Palantir's GAAP Profits: Fake Yet Good.

One-off or paradigm shift?

Editor: Emanuele Marabella

Hi, I’m Arny. If you are new, you can subscribe to spot Palantir asymmetries along with 1.330 investors. Please hit the ❤️ button if you find this article helpful.

To have full access to the article and support my research, please consider becoming a paid subscriber. You could also book a 1 on 1 meeting to discuss topics in detail with me.

Palantir shocked the market by showing in Q4 its first GAAP Net Income after being GAAP unprofitable for more than 20y.

Wall Street cheered with a +20% spike and the price is now around $10. However, there’s a caveat:

Palantir’s GAAP profitability is fake. Or at least, “crafted.”

Palantir’s Q4 results show positive signs and negative ones. They were more or less in line with what I expected with no substantial growth as the conditions are quite adverse on the Commercial side. In this first article, I’ll address the elephant in the room: GAAP Profits.

While it is nice to see the stock reacting, as investors we should be detached from the price action and ask crucial questions about Palantir's GAAP profitability:

Is this sustainable or a one-off joy?

What does this mean for investors?

Why now?

In further articles, as the 10-k will be available, I will go into detail about other dynamics that affected Palantir’s Q4 results.

Palantir’s GAAP Profits are “fake”

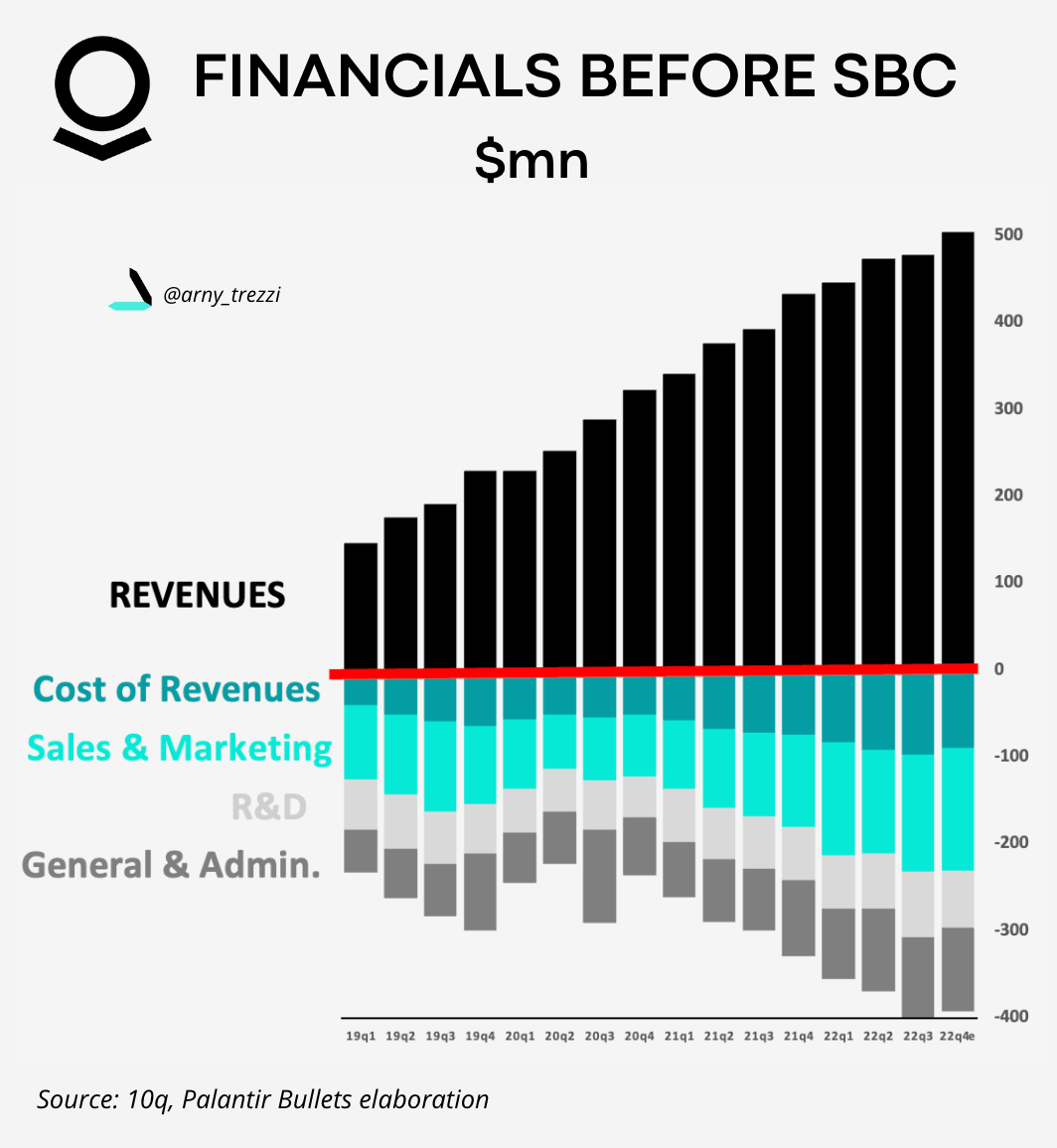

Despite the trend of the GAAP EBIT Margin being clearly positive, Palantir at an operating level still operates at a loss.

Breaking GAAP Profitability

Palantir’s GAAP profitability of $31mn Net Income in the quarter was achieved mainly thanks to an abnormal one-off contribution.

In particular, from the waterfall chart we can see the presence of two non-operating positive impacts:

$44mn from the step-up acquisition of Palantir Japan Join Venture (“JV”). I discussed what we know about the Palantir Japan JV in the Appendix.

$11mn Net Interest coming from the ~$2.6bn Net Cash.

SPACs devaluation generated an $11mn negative impact on GAAP results, which netted the positive Net Interest impact.

By excluding these non-operating factors, Palantir was not profitable yet.

Palantir's Operating Earnings are still negative at ~$18mn Operating Loss, which represents a 3% Operating Loss of Revenues. Negative, yet almost at break even.

As investors, it is particularly important to assess how Palantir got there.

Consultancy? No thanks

While Operating Costs stayed flat, QoQ Revenues increased.

In particular, the Cost of Revenue decreased QoQ, supporting Gross Margin expansion from ~80% to ~82%.

I see this as crucially important since, as we mentioned in the previous article (Palantir’s Money Machine Needs Scale), Gross Margin is the most precious hint for future FCF. This is further proof that the incidence of the “consultancy” component is decreasing.

In addition, by looking at the incidence of Operating costs on Revenues we can notice that R&D had a lower incidence on Revenues QoQ.

I don’t see this as concerning: Palantir’s priority now is to increase adoption with the products they have, which are already quite complex to sell. Stock-based compensation also supported the GAAP Profit achievement.

SBC decreased QoQ from $140mn in Q3 to $129mn in Q4.

NB: SBC is not decreasing due to the lower stock price, but because the existing RSU and Options related to the management equity plan are gradually being vested.

To have a comprehensive overview of how SBC works, please refer to a previous article (When will Palantir’s SBC Ease?) and the last SBC tracker (PLTR Q3 SBC Tracker). I’ll update the SBC Tracker in the coming days.

With this analysis, we showed that Palantir was able to achieve GAAP profitability basically by reducing costs and it seems sustainable over the long term.

Now Dividend?

While Palantir reaching GAAP profitability is a great sign, I believe we should not expect Palantir to start gaining significant Net Profits. At least, not yet. This implies that Palantir should not pay a dividend anytime soon.

Since only Net Profits are taxed, Palantir has the incentive to delay taxation by running just above GAAP profitability.

This way Palantir could signal it is GAAP profitable without incurring high taxes. Palantir will be incentivized to keep its Net Margin at this lowest level and reinvest resources into the business.

I think Palantir will operate at a thin 3-5% GAAP Profit margin like Servicenow while the business scales.

ServiceNow still runs at ~5% Operating Margin after 3 years of being GAAP-positive.

GAAP Warning

Palantir seeks GAAP Net Income for 2023FY. However, this doesn’t mean that each quarter Palantir will deliver GAAP Profits. For instance, the Guidance slide doesn’t point to Q1 being GAAP profitable as well.

If Palantir achieves $90mn EBIT Adj. in Q1, as Guidance suggests, it would still be GAAP negative as SBC for the quarter should be in the $110-120mn range if we assume it keeps decreasing by ~$10mn per quarter.

In other words, GAAP profits in 23Q1 could be achieved only if Palantir exceeds its Revenue Guidance or exercises further cost efficiencies.

Is better to have low expectations than to be fooled.

Conclusion

Despite the current GAAP profitability having been “manufactured,” the signal it provides is real.

Palantir is proving skeptics wrong. Paradoxically spending less will become a way for Palantir to acquire clients’ confidence.

For investors, this is a positive sign because it shows that the management is seeking to have better financial numbers. It is however crucial for us, as investors, to understand that this pivot is combined with sustained improvement in the product offering and the clients acquired.

I seek GAAP profits while pursuing market dominance and I don’t expect Palantir to become a GAAP income machine yet.

“The transformative potential of software, which we have been building for two decades, is only in the earliest stages of revealing itself.” - Alex Karp

Yours,

Arny

Appendix: Palantir’s Japan Joint Venture

Palantir Japan is a joint venture created in 2019 with Sompo to promote Palantir’s solutions to Japanese government agencies and commercial clients.

Palantir invested $25mn to have 50% of the JV. This means the JV was initially valued $50mn. The deal included a 10-year license agreement on Palantir’s platform and a revenue share agreement.

“Concurrently with the formation of Palantir Japan, the Company entered into a ten-year license and services agreement with Palantir Japan for a limited non-transferable right to resell the Company’s platforms and use certain of the Company’s trademarks in exchange for $25.0 million and future quarterly royalty payments to be paid based on Palantir Japan’s net revenue. In addition, the Company received a prepayment of $50.0 million to be used toward future services provided by the Company to support the business operations and future deployments of the Company’s platforms by Palantir Japan.” - Palantir 10k

Interestingly, this joint venture limited Palantir’s ability to distribute its software as Sompo gained the right to sell Palantir in the region. We can consider this a sort of “exclusivity on Palantir.”

In Q4 Sompo acquired Palantir’s 50% stake. Since Palantir obtained a $40bn Capital Gain it means the JV is currently valued at $130mn.

We don’t yet know the real motivations behind this, but I believe that is a positive sign since the relationship with Sompo is growing extremely well.

As we mentioned in Bullets #12, Sompo just signed a $50mn expansion with Palantir as it achieved crucial milestones in 2022. The timing of this operation makes me think that the sale of the joint venture could be related to the contract expansion. Hopefully, we will have further details in the 10-k.

As investors, the important takeaways are:

The relationship with Sompo, the most important partner in Japan, is good;

Palantir allegedly has no more limitations in selling its software in Japan.

It’s still a ~$40mn profit (almost 3x) from an investment they made in 2019.

great take, thank you!