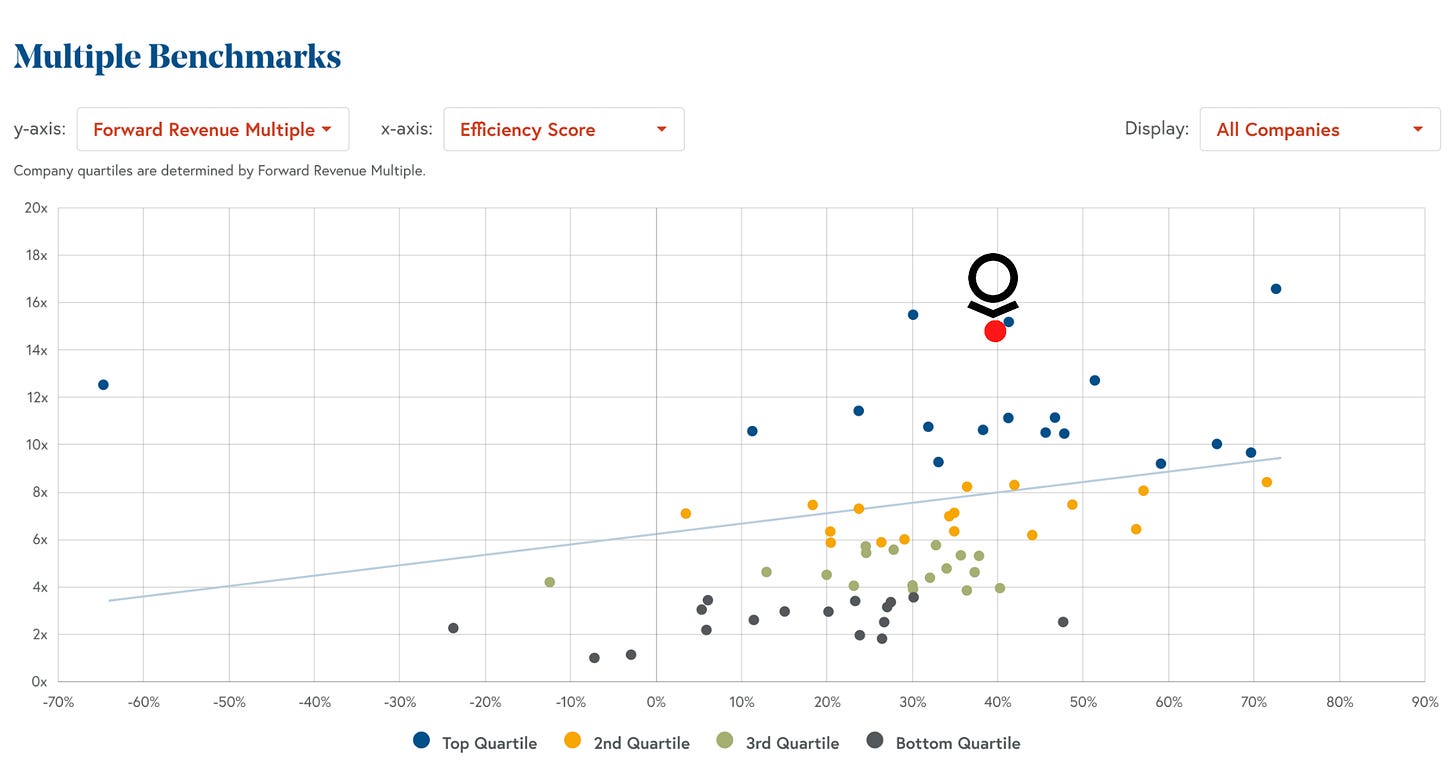

Palantir currently trades at around ~15x EV/Sales which is already a lofty premium compared with other SaaS peers having a similar financial profile of Revenue Growth and FCF Margin.

Under a relative valuation framework, Palantir’s multiples have little room to further appreciation unless the company shows clear signs of Revenue Growth acceleration.

“The next big thing”

BofA believes that the premium is deserved because Palantir is in a leading position in the AI Platform market, in which it has a ~10% market share, and faces an enormous opportunity in the related AI applications:

“According to IDC, generative AI platforms market will grow from $599mn in 2022 to $15,9bn in 2026, indicating a 126% CAGR. Palantir is the leader in AI platforms, with almost 10% of the market in 2021. On top of AI platforms, IDC expects the generative AI applications market to gro from $1.1bn in 2022 to $20.8bn in 2026, indicating a 110% CAGR. We think PLTR should benefit from this end-market growth through the industry-specific apps co-created in partnership with companies like Jacobs, Accenture or SOMPO.” - Bank of America

Furthermore, Generative AI, which Palantir entered with its new IAP product, is considered the “next big thing” and is expected to have a ~40% CAGR by 2026.

Reverse DCF on Bofa target

To better understand how optimistic BofA's target price is, we could deploy a Reverse DCF, which helped us see how pessimistic the price was last year.

A Reverse DCF shows us that an $18 valuation would imply:

25% diluted growth, which corresponds to a 28% Revenue growth with ~3% dilution. This is way superior to the ~15% diluted growth as of 23Q1.

22% FCF margin, which is in line with the recent past.

11% WACC, in line with other analysts, which could be decreased to 10% as shown previously.

5% terminal growth rate after 2033, which is not a conservative assumption as typically ~3% is used.

An $18 price for Palantir implies the business to restore its growth and sustain it for over a decade while generating strong after-tax FCF.

While I consider the scenario absolutely possible as I believe the business will eventually accelerate again to a 25-30% growth, as investors we need to acknowledge that the scenario offered by BofA is not a conservative case.

We still don’t have evidence that a strong acceleration in the business is in play.

Other analysts are still skeptical

The consensus fair value, calculated from the mean of the 16 analysts covering Palantir now stands at $11, which would correspond to a ~30% downside from the current price.

This is both a danger and an opportunity for a revaluation.

To assess this, we should look at which assumptions analysts imply.

Despite Palantir showing better than expected numbers in Q1 and the company providing slightly better Guidance for Q2 and FY23 backed by substantial demand, analysts didn’t change their expected numbers which hint at a ~20% Revenue Growth.

In other words, there is plenty of room for analysts to rerate the stock in the next 3-6 months if the acceleration of the growth is confirmed.

Conclusion

Palantir’s current valuation seems to offer limited upside based on a numerical standpoint. On the other hand, the “AI wave” is real and can be a major catalyst for the business that could restore the 30% target guidance or even above.

While Palantir is well positioned to accelerate, I encourage caution because there is still no strong evidence that Palantir is actually capturing the opportunity in the form of Revenue growth or very strong customer acquisition.

Palantir’s story is unfolding but the price asymmetry has reduced considerably. Therefore in the last month, I reduced my position to ~50% of the portfolio (from ~80%). I’ll leave the position compound and only act if I see real exuberance or if the price returns to an attractive level.

“The trick is, when there is nothing to do, do nothing.” - Warren Buffett.

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

CommonStock: @arny_trezzi

Thank you Arny for a very nice analysis. The “AI wave” will continue for a while and I believe that the best AI companies will benefit from it. In this case I believe Palantir is well positioned to benefit as well. I will continue to cautiously invest in it.

Thank you, excellent analysis.