Why 99% of Palantir DCFs Fail

Palantir SBC is costly and is here to stay, therefore must be included in the model. 99% of the DCFs on the web fail to properly represent the reality on Palantir and deliver outsized “fair prices”.

Editor: @Emanuele20x

The most common method to assess a company valuation is doing a DCF. However, without assumptions that reflect reality, these models can show you whatever you want.

In particular, I noticed that 99% of the DCFs on the web fail to properly represent the reality on Palantir and deliver outsized “fair prices”.

Our job as investors, is not to dream about unreasonable target prices but to be conscious of the possible downside. Incorporating the following considerations could be valuable to prevent major mistakes when assessing the value of an “unprofitable” company like Palantir.

As discussed in the previous article (“When will Palantir SBC ease?”), Stock-Based-Compensation (“SBC”) could have relevant consequences on the financial returns for shareholders given its dilutive impacts. Therefore it needs to be considered when addressing the value of a company. Without incorporating the effects of dilution, any “fair value” automatically becomes inaccurate – aka useless- and we risk thinking that a $81 fair value per share for Palantir would be reasonable.

Palantir SBC is costly and is here to stay, therefore must be incorporated into a financial valuation.

As a reminder, Palantir is considered by many an “unprofitable trash”. The reality is that Palantir has negative GAAP earnings, but -huge- positive Free Cash Flows from operations. 30% FCF Margin already puts PLTR at an FCF profitability comparable to a “big tech” like Google and Microsoft. If PLTR were truly unprofitable its Cash Balance would have not grown by 50% since the DPO as no new fresh equity has risen.

Discounted Free Cash Flows models focus on a company's ability to generate Cash Flows after all cash expenses are covered. However, SBC is not a cash flow item since it generates no cash in or cash out for the company, but still must generates an impact on shareholder’s value.

How can we incorporate it?

How to deal with with SBC

1) Not considering SBC at all.

This method is the most spread on the web, from Seeking Alpha to Youtube, since it is the simplest to compute. Is it also accurate?

Steps:

Calculate the FCF of the company to obtain the Enterprise Value

Subtracting the Net Cash obtaining the Equity Value.

Divide the Equity Value by the number of shares as of today to obtain a “fair price per share”.

This method is highly inaccurate because it assumes 100% of the future FCF will be given to existing shareholders, which is simply not true when a company incurs high SBC.

As we saw in the past year, ignoring the dilutive effects from SBC inevitably leads to inflated “fair price per share”, like saying PLTR is worth $81 per share (88x EV/Sales ‘22).

2) Consider SBC as a Cash expense.

This method is supported by Aswath Damodaran , the “dean of valuation”, and by many financial professionals and assumes SBC is a monetary expense to be subtracted from FCF.

The resulting FCFs are therefore the original FCF net of SBC expenses.

Steps:

Calculate FCF adj as FCF adj. = FCF – SBC

Perform a normal DCF using the FCF adj. and the shares outstanding as of today.

Despite it is accurate to assign a negative value to the dilution occurring due to SBC, this method fails to capture the optionality provided by the cash the company does not spend when providing SBC as the company actually holds the cash. This money could have crucial effect in boosting further growth, e.g. could be spent on marketing, which could lead to potential increase in future FCFs.

Let’s think of this with an example.

Company A: $100mn FCF. $100mn SBC because I pay the employees only in increased % of ownership. $100mn Cash in Bank at the beginning.

Company B: $0mn FCF, $0mn SBC because the company pays $100mn in salary to employees. $100mn Cash in Bank at the beginning.

According to the method, the two companies would be worth the same. However, in reality, company A should be much more valuable than company B.

After 1y of operations, Company A could use the residual $200mn in their bank account to boost growth, for instance investing in marketing or pursuing M&A operations.

The ability to generate free cash flow provides also the additional optionality to raise Debt at a cheap rate because FCF reduces the risk for potential lenders.

Company B, on the other hand, needs to erode its cash balance, or issue new Debt, in order to pursue growth. New Equity would be detrimental to existing shareholders because it would cause dilution. New Debt would be costly because of the weak ability to generate cash flows.

Therefore, Company A would be much more valuable than Company B over the long term, but the assumption that SBC is a Cash Expense would attribute them the same valuation, which is inaccurate.

Despite the intuition that SBC is a cost that must be accounted for its dilutive properties, considering SBC as a Cash Expense fails to recognize how valuable cash in the bank is for a company with growth potential. Cash generation creates non-linear effects in terms of optionality, which financial models fail to capture. Cash optionality is particularly relevant for companies not requiring much cash to grow, so-called “asset-light companies” like Palantir.

3) Incorporating SBC into the changing number of shares (best!)

This method, which I use, seeks to incorporate the negative effects of dilution as a “tax” on future DCFs.

Steps:

Calculate FCF from the company

Divide each future FCF by the expected number of shares so that we incorporate the dilutive effects.

For simplicity I assume there is no cash inflow from options (conservative).

Calculate the terminal value per share and add the Present Value of the estimated FCF per share.

The resulting “Fair Value per Share” is more accurate than the values obtained with previous methods. This method only deals with real cash flows while also incorporating the negative effect coming from the increase in the number of shares.

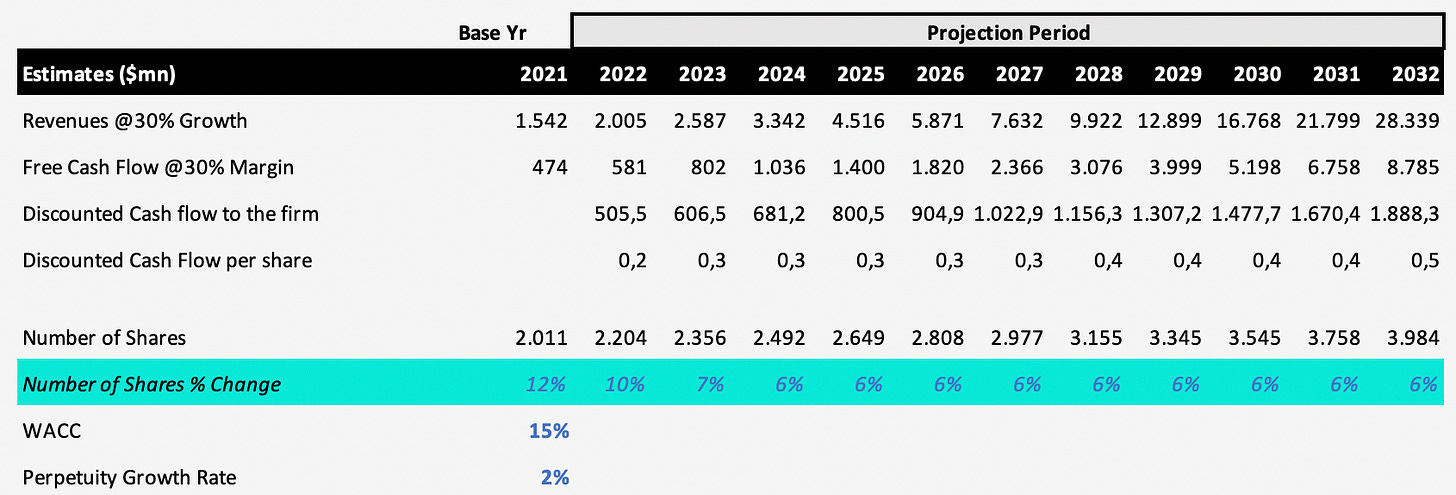

To show how important this consideration is, I’ll perform a sample DCF model with some gross ‘22-’32 assumptions:

30% Revenues Growth

30% FCF Margin

10% to 6% Dilution - assuming a “normalization process”

15% WACC (Weighted-Average-Cost-of-Capital)

2% Perpetuity Growth Rate

The following table shows the difference in valuation obtained from incorporating SBC vs Not incorporating. The divergence could be dramatic. This is why including SBC effect is crucial.

The Final Fair Value could change the valuation from $14 per share to $8 as an effect of the “simple” 6% increase in the number of shares by 2030.

In other words, Dilution alone can halve the Intrinsic Value of the shares.

Conclusion

I generally dislike DCFs since they heavily rely on future assumptions. Small variations in assumptions could deliver completely different valuations. Therefore, I prefer to focus on the current business developments rather than assuming future scenarios.

However, if we want to perform a DCF model, it is important that valuations are mentally honest and consider the factors that could have an impact. SBC cannot be ignored.

Be skeptical on DCFs, especially on YouTube finance. Many Youtubers provide an incredibly valuable qualitative assessment of the business. However, models could be easily misleading with fancy calculations that often go against the principle “It is better to be roughly right than precisely wrong”.

Precise estimates become useless if one does not consider the impact of SBC on a company like Palantir, which had SBC accounting for 50% of Revenues in 2021 😳

When a DCF seems too good to be true, it probably is. The incentive for people sharing considerations on companies we love - I include myself in the bucket - is to publish topics that support the bull thesis. Always ask yourself what crucial assumption is moving the valuation or if there is any missing key elements.

Interested in seeing how I value Palantir? Subscribe to be updated on my journey as an investor.

“It is better to be roughly right than precisely wrong” - Keynes

Yours,

Arnaldo

Join me on Twitter: @arny_trezzi

View expresses are my own. Do not represent Financial Advice.

I own PLTR 0.00%↑ stocks.

Does the issuance of stock options and other instruments (RSU?) have an impact on taxes? When stock options are exercised, does it trigger a tax event for the company issuing them? Thank you