Cloud + Defence = PLTR [Sum of the Parts Valuation]

Is the market currently undervaluing Palantir?

Editor: @Emanuele20x

Palantir has one soul, two bodies.

By assessing the individual value of each business, Commercial and Government, we can obtain a fair valuation for the Group by adding them.

In this article, we will perform a Sum of the Parts Valuation Model (“SOPM”), which is widely used by analysts. By wearing “Wall Street glasses”, we could better assess if there could be a potential upside from the relative valuation with Peers despite the strongly adverse market conditions.

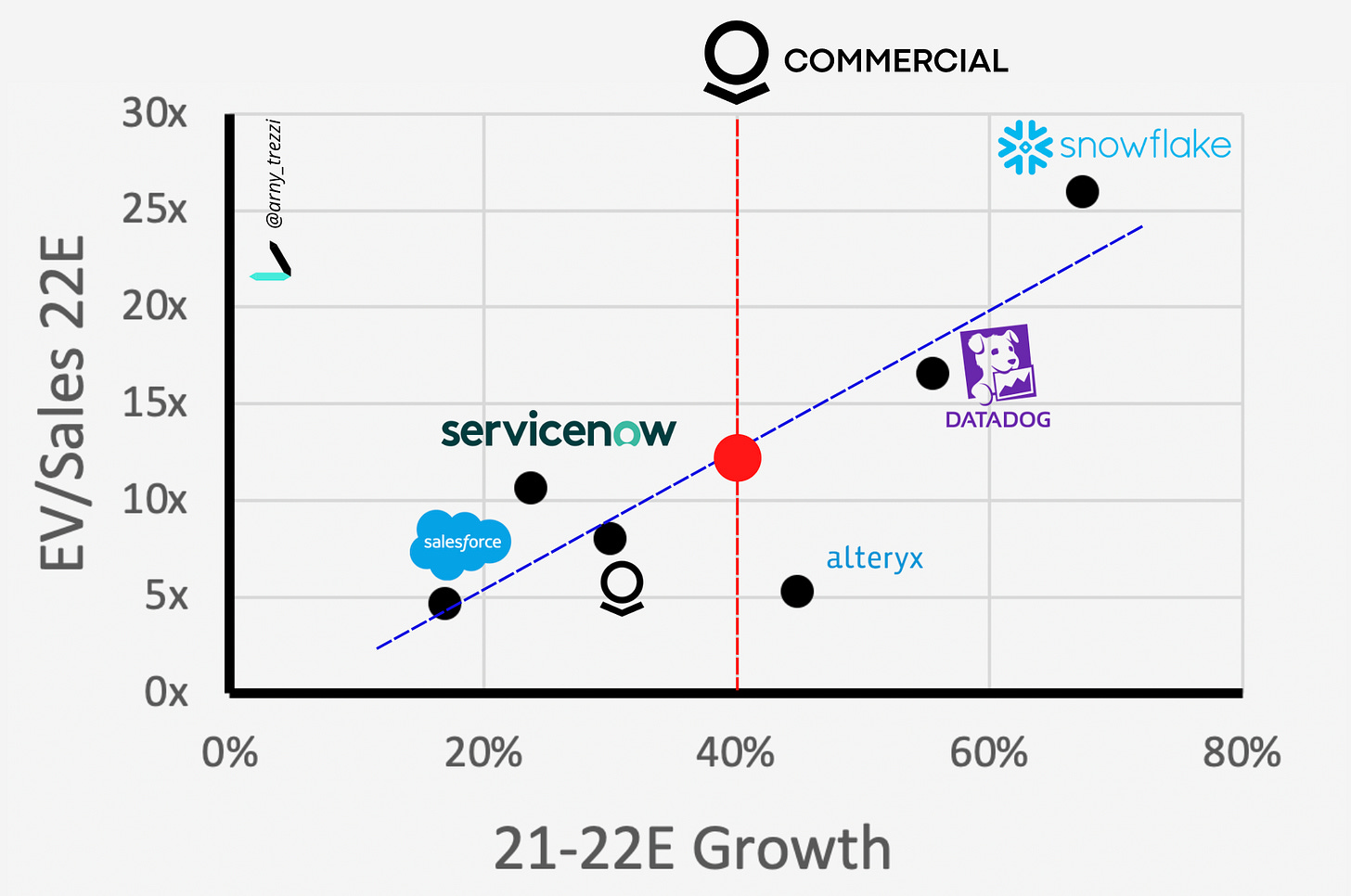

Cloud Peers

Palantir Commercial business has the steady recurring structure of the biggest B2B SaaS players while also approaching consumption-based pricing, which provides more growth potential.

Therefore the Cloud peers I chose are:

Salesforce; ServiceNow = B2B Leaders. Despite different products, Palantir has the same business structure (Seeking the Alpha: PLTR vs NOW);

Snowflake; Datadog = hypergrowth Cloud leaders. These companies successfully keep growing by more than ~60% per year;

Alteryx = B2B SaaS under $5bn Market Cap. It is useful for comparison because it has strong growth but a negative FCF margin.

As I shared previously (PLTR Deserves More), valuations in the Cloud sector are mainly driven by the mix of growth rate and FCF margin; the “Efficiency score”.

Higher growth rates + better FCF margins = higher valuations.

Compared to the selected peers, Palantir Group currently shows:

~12% slower growth. This is mainly due to the Government slowdown (Government Slowdown: Not Palantir’s Fault Only);

~9% better FCF Margin. This is obtained thanks to the high Contribution Margin, which comes from strong pricing power and faster software deployment (Palantir: This Time It’s Different);

Palantir currently trades at a ~36% discount relative to the 12x average EV/Sales ratio, despite having a similar Efficiency Score.

By focusing on the commercial side, Palantir Commercial Revenues grew 40% in the last twelve months, which is in line with the selected Peer average.

Palantir’s Commercial business deserves at least a multiple of 12x EV/Sales.

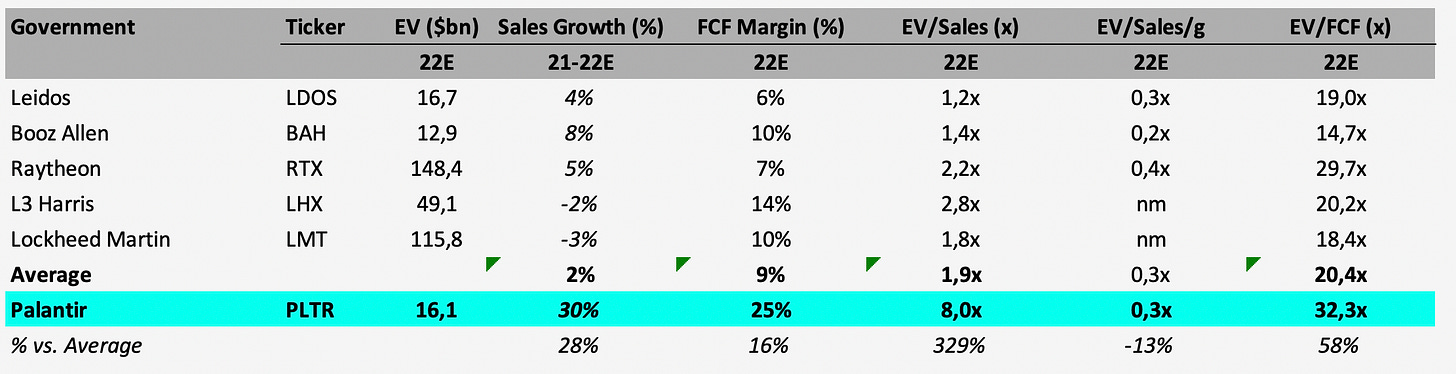

Defence Peers

As comparable companies for the Defence segment, I chose:

L3 Harris; Lockheed Martin; Raytheon = Prime Defence contractors. Palantir competes directly with L3 Harris and Raytheon on contracts. Lockheed is the benchmark Defence company.

Leidos; Booz Allen = major providers of National Security IT services. Despite the fact that they also provide solutions for commercial companies, their core business is focused on Defence.

Given the comparison with other Defence Peers, Palantir clearly has superior metrics and deserves a premium, due to:

Much stronger growth: ~30% Growth vs. ~2% Peers Average.

Much better margins: ~25% FCF vs. 12% Peers Average.

Despite operating in the Defence sector, Palantir has much stronger financials than Prime Contractors and leading National Security IT companies.

This means Palantir deserves a strong premium compared with Defence Peers.

Despite the slowdown to 21% in the last twelve months, Palantir Government clearly outperformed the almost flat or negative growth of its Peers.

Defence Peers, on average, trade at 0.3x EV/Sales/Growth. Therefore, from an extremely conservative view:

Palantir’s Government business should deserve a 0.4x EV/Sales/Growth at the very least.

Summing the Parts

We first need to select the growth expected for 2022. Conservatively, I chose the following growth rates:

40% Growth for Commercial (vs. 46% LTM);

20% Growth for Government (vs. 21% LTM).

With these growth rates, we could be conservative in our valuations even if both businesses slowed down in Q3-Q4.

If you would like to perform your own assumptions and help support my research, you could find the link to the Sum of the Parts Model below.

We can finally apply the selected multiples and obtain a valuation of:

~$11bn for Commercial @12x EV/Sales;

~$9bn for Government @8x EV/Sales or 0.4x EV/Sales/Growth.

By summing the two and the Net Cash expected at Year End, we would get a Valuation of ~$22bn Market Cap for Palantir, which hints that under these conservative assumptions, Palantir can be considered 20% undervalued, at least.

Context is key

For context, the Cloud sector to which Palantir belongs trades at multi-year lows. This is heavily impacted by the high-interest rates (PLTR Fights vs a Tough Competitor), which “hurt” the valuations of the so-called “growth sectors” like the Cloud.

This is a burden on valuations. Until the sector multiples recover, we can’t expect Palantir’s price to change significantly.

In the Sum of Parts valuation that we just performed, we chose 12x and 8x EV/Sales which could be attributed to “Top Quartile” Cloud companies, where Palantir belongs (Seeking the Alpha: PLTR vs NOW).

For Palantir to trade at significantly higher “fair multiples,” two conditions must be met:

Palantir should grow much more than the current ~26%. Related to the Government business, there are already very good signs the business could accelerate again due to the recent strong contractual activity (PLTR: It’s Raining). On the Commercial Side, the key growth potential is in the US, where Palantir is acquiring significant clients which could move the needle (PLTR US Commercial is Taking the Lead);

Wall Street should return to an appreciation for the Cloud sector. While many weak Cloud companies will disappear, the best Cloud players that could help companies solve their most important problems could emerge as winners from the current difficult macroeconomic environment and receive premium multiples (Is PLTR Recession Proof?).

Conclusion

By assessing Palantir’s Commercial and Government business separately, we could see that there is some potential upside from a relative valuation framework.

Hints of a brighter future exist, but until those become financial numbers, it is difficult for Wall Street to justify a richer valuation.

Without strong numbers, it is hard for Wall Street to support a growth story.

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Business Email: arnylaorca@gmail.com

View expresses are my own and do not represent Financial Advice in any way.

I own (many) PLTR 0.00%↑ stocks.

This is a heavy article 👏🏼

Top notch take, bravo, thank you! I did not see anybody around doing relative valuation on Palantir ... and especially via a Sum of The Parts Model by splitting the company in the 2 relevant segments which require way more work and diligence. Kudos!