Editor: Emanuele Marabella

Hi, I’m Arny. Thank you for joining 3.397 investors. Please hit the ❤️ button if you enjoy today’s article.

Subscribe to @arny_trezzi on X

Since Palantir became listed the dream of the “trillion-dollar company” has been persuasive. In 2021, when the Market Cap was ~$50bn, CEO Alex Karp claimed:

“There is no reason this company should not be 20 times bigger”. - Alex Karp, Palantir CEO

While the sentence probably referred to Revenue, which was ~$1.5bn at the time, most investors saw it as a hint about Palantir potentially reaching a $1 trillion market cap.

This sparked substantial debate.

Does Palantir need a consumer product?

I say NO!

Since 2020, Palantir investors seem to crave a Palantir “consumer product,” maybe a sort of digital assistant that helps us make better decisions while ensuring military-grade security.

While I consider the idea fascinating, I consider it a mere utopia for these reasons:

B2B and Government are already complicated enough to dominate;

Consumer products are centered on a completely different platform than B2B, where Palantir has no experience, nor has shown interest in pursuing.

A personal assistant for consumers would be completely out of the mission of becoming the “Operating System of the Modern Government and Enterprise.”

As a consequence, I believe it is extremely likely, that at a certain point an external company, entirely focused on B2C could leverage Palantir’s AIP and its security level to build a personal assistant service, rather than Palantir actively pursuing this path.

On the other hand, Palantir surprised us so many times, so never say never.

Does Palantir need a consumer product to reach a $ 1 trillion market cap?

Most of my X audience disagrees with my view, based on the observation that the big tech companies, now under the “Magnificent 7” acronym (Apple, Amazon, Alphabet, Nvidia, Meta, Microsoft, and Tesla), all have a B2C component.

The B2B market is considered “not large enough” to allow a company to reach the 13-figure goal. Is this really the case?

The purpose of this article is to provide a perspective based on raw numbers, which could serve as input for discussion, without including precise estimates.

$1 trillion worth of ingredients

To address the question of whether Palantir needs a consumer product, it can be helpful to evaluate what Palantir requires to achieve in terms of business results to reach a $1 trillion market cap.

In this assessment, the dilution has no impact as we focus on market cap terms. Dilution is crucial to consider if one is interested in per-share numbers.

Given the “normal” historical Price/Sales ranges, we observe Palantir could reach a $1trn market capitalization in different ways:

10x Sales on $100bn Revenue;

15x Sales multiple on $66bn Revenue;

20x Sales on $50bn Revenue.

Considering the most optimistic case of 20x Sales multiple on $50bn Revenue, Palantir would still require Revenue to 25x the current $2bn. Long way ahead!

Does Palantir have any chance to 25x its Revenue over the long run?

The biggest driver of Palantir's growth is the AI market, which is already a $170bn market, set to reach $1trn in 2032 growing at a ~23% CAGR.

I went into more detail on Palantir’s role in AI in this previous article:

Under the very optimistic assumption of 30% CAGR, Palantir could reach $50bn Revenue in ~12 years. This would represent ~2% of the AI market size by that time, which is a small fraction of the Total Addressable Market. I consider this a hint that the market is “big enough.” Ambitious, but not impossible.

Let’s take one step forward and try to have a sense of what is needed to reach $50bn Revenue.

To reach $50bn Revenue Palantir could require a combination of:

25k customers paying an average of $2mn per year;

10k customers paying an average of $5mn per year;

6.3k customers paying an average of $8mn per year.

Also here, I would call any combination, ambitious, but not impossible if we consider that:

in 2020 the average revenue per customer was $8mn;

the “pie” Palantir could capture naturally grows and the corporate world becomes more and more driven by software;

inflation and pricing power support gradual price increases.

Regardless of the combination needed to reach $50bn Revenue, those numbers are achievable only if Palantir becomes a truly dominant and recognized industry leader, legitimatizing its role as the “Messi of AI.”

So far we know Palantir can unlock immense value for customers thanks to its AI offerings, but it is very far from becoming a “standard.”

The fact that these ambitious numbers don’t seem absurd, in my view, supports the idea that the B2B component is “enough” to drive the business to $50bn in Revenue.

Note: $1trn being “possible,” doesn’t mean that it is a certainty. To reach this goal we need execution, execution, execution.

Palantir goes wide and deep

There are further considerations that could help assess the size of Palantir’s potential.

Salesforce CRM 0.00%↑ , the biggest pure B2B subscription SaaS generates $20bn Revenue and still grows at 10%-20%. This is a hint that a B2B company can reach significant Revenues without a B2C component.

Furthermore, Salesforce is a horizontal SaaS, meaning that its solutions are targeted to a wide audience of business users, notwithstanding their industry. So, whether you work for Coca-Cola or Airbus, the Salesforce platform is approximately the same.

This brings us to a peculiar observation:

if Salesforce can reach $20bn Revenue by having horizontal SaaS products, a company offering both horizontal and vertical software specific to industries can exceed those $20bn Revenues.

Veeva VEEV 0.00%↑ is probably the most classic example of vertical SaaS, which we can call “Salesforce for Healthcare.” We first mentioned Veeva explaining how Palantir monetizes Skywise:

Veeva operates in healthcare only and generates ~$2bn Revenue, which is approximately the current Revenue numbers of Palantir.

This is a hint that even vertical B2B software, typically considered “small niche players,” can reach substantial Revenues if they become the “standard“ of a sector.

Palantir is gradually proving that its capabilities are highly versatile and can help tackle problems in any vertical. No other company, to my knowledge, can offer such depth while being extended to almost any industry.

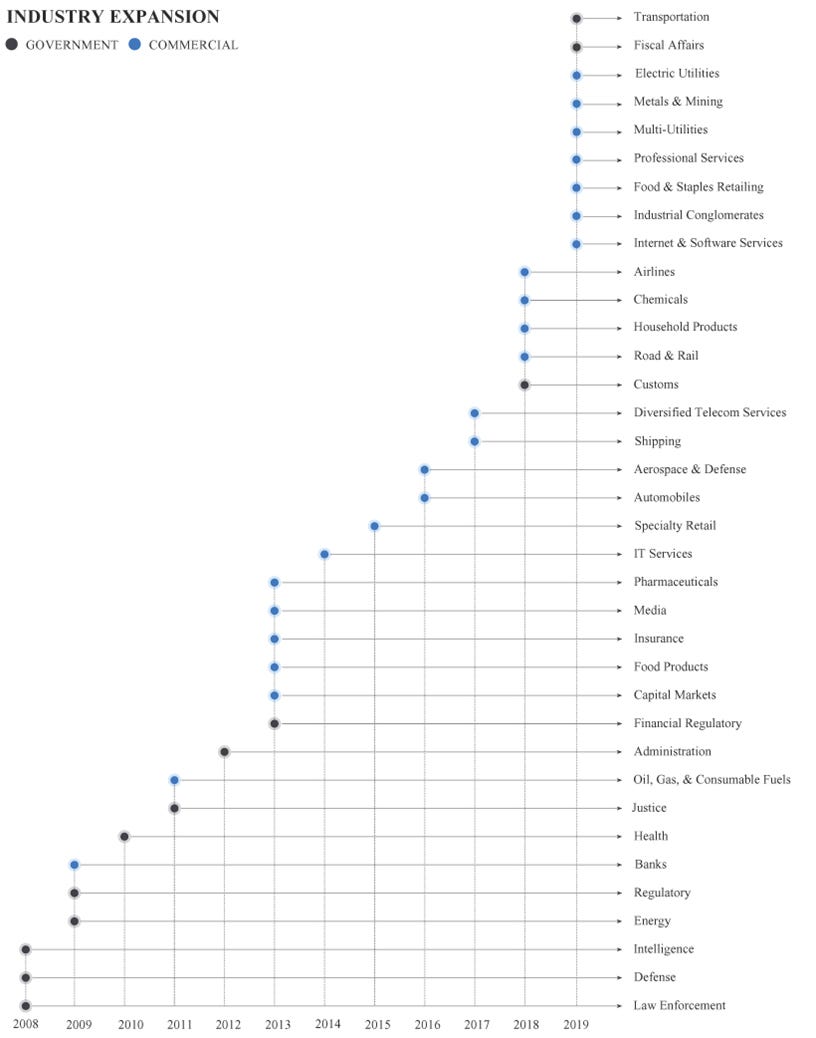

Palantir currently operates in more than 40 industries, offering both horizontal and vertical software:

In particular, what stands out for Palantir is its versatility: it can be deployed to:

facilitate the production of Panasonic batteries,

ramp up production of the Airbus A350,

and help BP extract more oil at a fraction of the cost.

As a notional example, imagine if Palantir could get ~$2bn Revenues, like Veeva, from each of the ~40 sectors it currently operates in: Palantir could reach ~$80bn Revenue by serving its corporate and government clients alone.

While not providing precise estimates, these simple observations can help us see that Palantir has “enough room” to reach the $1 trillion mark with its B2B / B2G business alone.

Conclusion

The 1 trillion dollar dream will continue to inspire investors' minds. With some simple and raw considerations, we can see the dream could be reached without the need for a consumer product.

Yours,

Arny

Reach me:

arnylaorca@gmail.com

Disclaimer: The views and opinions expressed above are current as of the date of this document and are subject to change without notice. Materials referenced above will be provided for educational purposes only. None of the above will include investment advice, a recommendation or an offer to sell, or a solicitation of an offer to buy any securities or investment products.

Literally started investing small amount in July of this year. Learning as I go. I have 1 share in Palantir as I guessed the name was from LOTR but knew nothing about the actual company.

Thank you for this. I think I’ll buy more shares now!!

I think PLTR could get there, and your excellent observations might be the roadmap.

I think they are going to find a way to get into smaller businesses that serve their largest customers for a nice, optimized supply chain.