Editor: @Emanuele20x

In a previous article, we performed a Reverse DCF (PLTR Reverse DCF: what is the current price implying?) to understand the expectations implied in the current price.

We saw that the market assumes that Palantir could grow 30% for many years and generate over $25bn in Revenues by 2032.

What does Palantir need to get there?

I tried to build a simple Revenue Model to answer the question.

If you would like to perform your own assumptions and help support my research, you could find the link to the Revenue Model below.

Palantir could reach almost $28bn in Revenue and +9.500 clients in 2032 by showing:

130% Net Dollar Retention: as shared in the previous article (PLTR’s New Clients are Irrelevant), this is the key driver as more than ~90% of the growth comes from existing clients;

30%-65% yearly growth in client count: as the numbers increases;

$1mn Revenues per new client: this is the avg. Revenue from clients acquired in the Fiscal Year;

$3.5mn-$8mn on avg. Revenue per existing client.

The real numbers that will be generated could differ significantly from this model. However, this is a starting point to set reasonable expectations in terms of:

Business growth KPIs (key performance indicators);

Investment returns at a given price.

In this model, I didn’t separate the Government from the Commercial numbers to keep it simple and set initial broad expectations. In the future, we can update it with more detailed information.

What return should we expect?

Assuming the 30% growth will be achieved, how much return should we get?

As we discussed previously (PLTR Buy Signals: A dive Inside my Playbook):

Investment Return = business growth +/(-) change in multiple.

Therefore, using the model above the key components determining our performance will be:

Revenue Growth;

Current Price/Sales multiple;

2032 Price/Sales multiple.

As we underlined previously, when talking about DCFs (Why 99% of Palantir DCFs Fail), it is crucial to include the change in the number of shares to incorporate the dilution coming from the Stock-Based Compensation.

This way we obtain a “Diluted Growth” of the sales.

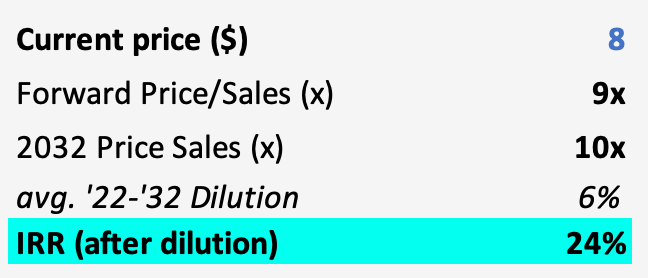

Palantir could reach $70 per share under the following assumptions:

30% growth;

~6% dilution;

10x Price/Sales multiple in 2032.

This would generate an Internal Rate of Return (“IRR”) of 24% from the initial $8 per share.

This would mean more than 3x the average return of the S&P500, which has an annualized rate of return of ~7%.

Why is $5 “offensive”?

From my previous article (PLTR Buy Signals: A dive Inside my Playbook), you may remember that I underlined how a $5 price for Palantir would be an asymmetrical opportunity.

We could see it also here.

At a price of $5, even if the final multiple would be 5x Price/Sales, Palantir could deliver 22% IRR.

The return would raise to 30% IRR at 10x 2032 Price/Sales and 36% at 15x.

A final P/S of 15x is not absurd if FCF margins stay at 30%. That would mean a P/FCF of 45x which is appropriate for a 30% grower with such high margins.

Durability is key

The numbers we saw could be proven absolutely wrong. They must be considered a starting point on which we can make reflections and have realistic expectations on what could happen.

The model presented relies heavily on the fact that there will be a 30% Revenue growth for 10 years, which is a very strong assumption. By studying the business in depth we can better understand how that growth can be achieved.

In particular, as investors, we need to deeply study the business to better understand the durability of the growth.

Palantir's relative strength of the business, which has better unit economics than CRM 0.00%↑ and NOW 0.00%↑ (Seeking the Alpha: PLTR vs NOW) suggests that it could also have a prolonged growth of Revenues above 20%.

Assuming 30% for many years is ambitious, but the opportunity is huge. With the right execution, Palantir could reach ~$28bn Revenue by 2032 and generate superior returns.

I am delighted to share this journey in understanding Palantir’s durability with you.

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Business Email: arnylaorca@gmail.com

View expresses are my own. Do not represent Financial Advice.

I own (many) PLTR 0.00%↑ stocks.

As a retail investor, generally we talk about long term time horizon as our advantage. And we are not traders- "time in the market vs timing the market."

That said, there's some concern about big crash coming up this year or early next year. There's some hope that until midterm election and next fed meeting in November, there may be a potential rally. Are you thinking about exiting all positions to re-enter the market after the potential crash at all? When PLTR may be around $5~6? Seeing the AMD in $60s has been painful.