PLTR Dilution Tracker [Q2]

The SBC path towards "normalization"

Editor: @Emanuele20x

Stock-Based-Compensation (“SBC”) is often the key argument raised by PLTR 0.00%↑ opponents.

In the previous articles I shared:

how it works (When Will PLTR SBC Ease?);

how we should incorporate it into our models (Why 99% of PLTR DCFs Fail).

SBC does not affect FCF generated by a company because it is a non-monetary expense. However, it does affect investors.

Palantir relies heavily on SBC to compensate its employees. Therefore, it is crucial for us, as investors, to track the progress towards “normalization”.

Q2 Dilution Tracker

In the last quarter, SBC reached its minimum level since 20Q3. In that quarter, Palantir became listed with the Direct Listing (“DPO”). This caused a massive ~$850mn in SBC expenses mainly due to special RSU awards linked to the listing.

Since then, SBC has steadily decreased and reached a relative minimum to $146mn.

We could see from the chart above that the General & Admin contributions increased after the DPO. This is probably due to the opening or expansion of offices outside the US.

SBC as a percentage of Revenues is decreasing steadily and reached 31% as of Q2.

This percentage should decrease further and help attain GAAP profitability as Palantir scales.

Previously (When Will PLTR SBC Ease?), I underlined that under conservative dilution assumptions Palantir should be profitable by 2024-25. This is line with what Karp said:

“That combination of radical optionality on expenses and what we perceive to be macro conditions converging with product conditions allow us to kind of see what we think will be a profitable company in 2025.” - Alex Karp

Palantir vs Peers

Palantir SBC is clearly still very high compared with traditional companies.

However, compared with other peers in the Cloud space, we notice Palantir’s 31% SBC as % of Revenues is well below C3.ai (AI 0.00%↑ ) and Snowflake (SNOW 0.00%↑ ). Their SBC amounts are 43% and 48% of Revenues, respectively.

Interestingly, by comparing the same charts with Q1 results, we notice Palantir is the only company with a decreasing impact of SBC on Revenues.

How SBC Impacts Investors

As investors, our major concern should not be in the amount of SBC but in the net effect of the change in the number of shares.

Let’s assume a company grows 30%, like Palantir. The Growth per Share, or “Diluted Growth” for shareholders would be:

30% with no change in the number of shares;

~20% if the number of shares increases by 10%;

0% if the number of shares increases by 30%.

Value for shareholders is created only if the business grows more than it is diluting.

Palantir’s dilutive effect from the increase in share count is decreasing.

A wider divergence between the business growth and the dilution creates a greater benefit to investors.

This is why it is crucial for Revenues to accelerate (PLTR is Planting The Seeds for Exponential Growth) and the number of shares to “normalise” towards 3-5% at most.

You could find my DCF that incorporates the dilutive effects in the previous article (PLTR Reverse DCF: what does the current price imply?).

Incoming SBC

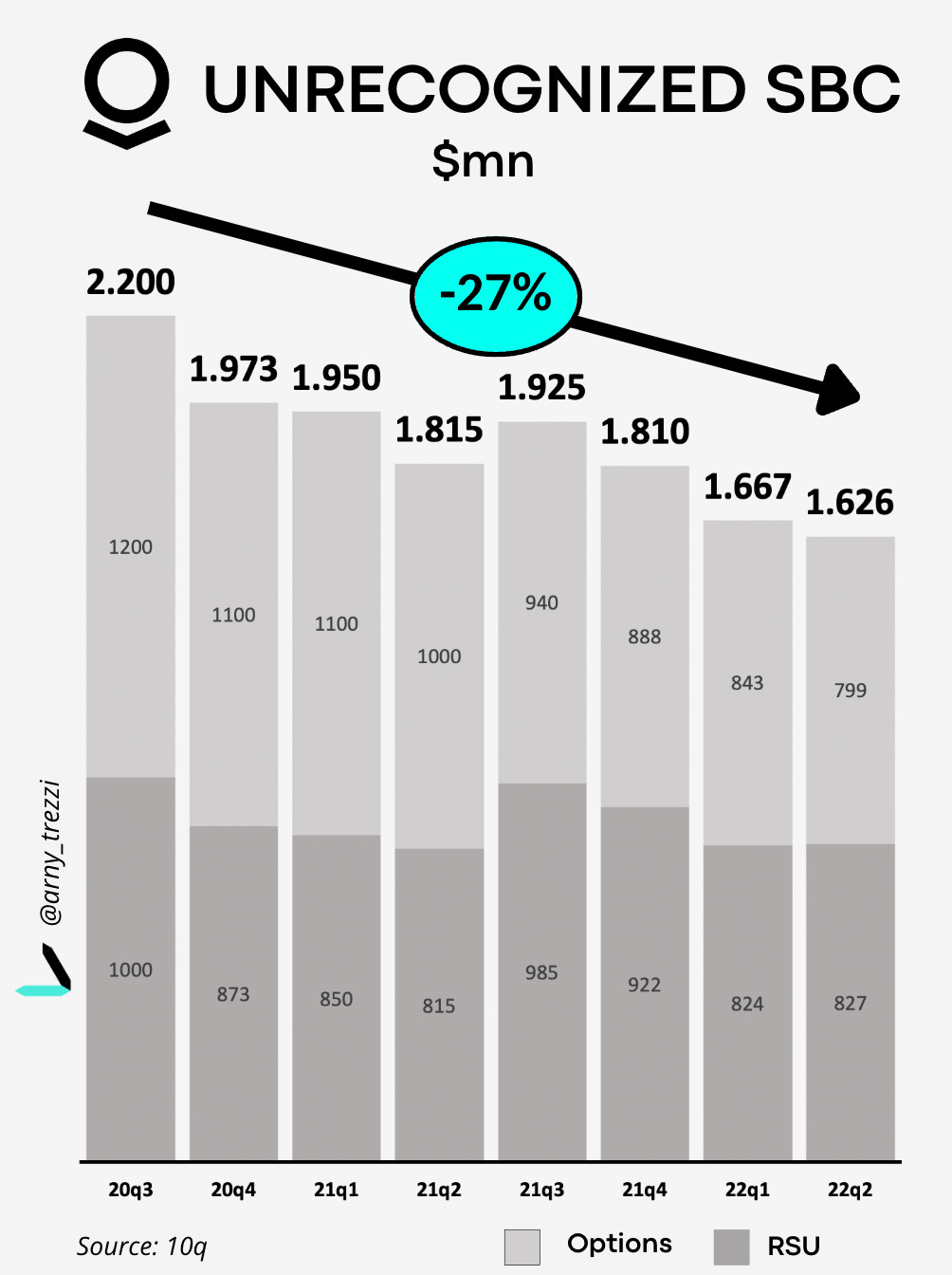

Unrecognized SBC is the amount of SBC that is yet to be recognized from the current SBC plans, which include Restricted-Stock-Units (“RSU”) and Options, as employees perform their job during the vesting period. Therefore, Unrecognized SBC hints at the direction of future SBC.

As of Q3, Palantir’s Unrecognized SBC decreased steadily and well below its peak of 20Q3.

Palantir currently has ~$1,6bn Unrecognized SBC. This is composed of $826mn RSU with an avg. vesting period of 3 years and $799mn Options with an avg. vesting period of 8 years. Therefore, we could expect RSU recognition to generate ~$70nm SBC per quarter (826/12), and Options recognition to generate ~$25mn SBC per quarter (799/32).

As a result, we should expect at least ~$90mn SBC per quarter from the recognition of Unrecognized SBC.

I say “the least” because as we go through the year, new grants occur, both from existing employees and new employees since Palantir is hiring aggressively (PLTR Hunting Season is Open).

Conclusion

Despite the fact that SBC doesn’t impact FCF, the derived dilutive effect is a real headwind for investors.

Therefore, as investors, our duties are:

consider it when we perform valuations (Why 99% of PLTR’s DCF Fail);

verify that the growth keeps outpacing the dilution;

track the rate of SBC as it heads towards “normalization” so that GAAP profitability can be achieved.

I aim to update these charts after the Q3 release.

Yours,

Arny

For creators: feel free to share my articles and charts. Please don’t forget to tag me!

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Instagram: @arnylaorca

Discord Channel

View expresses are my own and do not represent Financial Advice in any way.

I own (many) PLTR 0.00%↑ stocks.

great coverage on this key topic, bravo Arny & Emma, keep it rocking!