PLTR Copies SNOW's Pricing Model [part 2]

What evidence do we have?

Editor: @Emanuele20x

In the previous article (PLTR copies SNOW’s Pricing [Part 1]), we shared what consumption-based pricing is and how it could affect Palantir’s Commercial growth.

In this article, we will see where we are at and if there are any hints from the financials.

Palantir vs consumption-based pricing

First a brief history of Palantir vs. consumption-based pricing model:

Q4-21’ Call: No reference in slides. Karp mentioned it in the call:

“Most IT people prefer a small bite in consumption. You can argue whether that's the right model, but instead of fighting them, it's probably better to figure out a way to get our product more in their hands. So, that's kind of the known part. What we've been working on recently, which is less known is what we're really working on. We believe that people are paying a lot now for consumption and compute.” - Alex Karp, Palantir CEO;

Q1-22’ Call: Slide in the Appendix. No mention of it during the call;

Q2-22’ Call: Slide on page 11. No mention of it during the call.

Where is Palantir?

Palantir closed partnerships with the Cloud Hyperscales (AWS, Azure, GCP). These should help Palantir reach many more clients. A different breed, from the “$100mn/y” clients it has been targeting up to now (PLTR: the Biggest Network Start Small).

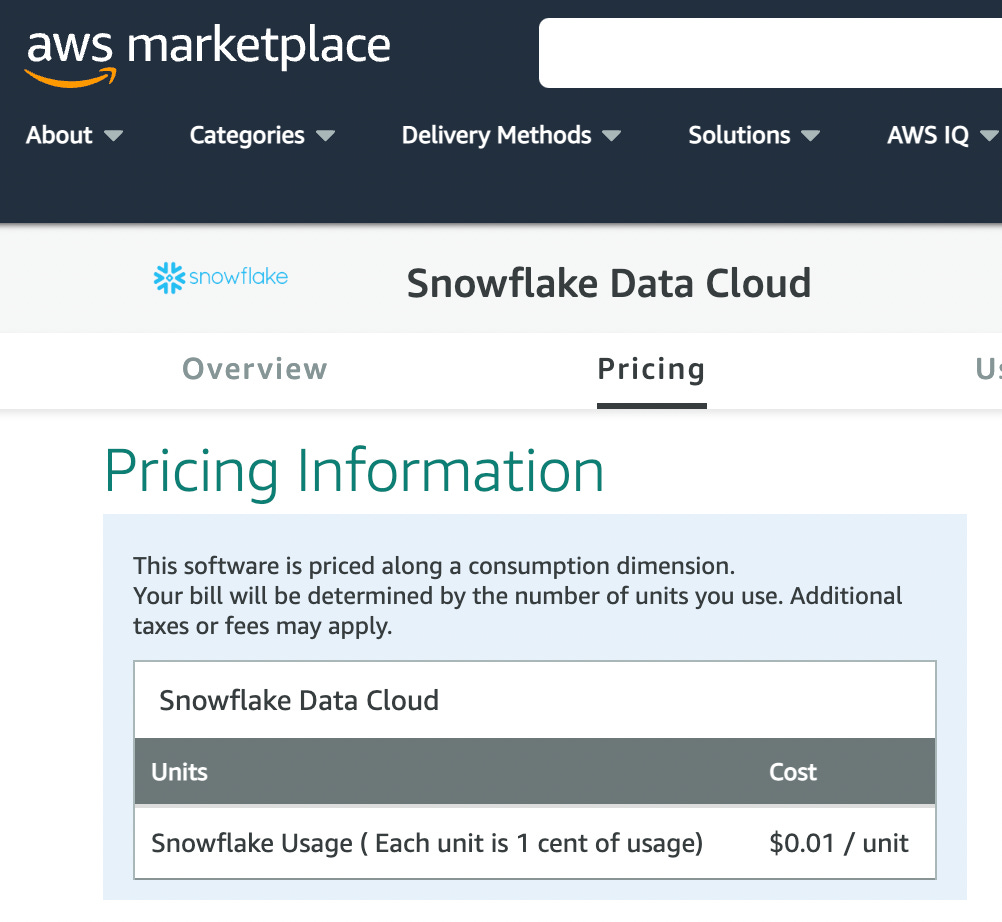

From AWS Marketplace, we have hints that Palantir is already offering its solutions with a consumption formula based on “units” of consumption.

We could think of “units” as the “CPU Usage over time”. For instance, C3ai wrote in its example:

“This table is based on the actual vCPU usage of a representative sample of customers, where 382 thousand vCPU hours represents the vCPU hour usage which meets the $210,000 per quarter minimum charge, and each period after shows the modeled growth of vCPU hours by customer” - C3 Q2 Earnings Slide

This is the same structure Snowflake has.

However, differently from Snowflake, to start using Foundry, potential clients still need to contact Palantir’s salespeople. Conversely, Snowflake could be deployed in a “plug and play” mode.

On Microsoft Azure, there is no indication of consumption-based pricing.

Neither on Google Cloud there is evidence of consuption-based offerings.

A look at the Financials

C3ai CEO underlined that the first 1-2 years of the consumption-based pricing would lead to slower Revenues and Remaining Performance Obligations (“RPO”) as a result of smaller commitments in the initial phases.

Therefore, going forward we will need to pay attention to the RPO development.

Unfortunately, in the financials, there is almost evidence from “consumption-based pricing”:

Q4 results: no mention;

Q1 results: 1 mention;

Q2 results: 1 mention.

“There is no guarantee that our existing or proposed business strategies, including subscription-based or usage-based pricing structures, will achieve broad adoption” - Palantir 10Q

The fact it does not receive particular attention in the financial results, it means that consumption-based pricing still should not impact financials.

However, I believe it is important to keep tracking where we could see variations:

Remaining Performance Obligations: these are non-cancellable commitments that are going to be recognized as Revenues in the coming 12 months (Current RPO) or beyond;

Remaining Deal Value (“RDV”): aggregate potential Value from the existing contracts. Therefore, it is the sum of the contractual obligations (RPO) and the potential options that could be exercised by the clients.

As we mentioned, consumption-based pricing prioritizes acquisition and starts showing strong Revenue growth after the second year.

However, since Palantir is also modularizing its offering (PLTR Q1 Outlook), we could only judge the combined effects of modularization and consumption-based pricing on Palantir’s RPO and RDV.

As a result of smaller commitments, it is possible that the RPO and Deal Value will not grow substantially in the coming quarters.

If the client acquisition stays strong, that would not be a worrying sign. Conversely, it would show that clients are embracing the strategy of starting with a module to later expand.

When Mesh?

Back in April, Palantir Japan unveiled a new product called Data Mesh hinting at consumption pricing.

It is not really clear if Palantir seeks to sell Data Mesh as a separate product or as a module strictly connected with other Foundry instances. The website and this video shared by @DarntonsMedia are the only things we have.

Data Mesh seems to be still available only in Japan. Therefore, the potential commercialization into the US could be a signal that Palantir seeks to give more weight to consumption-based solutions.

Conclusion

Despite Palantir mentioning it in the past quarters, we have weak evidence that consumption-based pricing is already affecting Palantir’s business.

It is important that as investors, we keep tracking the evolution of the contractual commitments which are a precious hint for future Revenues. I will discuss them more in detail in a dedicated article.

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

YouTube: @Arny Investing

Instagram: @arnylaorca

Business Email: arnylaorca@gmail.com

Discord Channel

Join Emanuele20x on:

Twitter: @Emanuele20x

YouTube: @Emanuele20x

Substack: Emanuele’s Notepad

View expresses are my own and do not represent Financial Advice in any way.

I own (many) PLTR 0.00%↑ stocks.

Thanks Arne for your insights and content!