🐾 Palantir Dilution Tracker [Q2]

Editor:Emanuele Marabella

I’m Arny. Thank you for joining 3.068 investors who receive the deepest Palantir research. Please hit the ❤️ button if you enjoy today’s article.

PLTR 1.78%↑ will release its Q3 earnings results next week on November 2nd before the opening of U.S. markets.

In the latest article, we investigated some hints from ServiceNow to assess how favorable the current industry conditions are for Palantir.

🔎 Palantir Q3 hints

Editor: Emanuele Marabella. will release its Q3 earnings results next week on November 2nd before the opening of U.S. markets. Q3 will be particularly important as last quarter Palantir guided for the first Revenue acceleration since the DPO.

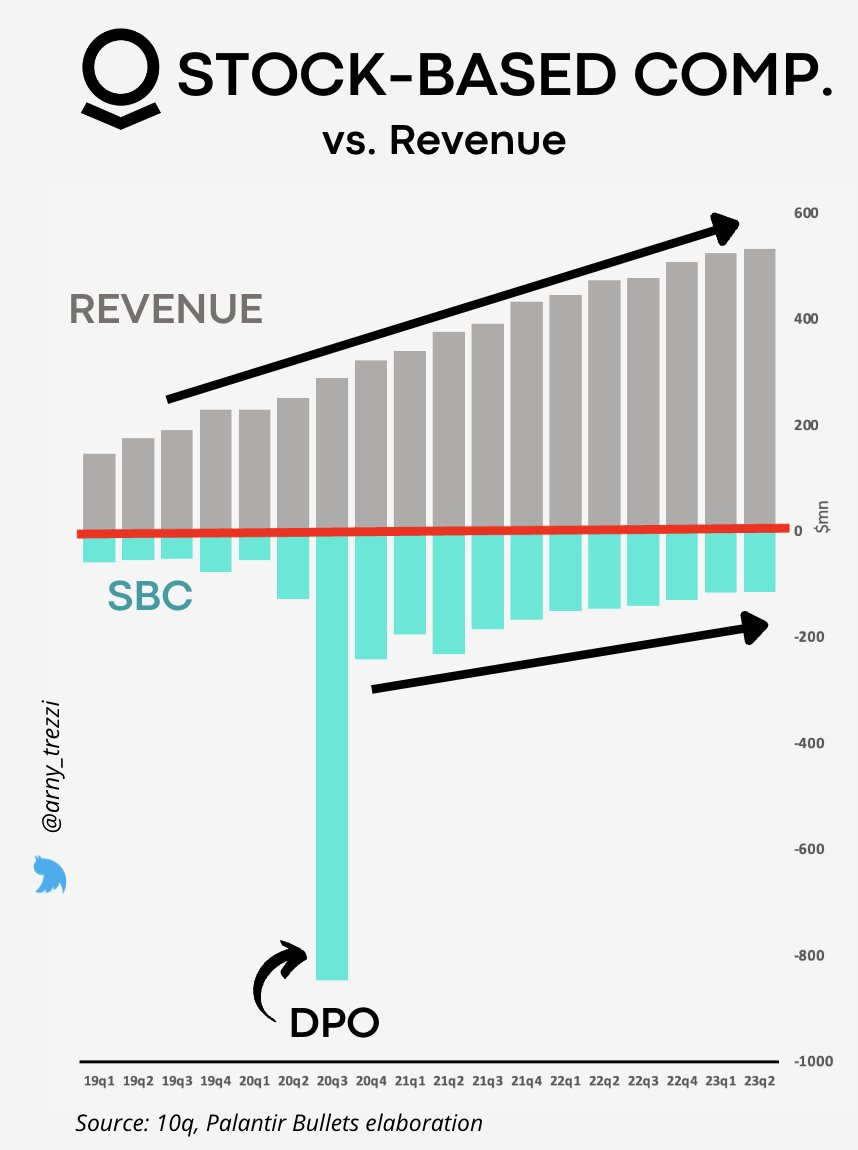

Today, we will assess the progress of Stock-Based-Compensation (“SBC”), which is often the key argument raised by PLTR -0.68%↓ opponents.

Here we assess the quarterly advancements toward the "dilution normalization.” Please refer to the previous articles to see:

how it works (When Will PLTR SBC Ease?);

how we should incorporate it into our models (Why 99% of PLTR DCFs Fail).

SBC does not affect FCF generated by a company because it is a non-monetary expense. However, it does affect investors.

Palantir relies heavily on SBC to compensate its employees. Therefore, it is crucial for us, as investors, to track the progress toward “normalization.”

Q2 Dilution Tracker

In absolute terms, SBC has steadily decreased and reached a relative minimum of $114mn, which was 22% lower YoY.

According to a previous comment from Palantir’s CFO, employee equity compensation is now linked to the success of AIP:

“As we think about equity compensation and aligning it to shareholder value, we are in the process of linking future employee equity compensation to the success of AIP.” - David Glazer, Palantir CFO at 23Q2 Earnings Call

This implies that an increase in SBC actually could signal the achievement of positive milestones.

As you can see from the chart below, Palantir hired aggressively during 2022 while most tech companies were firing.

In Q2 the employee count slighly reduced ~3% QoQ to ~3.7k employees.

As a reminder:

SBC is fixed at the grant date. Therefore a declining stock price does not affect the vesting SBC.

However, it is important to notice that there is a risk related to the newly granted RSU. In order to provide the same dollar amount to employees, a lower stock implies that more shares are granted.

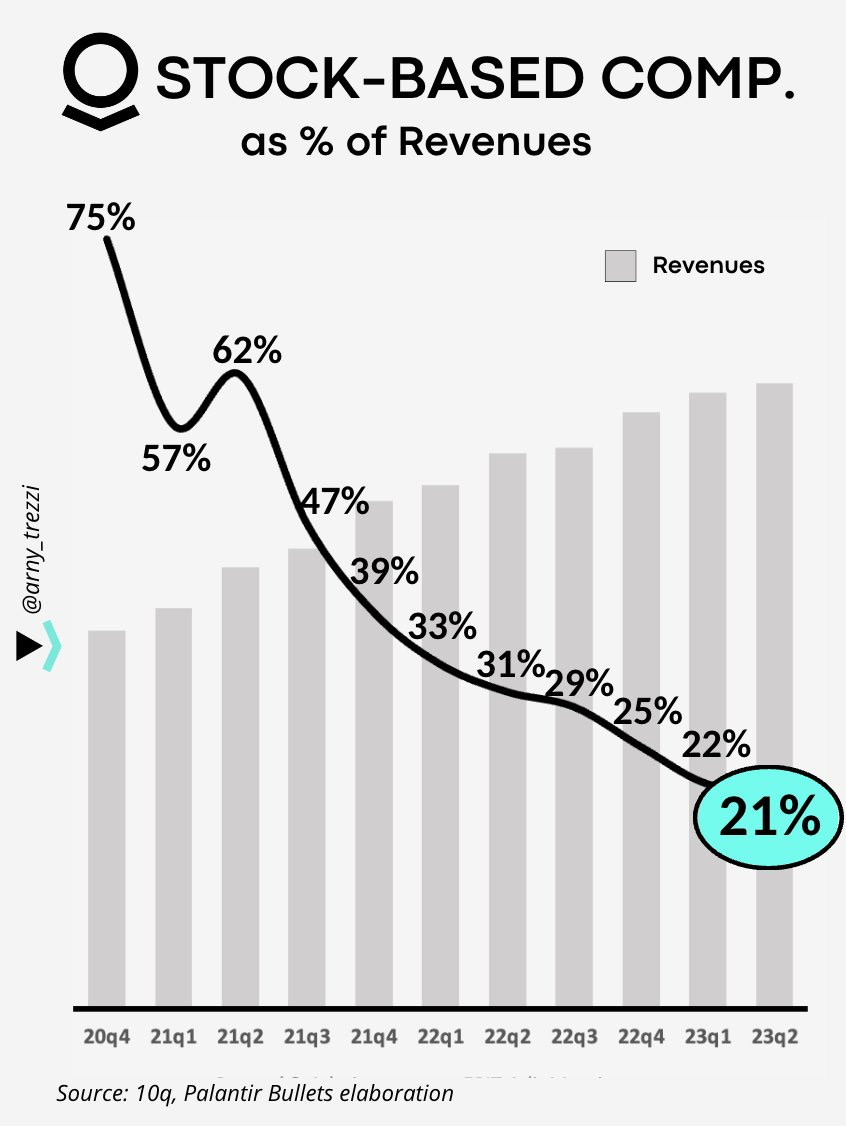

In terms of impact, SBC as a percentage of Revenues is decreasing steadily and reached the minimum level of 21% as of Q2.

The reduction in SBC combined with steady Revenue growth is the key reason why Palantir successfully became GAAP Profitable in terms of operations in Q1.

While achieving GAAP profitability is a huge milestone for the company, SBC still represents a financial risk for investors.

Palantir vs. Peers

Palantir SBC is clearly high compared with traditional companies.

However, compared with other peers in the Cloud space, we notice Palantir’s ~21% SBC as % of Revenues is well below C3.ai and Snowflake.

As of Q2, Palantir’s SBC as % of Revenue is now lower than that Datadog which stands at 23%.

How SBC Impacts Investors

As investors, our major concern should not be in the amount of SBC but in the net effect of the change in the number of shares.

Let’s assume a company grows 30%, like Palantir. The Growth per Share, or “Diluted Growth” for shareholders would be:

30% with no change in the number of shares;

~20% if the number of shares increases by 10%;

0% if the number of shares increases by 30%.

Value for shareholders is only created if the rate of business growth is greater than the rate at which it is being diluting.

Palantir’s dilutive effect from the increase in shares outstanding is decreasing.

However, it must be noted that there is a ~7% potential increase in shares from exercisable options, which is the difference between shares outstanding and diluted shares.

A wider divergence between the business growth and the dilution creates a greater benefit to investors.

This is why it is crucial for Revenues to accelerate (PLTR is Planting The Seeds for Exponential Growth) and the number of shares to “normalize” towards 3-5% at most.

Incoming SBC

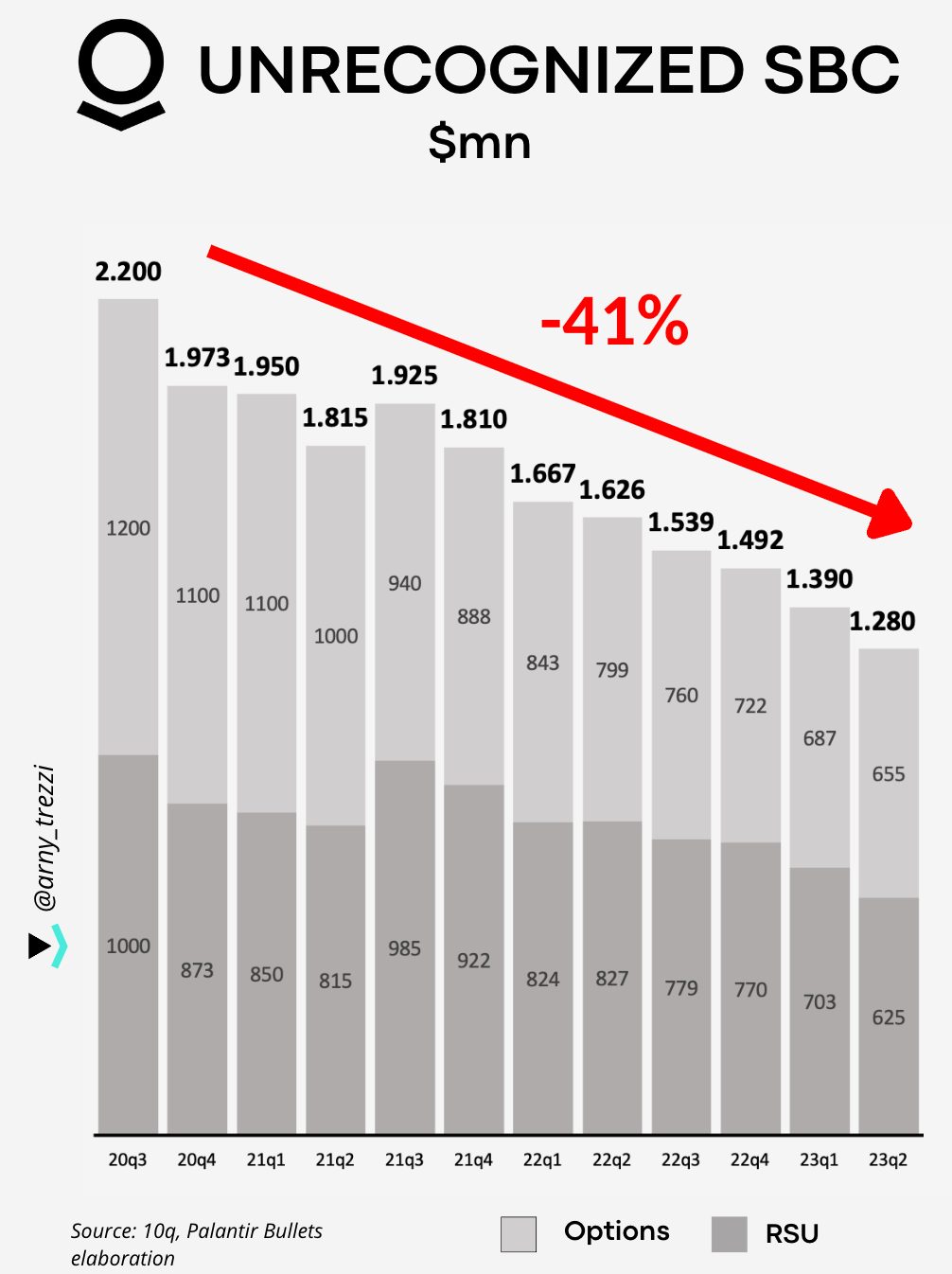

Unrecognized SBC is the amount of SBC that is yet to be recognized from the current SBC plans, which include Restricted-Stock-Units (“RSU”) and Options, as employees perform their job during the vesting period. Therefore, Unrecognized SBC hints at the direction of future SBC.

As of Q2, Palantir’s Unrecognized SBC decreased steadily, well below its peak of 20Q3.

Palantir currently has ~$1.3bn Unrecognized SBC. This is composed of $625mn RSU, with an avg. vesting period of 3 years and $655mn Options with an avg. vesting period of 8 years. Therefore, we could expect RSU recognition to generate ~$52mn SBC per quarter (703/12) and Options recognition to generate ~$20mn SBC per quarter (760/32).

As a result, we should expect at least ~$72mn SBC per quarter from the recognition of Unrecognized SBC.

Specifically, a comment from the CFO hints that we could see SBC rising further:

“While we expect to see stock-based compensation expense trend up through the remainder of the year, we remain focused on GAAP net income and operating profitability.” - Dave Glazer, Palantir CFO, Q1 Call

Hints from Guidance

From the Guidance Palantir provided in the presentation deck, we have a precious hint on management’s expectations related to SBC.

Reminder: GAAP Net Income = (EBIT adj. - SBC - Net Interest ) * (1-Tax Rate)

Palantir’s management expects Q3 to generate ~$137mn EBIT Adj (~25% Margin) while delivering GAAP Net Income.

GAAP Net Income Margin of Revenue should therefore be at least 1% in Q3.

Net Interest from Cash delivered ~$30mn in Q"2, which represented ~5% of Revenue. We can expect Net Interest to have a similar impact in Q2.

We have:

25% EBIT Adj.

5% Net Interest Income

1% Minimum GAAP Net Income Margin.

By making the inverse calculation, we can obtain that implicit SBC assumed by the management.

The management expects at most 20% SBC as a percentage of Revenue, which further support the idea that SBC is headed in the right direction.

Conclusion

Despite the fact that SBC doesn’t impact FCF, the derived dilutive effect is a real headwind for investors.

Therefore, as investors, our duties are:

consider SBC when we perform valuations (Why 99% of PLTR’s DCF Fail);

verify that the growth keeps outpacing dilution;

track the rate of SBC as it heads towards “normalization.”

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

View expresses are my own and do not represent Financial Advice in any way.

I own (many) PLTR stocks.

dilute my scotch please so that I can drink also in the next years :P ;)