Palantir: Will the Sun Ever Shine?

The new dashboard will help us spot Palantir asymmetries

Editor: Emanuele’s Notepad

Hi, I’m Arny. If you are new, you can join here to spot Palantir asymmetries along with 1.079 investors. Please hit the ❤️ button if you like today’s article.

Do you have questions arising from my research that you would like to discuss deeply? Please consider booking a 1-on-1 meeting.

Book a meeting with Arny Trezzi

In this article:

Introducing Palantir Dashboard;

Business drivers assessment;

Valuation assessment;

Portfolio update.

PLTR 0.00%↑ is close to its all-time low at ~$7. This leads us to the basic question:

Are we in a “Value Trap” scenario or can Palantir be an asymmetric “Opportunity?”

To help us better answer this question I built a simple dashboard, wrapping up the considerations we discussed up to now and underlying the key factors impacting Palantir’s businesses (Palantir: the Truth Behind the Surface). In addition, to provide the full picture I also included valuation based on the considerations shared in the previous articles (Palantir: Can it Drop Much Further? ).

The Dashboard is a useful framework both to assess the long-term trajectory and also to have reasonable expectations on future growth in the nearer term.

We can expect strong outperformance in the short term only if the business conditions are fully aligned but the stock doesn’t reflect it yet.

As time goes on, I will update this dashboard and, if needed, adjust it to make it more effective.

Let’s break down each factor.

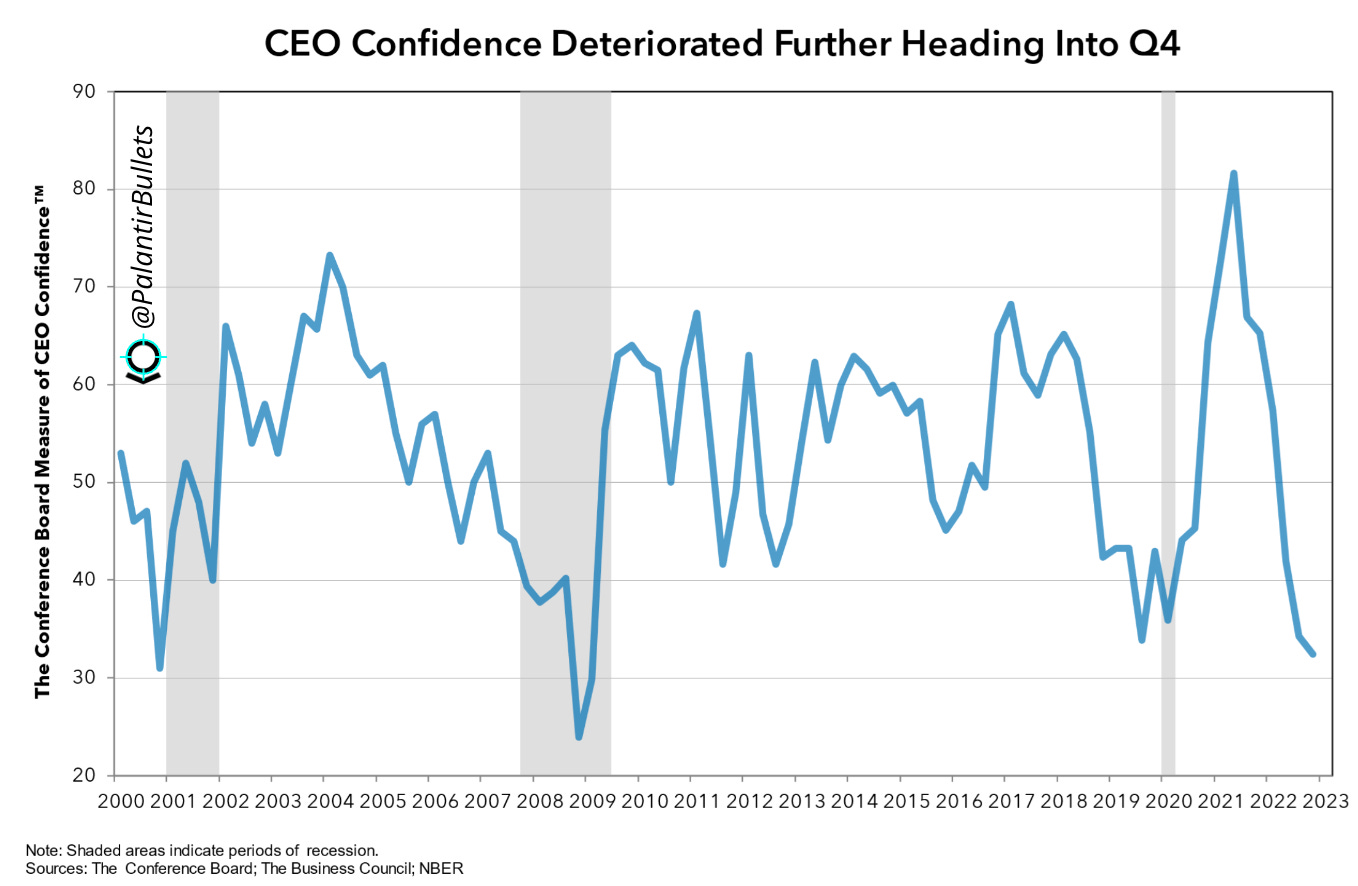

Palantir Commercial is stressed

CEO Confidence is extremely low. Companies are currently not prone to be involved in big digital transformation projects, so pilots and projects are postponed. CEOs' expectations of the short-term economic outlook are very weak: 74% of CEOs expect conditions to worsen. I consider this condition temporary, the underlying need for digitalization persists, so the big projects are just postponed. The shrewdest companies are already taking the opportunity to invest in technology to be in a better position when the rebound occurs. Despite the friction, we see Palantir keep expanding the number of pilots, as shown by Palantir's Missing Link , and the many new partnerships announced.

Forex is still adverse, but less. The currency impact, which made Palantir’s Commercial offering ~15% more expensive to International clients has been negative in Q4 in a similar way to Q2 and Q3 (Is Palantir Commercial Doomed?). Forex impact heavily affects Palantir Commercial as ~60% of Revenues still come from outside the US. However, the USD has weakened “only” ~5% YoY in Q1. This should alleviate some headwinds on Commercial International.

The conditions on the Commercial side are adverse, but not structural.

As confidence in the economy is restored, all the work performed on the clients should bring substantial contract expansion.

Palantir Government is a juggernaut

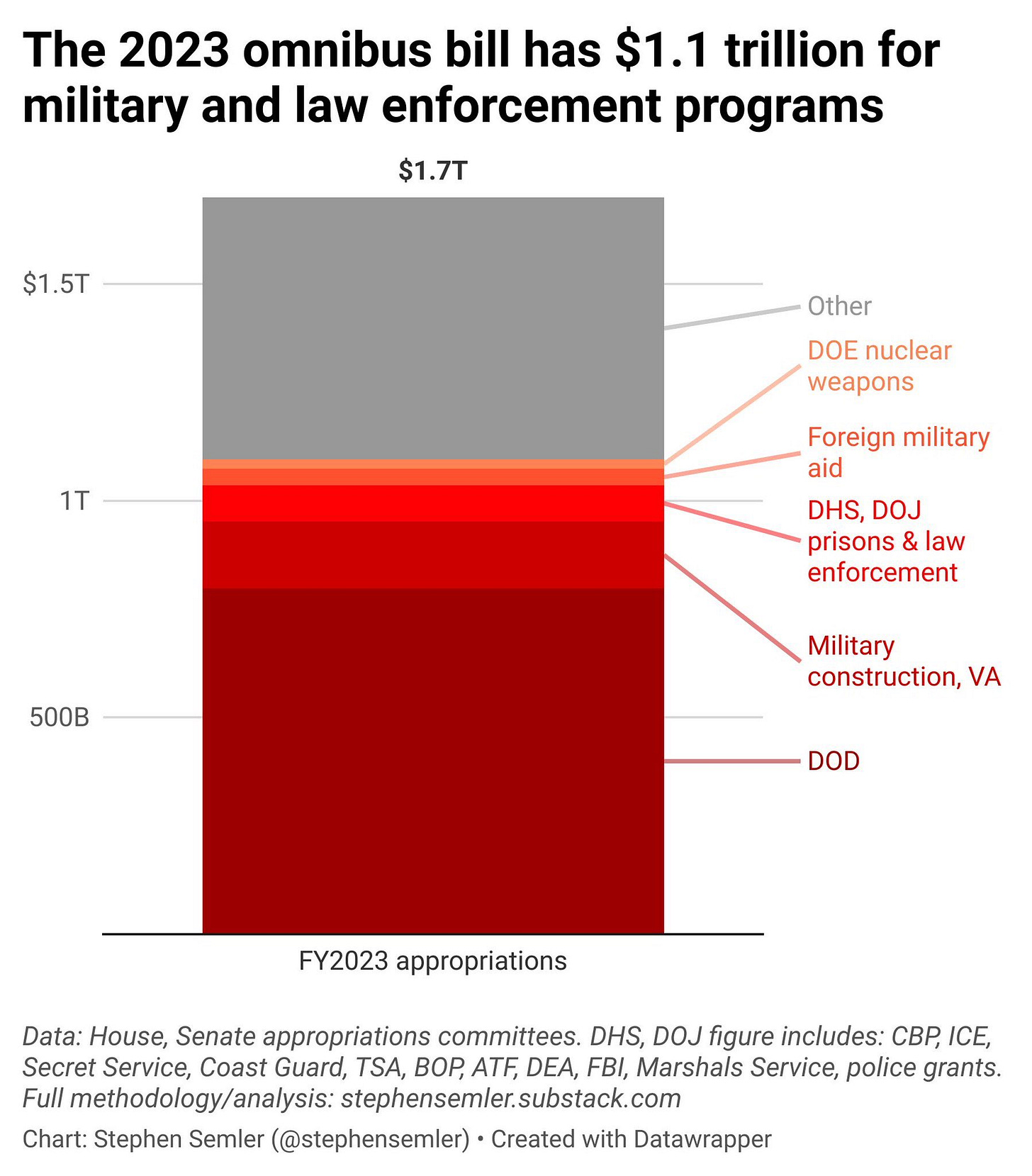

The Defense Spending outlook is strong. We mentioned many times that the War in Ukraine triggered defense spending in all NATO countries as heavily discussed (Palantir Government: It’s Now or Never). This inevitably creates an extremely favorable condition for Palantir which is now seeking to expand its reach both within the US and the EU.

Overall Government spending is increasing. The beauty of being a government supplier is that governments spend heavily no matter what the macroeconomic conditions. In particular, in the US, Biden signed a $1.7trn Omnibus Bill. This includes $773bn for nondefense discretionary programs involving medical research, safety, veteran health care, disaster recovery, and Violence Against Women Act funding – and gets crucial assistance to Ukraine. Palantir is already entrenched in almost all agencies and can potentially contribute to each segment.

Palantir’s Government business is a juggernaut also in times of high economic uncertainty.

Palantir is set to capture the opportunities coming from government budget expansions.

Valuation is asymmetric

Cloud Sector is asymmetric. The cloud index trades at its multi-year low but is still ~20% higher than its historical minimum. I see the condition as extremely favorable, yet with some possible downsides.

Historical Valuation at its lowest point. Palantir is trading at ~5x EV/Sales, which is its lowest point in history, even considering when it was a private company. Basically, the market is implying that the adverse conditions on the valuation are set to be perpetual. I believe this is not the case.

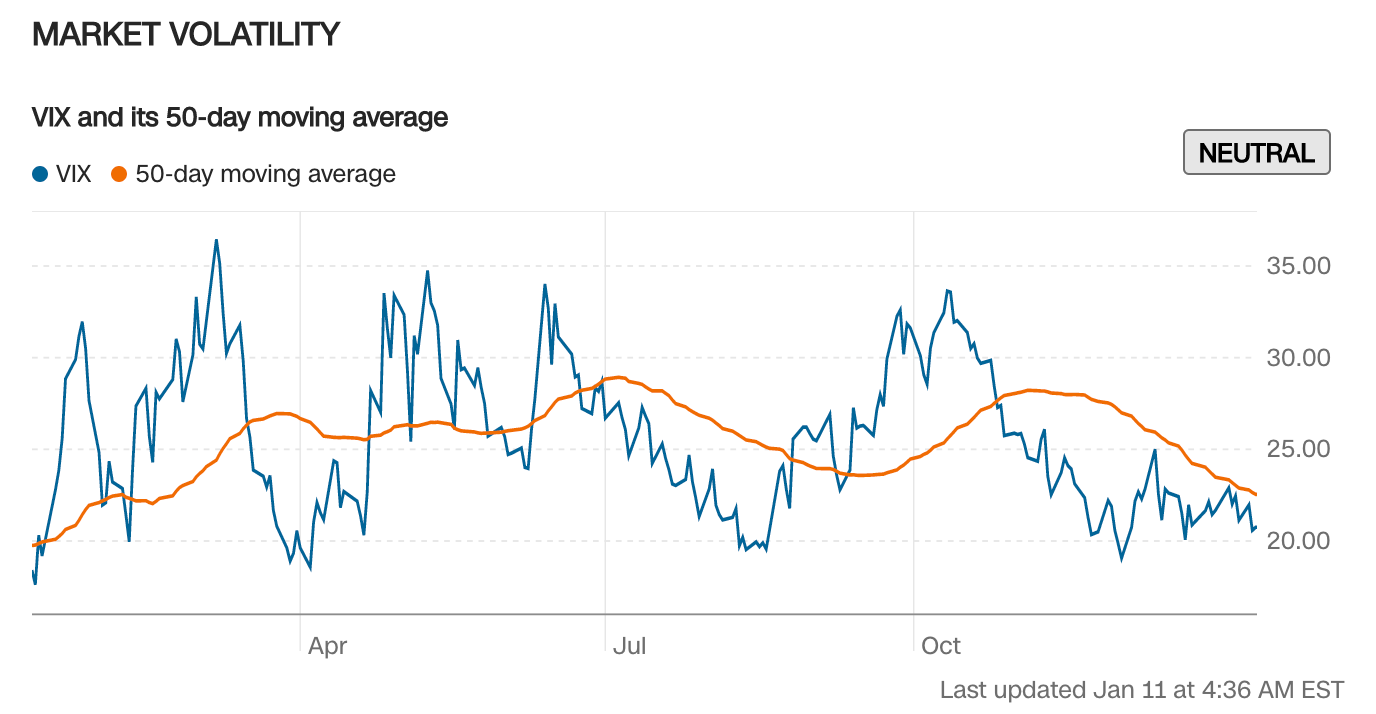

Market Sentiment is neutral. As mentioned before (Palantir Mistakes: a Matter of Survival), I usually track the CNN Fear Greed index to have a sense of the market sentiment. While I don’t seek to predict the future, I try to maximize the conditions to get a good deal. In particular, I pay attention to the VIX, one of the key components, often called the “fear index.” VIX currently doesn’t reflect “fear” as the money keeps flowing into the most “defensive” companies like Coca-Cola and Starbucks. Therefore, while I see "fear" in Palantir, I can't say the same about the overall market.

Cloud is the “hated” corner of a market that currently is not fearful.

Portfolio update

As mentioned previously, my goal is to maximize the number of Palantir shares, as I believe there is a big asymmetry between reality and perception. My allocation is very simple:

75% Palantir;

24% 1-3y Treasury ETF;

1% Other.

The allocation was initially 80/20 but it automatically changed as Palantir decreased to 75%, it dropped ~20% below my avg. cost of $8.3. This final drop at the end of the year definitely destroyed my 2022 performance which brought me around -40% from the beginning of 2022.

I plan to exchange my Treasury investment into the market if/when I see “Extreme Fear.”

Therefore:

If a disaster doesn’t happen and the market rallies: Palantir should outperform the market given the high beta.

If a disaster happens and the market crashes, I have 20% cash to deploy where I deem the price too cheap to ignore, like Palantir at ~$5 (Palantir Buy Signal: a Dive Inside my Playbook).

Wrapping up

By wrapping up, here is how we start 2023:

The conditions on the Commercial side are adverse, but not structural;

Palantir’s Government business is a juggernaut despite high economic uncertainty;

Cloud is the “hated” corner of a market that overall doesn’t show fear currently.

I believe this Dashboard would help us better monitor the conditions that could drive Palantir’s results in the stock market and adjust our positions accordingly.

Nothing ever goes according to plan. The software that really matters is a software that lets you react to reality - Shyam Sankar, Palantir COO

Talking about reacting to reality, in the next weeks, I will seek to publish more short articles during the week, rather than a “big” one on Thursday. This should make the articles lighter to read and would allow me to address specific questions more easily and incentivize more investors to join us.

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Mail: arnylaorca@gmail.com

Join Emanuele20x on:

Twitter: @Emanuele20x

YouTube: @Emanuele20x

Substack: Emanuele’s Notepad

View expresses are my own and do not represent Financial Advice in any way.

I own (many) PLTR stocks.

Great week = great bullets, Arny! A lot of work here, as always 💪🏻 Keep it up! 🤗