PLTR: Data is the new bullet, but nobody cares

Is being ignored a curse or an opportunity?

Editor: @Emanuele20x

Hi, I’m Arny 😊 Join more than 630+ fellow Palantir investors spotting asymmetries with the subscribe button below. Research articles are free. You could support my work with a paid sub.

Palantir was born as a Defense Contractor and is becoming the Army’s Operating System. Therefore, as shown before, its business is set to benefit enormously from the increase in geopolitical tensions (PLTR Government: It’s Now or Never).

A war officially started at the end of February when Putin attacked Ukraine. This has been contributing positively to the Defense contractors’ stock price. Palantir, on the other hand, is still more than 20% down from that moment.

Why is that?

We must understand how the stock is considered by financial professionals in order to spot asymmetries and fine-tune expectations.

Palantir is ignored

Typically, when geopolitical risks rise, due to the increasing possibility of war, Defense stocks increase in value as the markets anticipate stronger demand for their solutions.

Despite being on the route of becoming the “first Prime Software Defense Contractor,” Palantir stock doesn’t behave as a typical “Defense stock.” We saw it at the beginning of the conflict and more recently as potential tensions arise from Xi Jinping officially gathering more power, becoming de facto “emperor of China.”

Reaction: Defense stocks up, Palantir flat…

Palantir is not understood

Below you can see the list of the 13 Sell-Side Equity Analysts covering Palantir (according to Palantir’s website) and their sector expertise:

The only Equity Research Desk covering Palantir as a Defense Contractor is Bank of America.

Interestingly, Bank of America has a Target Price of $13 per share, well above the $11 average, analyst Target Price.

The other investment banks cover Palantir with the Tech/Software Desk and its analysts have no previous experience in the Defense sector (I checked their LinkedIn profiles).

Analysts in Investment Banking tend to be siloed, and once analysts develop expertise in a certain sector they rarely move. This gives them depth on standard companies, operating in the sectors, however, limits their assignments when outliers appear.

Palantir is unique because its business:

Operates in the Defense sector while exhibiting a superior business model compared to legacy Defense Contractors (Cloud+Defense=Palantir);

Has better unit economics than the major B2B Cloud companies (Seeking the Alpha: PLTR vs NOW).

Palantir is an outlier, therefore difficult to evaluate.

Bank of America: Data is the new bullet

We can note how Bank of America appreciates Palantir’s government business from the interview below:

The most important take from the interview is the analyst’s assertion that the revaluation of Defense has not been reflected in Palantir’s price. In particular, he said:

“Data is the new bullet... Palantir offers a great way of being exposed to the increase in National Security Spending. That has not already been reflected.”

Other takes worth mentioning from the interview:

“The increase in Defense budgets, growing from $850bn budgets this year to $1trn in 2026 is clearly a long-term driver for Palantir;”

“Palantir Operating System lives inside many other systems built by other companies we cover;”

“Most analysts that are covering Palantir today aren’t looking at that. They are not giving them full credit for what’s going on in National Security;”

“Another way to look at it is: they are pricing in Defense, but they are not giving credit for Commercial.”

These assertions are in line with what we discussed in the previous article (Palantir Analysts are wrong):

Analysts give credit only to one of the two business segments.

This creates an asymmetry.

Differently from analysts of the other investment banks, Bank of America’s Ronald Epstein is deeply knowledgeable on the Defense space. In addition, being a PhD in Engineering, Epstein appreciates how difficult it is to build a solution like Palantir.

Palantir is excluded

Technically speaking, Palantir doesn’t move like a Defense company because it is not included in the key Defense indexes and funds.

Defense ETFs generally include Aerospace companies due to their intertwined nature. For instance, we will consider the two following ETFs:

XAR - SPDR S&P Aerospace & Defense;

ITA - Ishares US Aerospace & Defense.

Palantir is not included in either of these two Defense ETFs.

The main constituents of these ETFs are:

Raytheon - Mainly Defense Contractor;

Lockheed Martin - Pure Defense Contractor;

Northrop Grumman - Pure Defense Contractor;

Curtiss Wright - Aerospace Defense company with ~34% of Revenues coming from the Commercial Sector;

Boeing - Mainly Commercial Aerospace company with ~34% of its Revenues coming from Defense.

By looking at the smallest components of such ETFs we can assess whether Palantir’s exclusion is a matter of Market Cap size:

V2x (~$1bn);

Archer Aviation (~$0.7bn);

National Presto (~$0.5bn);

Ducommun (~$0.5bn);

Smith & Wesson (~$0.5bn).

Since Palantir Market Cap is over $15bn, the exclusion from the Defense ETFs is clearly not due to limited size.

Palantir’s exclusion is probably due to its unique hybrid structure where Commercial is going to take a large component of the Revenues. However, in the current state Palantir’s business is still heavily driven by the DoD, as it accounts for ~35% of the Revenues.

Palantir could be appreciated as a Defense Contractor only when it will show the ability to transform geopolitical chaos into Revenues.

Despite the recent heavy contract rain and the declared contribution to the Ukraine-Russia conflict, Palantir still doesn’t show growth in the numbers from these occurrences.

The asymmetry

In essence, Palantir is both:

a highly profitable defense contractor: the Contribution Margin for its oldest clients (like Army) is ~89%, as reported in the S-1 filing;

an unprofitable (on a GAAP basis), growth, B2B software company;

Its stock price should theoretically reflect a mix of the two. However, it is labelled by financial professionals as an “unprofitable growth tech” stock.

Therefore, Palantir's stock price moves in line with the major “unprofitable growth tech” indexes and funds, like Cathie Wood’s ARK ETF.

An asymmetry between the business’ actual qualities and the financial labels, create opportunities.

The opportunity

When the financial sector struggles to attribute a label to a company, it is likely that the company is unique and probably offers the best mix of numerous labels.

Two great examples come to my mind:

Ferrari: at the IPO, analysts were confused if Ferrari should be considered an “Automotive” company or a “Luxury” company. The reality is that Ferrari has characteristics from both and is superior to Automotive peers and the average Luxury brand. Due to the uncertainty of the label, Ferrari was trading at 11x EV/EBITDA after the IPO. It has now proven that its business model is unique, backed by strong financial results, and it trades at a rich 20x EV/EBITDA (similar to the 24x of Hermes). As G. Tamburi, my favorite Italian investor said, “Ferrari is neither Automotive nor Luxury. Ferrari is a myth.”

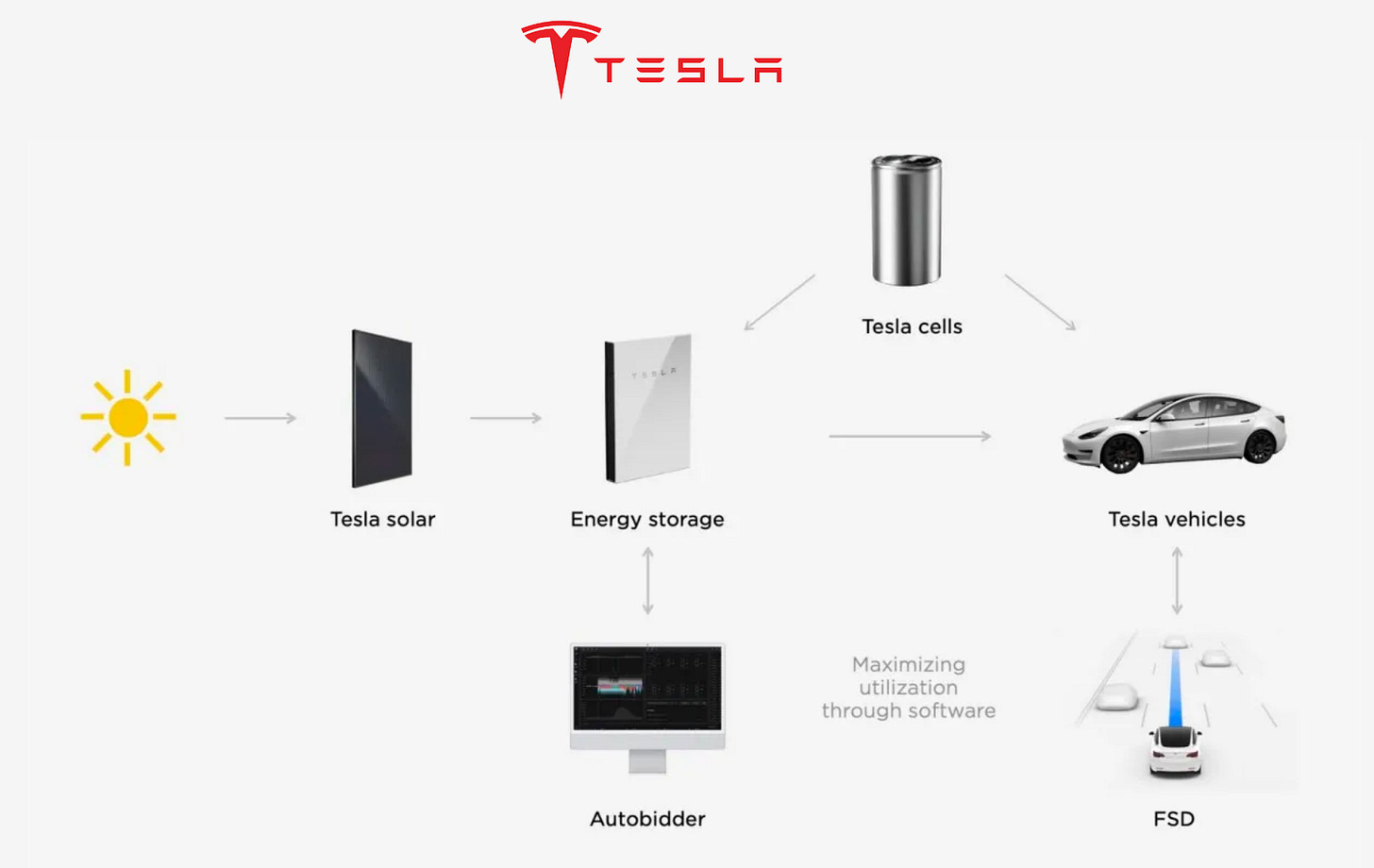

Tesla: many analysts still struggle to accept the fact that Tesla is obviously a Tech company selling cars. The topic becomes more complicated as Tesla is expanding into Solar Panels, Batteries, FSD, and Robots. Tesla is clearly not just an “Auto” company, despite ~87% of the Revenues coming from car sales. Its premium 27x EV/EBITDA reflects this. Tesla is an emerging ecosystem.

Palantir, in a similar way, is a unique hybrid that offers the combination of:

Resiliency in chaos as a defense contractor;

Scalability of an Enterprise Software company with strong network effects (PLTR: the Biggest Networks Start Small);

Exposure to exponential growth from the AI deployment in both the Government and Commercial sectors.

Therefore, any traditional label that restricts Palantir to just a “Defense” or “B2B SaaS” company, is short-sighted.

Conclusion

In the short term, prices are mainly driven by the interest in a certain sector.

Sector labels determine the price direction in the short term. In the long term, the market rewards companies for their ability to generate Free Cash Flow.

Until Palantir can provide striking evidence that it can transform war tensions into Revenue growth, it is set to continue trading as an unprofitable, growth company, similar to those populating Cathie Wood’s ARK ETF.

The recent contract rain (Palantir: it’s Raining), combined with the recent IL6 award, provide clues that the Palantir Government is still at the beginning with evidence of a future re-acceleration of the government business (PLTR Q3: What I am looking for).

A potential inclusion in the Defense ETFs could help Palantir stock move in line with other Defense Contractors when geopolitical tensions escalate.

Being associated with ARK companies was a curse for the PLTR stock price. Now, the “curse” has created an asymmetric opportunity.

“In the short run, the market is like a voting machine. But, in the long run, the market is like a weighing machine.” - Ben Graham, The Intelligent Investor author

Yours,

Arny

If you enjoyed this article, smash that like button and share it! Grazie.

Join me on:

Twitter: @arny_trezzi

YouTube: @Arny Investing

Business Email: arnylaorca@gmail.com

Join Emanuele20x on:

Twitter: @Emanuele20x

YouTube: @Emanuele20x

Substack: Emanuele’s Notepad

View expresses are my own and do not represent Financial Advice in any way.

I own (many) PLTR stocks.

great & unique coverage, thank you!