❗️ Palantir at $25? "Messi of AI" reality check

Editor: Emanuele Marabella. This article has first been published on Twitter/X (@arny_trezzi)

As we discussed a few days ago, the famous Tech analyst Dan Ives, Wedbush Managing Director, initiated the coverage on PLTR 0.00%↑ with a $25 price target.

While recognition from institutional investors is pleasing and necessary for the equity story of a company, I believe, with all respect to Dan, the report where Palantir is seen as the “Messi of AI” is more like an “AI candy” to stimulate the hype of institutional investors and retail around the stock rather than a detailed research report.

Hi, I’m Arny. Thank you for joining 2.576 investors who receive the deepest Palantir research. Please hit the ❤️ button if you enjoy today’s article and share it!

Here is why:

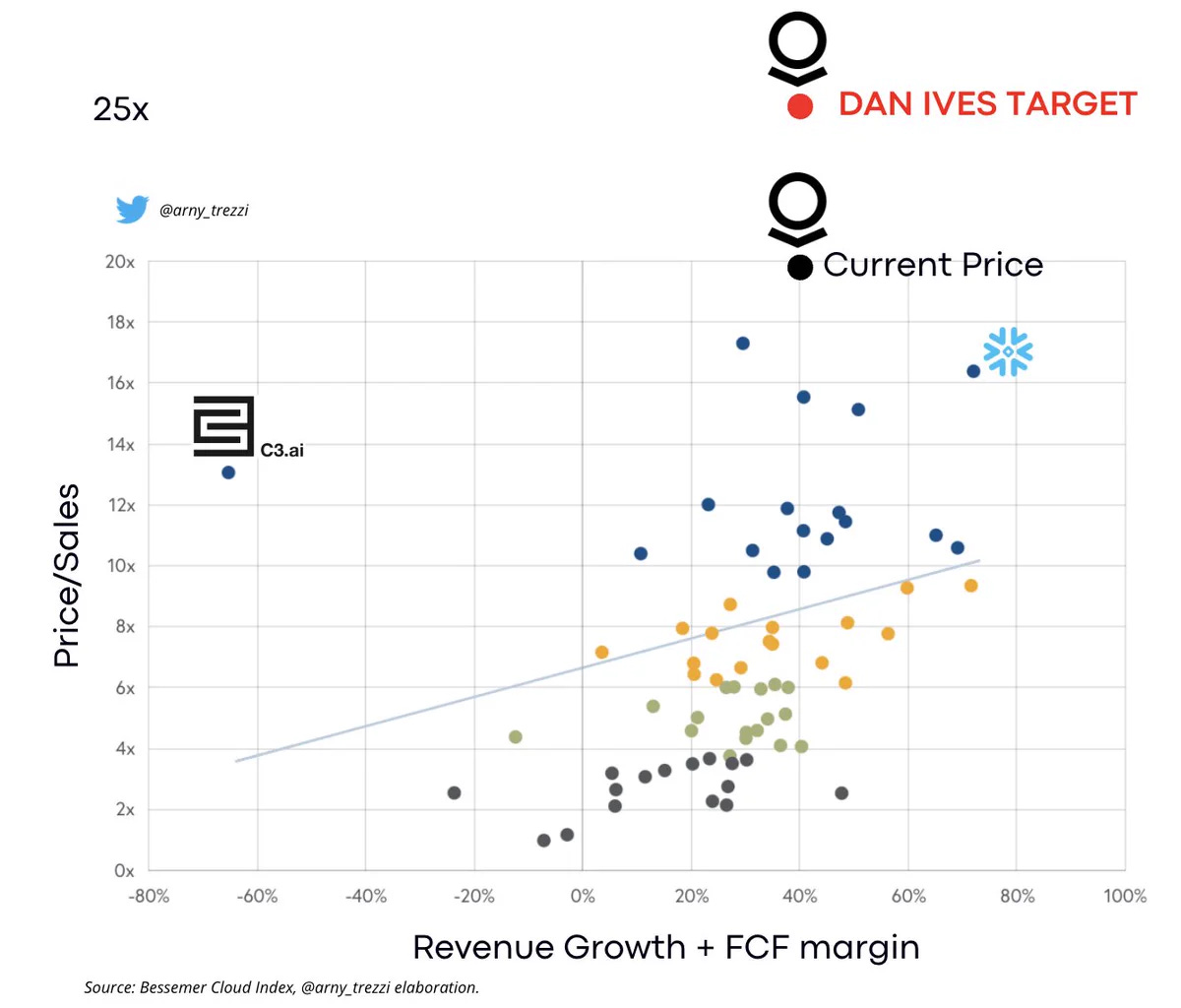

31% UPSIDE from a $25 price target implies a ~25x EV/Sales '23. Compared with its combination of Revenue growth and FCF margin, Palantir at ~$19 already trades at a substantial premium (~2x) vs. its peers with similar fundamentals thanks to the potential of the AI opportunity. A target price of $25 would push the premium even further. How is it justified?

NO JUSTIFICATION is provided on why the $25 valuation is achieved thanks to 10x 2027 Revenues. Why not 10x on 2050 Revenues? The report only affirms:

"Our $25 price target represents ~10x our FY27 revenue estimate of $5 billion at our bull case scenario." - Dan Ives, Wedbush Managing Director.

0% DILUTION estimated since the number of shares is fixed and the valuation is obtained on a Revenue multiple.

ZOOM AS A COMPARABLE. As a financial analyst, I learned the quality of a report is to be seen by how carefully comparables are chosen.

"AI" DIARRHEA. The term is mentioned ~80 times. However, no mention of relevant themes that could be discovered after simple research.

NO MENTION of NHS, War in Ukraine, TITAN, consultancy, FDE, IL-6, SPACs. Addressing these topics is key to understanding Palantir and related concerns.

NO RISKS EXPLAINED. The 3 risks underscored ("competition", "M&A integration", and "execution") could be applied to any company.

Summing up

The report sustains that Palantir is the"Messi of AI", which I agree with. I also agree that at a certain point, Palantir will reach and exceed the $25 valuation.

However, the report seems more of a marketing stunt to surf the recent hype around the stock rather than unbiased research. It would have been nice to have this report when PLTR was sub 6$ and not +$17.

In other words, be careful what you read.

Yours,

Unblocked Arny

Stay tuned on @arny_trezzi!

I think we will see some exciting news in the next 2 conference calls. I have conviction in the stock because they are the only company to provide their specific solution. It's difficult to call this capability something other than Palantir. Only a few will understand the value of bringing together disparate data sets to generatively provide valuable insights, that only Palantir can provide, without seeing it live and that's probably not going to happen soon. These use cases are highly contextual. They are changing the way hospitals are managed as we speak. We will eventually find the right analog. The iphone? Maybe. If the iphone were adopted 5 times faster? or 3 or 8? What is a capability that is a "must have" capability, that cannot be explained to people outside of a business. Personally I'd give it the Charlie Munger term - "is mispriced bet." This is where we are right now, it will start to explode upward one of the next three earnings calls. That's when it's an iphone moment, not until then. In years to come it will be called a Palantir moment. This thing that is happening with this offering in this market has no precedent. Be patient. But don't lose out thinking this is going to be just like something we've seen before. It clearly is not.

If you hate the stock so much why do you follow it with a stupid blog?