Palantir's Skywise: the Runway to Monopolize the Sky

How Palantir seeks to monetize Skywise

Editor: Emanuele’s Notepad

Hi, I’m Arny 😊 Join more than 770 fellow Palantir investors spotting asymmetries. If you are new, you can join here. Please hit the heart button if you like today’s article.

Skywise is the most important commercial project Palantir has worked on. Understanding how Skywise works is crucial to understand how Palantir can generate further growth from it and from the various platforms currently being developed with other partners (Palantir Platforms Unleash Network Effects).

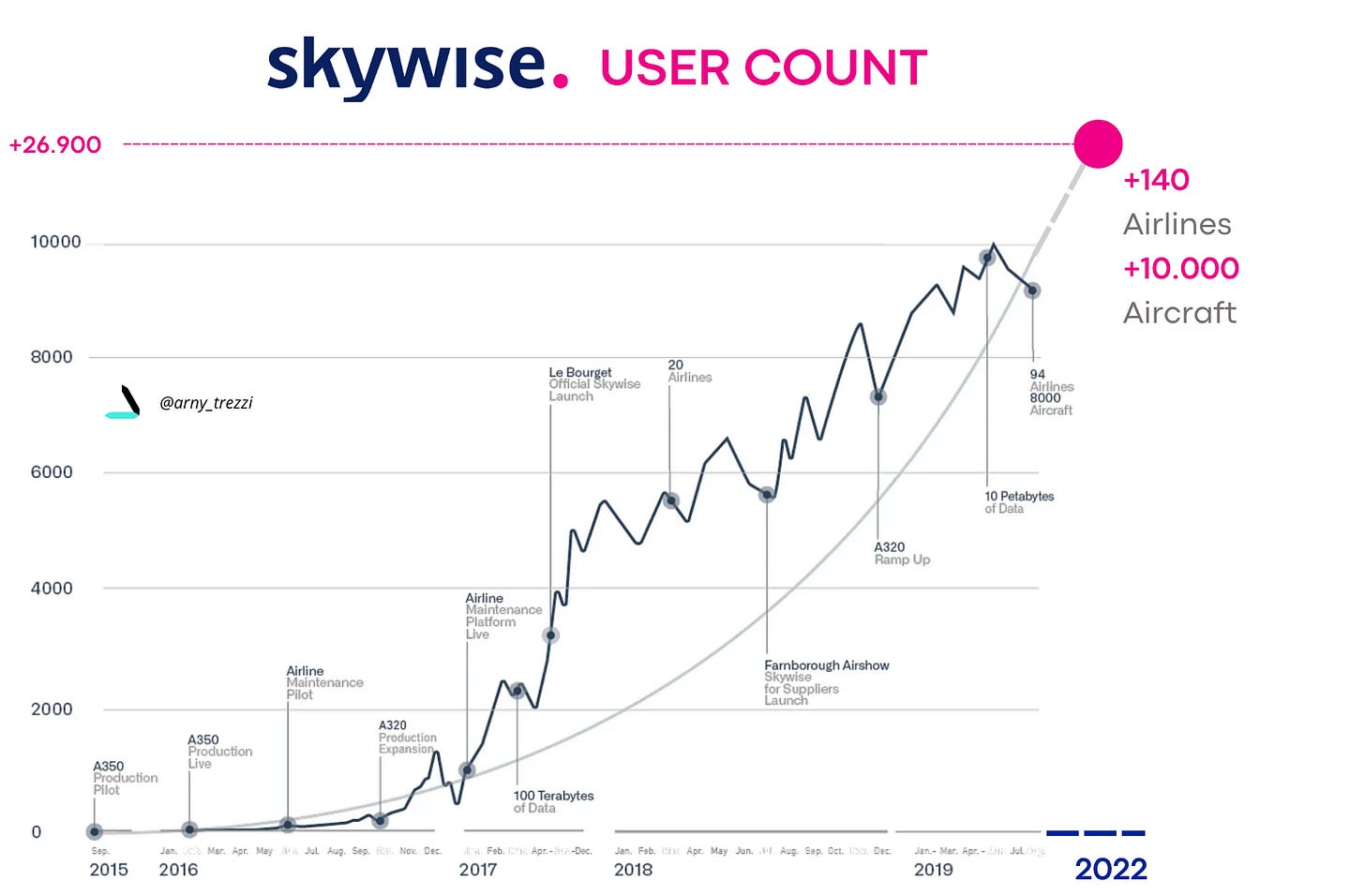

Skywise is the open platform developed with Airbus seeking to become the operating system for aviation. Born in 2017, Skywise connects:

+140 airlines;

+10.000 aircraft;

+26.900 users using the platform.

These few numbers show that Skywise is a success, which naturally leads to the following question:

How much money does Palantir make from Skywise?

Palantir doesn’t give a precise answer, but with the information available to us, we can support a reasonable hypothesis. Over time, as new information becomes available, we can test this hypothesis and eventually adjust it as necessary.

Additional Skywise licenses will benefit Palantir

Many people, including myself, until recently, thought that Skywise was just the extension of Palantir Foundry which Airbus seeks to propose to airlines as an additional platform. This is incorrect.

Skywise is Foundry adapted to Airbus for its internal use and then is gradually opened up to Airbus customers and suppliers.

Currently, Skywise is being used by over 26,900 users, most of which, are Airbus employees. In fact, over 20.000 Airbus employees (15% out of ~130k) are on Skywise.

This information is crucial when contextualized.

If we apply a $3.6k/year per user, similar to Salesforce's highest Enterprise tier, on 26,900 users, we get ~$94mn, which is in line with the estimated revenues Palantir gets from Airbus being one of Palantir’s top 3 clients. This is a hint that Airbus pays for Palantir licenses that are used both internally and “sold” to its clients when they purchase a plane.

If Skywise becomes more widely used, Airbus will pay Palantir more.

Therefore, Palantir’s goal is to empower Airbus with the best technology and support, in order for Airbus to reach more clients and expand existing contracts.

In line with the assertions above, Skywsise is offered to airlines as follows:

Skywise Core: free for airlines. This allows airlines to easily compare their fleet’s operating data against industry benchmarks. Airbus incorporates Skywise Core as an additional feature when it sells a plane, which is ~$100mn.

Skywise Premium: this is monetized as a software subscription service and includes Health Monitoring, Predictive Maintenance, and Fleet Reliability.

Interestingly airline clients don’t necessarily need Skywise Core to implement Premium.

Given the structure above, the Revenues generated by Skywise belong to Airbus. However, there is the possibility that Palantir takes a % from the subscription sales as a form of Revenue Share agreement. As Skywise becomes more important for Airbus I expect them to provide more disclosure on the terms.

Shortcut to dominate niche

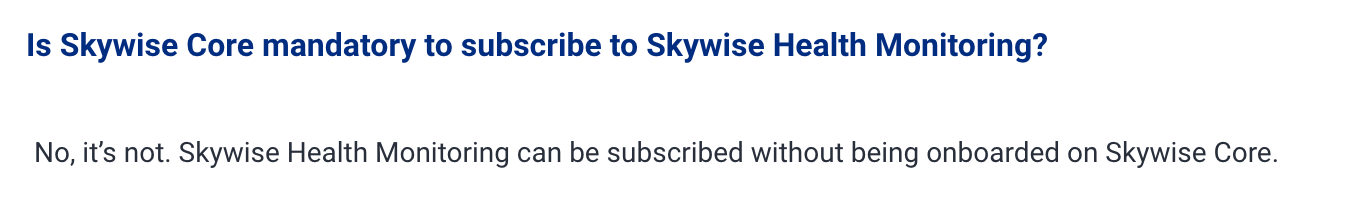

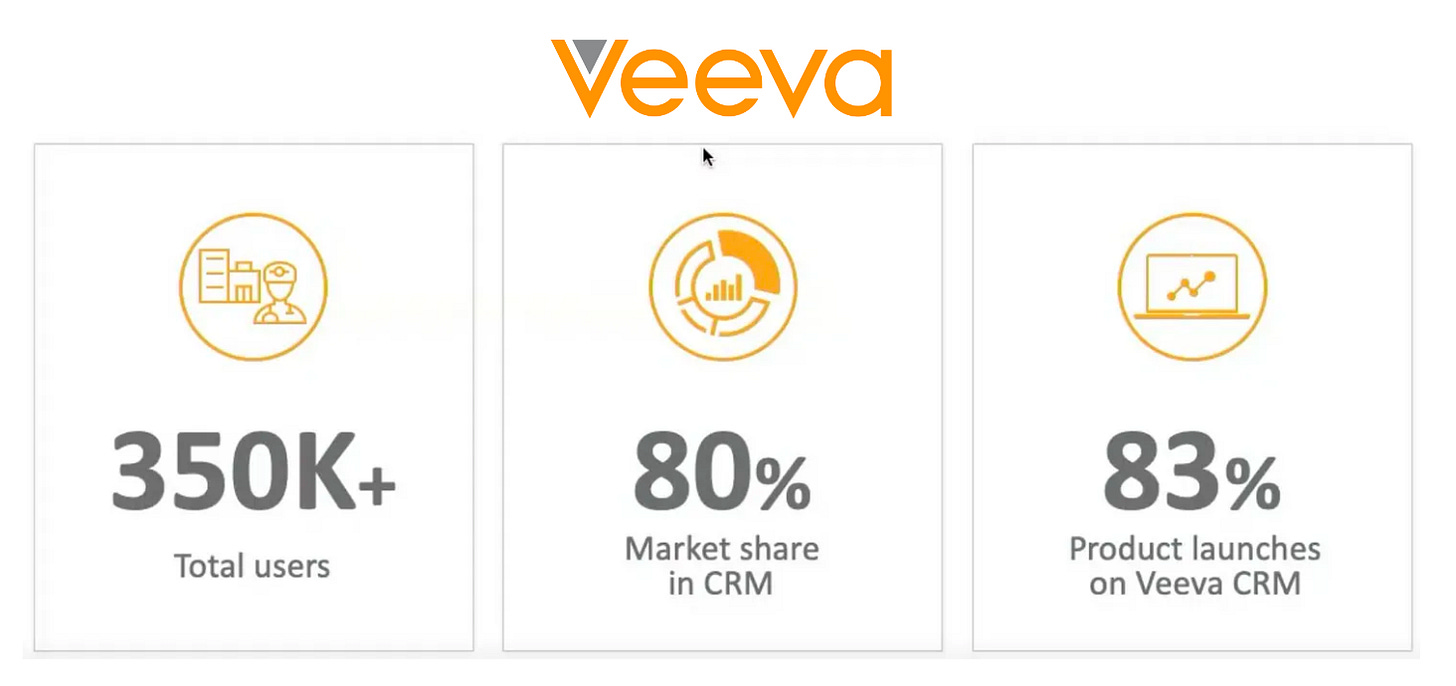

The partnership between Airbus and Palantir is comparable to the notable example of Veeva - Salesforce. Veeva is an American SaaS company focused on pharmaceutical and life sciences industry applications, whose flagship CRM product is built on top of Salesforce.

Salesforce is the backbone of Veeva CRM product, but Veeva tailored it to the specific needs of the healthcare industry.

In order to benefit from Salesforce’s infrastructure, Veeva pays Salesforce a “royalty” of $40-50mn per year, annually.

This agreement allows Veeva to dramatically cut development time and costs. By being focused only on serving healthcare needs, Veeva reached an astonishing 80% market share.

For Salesforce this is extremely beneficial because it is a way for them to penetrate a specific market, indirectly and generate a perpetual stream of high-margin revenues. Given this structure, Veeva can’t detach easily; Salesforce Revenues from Veeva are extremely sticky.

We showed that most Skywise users are Airbus employees and that, despite this not being official, the implied Revenues suggest that Airbus pays Palantir based on the number of licenses. Therefore the relationship between Skywise and Palantir seems comparable to the one between Veeva and Salesforce.

Skywise has been deployed by over 140 airlines in just ~6 years. To contextualize this number, consider that Amadeus has 210 airlines contracted for its Airline IT Solutions. Amadeus, one of the biggest IT European companies, is considered the monopoly of the aviation sector.

Before the pandemic, Amadeus had an EBITDA margin of ~40%, this is a hint of how a successful business in IT for Airlines can generate cash.

Skywise will open the doors to more Palantir Developments

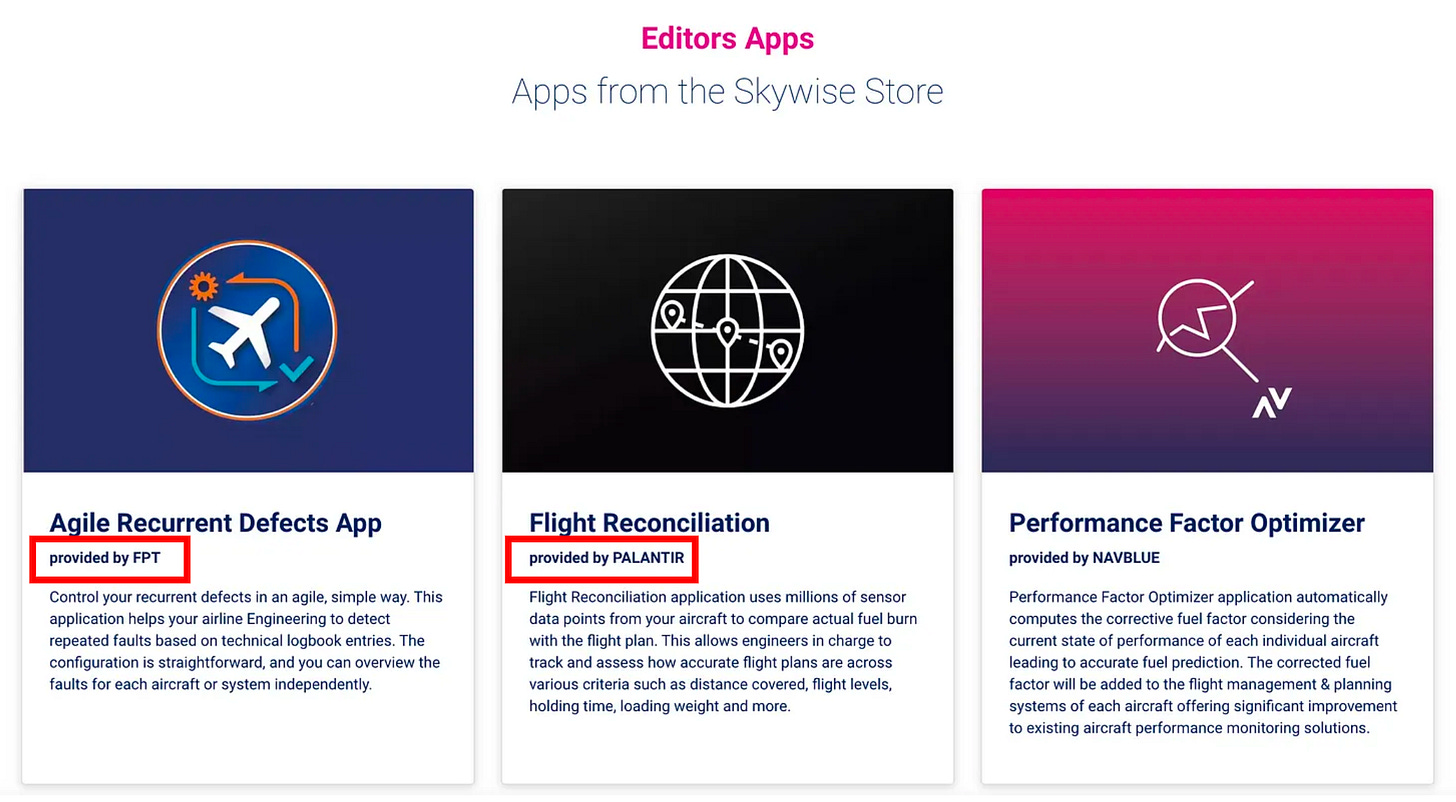

In 2020 Skywise introduced its App Store which now offers 19 applications. These applications are built both by Airbus (as of NAVBLUE) and by external parties like Palantir and FPT.

FPT is Palantir’s partner to sell Foundry in South Asia. This is a clear sign of emerging network effects which I previously discussed in depth (Palantir: The Biggest Networks Start Small).

This structure is crucial: we will likely see a similar development from the other vertical platforms. Palantir can have some tailored solutions developed on the App Store, but its strength is in creating a platform that facilitates the building and implementation of other solutions.

Airbus seeks to reach $10bn in Services Sales in the next decade. Skywise Revenue is the driver to reach this goal.

“Preparing the future of Airbus Services, at the Farnborough 2018 Air Show Airbus Presented its route to $10bn Revenues in the next decade.” - Airbus

Skywise Core [X]: different monetization layers

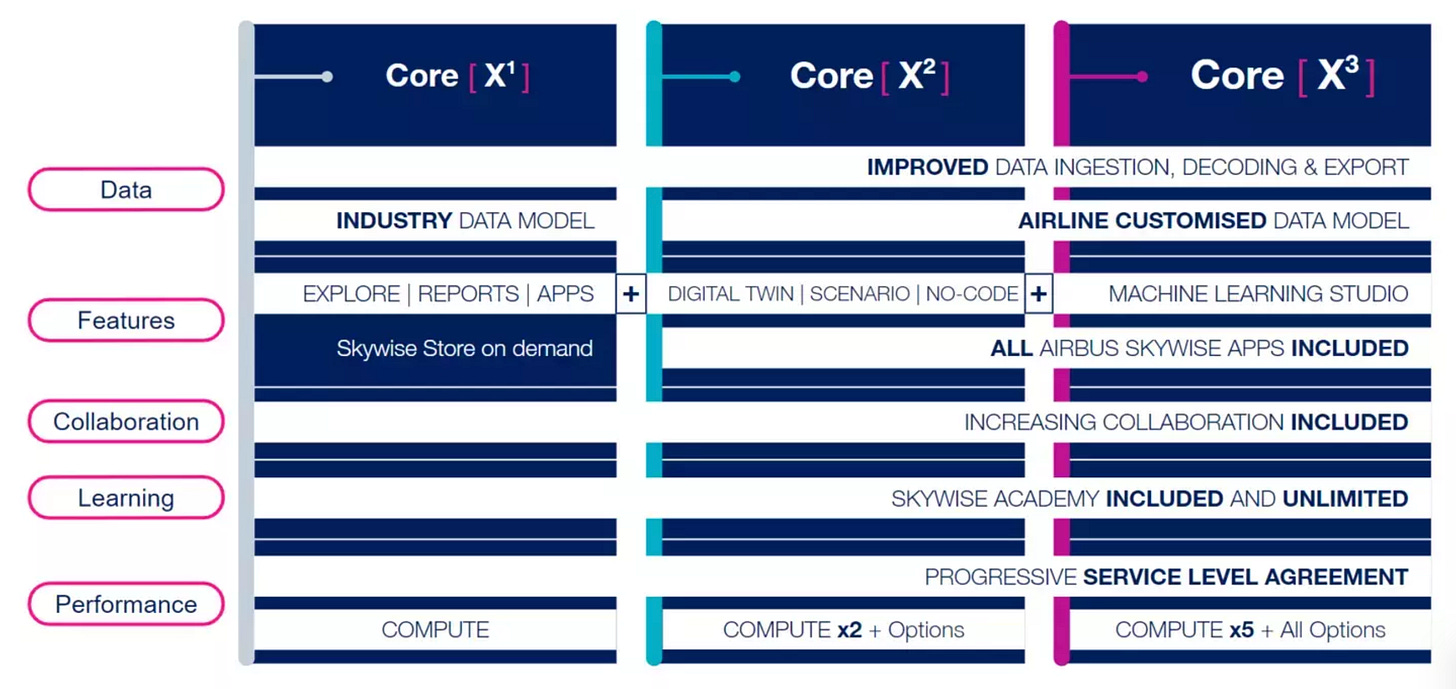

Skywise just released its next step in its monetization strategy: various subscription tier offerings to fit the different digital needs of airlines.

The new program is called Skywise Core [X] and consists of the layers of subscription:

X1 “navigate data”: data becomes visible and accessible also to non-IT users. This tier focuses on improving airlines’ data visibility by helping create dashboards and reports. Skywise Apps are available on demand.

X2 “navigate operations”: data becomes actionable between divisions and functions. This tier allows clients to download all the Skywise apps, develop custom applications quickly with low/no code, and create a digital twin of airlines’ operations to explore business hypotheses and scenarios.

X3 “navigate the uncharted”: make data proactive and discover things. This tier allows the exploitation of the full potential of digital twins with the support of AI/ML for predictive operating models.

As you can see, this offering perfectly matches the value proposition of Palantir Foundry.

This supports the idea that with Skywise, Airbus is implicitly a Palantir seller.

Conclusion

If Airbus successfully expands Skywise to its network, Palantir would benefit as more licenses are purchased and some additional revenues come from the apps directly created.

The more applications are built and the broader it becomes, the stickier it becomes and for Palantir, those will become “perpetual revenues.”

Skywise being the most advanced data platform offers the best picture of what we can see also from the other open platforms which Palantir is developing.

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Mail: arnylaorca@gmail.com

Join Emanuele20x on:

Twitter: @Emanuele20x

YouTube: @Emanuele20x

Substack: Emanuele’s Notepad

View expresses are my own and do not represent Financial Advice in any way.

I own (many) PLTR stocks.

Very interesting analysis, you highlighted a potential source of growth for PLTR that many could miss!

Great analysis as always!!