🎖 WINNING IN AI | Palantir Bullets #103

Stunning Q3 results, Anthropic deal, $1bn Navy

Editor: Emanuele Marabella

Last week:

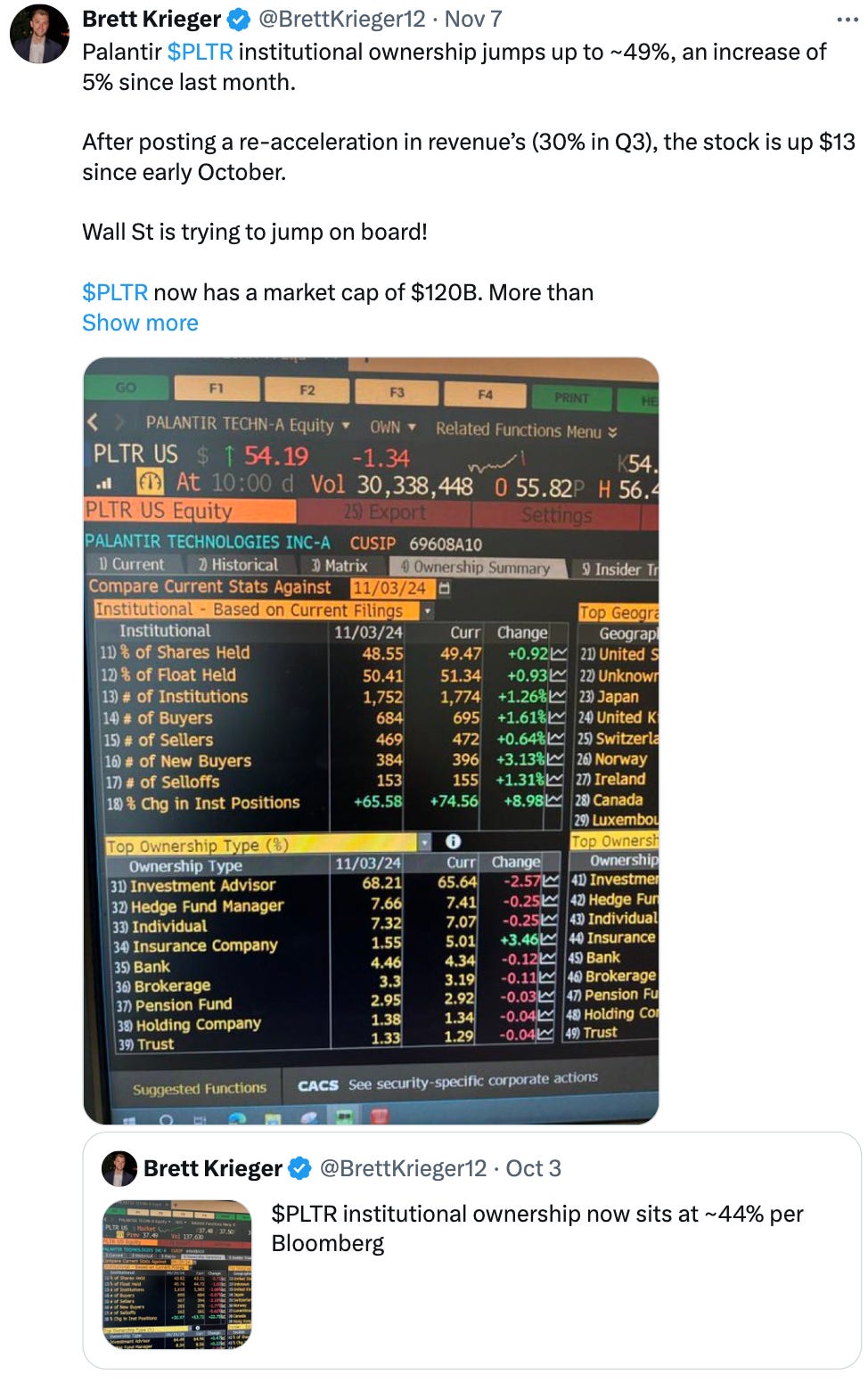

Palantir released stunning Q3 earnings results:

+30% YoY Revenues;

+39% YoY client count;

38% EBIT Adj. Margin (+10% YoY).

Analysts reacted:

Bank of America raised price target to $55 from $50;

Wedbush raised price target to $57 from $45;

Jefferies downgraded to Underperformed while keeping a $27 target;

RBC raised price target to $11 from $9.

Palantir stock reached a new all-time high of $58 per share:

Palantir partnered with Anthropic to bring Claude AI Models to the US Government Intelligence and Defense. Palantir is the first partner to bring Claude models to classified environments.

This article is free to read, but you can support Palantir Bullets with a paid subscription at the link below. Grazie! ❤️

Palantweets

Tweet of the week

Yours,

Arny

Reach me:

Disclaimer: The views and opinions expressed above are current as of the date of this document and are subject to change without notice. Materials referenced above will be provided for educational purposes only. None of the above will include investment advice, a recommendation or an offer to sell, or a solicitation of an offer to buy, any securities or investment products.

I would speculate that some very large contracts from the defense dept will be arriving shortly. Friends in high places.

Great job Arnie keeping the peeps up to date on Palantir which seems to be at a turning point - joining the index, Navy contracts and increased regular commercial applications. Thank you.