Palantir: We Can See the Future

These financial metrics help us see the future ahead

Editor: Emanuele’s Notepad

Hi, I’m Arny 😊 Join +850 fellow Palantir investors spotting asymmetries. If you are new, you can join here. Please hit the heart button if you like today’s article.

In this article:

Contracted Deal Value;

Deals Closed;

Government vs. Commercial Contracts;

Leading Financial Indicators.

By breaking down the financial metrics we can obtain precious hints about the future direction of the business. This is particularly true for software companies.

The last quarter was not exciting for growth, but we can’t ignore the elephant in the room:

Palantir closed a record $1.3bn Deal Value in Q3.

This is a 76% increase compared with 21Q3, which underlines how lumpy the Government's contractual activity could be.

While Palantir Revenues are extremely resilient, the contractual activity is extremely volatile.

According to the management, ~$900mn of the $1.3bn Deal Value comes from the US Government. From our previous analysis (Palantir: It’s Raining), we know the majority relates to Defense, for instance, the $229mn Maven contract, and the HSI.

Since Palantir is in a pure “growth stage,” the expansion of the client base and the related acquired contracts are more important than the past quarterly Revenue number.

Only if the contractual activity remains strong will Revenue targets be achieved.

Deals composition

The $1.3bn Deal Value was generated through 273 contracts (+63% YoY).

The breakdown provided shows that most of the deals were small in size. This hints that the process of becoming more “mass market” with modularization and consuption based pricing (PLTR is Copying SNOW’s Pricing Model) is in play.

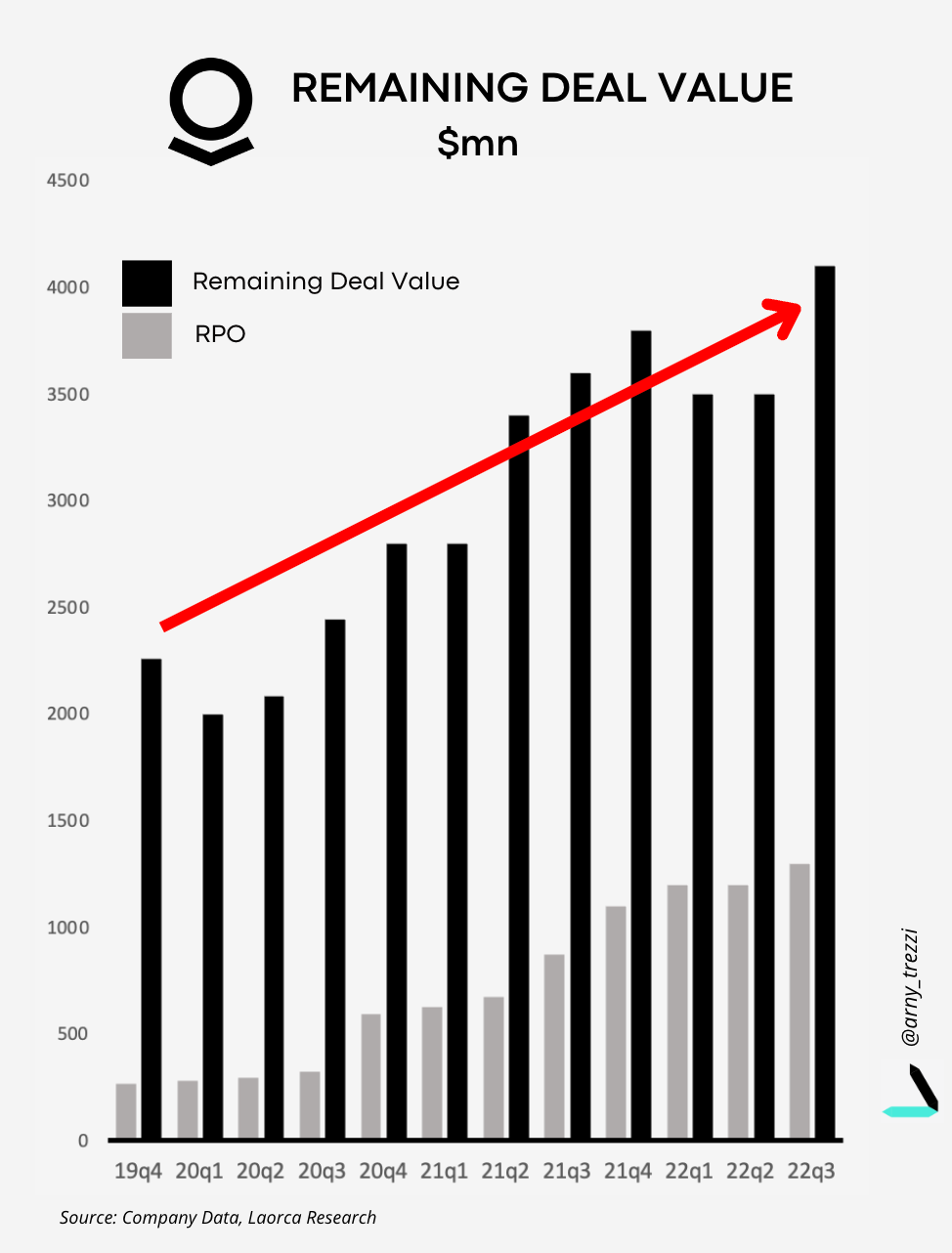

As a result of this contractual activity Palantir now has a $4bn Remaining Deal Value.

This represents a 14% increase against 21Q3 and 8% higher than the previous record achieved in 21Q4.

Does this mean we will see $4bn Revenues?

Contract Duration

Before going into the details, it is worth mentioning the length of the contracts.

As of 21Q1, Palantir’s contracts have an average duration of ~3.7 years.

The average contract duration is divided as follows:

~4.6 years for Commercial customers;

~3 years for Government customers.

Remaining Deal Value

The Remaining Deal Value represents the potential future Revenues from the active contracts.

However, not all Remaining Deal Value will be recognized as Revenues.

The $4.1bn Remaining Deal Value is composed of:

$2.8bn Contractual Options = clients have the option to activate their contract, but no obligations;

$1.3bn Remaining Performance Obligations = future Revenues under contract.

Contractual options: pay me maybe

From the S-1 filing, we know that most parts of the contractual options come from the Government segment.

This is due to the Blanket Purchase Agreements (“BPA”) which gives clients the optionality to execute 1-year “actions” over the length of the contract. According to the 10k, “U.S. federal government is prohibited from exercising contract options more than one year in advance.”

BPAs are established to cover recurring needs, purchases are also more likely to be in bulk and are backed by finite budgets.

Historically, ~56% of the Contracted Government Deal Value becomes Executed.

Therefore, we could expect ~$1.5bn Options out of the $2.8bn should be executed over the next 3 years.

This already gives a baseline of ~$500mn in Revenues per year.

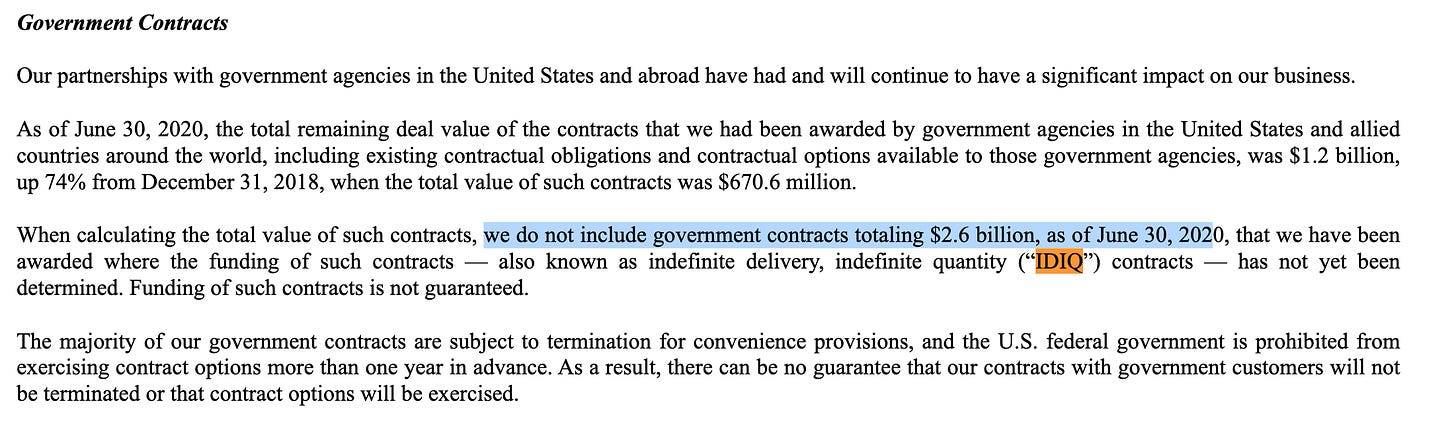

IDIQ: the hidden value

The reported Remaining Deal Value does not include an additional big component affecting future Revenues called indefinite delivery, indefinite quantity contracts “IDIQ.”

As of Q4, $2.8bn IDIQ contracts are not included in the the Remaining Deal Value.

Therefore, there is this additional layer of potential future Revenues. IDIQ relates to contracts that have been awarded but have not received funding yet.

Differently from BPAs, which focus on budgets, IDIQs focus on the term of the contract: during a fixed period of time the contractor is responsible for an unlimited number of separate projects or additional work on a current project. The pricing is not fixed as it can be scaled up or down according to budgets.

These contracts are common in Defense; therefore, they have a high incidence on Palantir’s Revenues.

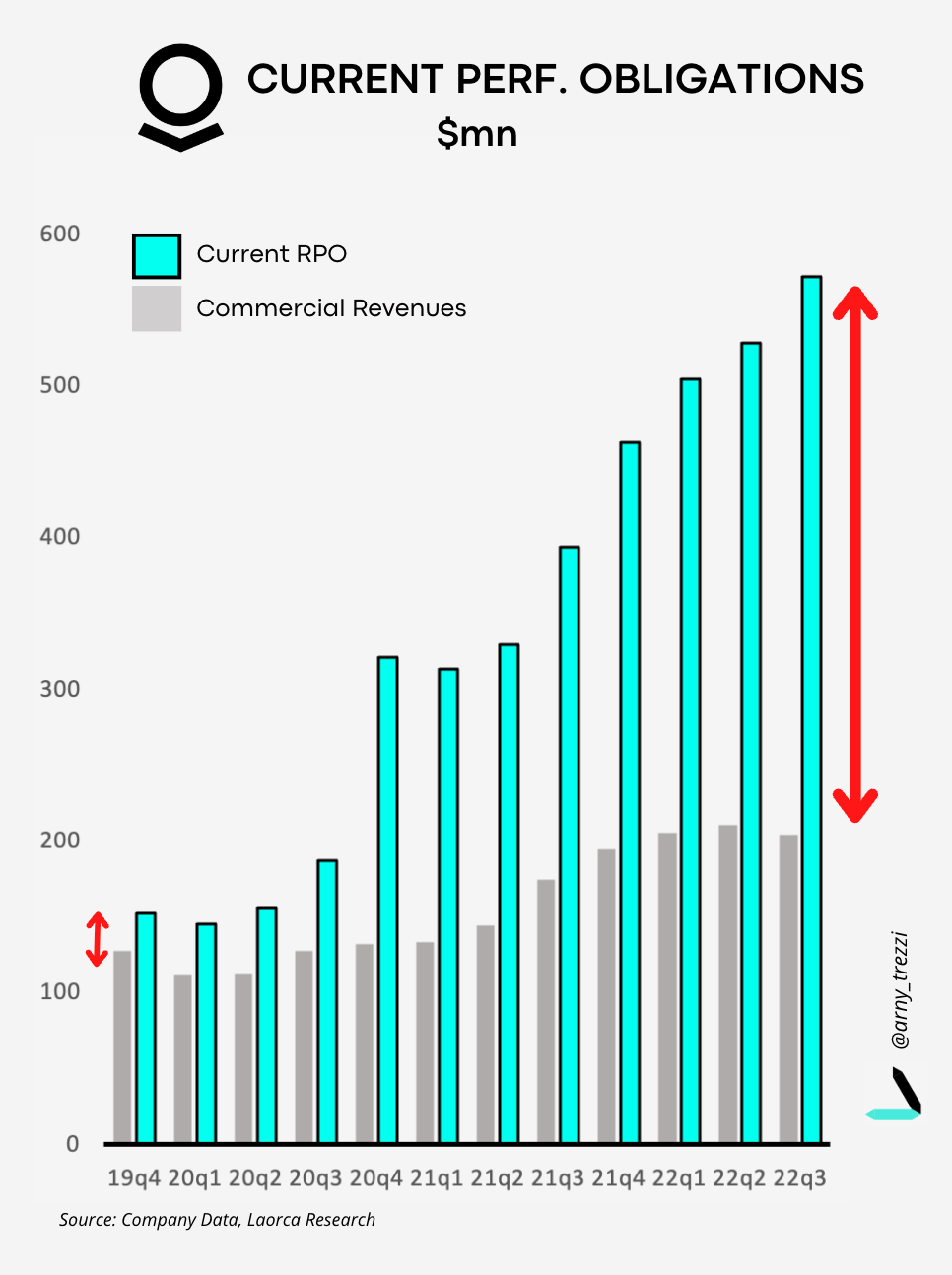

Remaining Performance Obligations: you will pay

Remaining Performance Obligations represent contracted future Revenues; therefore, they have an almost certain degree of recognition.

Revenue recognition occurs as Palantir delivers its software over the length of the contract.

As of Q3, Palantir has $1.3bn in Remaining Performance Obligations. This means that ~$1.3bn are contractually “sure” to be recognized as Revenues over the length of the contracts.

From the 10k, we know RPO is primarily referred to the Commercial business and does not include contracts with less than 12 months termination. This excludes most government contracts and consultancy projects, which are “on-demand” and don’t generate RPOs (Palantir: the QoQ Decline).

Therefore, we can consider RPO is the proxy of the future Commercial Revenues subscriptions.

“As a reminder, RPO is primarily comprised of our commercial business as it does not take into account contracts with initial term of less than 12 months and contractual obligations that fall beyond termination for convenience clauses, both of which are common in our government business.” - Palantir 10k

As a leading indicator, the assessment of RPO is crucial to understand the direction of future Revenues.

RPO growth is the prerequisite to future Commercial Revenue growth.

Specifically, the Current RPO provides the best indication of the Revenues coming in the next 12 months.

Current RPO: you will pay me soon

Current RPO (CRPO) is the subset of RPO that is going to be recognized as Revenues in 12 months.

Since RPO is mainly Commercial, CPRO by definition is also related to Commercial.

~$600mn Current RPO means that in the next 12 months, Palantir is entitled contractually to generate at least ~$600mn Revenues from the Commercial side.

As of 22Q3, the Current RPO represents 2.8x quarterly Commercial Revenues. This can be compared to 19Q4, which had the Current RPO at 1.2x quarterly Commercial Revenues.

The growth of this metric is absolutely crucial because it offers “visibility” into the future, which analysts and investors highly value in their assessment. Substantial growth in CRPO means that Revenues from Commercial subscriptions are set to increase in the coming quarters.

A strong trend in CRPO is a leading indicator for future Revenue growth.

This is the most precious hint we can get from the financials.

Investment banking analysts struggle to appreciate Palantir as a software company due to the “limited visibility” of Revenues. However, substantial growth in CPRO is set to change that assessment.

Rather than forecasting precise Revenues for the near future, the most important thing is to assess these crucial metrics keep going in the right direction.

Comparison with Commercial Peers

Palantir’s 2.8x CRPO/Comm. Revenue is similar to its peers:

ServiceNow: ~3,3x

Salesforce: ~2.7x;

Snowflake: ~3.1x;

The financial metrics confirm Palantir is becoming a pure software business.

What our crystal ball sees

Summing up, we currently have this visibility for the next twelve months Revenues:

~$600mn from the recognition of CRPO. This could be considered “secured;”

~$500mn estimated Revenues from the execution of contract options.

This leads us to already see $1.1bn in Revenues in the next twelve months ($2.3bn expected in ‘23). This should be considered the baseline. On top of this, further Revenue generation should come from:

IDIQ contracts;

new contracts;

consultancy projects.

The more Palantir becomes a “pure software company” and the higher the incidence of Commercial Revenues, the higher the visibility we will obtain.

Conclusion

With this initial analysis, we showed that Palantir’s contractual activity is strong and sets the basis needed to support the growth ahead.

By breaking down the Remaining Deal Value we can obtain precious hints about the future direction of the business. In particular, on the Commercial side, Current Remaining Performance Obligations are leading indicators of future subscription Revenues and the resulting “visibility in the future” could be more appreciated by analysts going forward.

Strength in Remaining Deal Value, especially in the CRPO, will lead to future growth.

Therefore, to properly assess whether Palantir will be able to reach the ~30% guided CAGR we will need to keep assessing them and gradually fine-tune our expectations.

When do you capture that in the form of revenue? That's a legitimate question to which we have no answer. But we will capture them because the contracts have been concluded and because we are sitting on the most important missions in the world. And those missions are going to end up being fully funded. - Alex Karp, Palantir CEO

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Mail: arnylaorca@gmail.com

Join Emanuele20x on:

Twitter: @Emanuele20x

YouTube: @Emanuele20x

Substack: Emanuele Marabella

View expresses are my own and do not represent Financial Advice in any way.

I own (many) PLTR stocks.