Palantir Q4 Preview - Understanding the Battlefield

Q4 earnings are near! Here are the most crucial drivers and catalysts.

Editor: Emanuele Marabella

Hi, I’m Arny. If you are new, you can subscribe to spot Palantir asymmetries along with 1.263 investors. Please hit the ❤️ button if you like today’s article.

To have full access to the article please consider becoming a paid subscriber. Paid subscribers receive each Thursday the deepest research on Palantir's financials and strategy.

In the first part of PLTR 0.00%↑ Q4 preview (Q4 Preview - Just Look Nearby), we analyzed the results of Servicenow NOW 0.00%↑ , the closest comparable.

In this article, we will share a few thoughts specific to Palantir to tailor our expectations.

Concerning Q4 results, I will pay particular attention to the key metrics I usually track:

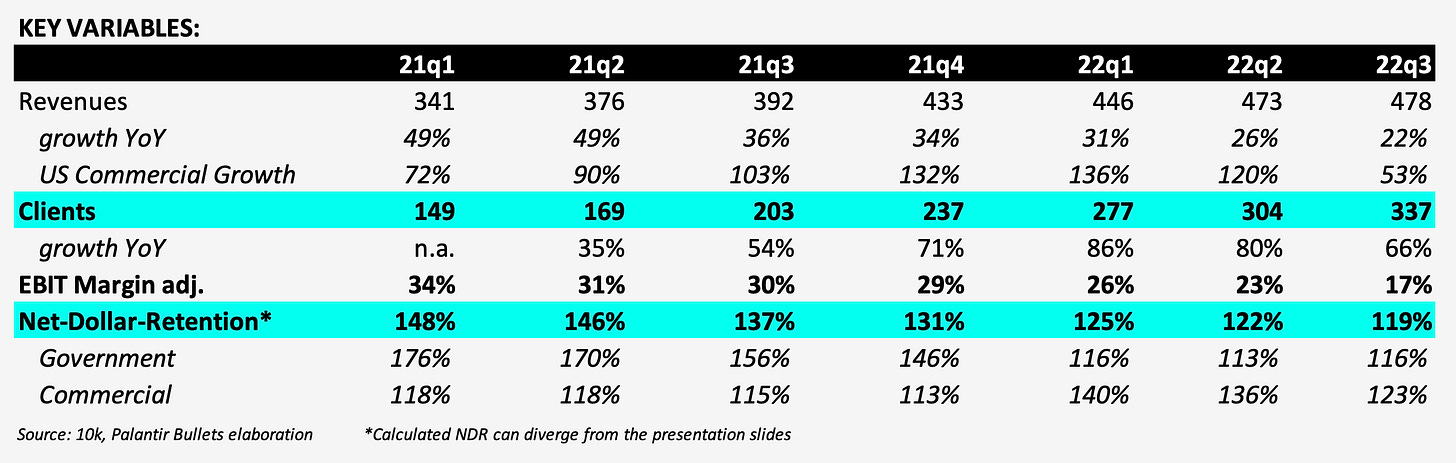

Client growth: it would be great to see more than 40 new additions. The Commercial business should benefit from positive seasonality (PLTR Q1: better than it seems). FoundryCon US and UK were performed at the end of October and November, therefore, despite their success, it is too early to see their contribution in the numbers. Meanwhile, we know Palantir is performing several pilots. For details on Palantir's active links, please refer toPalantir's Missing Link 's amazing work.

Net Dollar Retention: it is crucial to stay above 120% to highlight the strong organic expansion of existing customers. This is the most important metric which tracks the growth durability (PLTR in 2032: A Jump in the Future).

US Comm. Revenue growth: I seek continued growth combined with strong client acquisition. Again, this is the most important segment to track because it is the key driver for Palantir’s growth (PLTR US Commercial is the Key).

In terms of Q4 financial numbers, I don’t expect a deviation from the guided numbers:

$503mn Revenues (+16% YoY);

$79mn EBIT Adj. (16% EBIT Adj. Margin).

However, it is crucial to understand what forces affect the numbers. Being a “growth stock,” Palantir is heavily affected by future expectations more than past results.

To set future expectations, we first need to understand the battlefield.

We will discuss:

Headwinds on Q4;

Hints from Karp;

Catalysts for the stock.

Headwinds on Q4

Key headwinds that affected the recent results have continued to persist:

CEO Confidence is still low. This means that companies are reluctant in pursuing big transformational projects. However, this is more a matter of delaying than canceling. Software is the engine of the modern enterprise, not a luxury item.

Forex heavily affects International business. Since most Palantir contracts are denominated in USD, for International clients Palantir solutions become ~20% more expensive YoY, affecting, in turn, the propensity to expand. We saw Servicenow had a ~5% headwind from FX. For Palantir, this impact is even stronger, especially on the Commercial side.

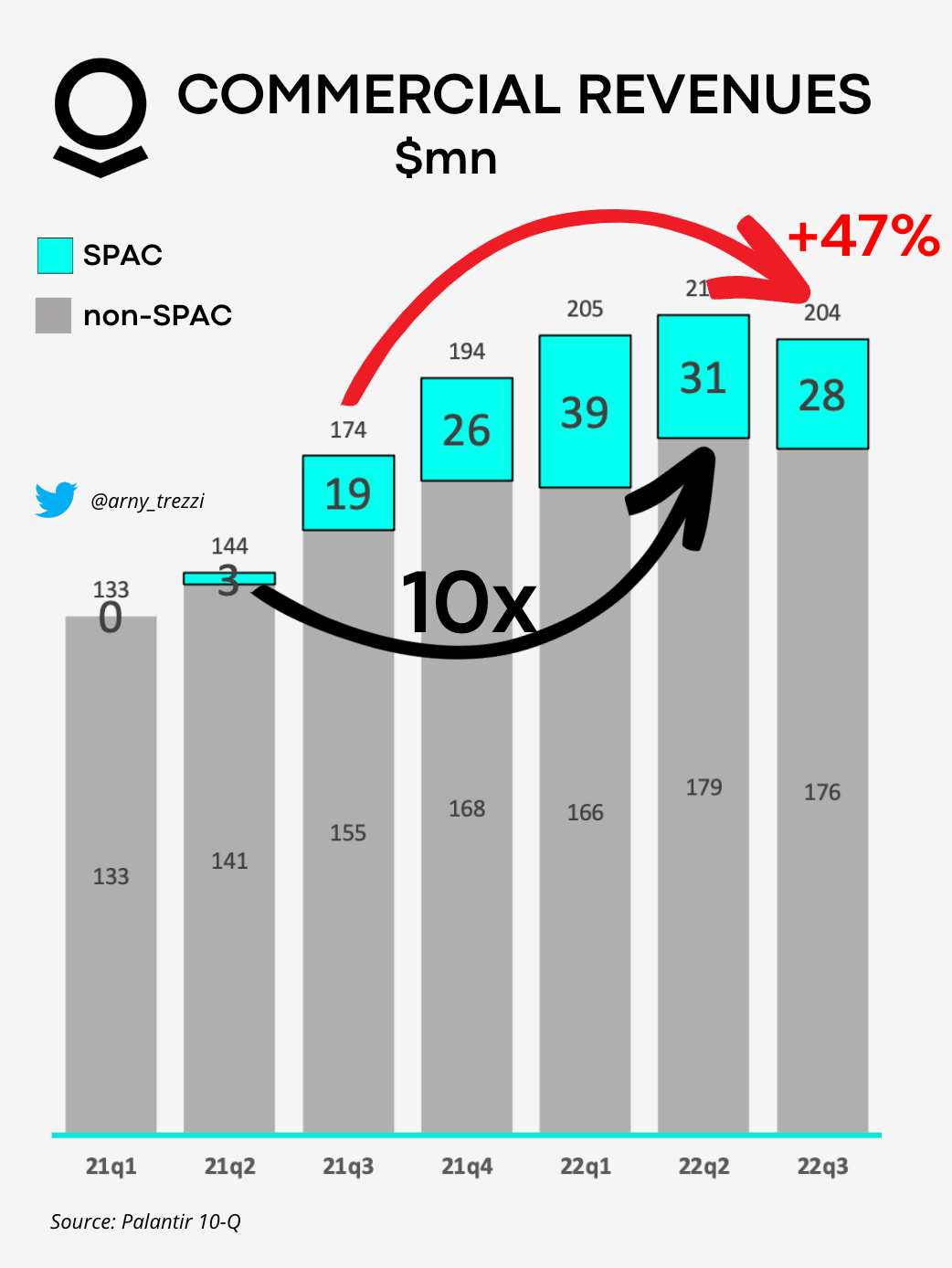

SPACs Distortion. As mentioned in the Q3 analysis (Palantir Q3: Another disaster?), SPACs generated anomalous growth in the quarters before Q2. In Q4, SPAC Revenue should stay at ~$30mn despite many suffering from difficult financial conditions. If SPACs are not able to pay would negatively affect the coming results.

Hints from Karp

From the recent Karp interviews, we have further hints: