💥 Q4 Earnings: Bombastic | Palantir Bullets #64

Q4 results, Analysts U turn, Babco Energies, Voyager Space

Hi, I’m Arny. First, let me thank you! We crossed the 4,000 subscribers milestone in one of the most exciting weeks as a Palantir shareholder:

Editor: Emanuele Marabella.

Last week:

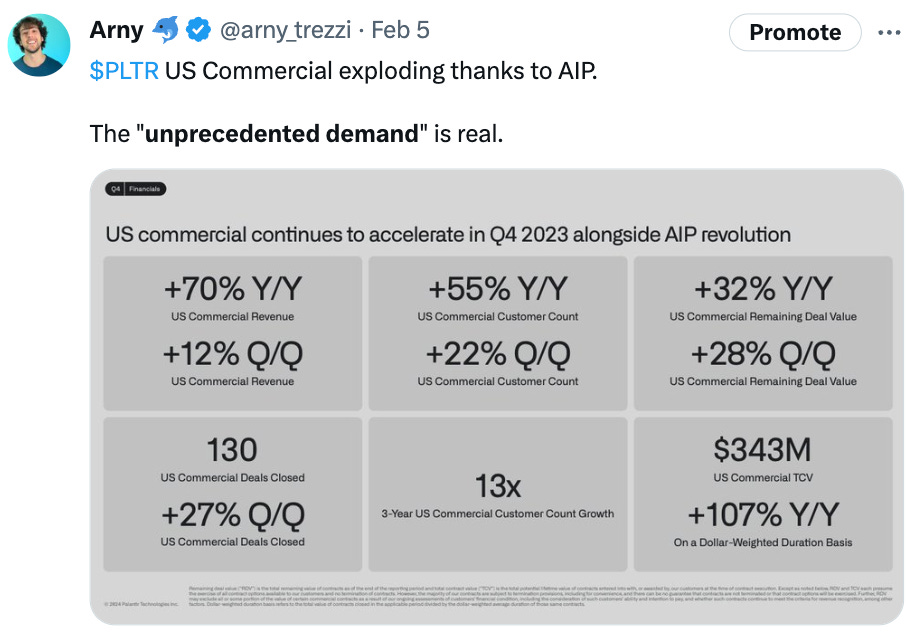

Palantir released its Q4 results, which proved that the “unprecedented demand” driven by AI is real. The US Commercial, which is growing at ~70% YoY supports the acceleration of the Group Revenue to ~20% YoY and an impressive ~34% EBIT Adj. Margin. The stock rose +50% to $24 in the week following the results.

~5k people watched our Q4 stream on Amit’s channel (subscribe!): ~2x the official Palantir stream!

What are the most important takeaways from the Q4 results?

Amit, Vince, Matt, Steven and I discussed them at Palantir Weekly #108

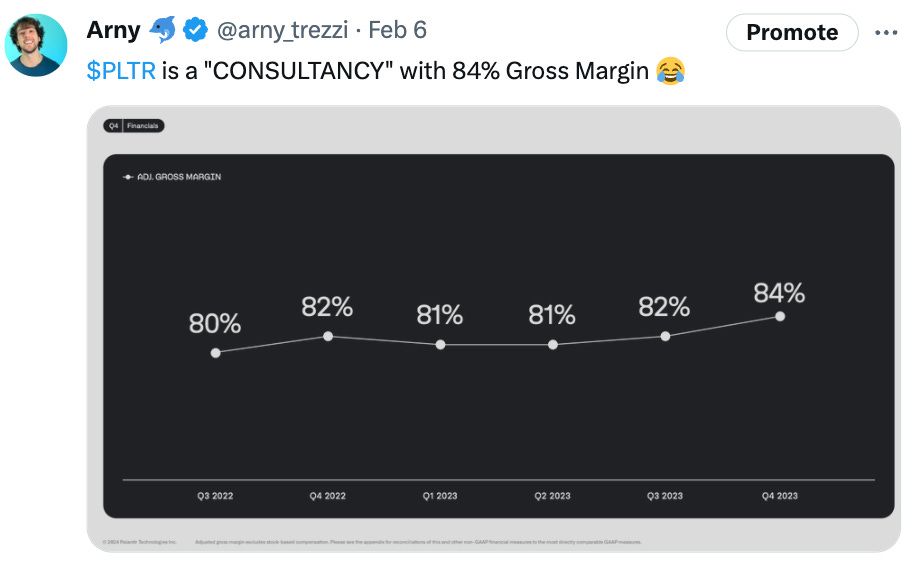

Citi and Jefferies analysts, who last week reiterated their SELL ratings ($10 and $13) almost doubled their target price to $20 and $22, respectively. Even the most bearish analysts must accept reality: Palantir is a top-notch SaaS.

Voyager Space signs a partnership with Palantir USG focused on exploring AI capabilities and enhancing national security capabilities in the commercial space domain.

“The collaboration between Voyager and Palantir will center around the joint exploration of cutting-edge AI and ML capabilities, aimed towards technology demonstration missions on the International Space Station and the future Starlab commercial space station.” - Pr Newswire

In my first article, I explained Palantir’s immense opportunity to lead the commercialization of space:

Palantir’s $140B Opportunity To Monopolise Space

This article has first been published on Darntons (@DartonsMedia). Palantir ( ) is increasing its influence in space, and this has been seen within recent times from the videos and initiatives shared around on social media. These hot-topics related to Palantir include: meta-constellation, Space Symposium and Edge AI.

Bapco signed a 3y deal with Palantir to deploy Foundry and AIP to maximize its return on investment on energy production and support its mission to connect the energy infrastructure of the Kingdom of Bahrain while reducing emissions. Bapco Energies is a semi-independent agency within the Ministry of Oil and Gas in Bahrain with +$10bn Assets.

“Using data and artificial intelligence is a key part of the Kingdom of Bahrain's strategy to deliver on its commitment to reducing carbon emissions, to reduce emissions by 30 percent through decarbonization and efficiency initiatives by 2035, and double the Kingdom’s deployment of renewables, to achieve Net-Zero by 2060.” - Palantir press release

Sky-Watch, a Danish drone manufacturer specializing in Defense, signed a partnership with Palantir.

Palantir is awarded a $650mn notional contract with the US Government until 2029. Unfortunately, the (horrible) website doesn’t make it clear if Palantir is the sole winner or if the contract is to be split between other parties.

Time Magazine wrote a detailed article on Palantir’s contribution to Ukraine, titled “How Tech Giants Turned Ukraine Into an AI War Lab.” In particular, the article highlights how Palantir’s support goes beyond military support:

“More than half a dozen Ukrainian agencies, including its Ministries of Defense, Economy, and Education, are using the company’s products." - Time Magazine

Palantir announced it will join the ~200 companies in the new US AI Safety Institute Consortium. ASIC is the latest manifestation of the Biden administration's consensus-driven approach toward AI regulation. This represents a tailwind for Palantir thanks to its access control and handoff functions already integrated into its products.

Palantir released a demo on how AIP can support a Football coach to make decisions in real time:

Do you still struggle to understand what Palantir does?

In my latest article, I explained it with simple words:

✍️ Introducing Palantir Technologies (PLTR)

Editor: Emanuele Marabella After nearly two years and over 150 articles, I'm returning to the basics. In the early days of Palantir Bullets, the web was saturated with introductory pieces on Palantir ( ) , prompting me to delve directly into the financial intricacies. However, Palantir has undergone significant transformations, as has its pool of inves…

Palantir Bullets is free. If you wish to support my work, you could provide me with the caffeine I need to spot asymmetries.

Q4 highlights

Palantweets

Tweet of the week

Yours,

Arny

Reach me:

Disclaimer: The views and opinions expressed above are current as of the date of this document and are subject to change without notice. Materials referenced above will be provided for educational purposes only. None of the above will include investment advice, a recommendation or an offer to sell, or a solicitation of an offer to buy, any securities or investment products

I got on Reddit for the first time a few weeks ago and started following you. Today I got this app so I could follow you better, per your recommendation. I’ve been absorbing all I can and will have access to $5k-$10k 2/20/2024 it’s what’s left of my savings after I retired in ‘19 with a physical disability but have not been approved for disability benefits. I could really use any help with making calls, options buying PLTR. Thank you