PLTR US Commercial is Taking The Lead

The explosive growth is shifting Palantir's balance.

Editor: @Emanuele20x

With US Enterprise software at ~50% of the global Enterprise software market, my recent article (PLTR US Commercial Is The Key) explained how Palantir’s US Commercial is the most important segment with:

5x clients YoY;

2x Revenues YoY.

What’s the real contribution of Palantir US Commercial to the overall group?

Composition shift

As of 21Q2, the number of clients between Commercial and Government was extremely balanced with Commercial clients representing 47% of the Total.

The composition has shifted due to the explosive growth of US Commercial.

Palantir US Commercial clients doubled in contribution as of 22Q2, moving from 20% of the total client count to 39% in just 1 year.

This comes from a very fast client acquisition in the United States.

US Commercial is acquiring ~2x the amount of clients compared to International Commercial.

The relative weakness we recently saw in the International Commercial could be attributed to a very strong Dollar, which makes Palantir’s solution more expensive (Is PLTR Commercial Doomed? [part 1]) and have a longer sales cycle (Is PLTR Commercial Doomed? [part 2]).

As a result of the rapid pace of client acquisitions, US Commercial now represents almost 60% of the Commercial Clients.

Notably, these clients have been achieved with a salesforce of ~40 people. Further growth could be expected as the sales force is expanding (PLTR: SELL SELL SELL) and the macro environment puts Palantir into a very strategic position to acquire talents (PLTR Hunting Season Is Open).

Seeds are planted. Fruits to come.

Given Palantir’s business model which consists of an acquire-expand model (PLTR is Planting the seeds for exponential growth), client acquisition is a leading indicator of potential growth. In other words, fruits will come where seeds are planted.

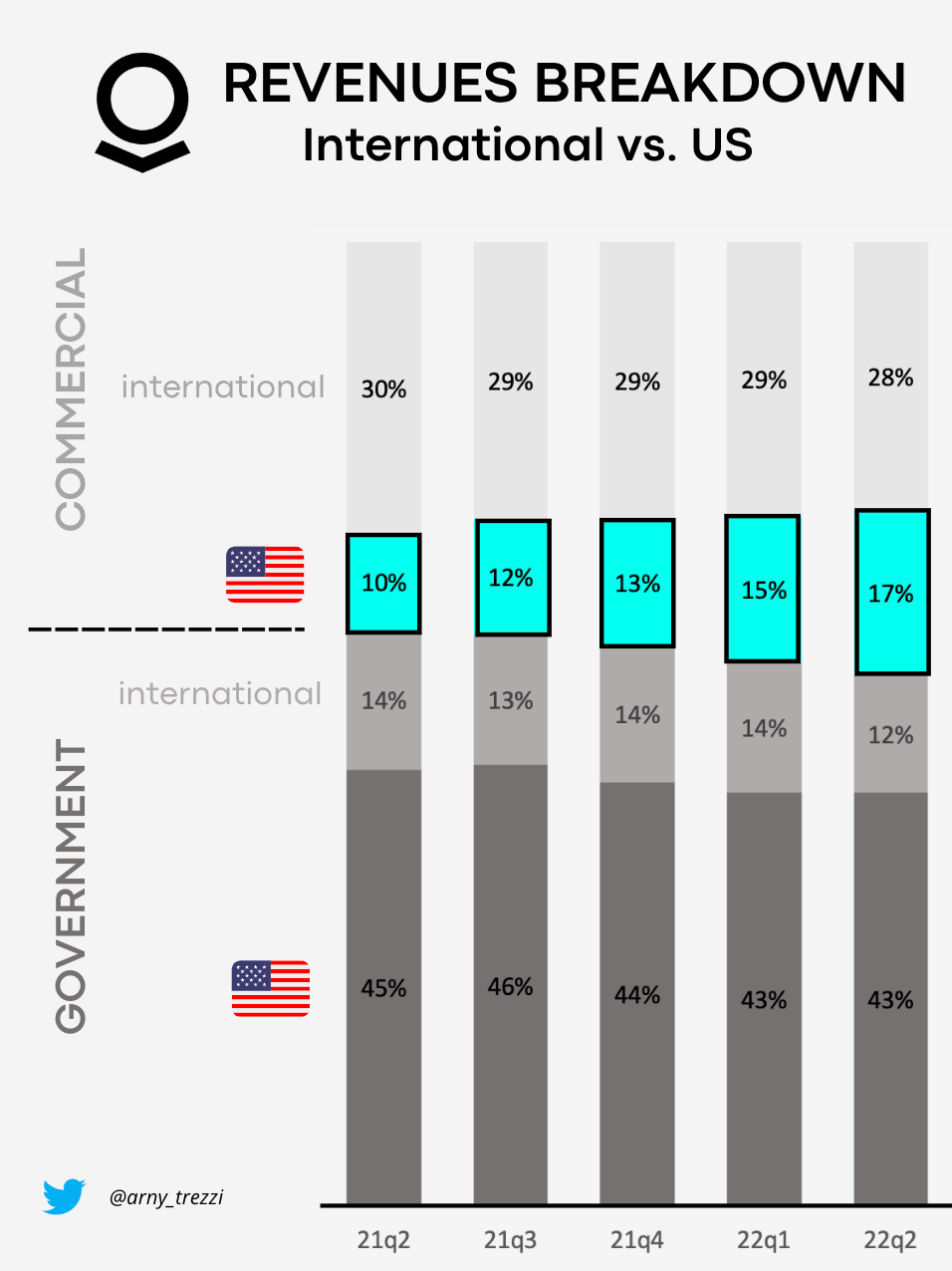

Palantir US Commercial represents 39% of the Clients but only 17% of Revenues.

This means that there is still a huge Revenue growth potential as the recently acquired clients will mature in the future. During the acquisition year, the contribution of a new client is minor (PLTR’s New Clients Are Irrelevant), and substantial Revenue gains are attained after 3-5 years.

Sizing the opportunity

We could have a clue of how big the potential is by looking at the Average Revenues per Client:

$2.5mn for US Commercial;

$5.8mn for International Commercial.

US Commercial currently generates ~$300mn/y, but the existing clients alone could double that amount.

The existing clients could potentially generate Revenues of:

~$700mn at $6mn avg. Revenue per client, similar to International Clients;

~$950mn at $8mn avg. Revenue per client, similar to the SPACs.

As a reference, the entire Commercial business generated $782mn in the Trailing Twelve Months, so the US Commercial can really drive the entire Commercial business.

The potential is actually stronger than the $6mn avg. Revenue per client:

SPACs, which are small companies generate, on average ~$8mn/yr (Are PLTR’s SPACs a SCAM?);

Palantir mainly targets companies with the potential of reaching $100mn/yr after 5-6 years (PLTR: The Biggest Networks Start Small);

The top 20 customers generate, on average $46mn/yr while growing 20-30%/yr.

Given the considerations above we can better understand why Karp is convinced that Palantir's US business is set to contribute 70% of the Revenues in two years from the current 60%.

“In two years from now we will be a 70% US business.” - Alex Karp, Palantir CEO

Conclusion

While the Government business is already established in the US (PLTR Government: It’s Now Or Never), the US Commercial is an emerging gem on which the management is directing the sales efforts and which could drive the growth for the entire group.

Palantir US Commercial in a few years could generate more Revenues than the entire group currently generates simply by expanding the existing clients.

The potential of the US Commercial is immense, but the market doesn't appreciate it yet.

“While most companies are content with addressing the idiosyncratic needs and inefficiencies of select customers in a subset of industries, the market we seek to address, particularly among the world’s commercial enterprises, is essentially unlimited.” - Alex Karp, Palantir CEO

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Instagram: @arnylaorca

Business Email: arnylaorca@gmail.com

Discord Channel

View expresses are my own. Do not represent Financial Advice.

I own (many) PLTR 0.00%↑ stocks.

Fortissimo💪🏽

thank you, great take via a compact format! cheers!