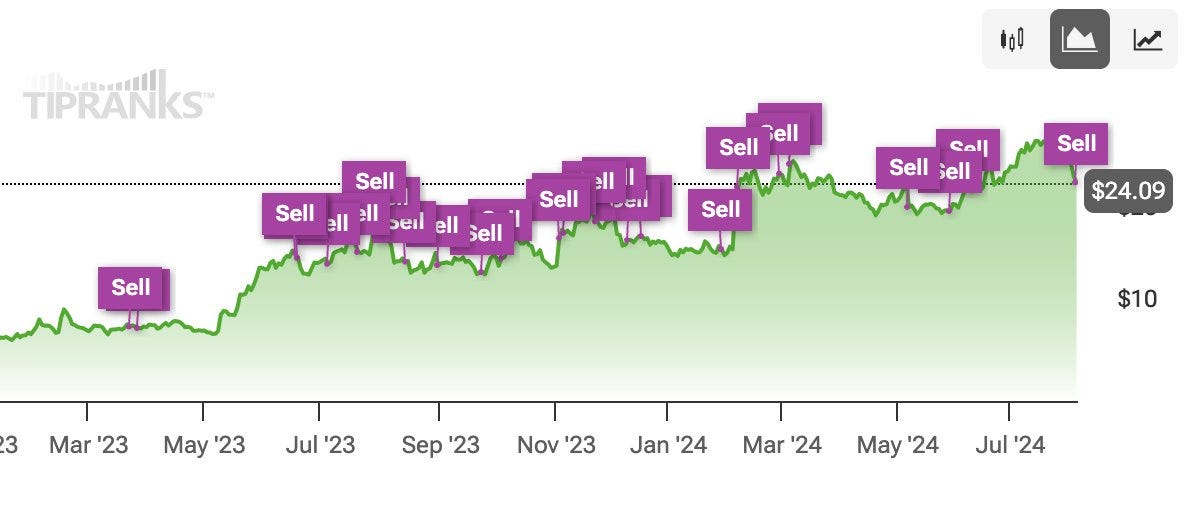

❌ Palantir is a SELL

Q2 results aftermath - DiPalma breakdown

Louie DiPalma, William Blair analyst, reiterated in a note after the Q2 results.

It's the worst report I've ever read.

Yet, it's helpful to understand how NOT to judge Palantir's results.

1. "Guidance raise is minuscule"

DiPalma is disappointed by the "Itsy Bitsy" guidance increase.

Palantir delivered 27% YoY growth in the quarter vs 22% guided.

Palantir guided for ~$700mn in Q3 (+25% YoY), compared to the $676mn expected by analysts.

Furthermore, Palantir increased their Guidance for the full year to $2,750,000, representing a 24% YoY growth, while previously guiding for 21% YoY growth.

Unless Palantir expects a slowdown in Q4, further guidance raise for the FY seems inevitable.

This is not rocket science.

I thought it was the analyst's job to understand opportunities when the guidance could be underestimated.

2. "SPACs were not disclosed"

This is false and underscores the inability of the analyst to focus on the things that matter.

SPAC investments were a significant topic in '22 because they had a relatively high weight compared to total Revenues and clients and generated accounting losses from the devaluation of their stock prices.

By subtracting the Revenues ex SPACs of $669mn (slide 22) from the Total Revenue of $678mn (slide 21), we obtain $9mn from SPACs.

It should not be a complex calculation for a team of three analysts, two of which are Chartered Financial Analysts.

SPACs don't seem to be the most critical topic. SPACs represent:

5% of US Commercial Revenue

3% of Commercial Revenue

1% of Total Revenue

There was no mention of:

Commercial acceleration

Government acceleration

Margins expand to levels beyond imagination

AIP has a clear market fit with no competition

DiPalma highlighted:

"SPAC Revenue upside may have played a role in US Commercial Revenue accelerating."

Again, this is wrong.

US Commercial grew in Q2 to $159mn from $103mn last year. SPAC contribution went from $19mn to $9mn in 24q2.

SPACs were a drag on US Commercial results.

3. "Beating consensus was so easy"

Palantir delivered 27% YoY growth in the quarter.

"While beating consensus is positive, the consensus numbers are fairly low."

This is precisely why, on Monday, there was an opportunity (that I exploited) with a 15% drop in the price.

The stock was depressed, but the expectations were easy to beat.

Isn't it the analysts' job to inform investors of this before the results?

"Consensus today and management's new 2024 Revenue outlook remains below where consensus expectations were in January 2023 when the stock was a single digit."

After 4 years of covering Palantir, I've heard many bad and erroneous bear arguments; these are beyond any level I’ve seen before.

Back in January 2023, Revenue expectations for 24’-26’ were ~20% CAGR.

I see an investment opportunity because analysts are still stuck to a ~20% Revenue while the AIP Go-To-Market works.

By the way, I remember when the stock was in the single digits, and at the bottom, he rated it a SELL.

4. "Should trade like $SNOW "

DiPalma argues that Palantir's market cap of ~$70bn after Q2 is excessive and should trade more in line with $SNOW because the latter has more Revenues.

"Snowflake has greater Revenue and is growing at a similar rate in the same data-analytics end market."

The unfortunate details that he missed:

Palantir is accelerating; Snowflake is decelerating.

Palantir operates at a 16% GAAP operating profit margin, while Snowflake has a 42% loss margin, good luck!

Palantir is an OS for AI. Unlike Snow, it didn't need to make 5 M&A in a year to pretend it was an "AI company.

Whoever says, "Palantir is just data analytics," does not know the company.

After four years of videos and blogs by the company and research by creators and analysts, there is no other reason than laziness for someone not to understand Palantir. Embarrassing!

I highly suggest you follow Chad Wahlquist for great explanations directly from the mouth of a Palantir employee.

5. AI Competiton Risks

DiPalma underscores that "competition" and a potential decline in interest in AI could represent downside risk to the stock.

Rather than writing vague statements, it should be the job of the analyst to explain the risks.

However, that requires understanding the company, which is not the case.

Analysts write a generic "competition risk" when they have no idea what you are talking about. Source: I worked as an analyst.

Furthermore, DiPalma reiterated an UNDERPERFORM rating without providing a target price.

This happens when analysts are embarrassed.

Should we short DiPalma?

Yours,

Arny

Reach me:

Disclaimer: The views and opinions expressed above are current as of the date of this document and are subject to change without notice. Materials referenced above will be provided for educational purposes only. None of the above will include investment advice, a recommendation or an offer to sell, or a solicitation of an offer to buy, any securities or investment products.

Savage. Excellent piece of work, Arny!

Another much appreciated Master Class in Palantir Vision which never underestimates the power of of the Destoyer, as Shyam reminds us.