Palantir: Can it drop much further?

Valuation Tracker [November]

Editor: Emanuele’s Notepad

Hi, I’m Arny 😊 Join more than 760+ fellow Palantir investors spotting asymmetries. If you are new, you can join here. Please hit the heart button if you like today’s article.

Since our last tracker (July Valuation Tracker), the valuation changed substantially, so this is an opportune time for an update.

Palantir currently trades at $7, which consists of ~6x EV/Sales and ~30x EV/EBIT adj. on 2023 analysts’ consensus numbers.

In the table below you could see the EV/Sales and EV/EBIT adj. valuation ranges at different prices:

As a reminder, EBIT adj. is approximately equivalent to FCF for a business with virtually no Capex and no GAAP Profits like Palantir.

From the previous update, the EV/EBIT adj. multiple increased as a result of the decreased estimated Margins. This is due to sustained client acquisition, as shared previously (Palantir Q3: Another Disaster?) and not to competitive pressure. Therefore I don’t see it as a concern, but rather, as a necessary step to boost growth in the future.

Analyst estimates for 2023-24 were already conservative (Palantir Analysts are Wrong), after Q3 they lowered them even more.

This is despite Palantir slightly increasing its Q4 Guidance for EBIT adj. and achieving $1.3bn Contract Deal Value in the quarter, which should help sustain growth.

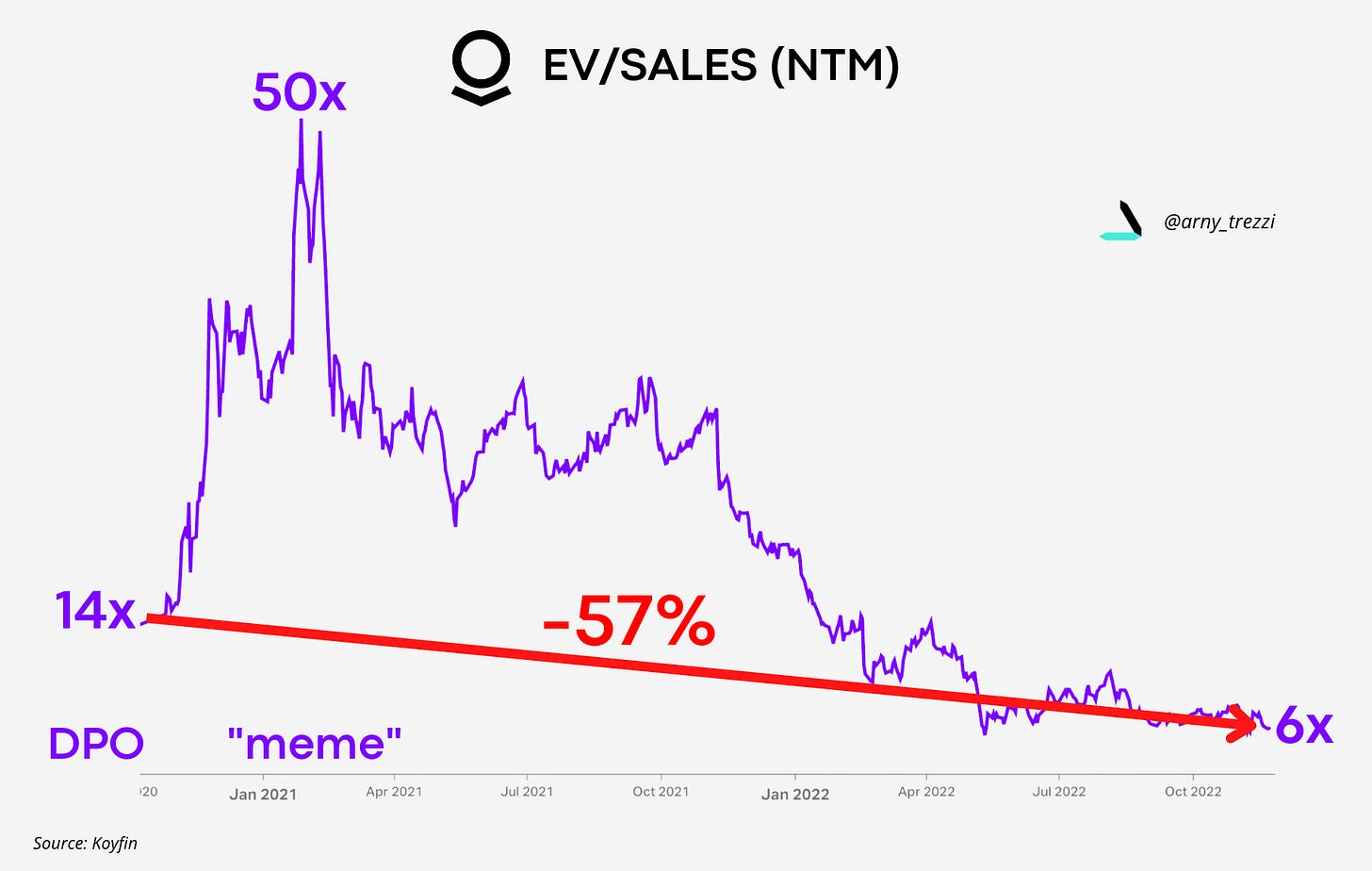

Palantir’s Historical Multiple

Palantir’s EV/Sales is ~57% cheaper than at DPO.

This is the result of the combination of multiple compression and business growth, which naturally lowers the multiple.

If the price stays flat and the business keeps growing the multiple would contract even further.

Can it drop much further?

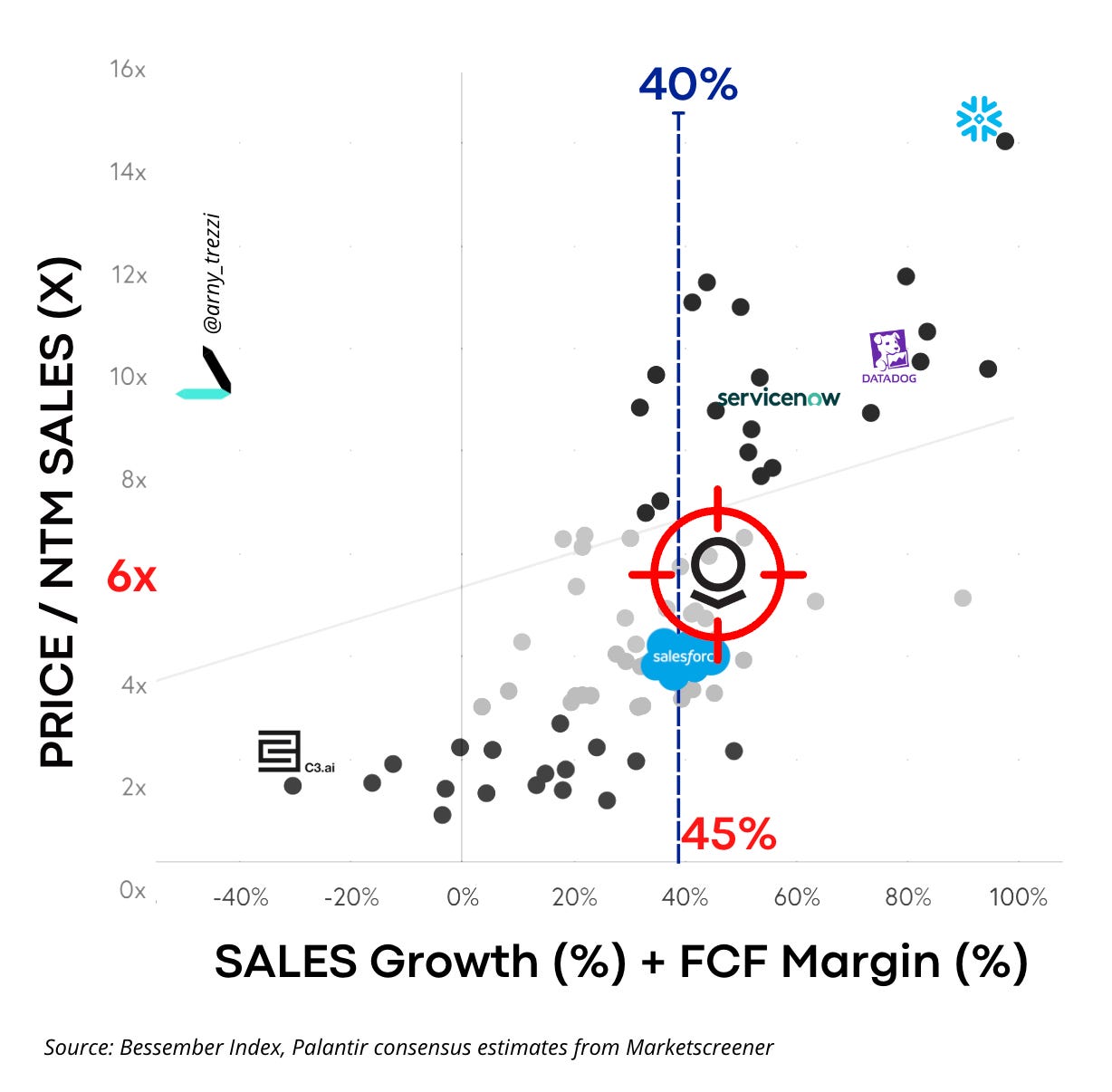

Palantir vs. Peers

SaaS companies are mainly valued on the combination of Revenue Growth and FCF Margin, the so-called “Efficiency Score.”

Palantir Revenue growth slowed down and its FCF margin compressed due to client acquisition. Therefore, its Efficiency Score decreased from 60% to 45%.

This in turn leads to a lower valuation in the short term. Palantir currently trades:

at a premium vs Salesforce, which trades at 4x EV/Sales and has an Efficiency Score of 40%.

at a discount vs. Servicenow, which trades at 9x EV/Sales and has an Efficiency Score of 47%. Previously, I shared why I consider Servicenow as the closest comparable for Palantir (Seeking the Alpha: PLTR vs. NOW).

Differently from Palantir, ServiceNow is GAAP profitable, which is a characteristic appreciated by the market during inflationary times.

Therefore, from a Peers’ Valuation perspective, I believe that Palantir can hardly trade at more 9x EV/Sales without accelerating its growth.

To deserve a higher multiple like Snowflake (14x EV/Sales) and Datadog (13x EV/Sales) Palantir needs to increase its growth.

Growth should arrive as the recently acquired clients generate a re-acceleration.

Cloud Sector Valuation

The Cloud Sector, currently trading at 4.3x EV/Sales, is approaching its lowest absolute minimum of 3.5x EV/Sales reached in February 2016, which represents a further potential ~20% downside.

If the Cloud Sector drops an extra ~20%, Palantir could reach ~$5.60.

At that price, Palantir would trade at ~5x EV/Sales and ~26x EV/EBIT adj. at ~20% Margin, which is intuitively, remarkably low for a company with long durable growth intersecting many “secular trends” while already having a very solid financial structure. As shared in my “playbook” (PLTR Buy Signal: a Dive Inside my Playbook), I see the ~$5 range as a price “too low to ignore” for a portfolio manager. This would be a point where it can easily rebound.

Conversely, Palantir could rebound sooner if there will be renewed interest in SaaS companies. This could come from decreasing interest rates.

Palantir vs. the gravity force

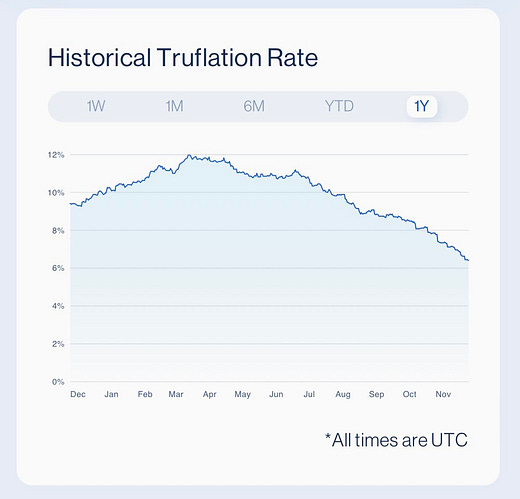

In the previous article (Palantir Competes vs. a Tough Competitor), we showed how the yield of the 10y Treasury heavily affects equity valuations, especially for those labelled “growth.”

Treasury yield decreased from the peak of 4.2% to 3.8%, which should be beneficial to “growth stocks,” but PLTR valuation has not recovered yet.

There are hints supporting the fact that yields could decrease thanks to a reduction in inflation, which in turn, creates the condition to avoid further interest rate hikes. Thank you @SamMeciar for sharing this tracker.

Palantir vs. the “ARK” label

As mentioned in the previous article (Data is the New Bullet, but Nobody Cares), despite Palantir’s business being heavily driven by the Department of Defence, the labels associated with it make the stock move in line with Cathie Wood’s Ark, which currently is facing severe critics for its investments in crypto companies.

Pressure on ARKK is negative for Palantir in the short term due to their price correlation.

This phenomenon is emphasised by the fact that the correlation is increasing between stocks and sectors.

Both single stocks and sectors are becoming more and more correlated.

This is boosted by the dramatic raise of passive investing, under which most allocations are based on “themes” or “sectors” rather than on assessments of specific companies.

From the standpoint of fundamental investors, this is all but negative.

Fundamentals investors who can wait patiently for the financial numbers to unfold the true story will be rewarded.

What I am doing

The prolonged agony in the price generates a situation where the upside from a renewed interest in the Cloud Sector seems asymmetric compared with the downside.

Is it worth being exposed to a ~20% downside in the short term to potentially get a multiple of the investment?

At this price, I am in “do nothing mode” despite the price being appealing simply because I am already positioned. My avg. price is slightly above $8.5 per share (~80% of portfolio) and I am waiting patiently for the story to unfold.

If a further “leg down” happens while the business story doesn’t change (or improve), I would be happy to increase further.

“Our preparation for the current moment is anything but accidental.” - Alex Karp, Palantir CEO

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Instagram: @arnylaorca

Join Emanuele20x on:

Twitter: @Emanuele20x

YouTube: @Emanuele20x

Substack: Emanuele’s Notepad

View expresses are my own and do not represent Financial Advice in any way.

I own (many) PLTR stocks.

Great coverage, thank you! ... I did expect a small rebound in PLTR price with the 10y yield dropping a bit ... maybe we need some time ... . Cheers!

I expected that too, but PLTR wants to train our patience. Thank you so much Mave, cheers!