Palantir $4.5bn Revenue in 2025: a Mirage?

Karp seeks an ambitious Revenue target. Dream or possibility?

Editor: Emanuele Marabella

Hi, I’m Arny. Thank you for joining 1.423 investors who receive the deepest Palantir research. Please hit the ❤️ button if you enjoy today’s article.

Last year Karp, Palantir CEO, reiterated his intention of bringing the company to $4.5bn Revenue in 2025.

“So I am driving the company to get to $4.5 billion in 2025. I believe in driving the company that way.” - Alex Karp, 22Q2 Earnings Call

However, the results in the second part of 2022 and the Guidance issued for 2023 seem to not support Palantir achieving it:

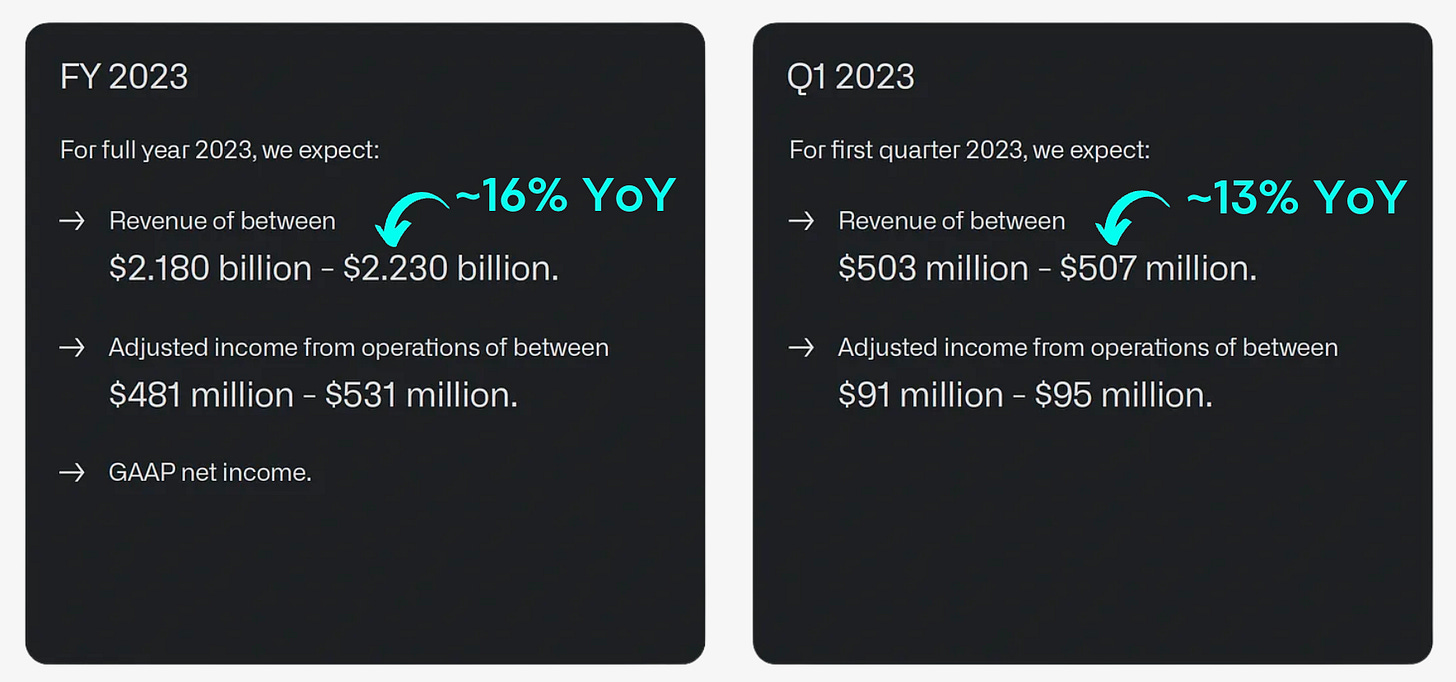

13% growth expected in 23Q1;

16% growth expected in 23FY.

These guidance results are well below the ~30% “long-term guidance” initially shared by the company.

To reach $4.5bn Revenue, Palantir would need to grow ~$2.6bn in 3 years or 33% CAGR 22-25’.

Is Palantir achieving $4.5bn in 2025 a real possibility or just a mirage?

We will explore ways to get there.

Asymmetry emerges from skepticism

Following the progressive Guidance reduction, analysts are clearly skeptical.

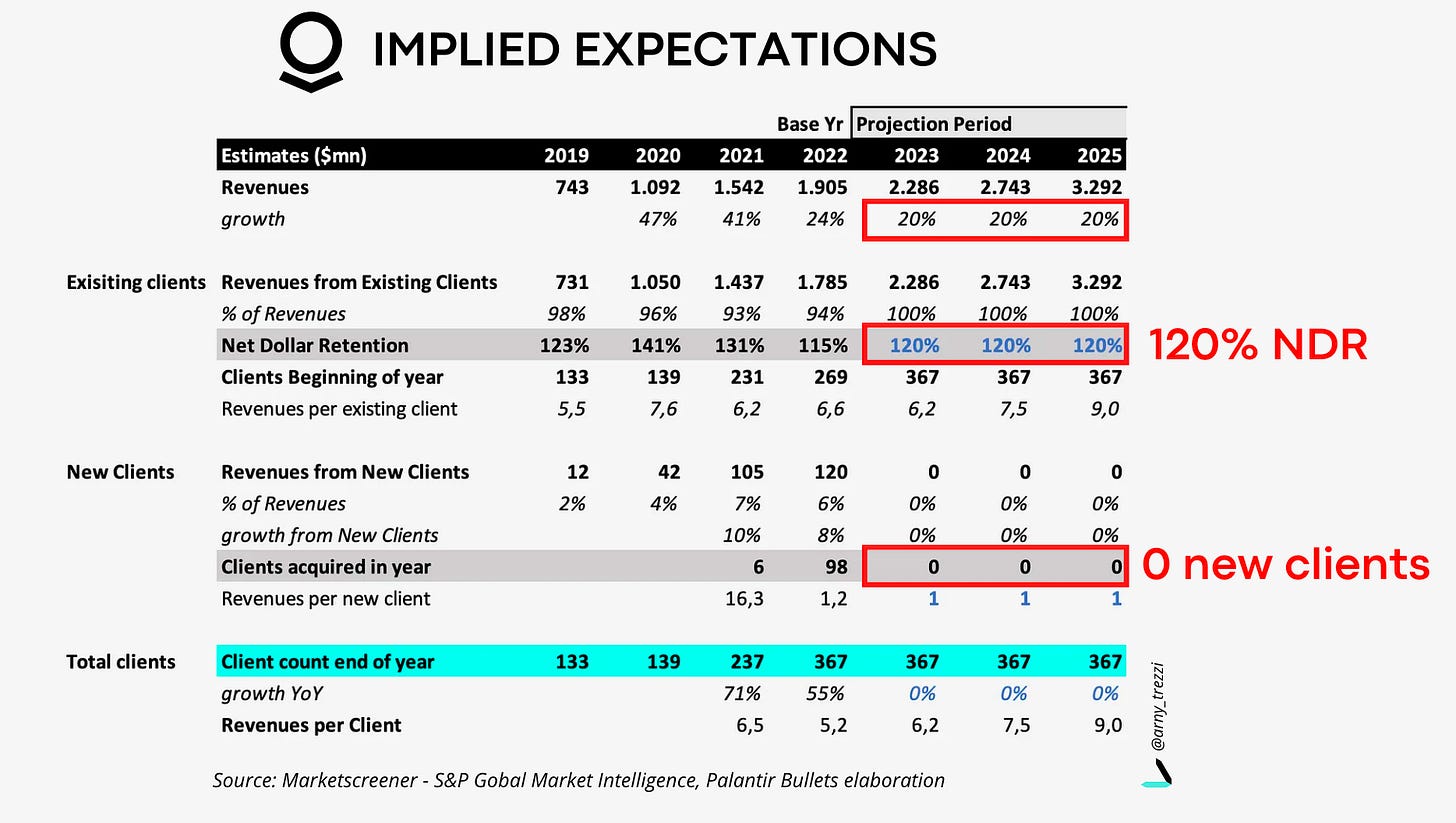

The average consensus numbers point to a ~20% CAGR reaching $3.2bn in 2025. This would mean $1bn below the target, or 30% below in percentage terms.

In a previous article, I underlined that analysts, on average, are underestimating Palantir’s growth in the coming years ( Palantir Analysts are Wrong). Let’s update these considerations with the recent developments.

In particular, if we consider that Palantir Commercial could grow by ~30% CAGR, a ~20% Revenue CAGR for the Group would imply a growth of the Government segment of only ~5% CAGR. In my opinion, this seems inappropriate given the huge catalysts currently in play.

To understand why these assumptions are actually low, we can exploit our Revenue Model (PLTR in 2032: a Jump in the future), which can be downloaded with the link at the bottom of the article.

Palantir could achieve the targets implied by Wall Street just by expanding the existing clients (as of 22Q4) by 20% per year.

The assumption of 0 new clients acquired for 3 years is clearly absurd as Palantir is now able to achieve 100-150 new customers per year, which can easily deliver an average of ~$1mm/y per client in the first year.

To download the model and unlock the full article, please consider becoming a paid subscriber.

If the analysts’ expectations could be reached with a modest NDR and an extreme assumption, there is actually substantial space for improvement.

I call this an asymmetry.

What hints do we have if it is really the case? It could be useful to underscore the different dynamics in play for each division.

In the following part of the article, I explain more in detail what could be the drivers of Palantir’s future growth and my own expectation on the $4.5bn goal. To read the remaining part of the article please consider upgrading to a paid subscription.

Commercial: untapped greenfield

Even before FoundryCon, Palantir showed that they can acquire up to 36 new Commercial customers per quarter. This number can improve significantly thanks to:

the newly constructed sales team should now be fully operational;

the time to deploy the platform keeps decreasing;

network effects: as more clients are onboard, growth by referrals becomes simpler.

The potential is still immense if we think that Palantir has only captured 15% of the Fortune 1,000.

“Our customers went from something like 80 to 143 last year. It's almost 70%, 80% growth. And then in the U.S., we only have 15% of the top 1,000 companies buying our product, which means we have a lot of room for growth.” - Alex Karp, Q4 Earnings Call

Not only is the potential in terms of new clients untapped, but each of the existing or prospective clients can become a huge Palantir client.

“And last but not least, arguably most importantly, in the U.S., all parts of the enterprise buy our product.” - Alex Karp, Q4 Earnings Call

The potential reach for Palantir in any organization is underscored by the Revenue growth of the top 20 clients. Each contributes to an average of ~$50mn Revenue per year.

Furthermore, it is important to remember that clients tend to really expand their relationship with Palantir after ~2-3y years. For instance, Sompo, a client since ~2019, expanded its relationship with Palantir by $50mn for 5 years after having achieved the ‘22 milestones.

Defense: a sea of opportunities

Meanwhile, the Government segment also faces a sea of opportunities:

Contract renewals. While a potential renewal failure poses a risk, there is also the possibility of the existing contracts actually being expanded thanks to the crucial contribution Palantir is providing in a war for which the US has committed $100bn of military aid.

“William Blair analyst Louie DiPalma issued a warning on Palantir following the stock's previous rise over the prior week. Importantly, DiPalma noted that six large government contracts were up for renewal over the upcoming 15 months, including three of the company's four largest contracts” - The Motley Fool

NHS: the contract has been delayed already for 1y due to activist campaigns and according to a new article shared by the Financial Times, it will be awarded in Autumn. As we mentioned previously, Palantir has the support of the PM and meanwhile keeps unlocking the value of the NHS, which implicitly gives it more leverage to win the contract. In other words, if Palantir proves in this little time that it can generate a significant impact, why should the NHS choose a legacy provider that didn’t perform?

TITAN: Palantir is now in the final stage. Unfortunately, we don’t know the actual size, but since the 1y prototype has been paid more than $30mn I would argue the effective contract is worth at least 2-3x that amount, so probably in the range of $50-100mn/year.

FDIC. Palantir is one of the four finalists since August 2021. No update since.

NATO: as mentioned many times, NATO countries are all increasing their defense budgets, de facto, increasing Palantir’s TAM. So far we know that the UK has expanded its Military relationship and Spain is currently in the early stage of the relationship.

Skykit: this new hardware product that incorporates Metaconstellation is used in Ukraine. Success on the battlefield sets the ground for Palantir to receive, at least, a part of the military aid to Ukraine and dedicated contracts from the DoD or NATO countries.

Ukraine Reconstruction: once the war will end, Ukraine will require immense investments in infrastructure, including IT. This is more speculative, but I would underline the importance of what Palantir is doing in Ukraine. Despite this, according to Karp, Palantir is providing its software for free, which is implicitly a significant bet that Palantir can play, not only for the present but also for the future of Ukraine. In other words, if Ukraine wins the war, Palantir could become the cardiovascular system on which the Government runs. This would be a role model that would incentivize other EU Governments to expand. It is very early, yet the possibility of this happening is real.

2023 will be the year of Apollo

Palantir Apollo is the Trojan Horse that could facilitate Palantir’s growth inflection point. I explained in detail what Apollo is and why it is crucial for Palantir’s growth in a dedicated article (Palantir's Apollo, the Trojan Horse). Thanks to its “freemium” structure, Apollo would not only support Revenue generation to easily penetrate potential clients’ IT departments.

Once inside, Palantir can expand to other solutions in a simpler manner.

In a recent interview with Investor's Business Daily, Shyam Sankar, CTO, considered Apollo a key initiative for 2023:

“The third thing that I'm really spending a lot of time on is Apollo which is our software delivery” - Shyam Sankar, CTO

Other products worth mentioning that could facilitate sales:

Hyperauto;

Pipeline Builders;

Metaconstellation for Commercial.

Is the goal achievable? My expectations

Given the considerations above, Palantir achieving its $4.5bn goal is clearly ambitious but I see solid conditions to achieve it.

According to my estimates, Palantir can achieve its $4.5bn goal by:

Increasing its Net Dollar Retention up to 135% thanks to the expansion of the commercial clients acquired in these last years and Government achievements.

Expanding by more than 35% per year the total clients, which I consider quite conservative considering the efforts to gradually go mass market.

Despite the recent growth numbers have been clearly disappointing, I believe the seeds for the coming growth are more numerous and set to deliver substantially more fruits than the market currently perceives.

While the effective future numbers can vary substantially from these expectations due to changes in the macroeconomic environment, I believe we are already seeing the part of the cycle with adverse conditions leaving more upside than downside now that expectations of the market are quite low.

“The transformative potential of software, which we have been building for two decades, is only in the earliest stages of revealing itself.” -Alex Karp, Q4 Letter

Yours,

Arny

View expresses are my own. Do not represent Financial Advice. I own (many) PLTR stocks.

great analysis, thank you ... feasible to be achieved, won't be a piece of cake but likely ... cheers!