PLTR CheaTweets [May archive]

Top-10 Tweets | Articles | Videos

My Top-10 Tweets 🐥:

𝕏.com

$PLTR at $7.5 trades at ~23x EV/FCF 22E.

~30% Revenues growth.

~30% FCF Margin.

Cheap enough? 🤓

EBIT Adj. ~FCF for @PalantirTech.

𝕏.com

$PLTR Tripled its Commercial Client count 😲

In particular, US Commercial:

• +136% Revenues YoY

• 5x Clients

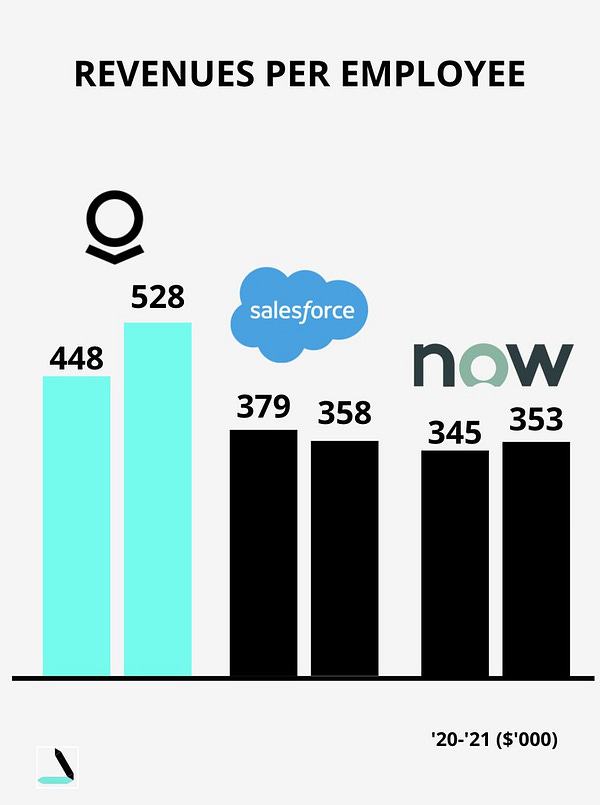

= the new salesforce (~80 people) is delivering.

US Commercial is the KEY DRIVER of @PalantirTech grow.

𝕏.com

$PLTR Net Dollar Retention 126%, down from 131%, seems scary 😳

Unless we unpack it:

• 116% Government

• 140% Commercial ✅

= Commercial business is stronger than it seems. 🏋️♂️

𝕏.com

$PLTR Q1 Stock-Based-Compensation is 33% of Revenues (37% in 21Q4).

"Normalisation processes" ongoing 👍

𝕏.com

The simple method I use is to incorporate $PLTR SBC by increasing the number of shares.

= Dilutive effects become a “TAX” on future DCFs 💸

This way we:

•Deal with "real" FCF generated by the company

•Incorporate dilutive effects in the Share Fair Value.

Better?🤠

My Articles ✍️:

Palantir Q1: better than it seems. Gov. slowdown hides Commercial ramp up

Palantir Q1 Outlook: Crucial ER between Tailwinds And Headwinds

My Videos 🎥:

My Appearances 🎬:

Arny, your insights are priceless! I’m honored to accompany you on this journey 💪🏽

awesome ... keep it rocking ...