Palantir Slowdown: Has the Worst Passed?

The Recession Playbook

Editor: Emanuele Marabella

Hi, I’m Arny. Thank you for joining 1.619 investors who receive the deepest Palantir research. Please hit the ❤️ button if you enjoy today’s article.

The SaaS industry is facing a severe slowdown.

All subsectors, regardless of size, reported a deep decline in Revenue growth in ‘22 and expect the headwind to continue in ‘23.

Palantir was not immune. Its Revenue growth declined from 41% in ‘21 to 24% in 2022 and has recently guided for 16% growth in 2023. The decline is dramatic, but as investors, we need to learn from the past and make our best estimates regarding future developments.

Are we facing further deterioration or has the worst just passed?

We will seek clues from the past and recent comments from Palantir’s peers.

The Recession Playbook

During the Great Financial Crisis, B2B SaaS companies suffered a severe slowdown that brought their Revenue growth from ~55% as of late 2008 to just ~15% in late 2009.

From the chart above, we observe:

SaaS, on average, kept growing despite the extremely adverse conditions of those moments;

Companies maximized their operating profits while Revenues growth slowed;

Once growth re-accelerated, they compressed their operating profits again.

Are we witnessing a similar phenomenon right now?

Interestingly the dynamic above is very linked to the CEO’s confidence, which I consider one of the key variables that affect Palantir’s Commercial growth: when CEOs are fearful of a recession, they are not prone to engage in big transformational IT projects.

The abrupt drop in CEO confidence in ‘08 coincides with the SaaS slowdown. As CEOs regained confidence SaaS also recovered.

Last year CEO’s confidence, hit by recession fears, dropped to the lowest level since the great financial crisis.

Now confidence is still relatively low but shows encouraging signs of improvement.

Salesforce’s Playbook

Last year I shared how the GFC affected Salesforce (Is Palantir Recession Proof?) as I believe it is the best example we have to understand how SaaS reacted to the macroeconomic shock. We can now dive into greater detail.

During the Great Financial crisis, Salesforce observed the following steps:

EV/Sales multiple drops due to the anticipation of a slowdown;

Revenue slowdown;

Margin Expansion due to cost savings;

Stock rally in anticipation of restored growth and profits;

Growth recovers and multiples further expand.

What I find interesting is that Salesforce’s price didn’t bottom when growth bottomed.

Salesforce valuation recovered 1 year before Revenues actually accelerated again.

The expectation that the “worst has passed” was enough to bring confidence again to the stock. Markets are forward-looking.

Where we are right now?

Based on Salesforce’s updated chart and the industry metrics shown previously (Palantir DCF: 20+20 is not 10+30) I believe we are around Phase 4, where companies focus on efficiency and the multiples start to recover in anticipation of restored growth.

What’s next?

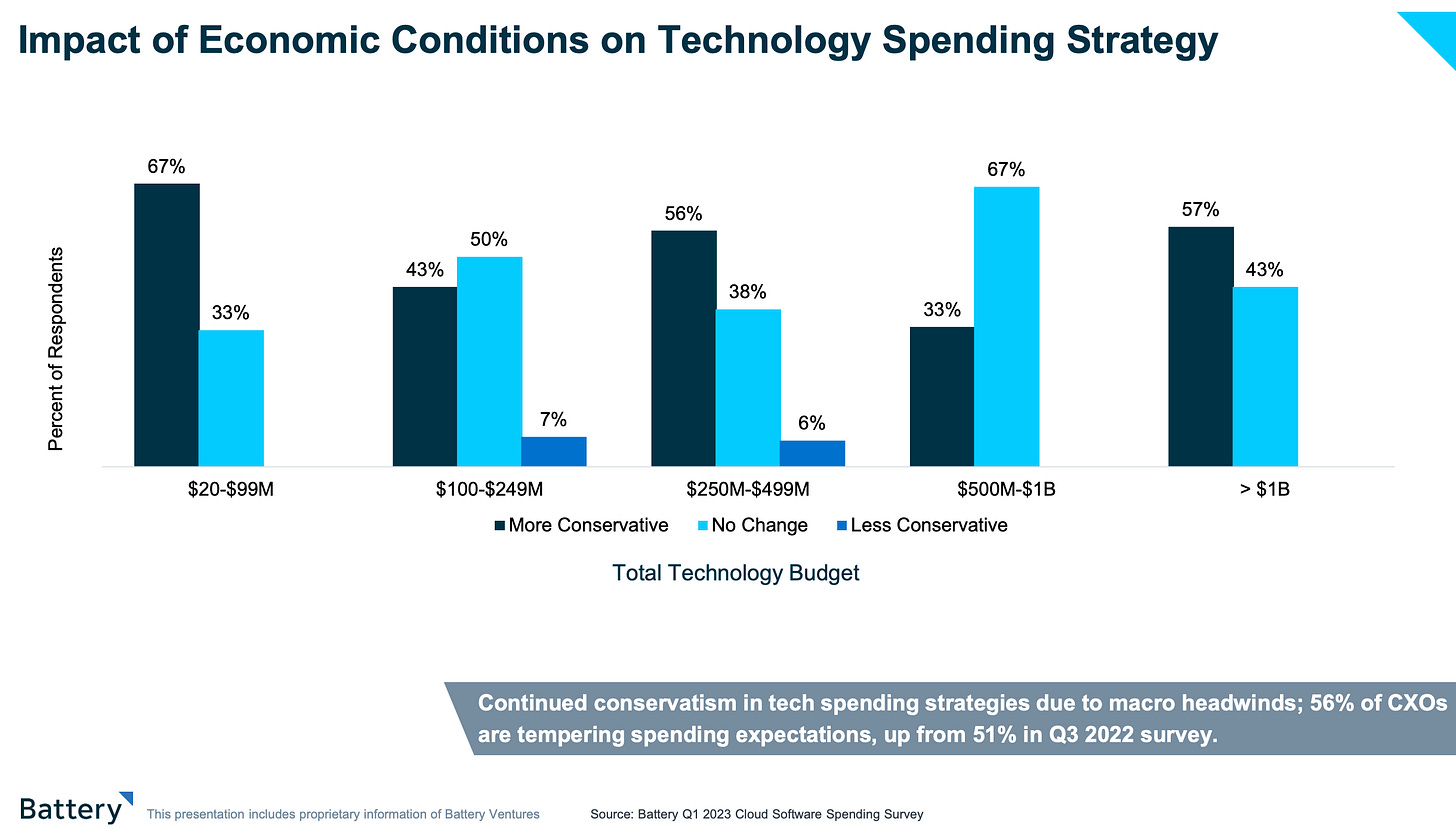

While in the next 6 months, it seems as though companies have no urgency, there will almost certainly be increases in Cloud Software spending, especially in the areas of Security, Data, and AI/ML, both next year and more importantly in the next five years.

According to Battery’s research, companies spending priorities are:

Cloud Infrastructure (AWS, Azure, Google Cloud)

Data Warehouse (Databricks, Snowflake)

Enterprise Security (Wiz, Paloalto, Crowdstrike)

Enterprise Apps (ServiceNow, Salesforce).

Palantir mainly belongs to the latter one, but in reality, Palantir solutions are very interconnected to all the reported segments.

For instance, Palantir’s new partnership with Cloudflare seeks to improve efficiency on cloud expenditure. Apollo supports Enterprise Security and the implementation of AI/ML updates. Lastly, Foundry automation helps reduce inventories and incidents.

Furthermore, stimulated by the rise in interest in ChatGPT and Generative AI, companies are confident they will increase their spending on AI/ML in the coming years.

As Palantir is already a recognized leader in AI Software Platforms (Palantir AI AI AI), this would benefit enormously given the appeal of its solutions.

Hints from peers

To further contextualize what we just shared, it could be particularly helpful to capture precious hints from the latest earnings call of Palantir’s peers.

Salesforce, Q4-22 earnings call highlights:

Small and Medium Businesses (“SMBs”) seem to be the most impacted by the economic slowdown. The fact that Palantir has not been focused on SMB seems to be an advantage that provides solutions at a mass market level.

“On the industry side, and maybe even the segment side, in our SMB market, economic headwinds tend to hit that a little bit harder. And so we saw some headwinds in our SMB market. Some of the self-serve strategies and motions that we have for Slack were impacted by the economic headwinds.”

The public sector, manufacturing, and energy are among the strongest sectors for Salesforce. Since Palantir is heavily exposed to the same verticals we can expect strength there as well.

“From an industry perspective, we actually saw a lot of strength in industries around public sector, manufacturing, engineering -- excuse me, energy and travel hospitality was a strength for us in the quarter.”

Salesforce is using the same playbook it used in the Great Financial Crisis. As they saw the Annual Contract Value declining from emerging difficulty in closing deals, Salesforce hit the brakes on spending, focusing on profitability.

“To understand what we're going through, I really did go back and looked at all the numbers in '01, '02 and '08, '09. And what you said, Kash, is quite enlightened in that. Of course, we saw in '08, '09 ACV fall off dramatically. And of course, we hit the break on spending, and we accelerated margin, I think, six points during that time.”

The SaaS sector is experiencing a market implosion similar to the one of the Great Financial Crisis. Salesforce is executing the recession playbook.

“As soon as the stock market implodes CEOs, they hit the brakes. So I think that that's what we saw in '08, '09. I think we really started to see that in the middle of '22, maybe August, September, October, November. Certainly, as we've exited Dreamforce, we were like, I think that we can execute our playbook. We have a recession playbook. We know how to transform the company.”

The primary way to achieve customer satisfaction in a moment like this is through time to value. This is where Palantir excels.

“Time to value is very critical to our customers, automation, digital transformation, efficiencies, and cost reductions in their organizations.”

Salesforce is starting to see the end of the tunnel providing Guidance of +10% for the year despite the macroeconomic uncertainty. This is quite an encouraging sign.

“So all of that led to a very strong Q4 on the revenue side. In terms of the FY '24 guide, we feel very good about the guide coming in, a little above 10% for this year. We've taken into account all of the factors that we're talking about, including macro. On macro, what we're assuming is really no near-term change when it comes to the selling environment.”

Customers’ demand for data analytics solutions is still strong.

“Tableau and MuleSoft and Slack continue to be highly relevant for our customers. And as Marc noted in his comments, they're part of our largest and most strategic deals in the quarter.”

Servicenow, Q4-22 earnings call highlights:

Despite the slowdown, Servicenow still sees a healthy demand environment which leads to a robust pipeline.

“Heading into 2023, we believe we have prudently factored in the evolving macro crosswinds into our guidance. Overall, the demand environment remains healthy, deals getting done, the market opportunity is growing, the ecosystem is expanding, our renewal and net expansion rates ended the year strong, our pipeline is robust.”

Clients are seeking cohesive platforms that they can trust for multiple solutions. This is extremely positive for Palantir as Foundry can be considered “100 integrated products in one.”

“A CEO told me, ‘We can't afford 1,000 points of We need a cohesive plan with a trusted platform.’ So this is now without any doubt, a platform economy. And only a few platforms will be relevant in this shift, and none are as well positioned at ServiceNow.'“

To deal with a fragmented world, companies want a clear roadmap that generates impact at speed in a cohesive way. Again, this sentence perfectly resonates with Palantir’s offering.

“The theme in Davos this year was cooperation in a fragmented world. It all begins with a fragmented enterprise. C-level buyers don't want long-term road maps to clean up a siloed mess of point solutions. They want integration, speed, automation, great experiences and business impact.”

C3 AI, Q4-’22 earnings call highlights:

C3 AI sees a “dramatic change” from the strong headwind experienced last year. Although I don’t admire C3 as a company, I have to recognize that its CEO was one of the first to underscore the severity of the headwinds affecting the SaaS world.

“Now, as we enter into our fourth quarter, we are seeing tailwinds on from improved business optimism and increased interest in applying C3 AI solutions to address an increasing range of applications across a broadening set of industries. This is a dramatic change from what we experienced in mid-2022. There is a genuine optimism in the marketplace for our solutions. And the overall business sentiment appears to be substantially improving.”

Conclusion

While the slowdown is severe, the best software companies are not only resilient but also set to benefit once a recovery will be in place. After a couple of years of strong headwinds, there are signs that we are actually headed toward the recovery of the sector.

“What I see on the ground are a lot of people wanting to use our software. We believe in our software.” - Alex Karp, Palantir CEO

Yours,

Arny

This is NOT Financial Advice. I own PLTR shares.

Thank you for your research!

great take, thank you, looks good from here imo