Editor: @Emanuele20x

Palantir is unlocking its biggest opportunity.

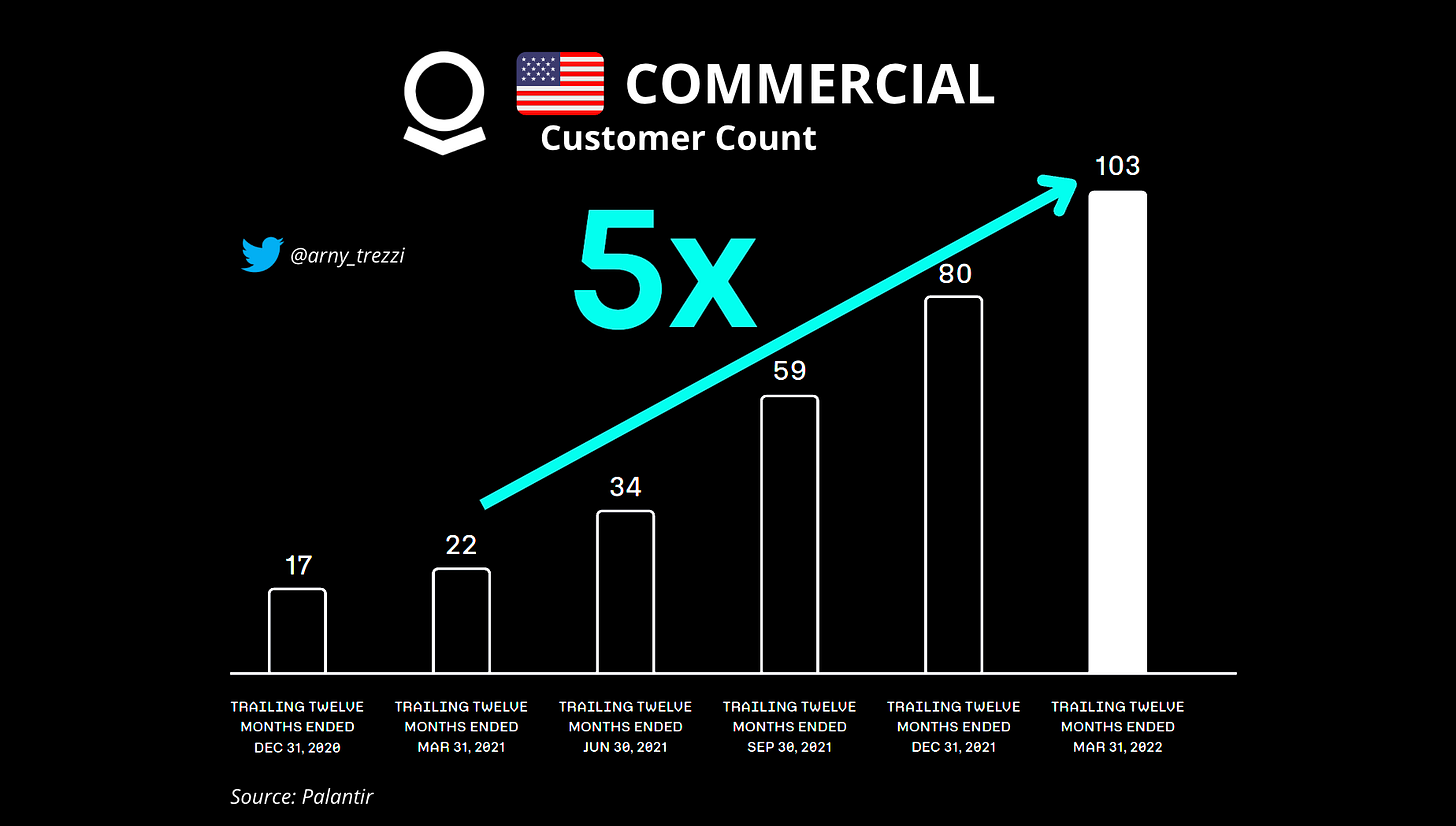

5x new clients in one year

Palantir grew its US Commercial client count by almost 5x in one year. They have reached 103 clients, which represents 55% of the total 184 Commercial clients as of 22Q1.

SPACs, 25 in total, start to become negligible and according to the management, Palantir will not pursue new SPACs in the coming quarters.

Notably, new US Commercial accounted for 23 of the 40 total new clients acquired in Q1.

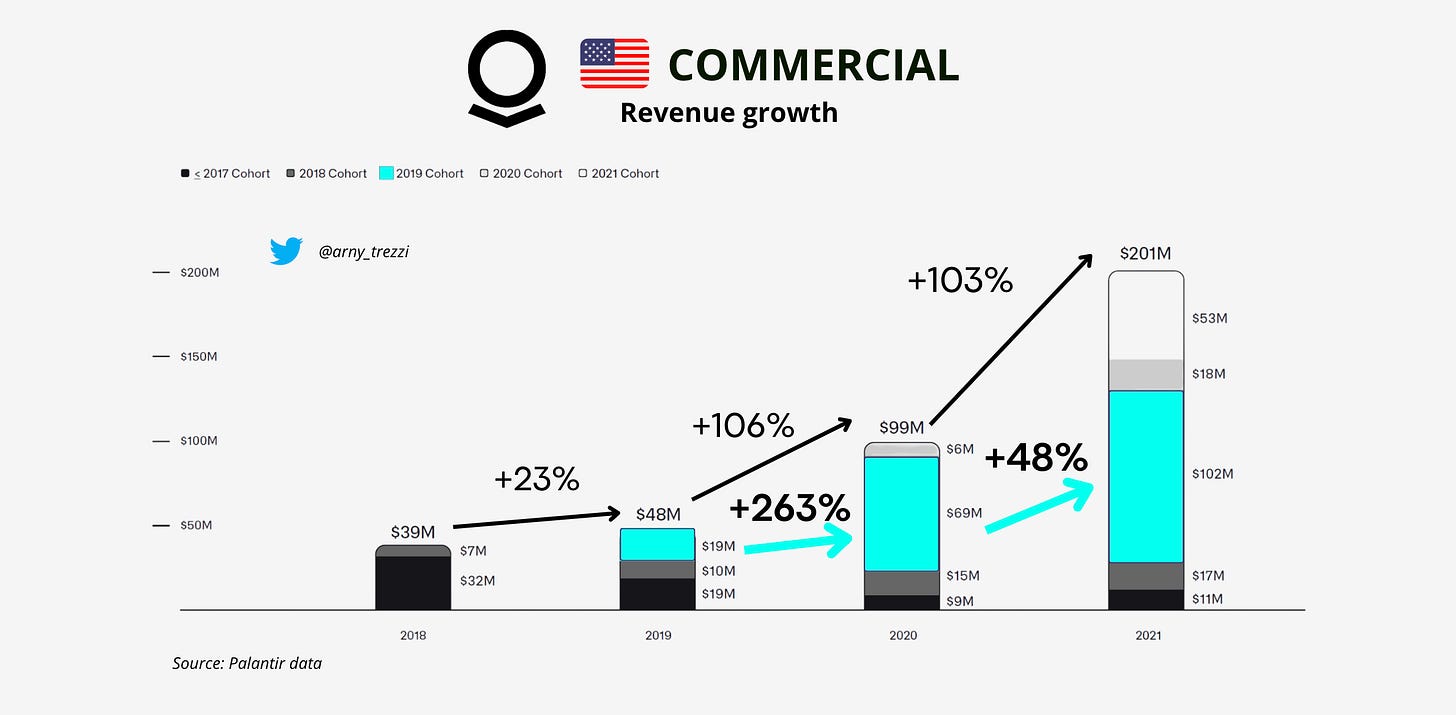

Revenue growth is accelerating

Revenue growth pace is accelerating fast reaching 136% in 22Q1.

This growth does not only come from new clients.

Existing clients expand substantially even after 3 years with Palantir.

For instance, Revenues generated by clients acquired in 2019:

$19mn in ‘19;

$69mn in ‘20 (+263% YoY);

$102mn in ‘21 (+48% YoY).

These results were obtained with a small salesforce of 25 salespeople with at least 9 months of tenure:

Huge potential to grow

While the US represents ~75% of the Government Revenues, the US Commercial size is still small but rapidly increasing its relevance.

US Commercial Revenues as a % of Commercial Revenues are shown here:

12% in ‘19;

21% in ‘20;

31% in ‘21.

The fact that US commercial clients account for 55% of clients but only 31% of revenues is a sign for huge potential growth in this area.

As mentioned in the last article (Palantir is Planting the Seeds for Exponential Growth), client growth is a leading indicator of future growth because each client expands in time.

Average Revenues per Commercial client is $3.9mn, composed of:

$2.4mn per US Commercial client;

$5.8mn per International Commercial client.

US Commercial Revenues could realistically 3x if the average Revenue per contract would match those of International clients.

Very small in the most important market

The 31% of Palantir's Revenues coming from the US is very small when compared to comparable companies mentioned in the previous article (Palantir Peers Valuation):

Salesforce: 70%;

ServiceNow: 64%;

Snowflake: 80%.

Datadog: 71%.

The US enterprise software is the most important market for these companies.

According to Statista, the US accounts for ~50% of the ~$240bn Global Software Enterprise market.

The fact that Palantir is penetrating so aggressively is an encouraging sign of a good market fit for its solutions.

Data supports the idea that the modularization efforts are delivering results.

The opportunity is there. Palantir is running for it.

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Discord Channel

View expresses are my own. Do not represent Financial Advice.

I own (many) PLTR 0.00%↑ stocks.

Appendix:

CRM 0.00%↑ breakdown

NOW 0.00%↑ breakdown:

SNOW 0.00%↑ breakdown:

DDOG 0.00%↑ breakdown: