PLTR Copies SNOW's Pricing Model [part 1]

Incentives drive behaviour and consumption!

Editor: @Emanuele20x

Incentives drive behaviour. And consumption!

Amid the fear of a recession (Is PLTR Recession Proof? [Update]), CEOs are not willing to engage with $50mn deals for software. This creates a major headwind for major software companies, but not for all.

Some companies are even benefitting from the situation. Others rapidly shifting their pricing models to adapt.

Palantir traditionally relies on a subscription model and they showed their intention of going towards consumption-based pricing since the FY21 Earnings Call. Therefore, this could be a major topic of the incoming Q3 Earnings Call.

In this article, we’ll navigate through the basis of consumption-based pricing. If we understand how this works, we can properly judge the progress in the field.

The change could be an incredible boost over the long-term horizon. However, it also has operational risks and could further delay the “exponential growth” that we would love Palantir to show. This may not be appreciated by the market and generate further pressure on the stock.

Snowflake’s success driver

Consumption-based pricing has been a key driver of Snowflake's ( SNOW 0.00%↑ ) success. Even in a very adverse environment for Software Enterprise companies, where also the major B2B SaaS companies Salesforce ( CRM 0.00%↑ ) and ServiceNow ( NOW 0.00%↑ ) slowed down, Snowflake has been able to grow 83% YoY.

Why does this pricing model strive compared with a typical Subscription model?

To answer this question, we first need to understand how it works.

Pay what you eat

Subscription businesses receive a fixed rate over the length of the contract. Consumption-based pricing changes the paradigm and makes clients pay only for the software that clients use.

We could synthesize:

Subscription = “pay a fixed amount over a determined time”;

Consumption-based-pricing = “pay what you use”.

Apart from Snowflake, consumption-based pricing drives also the success of the cloud providers (AWS, Azure, GCP) and SaaS companies with strong growth like Datadog (DDOG 0.00%↑ ) and MangoDB ( MDB 0.00%↑ ) .

Palantir is not the only company changing its pricing strategy, therefore, we could capture precious hints.

C3ai announced a radical shift

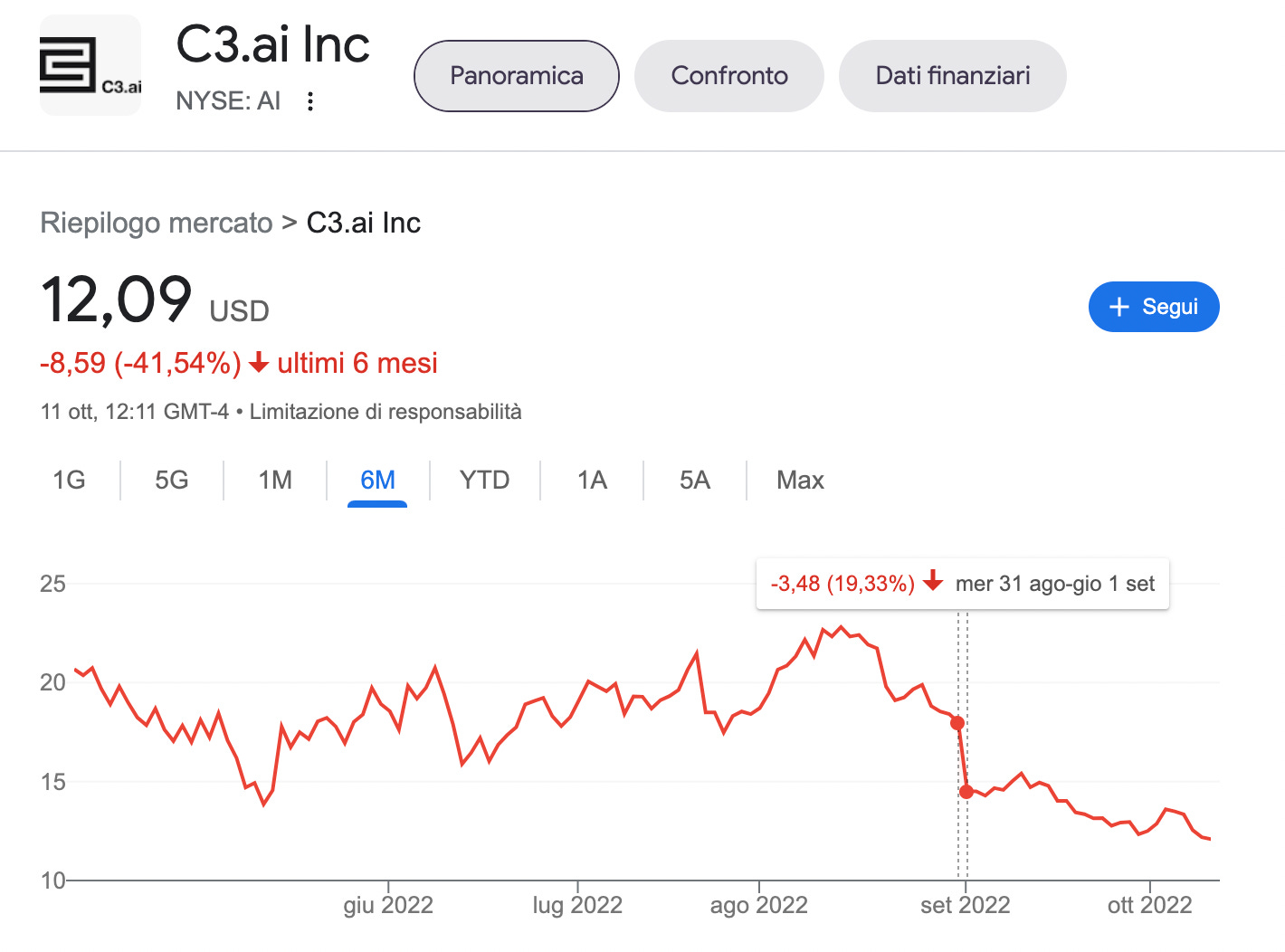

C3ai ( AI 0.00%↑ ), an enterprise AI software provider, announced in its Q2 Earnings Call, a radical shift in the new contracts, towards consumption-based pricing. This was driven by the difficulty in closing ~$50mn contracts.

The shift towards consumption-based pricing should:

Make it easier to acquire new clients: closing 10 contracts for ~$0.5mn with the new pricing would be much easier and faster than closing a ~$50mn contract.

Affect only new customers: Existing clients would receive little benefit from the change as they have already been offered bundle discounts. However, it would be easy for them to switch at the renewal date.

Impact the Company's financials: This is crucial to understand the potential impact on Palantir’s numbers.

Impact: Less now, more tomorrow

According to C3ai, this change will have a strong impact in the first two years.

Compared with the previous Subscription model, a new potential client under a consumption-Based contract would generate:

Fewer Revenues for the first 1-2 years: In the first period, the Consumption model underperforms the Subscription one. In this phase, ~6 months of $80k/month pilots are conducted and, in the following ~6 months the client is still expected to consume little while generating ~$70k/month.

More Revenues from the 2nd year: After the 2nd year, the client can expand much faster and growth will accelerate. The growth comes from less friction in expansion and better alignment between the software company and the client (more on this later).

Therefore, we could summarize the effects of consumption-based pricing as follows:

More clients: with a low entry cost of ~$0.5mn it is easier to make new clients sign.

Smaller Revenues per Client initially: as mentioned it would take ~2 years for clients to really scale up usage.

More subsequence growth later: no paperwork and no CFO approval are needed to expand usage. This reduces friction enormously.

Guidance risk

In line with what we mentioned, C3ai slashed the previous FY23 Guidance of ~22-25% Revenue Growth to just 1%-7%. However, it expects a very strong revamp during FY24.

The market, already nervous in those days, didn’t appreciate the renewed Guidance as they punished C3ai with a ~-20% drop after earnings.

Especially when interest rates are high (PLTR Fights vs a Tough Competitor), delaying cash flows in the future is not what excites Wall Street.

The beauty and the risk

From a client perspective there is a crucial difference between the two pricing models:

Subscription model: salespeople have the incentive to push more licenses and upsell. After the signing, the account team signs the contract and transfers the customer to a support or customer success team. If the subscription is not fit for the client and goes unused only the client suffers.

Consumption-based-model: salespeople are heavily aligned with customers. If customers are not happy, they don’t consume. This way salespeople have “skin in the game” with the success of their customers.

With consumption-based pricing, usage becomes tied to value.

This should incentivize software companies in delivering their best solutions to their clients. However, it is not all roses. Consumption-based pricing can expose the software company to strong execution risks.

The risk of Operating Leverage

As @TheInvesttoLive explained to me, consumption-based is a way to “leverage your product”:

If the solution is really appreciated by the client and uses it substantially the software company benefits too, generating positive operating leverage (Company C and D).

If the platform is not used, the software provider doesn’t earn enough compared with its fixed costs, generating negative operating leverage (Company A and B).

As any form of leverage, it can empower your returns when things go well, but would destroy them in the opposite case.

Given the delicate balance, it is crucial to have a dedicated team that is responsible to manage the pricing right.

With the right price, the incentives are fully aligned, and both the software company and the client strive.

The risks of wrong pricing would be a disincentive for the customer to consume the software and the consequent inability for the software company to properly generate margins over its fixed cost.

In other words, with the wrong pricing Revenues struggle to grow and FCF margin could be eroded.

As you can see, consumption-based pricing can be a double edge sword. If the software solutions are really aligned with the customer’s needs, they can generate spectacular returns for both parties. Inversely, the opposite scenario is also possible.

Conclusion

Consumption-based pricing could be a great opportunity for the Commercial business since the high price of its solution is often considered a major headwind for Palantir’s adoption.

Palantir claims it has the best existing software offering. Therefore, with consumption-based pricing, Palantir could join many new customers and leverage the strength of its products.

If it succeeds it could achieve higher valuation multiples like Snowflake and Datadog (PLTR Sum-of-Parts Valuation).

Palantir already has a very wide range of products that could make it an “Enterprise Operating System”. If clients could easily engage with pilots and then rapidly expand without many approvals and paperwork, they could be more engaged in testing further use cases and gradually expand their usage of Palantir’s Foundry.

If Palantir calibrates its pricing appropriately, growth could be exponential.

Are there any hints of how Palantir is implementing the strategy?

Subscribe to receive the second part in your inbox!

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

YouTube: @Arny Investing

Instagram: @arnylaorca

Business Email: arnylaorca@gmail.com

Discord Channel

Join Emanuele20x on:

Twitter: @Emanuele20x

YouTube: @Emanuele20x

Substack: Emanuele’s Notepad

View expresses are my own and do not represent Financial Advice in any way.

I own (many) PLTR 0.00%↑ stocks.

Great work! If PLTR is what we think it is, consumer based pricing seems like a great way to get their foot in the door and companies will inevitably increase spend over time. Bravo!

great original & unique coverage ... on the ins & outs of business models in this space ... great job guys, thank you & keep it rocking!