🌘 Palantir Q1: the Dark Side

↳ The Moon is not full #77

Editor: Emanuele Marabella

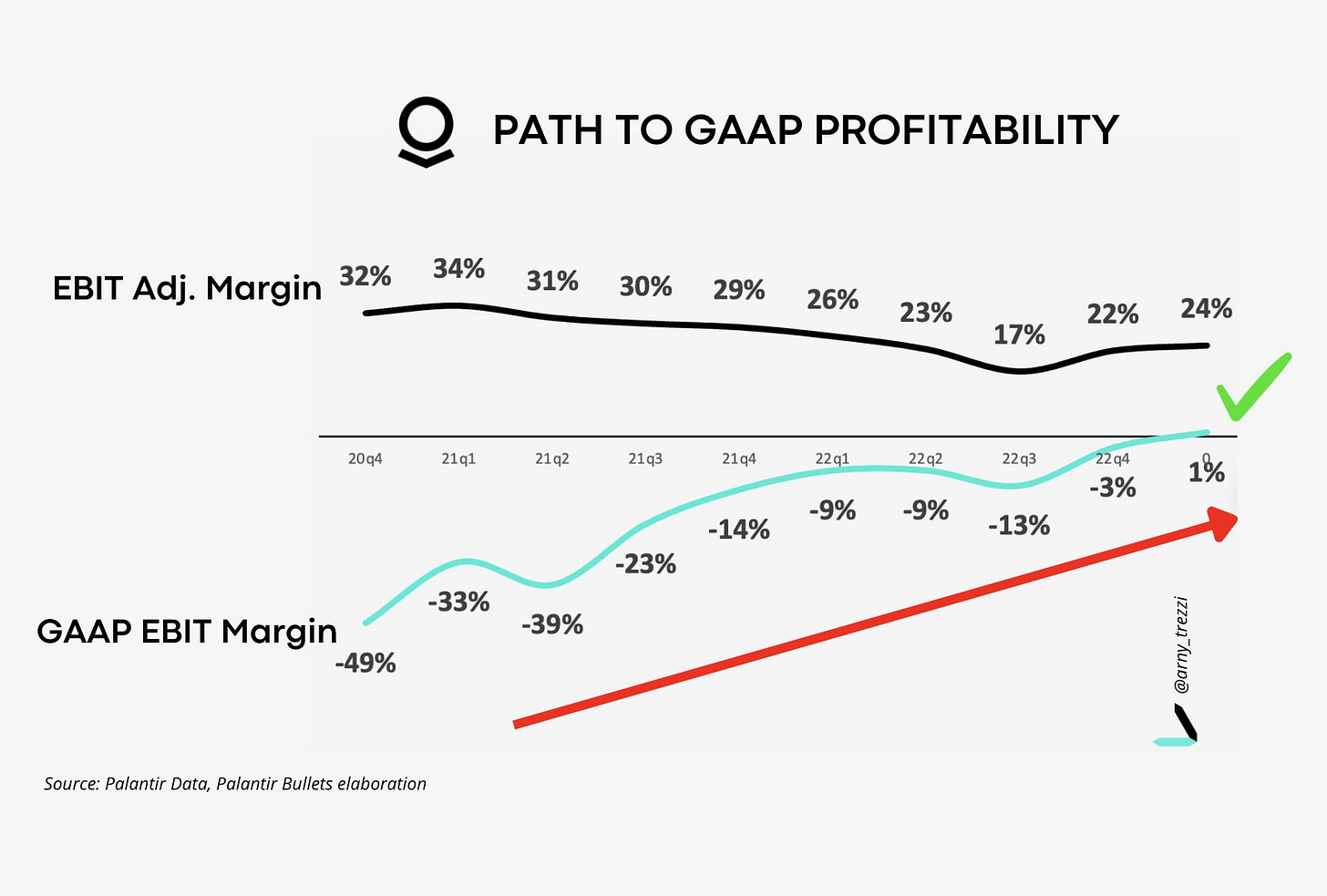

PLTR 0.00%↑ ‘s stock jumped more than 30% since earnings, celebrating the first operating GAAP profitable quarter.

This is a crucial milestone for the company’s story because it creates the basis to enter the S&P500, which, in turn, would attract a broader spectrum of investors.

Operating at a GAAP profit provides a strong signal on the quality of the business, despite from a substantial point of view, there is not a difference from the ~3%. GAAP loss of Q4.

The switch to profitability triggered an impressive positive reaction from investors and the media which supported very positive price action.

A stock bump is great; however, this is not an excuse to lower our guard.

In this article, we will assess the key concerns regarding the Q1 earnings. Assessing the dark side of a perceived brilliant quarter is essential to stay grounded and not jumping on the hype cycle.

For the highlights of the quarter, you can refer to the video below.

I’m Arny. Thank you for joining 1.817 investors who receive the deepest Palantir research. Please hit the ❤️ button if you enjoy today’s article.

Net Dollar retention decreased and touched a minimum of 111%.

This compares with ~131% as of last year, meaning that the existing clients expanded much less than the previous year. This dramatic drop could be attributed to:

the general slowdown of the overall SaaS market, as shared in the Q1 preview.

potential client losses, which, unfortunately, we can’t assess as Palantir doesn’t provide information on the renewal rate.

On the positive side, the new clients acquired in the quarter generated 7% of the Revenue growth, hinting that Palantir acquired some “big fish” in the quarter.

The number of new customers is low despite the new salesforce.

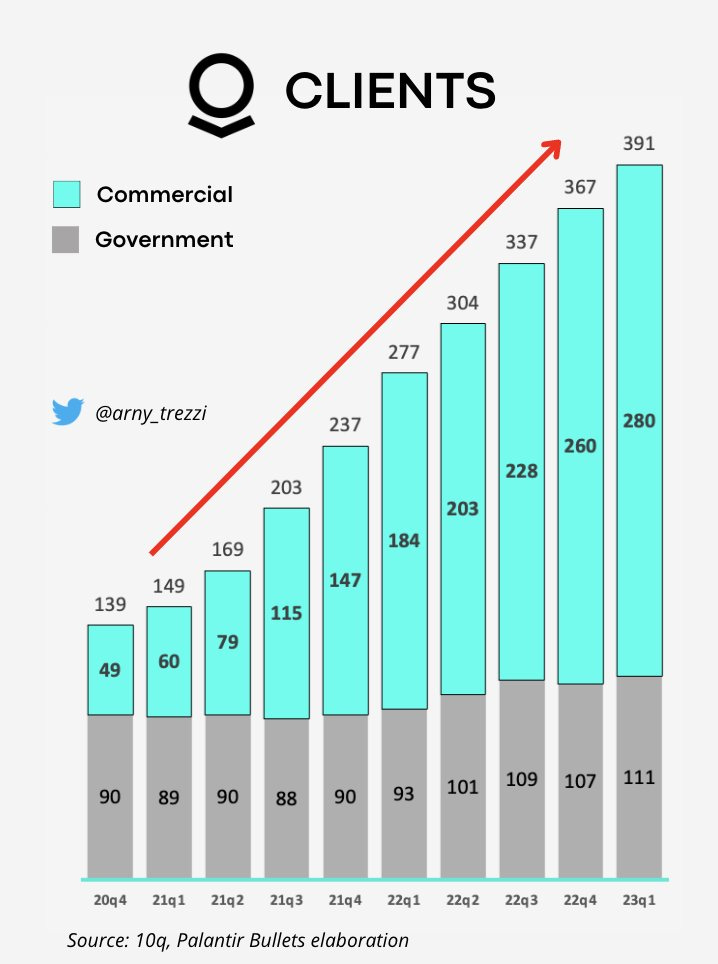

The total number of clients keeps increasing steadily and reached 391, which represents a 41% YoY increase.

The number of net new customers in the quarter is disappointing with only 24 new customers acquired in 23Q1.

This is well below the 40 customers acquired in the same quarter last year, which, thanks to the newly established salesforce, I expected to be exceeded.

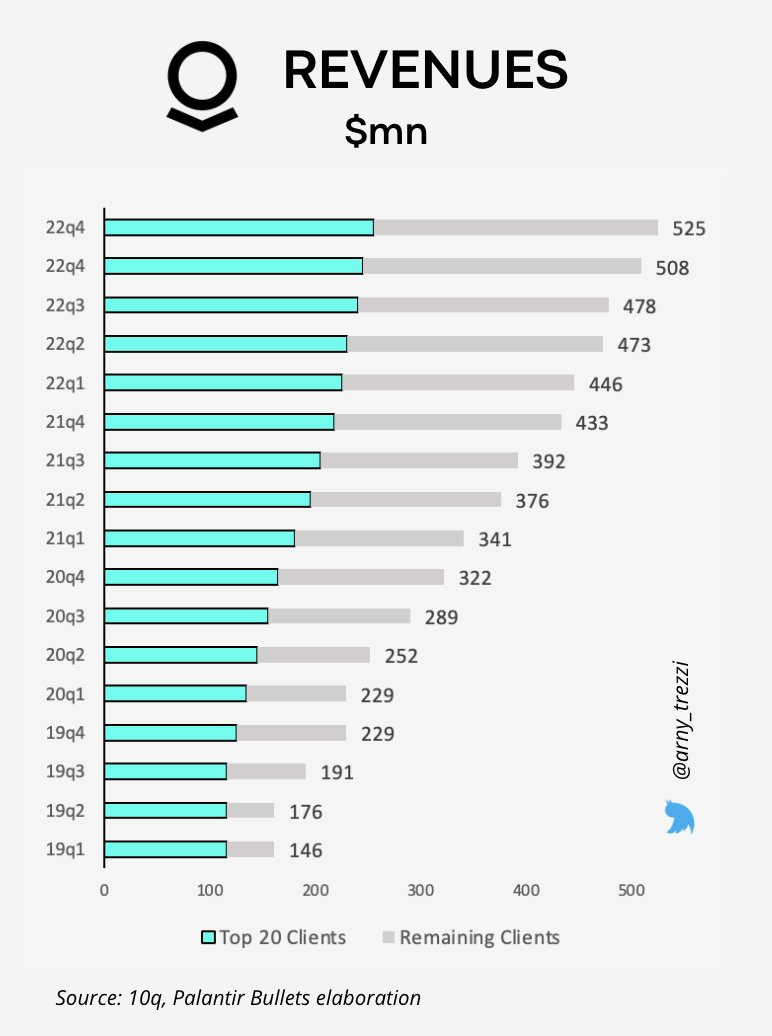

On the positive side, we must note that the key customers keep expanding, especially the top 20.

This is a precious hint, pointing towards the most entrenched clients with Palantir being happy to continue expanding.

An aggressive pricing strategy could mean Revenue pressure

Palantir seems to be willing to pursue an aggressive pricing strategy for its newly launched Artificial Intelligence Platform (“AIP”).

This, according to Karp would help Palantir acquire “hundreds of new customers.” Despite not knowing the details, an aggressive pricing strategy of heavy discounts or free usage, could result in relatively low Revenue growth in the first stage.

“Our strategy on AI is to take the whole market. We don’t have a price strategy. We're going to create a lot of value; we're going to get hundreds of customers and we will price it as we go. When you're ahead of the market you need to take territory.” - Alex Karp, Palantir CEO, Q1 Call

These lines are in line with what I shared multiple times:

Palantir is focused on maximizing client adoption, not Revenues or Margins.

My friend @vinceisbullish shared further precious details on these thoughts in the video below.

International business is lagging.

Revenues outside the US are still weak with a 9% YoY growth, compared to the 23% YoY growth of the US business, and not expected to recover significantly in the coming quarters due to a general reluctance to start significant digital transformation projects.

As a result, Palantir will focus its sales efforts in the US, which sees strong demand:

“In the US we're going to invest heavily. In places growing ten percent, we're going to reduce costs. There's no mystery.” - Alex Karp, Palantir CEO, Q1 Call

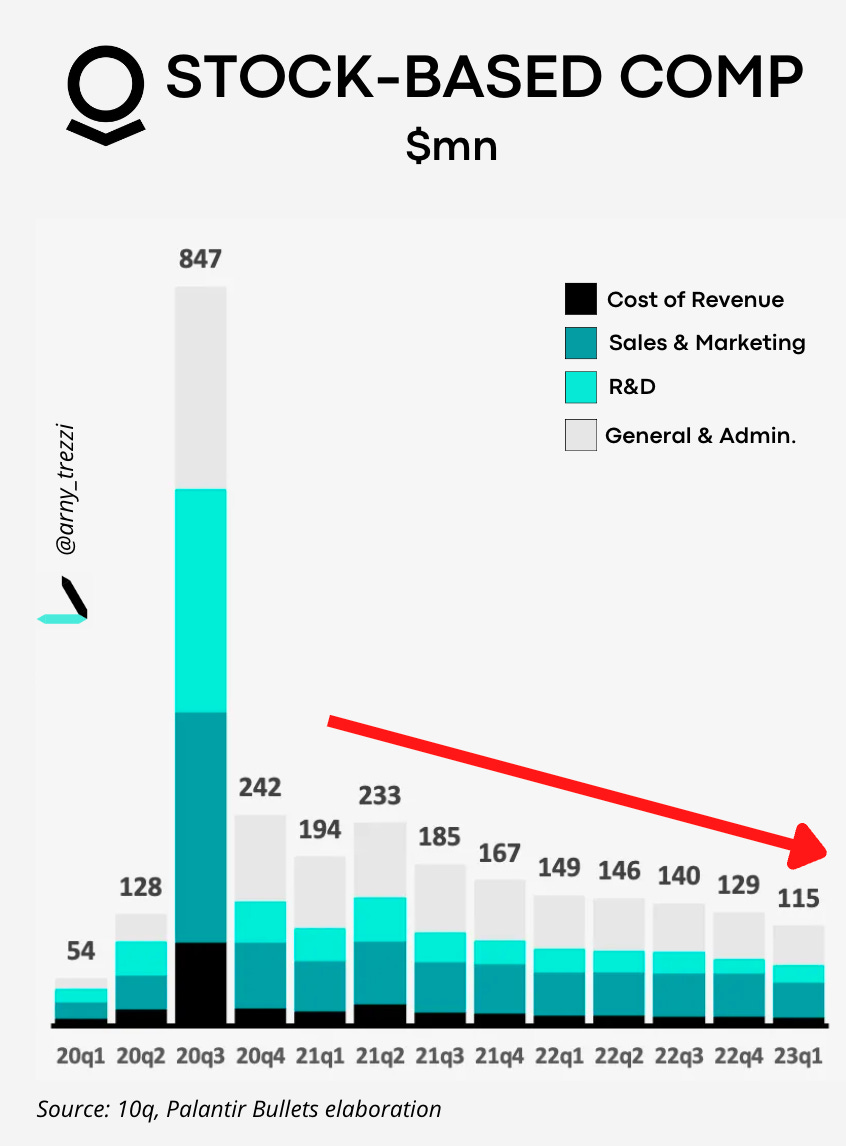

SBC is not over yet.

Decreasing Stock-based-compensation has helped Palantir achieve GAAP profitability, however, the downtrend seems to end.

“While we expect to see stock-based compensation expense trend up through the remainder of the year, we remain focused on GAAP net income and operating profitability.” - Dave Glazer, Palantir CFO, Q1 Call

My expectation is that they will adjust expenses and related SBC in order to stay barely GAAP positive on paper and reinvest aggressively in the business.

The RPO trend is relatively weak.

As deeply discussed in a previous article (Palantir: We Can See the Future), RPO, in particular, Current RPO, is the best hint of future Commercial Revenues because they are essentially “Contractual Revenues to be recognized in 12 months.”

Current RPO for 23Q1 increased by only 6% YoY, signaling weakness for future Commercial Revenues.

In line with the previous points, this could be due to an aggressive pricing strategy to acquire market share by focusing on solving clients’ problems, therefore “locking them” and extracting more Revenues in the future.

Conclusion

Despite the positive stock reaction, there are operating features that are far from outstanding and require close monitoring.

As investors, we should not let the recent hype obfuscate our judgment. On the contrary, it is crucial to keep a critical eye on the weaker points that could pose a risk for future results.

The results show improvement in all the key metrics, which is of primary importance, however, I consider the improvements disappointing compared to the full potential of Palantir.

This quarter was a victory lap, but the race is still a long way to be finished.

“You have a technology that will allow you to outproduce, change the margin of your company, understand your business, react on the battlefield quicker, and create software that is so obviously dominant that adversaries quiver. And there's one company in the world that is positioned.” - Alex Karp, Palantir CEO, Q1 Letter

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

CommonStock: @arny_trezzi

View expresses are my own and DO NOT REPRESENT FINANCIAL ADVICE.

I own PLTR stocks.