🔎 Palantir Q3 hints

Editor: Emanuele Marabella.

PLTR 0.00%↑ will release its Q3 earnings results next week on November 2nd before the opening of U.S. markets.

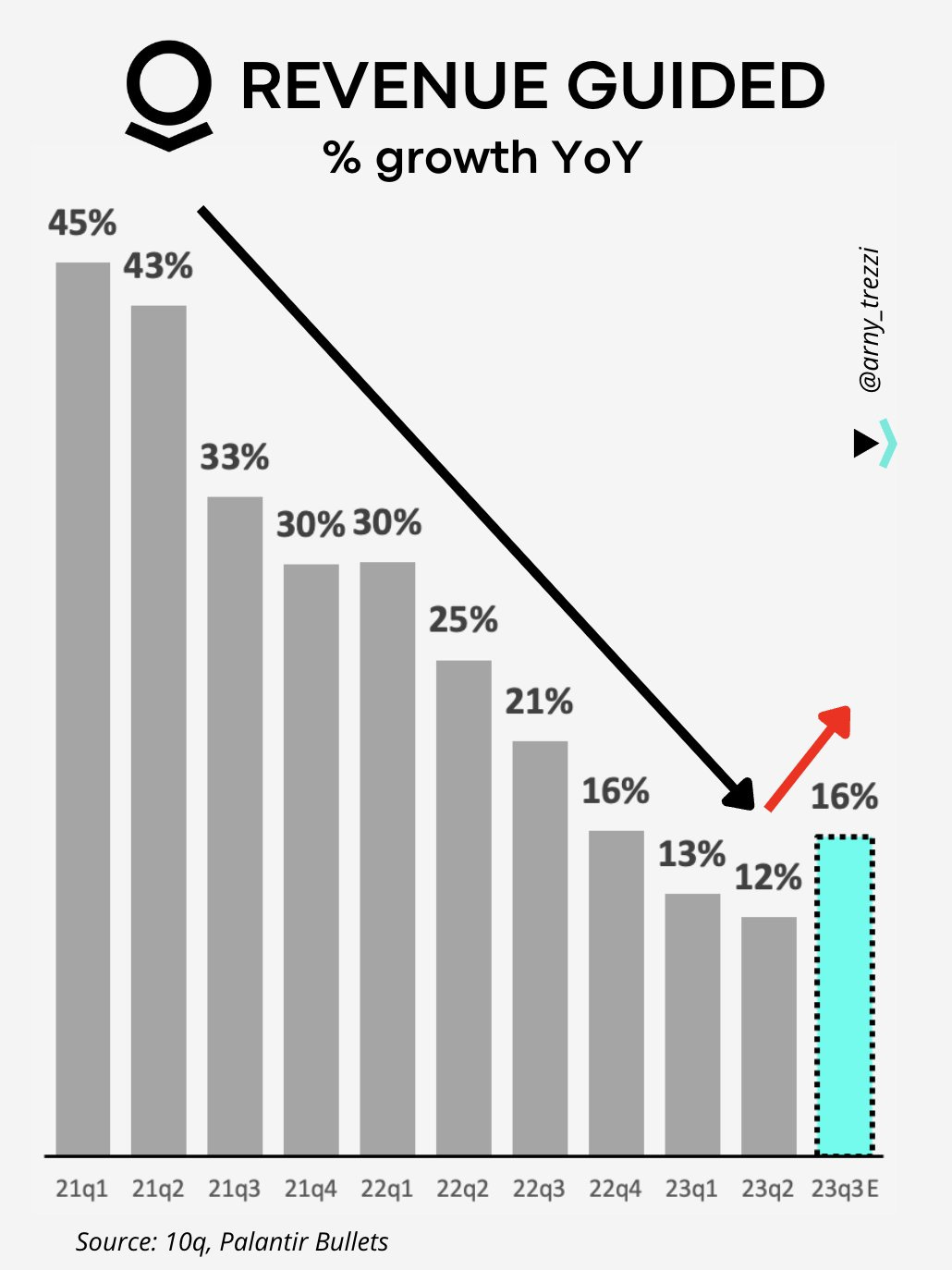

Q3 will be particularly important as last quarter Palantir guided for the first Revenue acceleration since the DPO.

At ~43x EV/ NTM EBITDA valuation, the implied expectations for Palantir’s growth are not low. A miss should create substantial selling pressure on the stock.

Will Palantir be able to achieve or even exceed the 16% Guidance?

Some precious hints can be found nearby…

Hi, I’m Arny. Thank you for joining 3.021 investors who receive Palantir’s deepest research. Please hit the ❤️ button if you enjoy today’s article.

Palantir Bullets is supported by the Asymmetric Value Club, the new discord community focused on spotting market asymmetries.

Look nearby

As we often have done in anticipation of the quarterly releases, it is worth seeking hints from ServiceNow ( NOW 0.00%↑) , which is exposed to the same IT spending trends and just reported its Q3 results.

Servicenow Q3 in a nutshell:

Revenue: +25% YoY (+22.5% in Constant Currency);

Current RPO: +27% YoY (+24% in Constant Currency);

Q4 Revenue Guidance raised to +24.5-25% YoY.

These brilliant results, which confirm a reacceleration of the business were praised by the market with a +5% spike in the stock price.

Strength across the board

ServiceNow business is performing strongly across verticals, supported by key underlying trends. In particular:

Manufacturing and Technology, Media & Telecommunications, where Palantir is also strong, had “robust growth.”

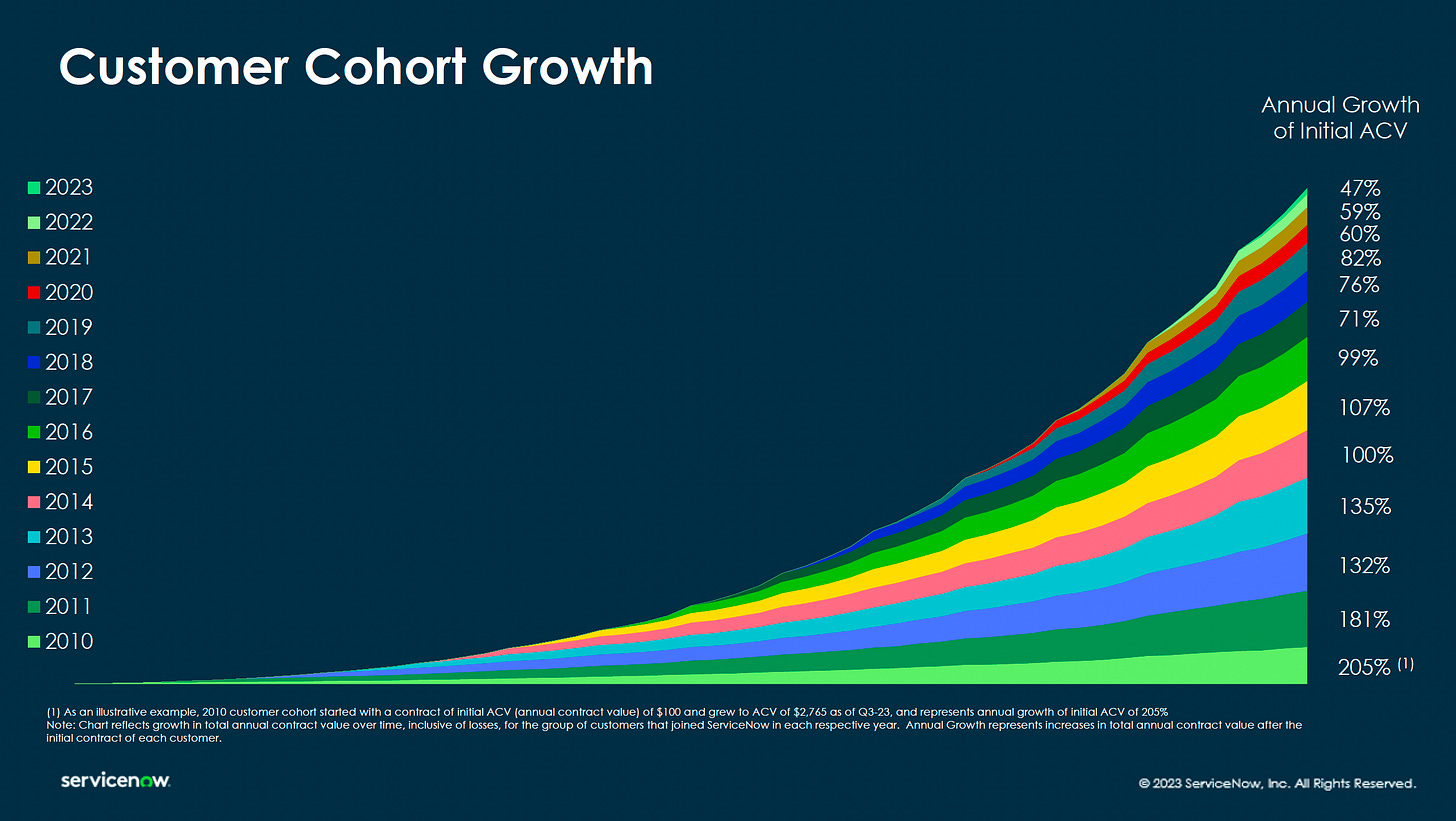

Retention remained exceptional with a renewal rate of 98%.

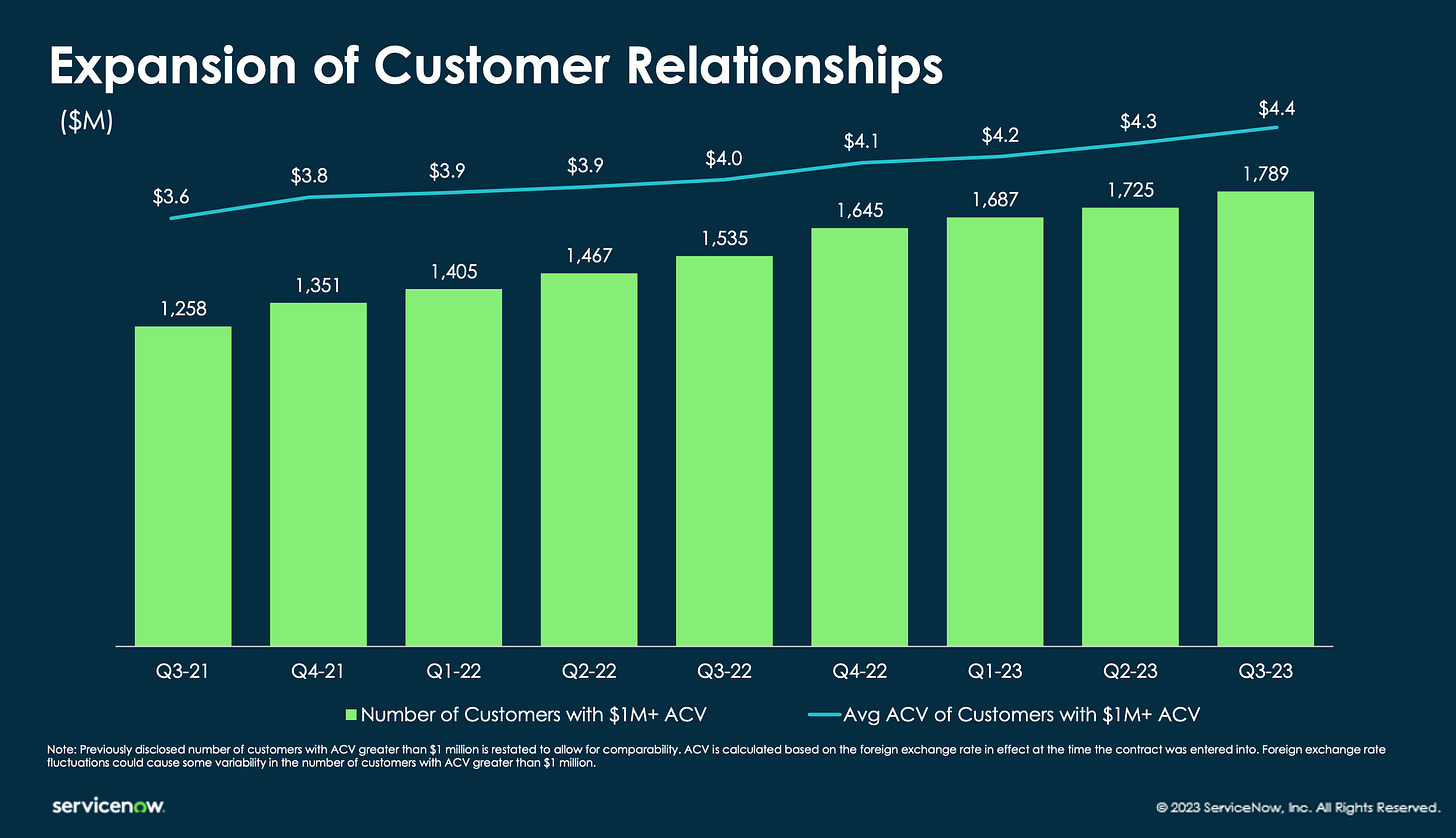

Strong expansion from clients contributing to over $1mn in ACV (“Annual Contract Value.” Even stronger at 58% YoY growth the growth from clients contributing over $20mn.

Numerous new big deals were closed in the quarter.

“In Q3, we successfully closed 83 deals greater than 1 million in net new ACV, with four deals greater than 10 million. Notably, 18 of our top 20 net new ACV deals included eight or more products.”

IT budgets are set to increase ~7% next year, according to IDC, creating a strong tailwind as “the IT strategy has become the business strategy.”

“According to IDC, the IT budget this year would have been about 3.5% spend. And next year, it's expected to go to, instead of incrementally increasing 3.5%, which is your typical year, it's expected, according to IDC, to incrementally go up 7%. And that's the IT budget itself.”

“This is really about business transformation and truly transforming the way you run your company, and it's not a nice-to-have IT project. And I do think that is one of the more interesting question you have because I think it's one of the reasons why I have said repeatedly the IT strategy has become the business strategy because digital transformation is an end-to-end imperative.”

ServiceNow raised its Guidance despite the macro crosswinds thanks to strong growth in Remaining Performance Obligations (“Contracted Revenues”).

“We're raising the full-year outlook to reflect the strength of Q3. As we have done all year, we continue to prudently factor the macro crosswinds into our guidance. This includes incremental FX headwinds from a strengthening U.S. dollar Notably, the strength of our federal business has resulted in a higher mix of 12-month contracts that will create a one-point headwind to Q4 cRPO growth and remain a headwind into 2024.”

The B2B consolidation and prioritization process we described last year continues.

“Businesses are looking to consolidate vendors and standardize on a platform with a core set of products so they can build a predictable and reliable road map to drive digital transformation. ServiceNow is that strategic platform.”

AI isn’t a hype cycle

‘The rise of ChatGPT created a paradigm shift in the software industry. The disruption is reaching the enterprise software. Here are the key points highlighted:

AI is a $3 trillion generational movement and no CEO can stay behind.

“While the world's challenges are sobering, the digitization imperative is stronger than ever. Gartner forecasts that $3 trillion will be spent on AI and gen AI between 2023 and 2027. Gen AI represents 36% of AI spending overall. We believe every dollar of global GDP will be impacted by AI over the next several years. This isn't a hype cycle; it is a generational movement.”

“Yeah, some of the CEOs all have boards of directors, and they don't want to show up without a gen AI plan. So, this is a CEO-level decision. And I think that is why we meet with so many CEOs and the C-suite is now completely embedded in the ServiceNow go-to-market plan, and it's working beautifully. What they're doing is as follows.”

Servicenow AI products already have the “highest number of customer requests for a prerelease product.” This comment validates the “unprecedented demand” released by Palantir CEO Alex Karp months ago.

“We have over 300 customers in our pipeline from every industry, every buying center, in every stage of testing. Our gen AI SKU drove the highest number of customer requests for a prerelease product in our history. While launching at the end of the quarter, we have already -- we have also already closed four gen AI-related enterprise deals, and we're seeing strong pipeline build for our Plus SKUs.”

Generative AI players should have a strong 2024 regardless of the macro.

“Now, generative AI across platforms that matter and there's only a few, and we're one of them, is really, to me, going to get a very nice tailwind investment in 2024 regardless of the macro.”

Federal Agencies React to AI

Like Palantir, ServiceNow also works with the Government, which seems to be strongly executing its digitalization plans.

Here is what ServiceNow disclosed on its US Government business:

ServiceNow reported its best US Federal quarter with +75% YoY Net New Annual Contract Value and strong retention.

“From an industry perspective, this was the best U.S. federal quarter in ServiceNow history. NNACV was up over 75% year over year.

We expect that these contracts will renew in 2024 as ServiceNow federal contract renewal rates are 99%.

ServiceNow closed 3 federal deals over $10mn. The US Air Force contributed with the third largest deal in the company’s history.

U.S. federal agencies are standardizing on a single platform with a core set of end-to-end solutions. We had 19 federal deals over a million including three deals over 10 million. Our top deal in the quarter, the United States Air Force, was the third-largest deal in the company's history.

The US Federal agencies are reacting positively to Generative AI.

“We launched Vancouver on September 29th. That left us one day in Q3 to sign deals, and we signed four large deals. A U.S. government agency selected our premium SKU offerings to be an early adopter of gen AI. Real estate leader, CBRE, is harnessing generative AI with ServiceNow to deliver superior service to customers and employees while reducing costs.”

The conversation shifted from “Is it good?” to “How do I implement it?” This comment is very similar to what Palantir's CEO released at AIPCon.

“With Pro Plus, what I'm seeing is it is no longer about the potential of generative AI, where they are questioning is generative AI good for us in context of ServiceNow platform. But the conversations have shifted to, "Hey, CJ, how long would we -- would it take for us to implement? Does our data strategy need to be aligned, and what about security, etc.?"

Government represents “durable demand” as the federal agencies’ digitalization programs are “only growing.”

“This is durable demand. The federal agencies' digitization agenda is only growing. And the success that we've had at federal, we absolutely have the ability to replicate that outside of the U.S. in public sector around the world.”

Conclusion

The analysis of the factors driving ServiceNow's growth suggests that Palantir should benefit from positive industry tailwinds, which could sustain its reacceleration.

The interest in AI is real and affects all sectors, including the Government.

Therefore, I expect Palantir to deliver results at least in line with Guidance, while also having plenty of room for improvement based on the extremely supportive feedback we documented in our weekly recaps.

If you are interested in discussing this topic more in detail, you can join me and other passionate investors at the Asymmetric Value Club, a new community on Discord to spot market asymmetries.

With $5 per month, you could support my research for you 😊

Yours,

Arny

You can also reach me at:

Twitter X: @arny_trezzi

YouTube: @arnytrezzi

Asymmetric Value Substack: Asymmetric Value

Amazing stuff, thank you!

Seems PLTR's Government contracts and rev didn't see much improvement this Q, relative to what NOW's results would have implied. Any thoughts here?

great coverage, thank you!