Palantir: the Truth Behind the Surface

Investing is capturing the asymmetry between perception and reality

Editor: Emanuele’s Notepad

Hi, I’m Arny 😊 Join +900 fellow Palantir investors spotting asymmetries. If you are new, you can join here. Please hit the heart button if you like today’s article.

Are you seeking a deeper understanding of Palantir’s financials and strategy? Please consider becoming a paid subscriber.

PLTR 0.00%↑ stock is down ~80% from its peak and ~65% YoY. Needless to say, the sentiment is sinking.

As often happens in the market, a falling price reinforces the negative sentiment and investors become even more sceptical, creating a dramatic feedback loop.

In this situations, understanding what’s the reality under the surface becomes even more important.

Perception: Palantir is uninvestable

Analysts are sceptical

Wolfe Research just downgraded Palantir to “SELL”, suggesting that its clients leave the stock before it goes under $5.

Interestingly, the same analyst had a “Hold” rating since $20 in early 2021. How credible is he?

Meanwhile, Morgan Stanley decreased its target price from $10 to $8 under the following assumptions:

21% Revenue growth up to ‘28;

22x EV/FCF;

13% WACC.

My observations towards these:

Growth seems very conservative considering the number and the quality of newly acquired clients;

22x EV/FCF is a fair multiple under a 20% growth assumption. If growth accelerates the fair multiple could easily improve.

13% WACC assumed for each future cash flow is high as it assumes the interest rates will not substantially decrease up to 2028. We showed previously that there are already hints that inflation is cooling down, which should support decreased interest rates.

If the reality unfolds better than these implied conservative assumptions, the potential upside could be substantial.

Only Bank of America is defending Palantir’s role as a Defense contractor, with a $14 price target and stating the same conclusion that was drawn in the Sum-Of-the-Parts Valuation (Cloud+Defense=PLTR):

“At $6 you pay for Defense, and you get Commercial for free.”

As a reminder, Bank of America is the only desk covering Palantir as a Defense company (PLTR: Data is the New Bullet, but Nobody Cares).

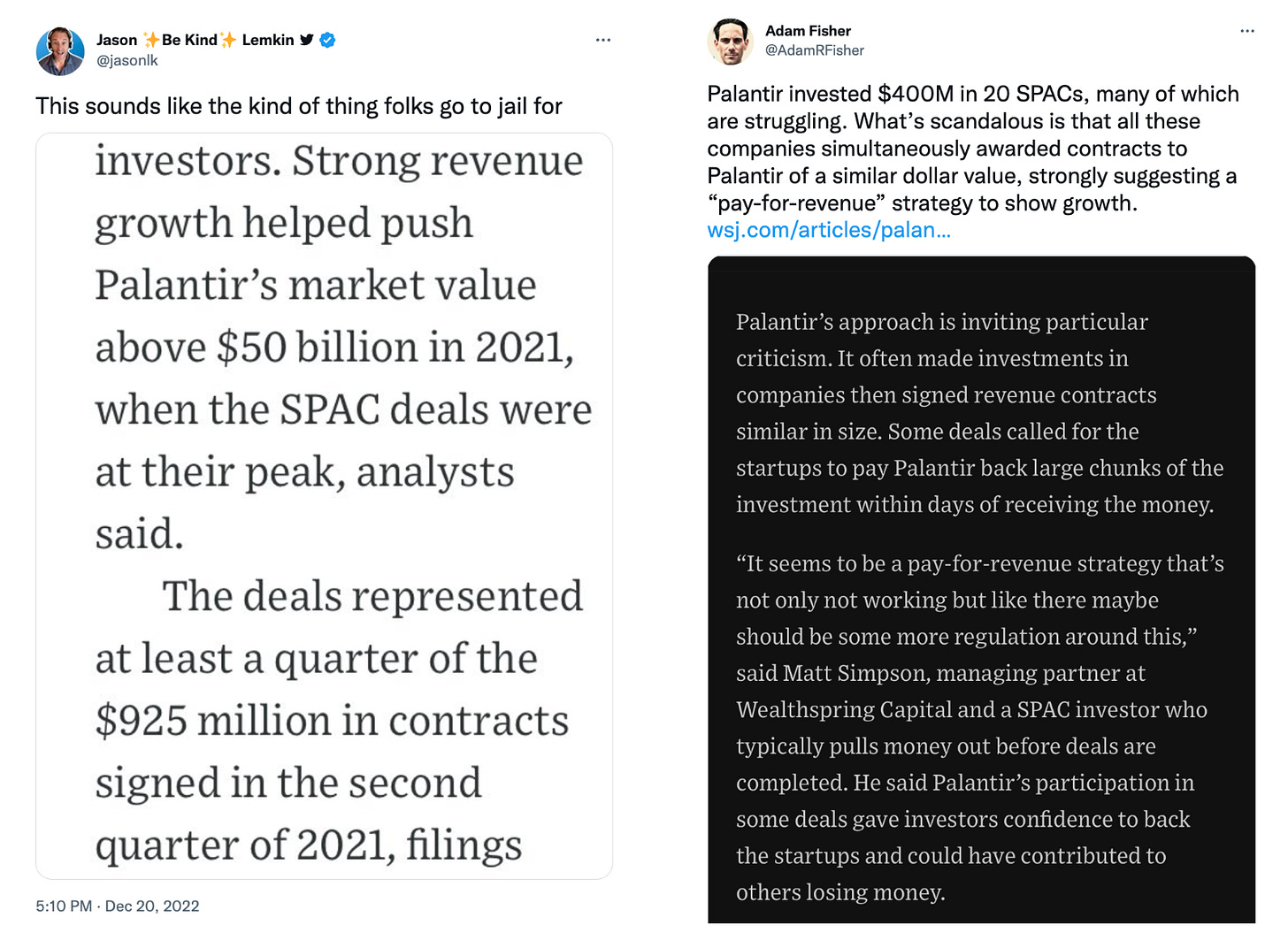

SPACs controversy is not over

A new article from the WSJ puts even more fire on the controversy. As if it was something we didn’t know, they reported that Palantir invested $400mn to get a $700mn Deal Value over 5 Years (3-10y contracts). The $400 investment is now worth less than $50mn now, which, frankly, is a financial disaster (Are PLTR SPACs a SCAM?).

This article created a flow of relevant people in the SaaS world hinting at how “illegal” this practice is.

I asked for details on why this should be illegal, but no one provided an exhaustive answer. There were hints that the problem lies in the greater than 1:1 ratio between investment and deal value.

NB: the tweets below are from people having SaaS portfolios which can be disrupted by Palantir.

The practice of investing in a company while receiving Revenues for software provided is nothing new.

Salesforce and Snowflake, for instance, have their Venture branch which does exactly this. However, differently from Palantir, they focus on private companies for which they don’t have to update their market valuation each quarter therefore don’t create big headlines.

Interestingly, Salesforce and Snowflake don’t disclose the amount of Revenues they receive from their Strategic Investments.

Investors are intolerant towards SBC

For Laorca readers, this should not come as a surprise, as I always insisted that SBC must be incorporated into valuations because it poses a financial risk to investors (Why 99% of PLTR DCFs Fail).

Despite still being relatively high, SBC impact is decreasing as the business scales.

If this didn’t happen it would be a serious red flag on the scalability of the business.

In reality we notice how SBC helps attracting and retaining talents in order to scale.

As the business scales, Palantir should reach GAAP profitability and narrow the difference between EBIT Adj. and GAAP EBIT Margins.

GAAP profitability would be a great milestone to obtain a re-rating of its valuation.

Unfortunately, it will need a couple of years to reach that goal.

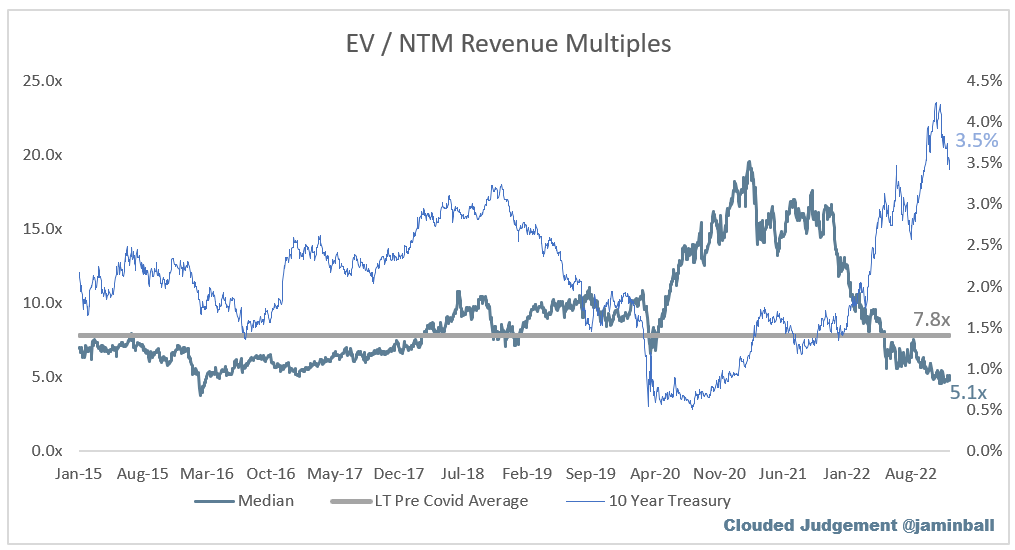

Meanwhile, the negative sentiment is exacerbated by the high-interest rates environment, which penalizes “growth stocks,” in particular the cloud sector.

Given the pessimism in the market, any potential improvement in interest rates could generate a positive surprise.

Reality: Palantir is delivering

Marginal contribution in war? No thanks

A new article released by the Washington Post describes how Palantir is “tipping the balance in Ukraine.” Thanks to Palantir’s Metaconstellation, Ukrainian soldiers can penetrate the “fog of war” by having a clear representation of the battlefield thanks to satellites. This provides Ukraine with a formidable “war engine.”

Palantir's contribution to the world’s most important geopolitical event cannot be underestimated.

This war helps Palantir become close to NATO countries as shown by the $90mn contract over three years just received from the UK Ministry of Defense.

In addition, an eventual Russian defeat would seal Palantir’s role as a Software Prime, creating further opportunities in the US and abroad.

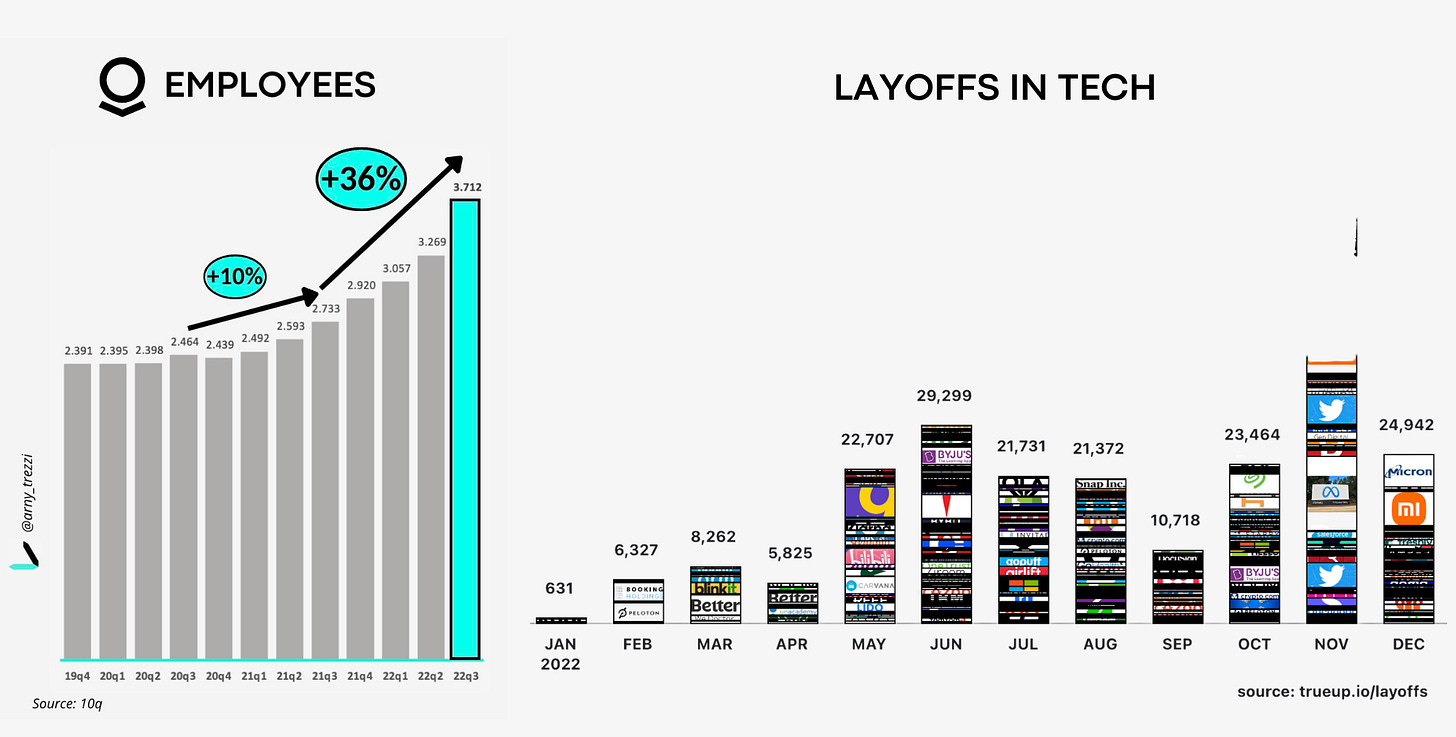

Hiring freeze? No thanks

Palantir is hiring aggressively while the industry is firing at a record pace.

Since Palantir’s product offering is strong, now their key focus now is on scaling.

I consider the hiring strength an extremely good sign of management confidence and a very good human capital allocation.

Palantir is expanding while others are withdrawing.

Has Palantir learned this while dealing with the Army?

Deals blocked? No thanks

While the market focuses on the SPACs and on the SBC, the market is not weighing on the elephant in the room.

Amid the storm, Palantir closed $1.3bn in Deal Value in Q3, proving that the Government can be a big spender even during uncertain times.

Moreover, the deal activity has been strong also in Q4. Deals recently achieved include:

CDC ($434mn over 5y);

UK Ministry of Defence ($90mn over 3y);

Cleveland Clinics (10y);

Lockheed Martin (Apollo for Aegis combat system);

Tampa General Hospital.

We can reasonably expect that at least ~$700mn has been closed in the quarter.

In addition, active links uncovered by Palantir's Missing Link support the fact that Palantir is running an immense amount of pilots, which reduces margins short term.

This could change the story

For close observers, it is clear that Palantir is planting good seeds (PLTR is Planting the Seeds for Exponential Growth). However, up to now we still don’t see big recognition from that in the form of Revenues.

Analysts need to see Deal Value transforming into Revenues to restore their confidence.

Furthermore, as the industry is currently, relatively weak, Palantir has a big incentive to leverage its condition of strength (~$2.4bn Cash) to offer very attractive deals to potential customers to acquire market share.

This could lead to relatively little Revenue growth and margins, but in reality, it would create enormous future value.

For this reason, the current priority is not assessing the Revenue growth as much as it is acquiring the biggest number of clients possible and with the best quality.

Once these companies will exit from the macroeconomic storm thanks to the support of Palantir (and we are receiving plenty of evidence of the real support it can give to companies), those partners should deepen their relationships with Palantir.

Stronger links are built when stressed.

Conclusion:

Palantir suffers from negative sentiment more than an operating problem.

The operating machine is stronger than ever and is capturing the opportunity that “bad times” offer.

Especially in Palantir’s core vertical, the Defense segment, they are acquiring a dominant role. Palantir is a defense contractor actively changing the balance of the most important geopolitical events in modern history.

The success in war could create ripple effects that should generate further business opportunities.

The price can drop further if the sentiment continues to deteriorate. However, if the business strength continues, the asymmetry would get wider.

“Deep value investing, to me, is not about big discounts. It’s about finally seeing something profound and deep underneath the surface, when others are still only seeing the tip of the iceberg, and still making judgements.” - Ho Nam, Altos Ventures

Yours,

Arny