PLTR Government slowdown: not Palantir's fault

Many are worried because the Government side grew "only 13%" vs. last year’s 66%. Is it really a Palantir's specific problem?

Editor: @Emanuele20x

We assessed in the previous article, (Palantir Q2: Really a Disaster?) that while the Palantir Commercial business performed well, the Government results dragged the overall Group performance lower.

Is the slowdown to +13% growth really Palantir’s fault?

Hints from Prime Defence Contractors

The increase in Defence spending from NATO countries has not been recognized as Revenues yet by Prime Defence Contractors.

NATO Countries are targeting a substantial increase in Defence Budgets of 4-6% to reach the 2% GDP Target. Below are charts from an L3 Harris letter.

A breakdown of the massive increase in European Defence spending is offered by a slide on the BAE Systems (British defence contractor) presentation:

US Government accounts for ~40% of Palantir's Revenues, most of which are from DoD. Therefore I believe the slowdown in Government is partly due to the same delays in contracts affecting other Contractors.

This is no different from Q1, remember - the DoD budgets were enacted at the end of Q1, as we mentioned in the analysis of the Q1 results (Palantir Q1: better than it seems):

“The US DOD budget was enacted only on March 25th, the end of the fiscal quarter, probably due to tensions in Ukraine. This constrained Palantir's ability to capture new contracts in the first quarter.”

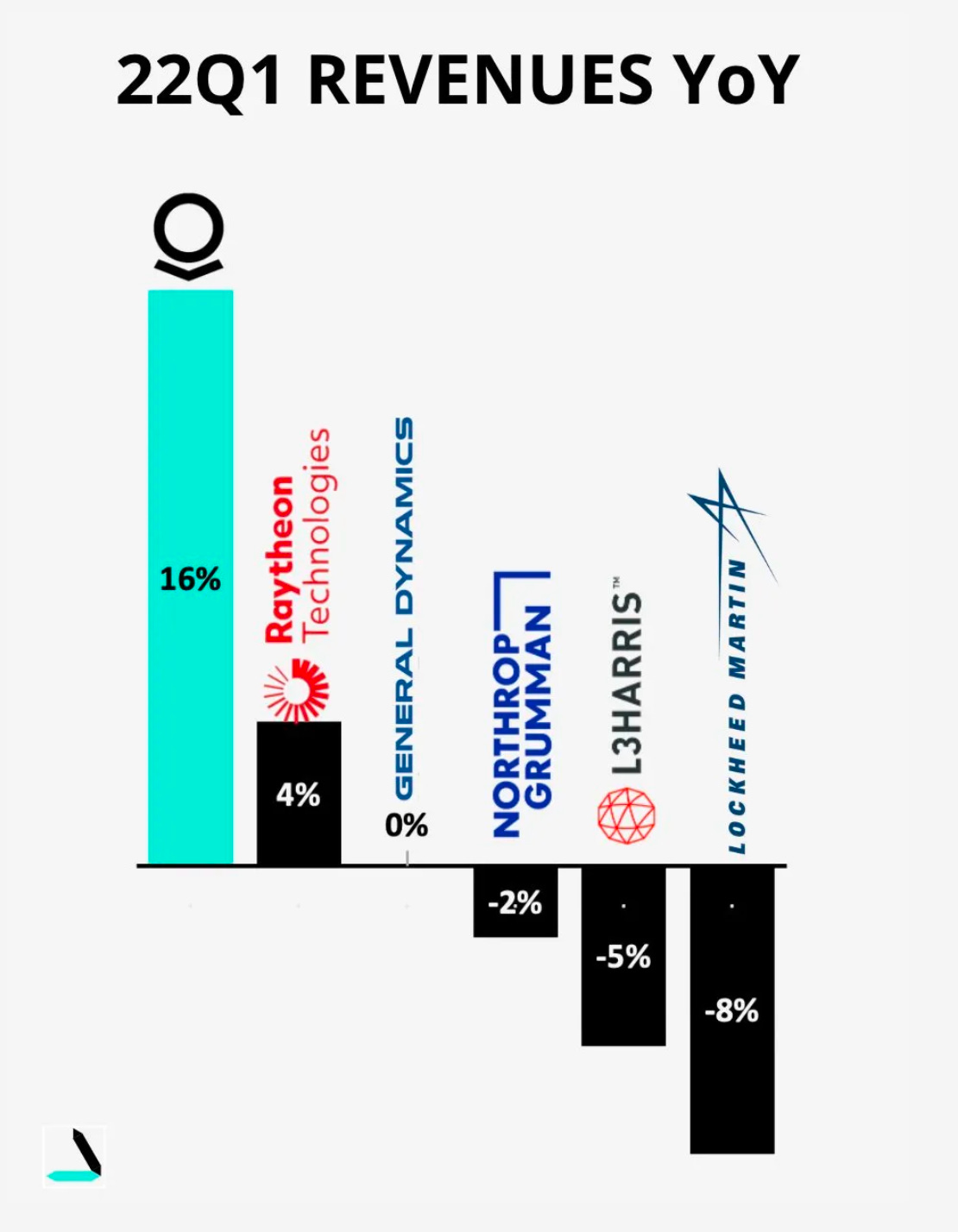

How did competitors perform?

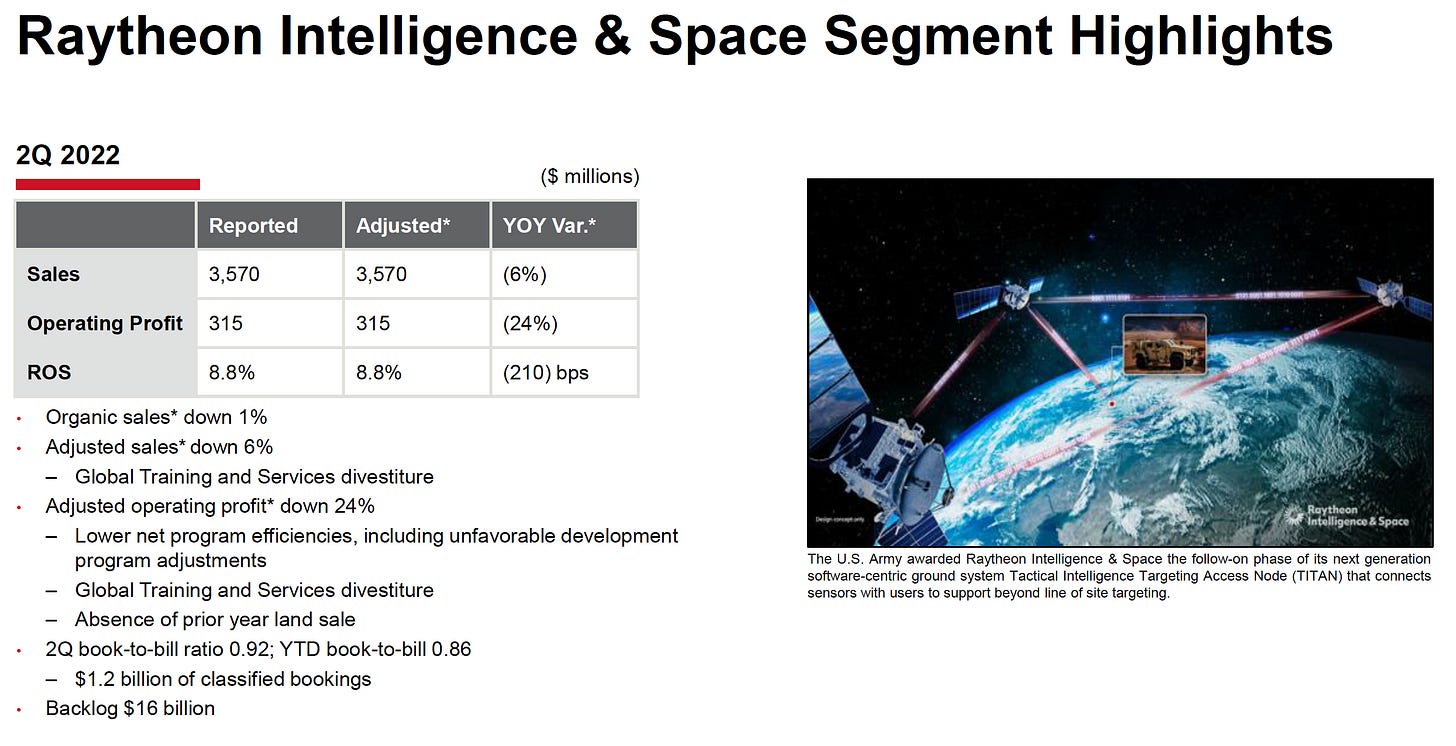

By looking closely at the divisions that could compete with Palantir in the tech defence space we see an equally weak performance in terms of Revenues:

Raytheon Intelligence & Space: -6%

L3 Harris Integrated Mission systems: -7% Revenues

General Dynamics Technologies: -5%

Should we be worried?

These charts show that the slowdown is spread across defence contractors and not Palantir only. Actually, Palantir performed relatively well despite the sector headwind.

I am not worried about the Government slowdown.

You live by the same sword that you pay the price for. And we deal with very, very large contracts.

The USG has some of the large -- our largest contracts, and they have been pushed out.

The large and chunky nature of our contracts will continue to be, in large part, an advantage because these contracts do not disappear.Sometimes, they are put off. - Alex Karp, Palantir CEO

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Instagram: @arnylaorca

Email: arnylaorca@gmail.com

Discord Channel

View expresses are my own. Do not represent Financial Advice.

I own (many) PLTR 0.00%↑ stocks.