Palantir Q3 Slowdown: Another Disaster?

The US Commercial slowdown explained

Editor: Emanuele’s Notepad

New quarter, same old story.

Palantir went down ~13% after the release of its Q3 earnings. Were the earnings a disaster?

Let’s update the tracker I shared previously to assess the progress of the key drivers of the business:

NDR is calculated from 21Q4 while the presentation uses LTM data.

Palantir’s financials are complex. In this article, I will focus on a few key metrics from the Q3 results. I will dig deeper into more detail in upcoming articles.

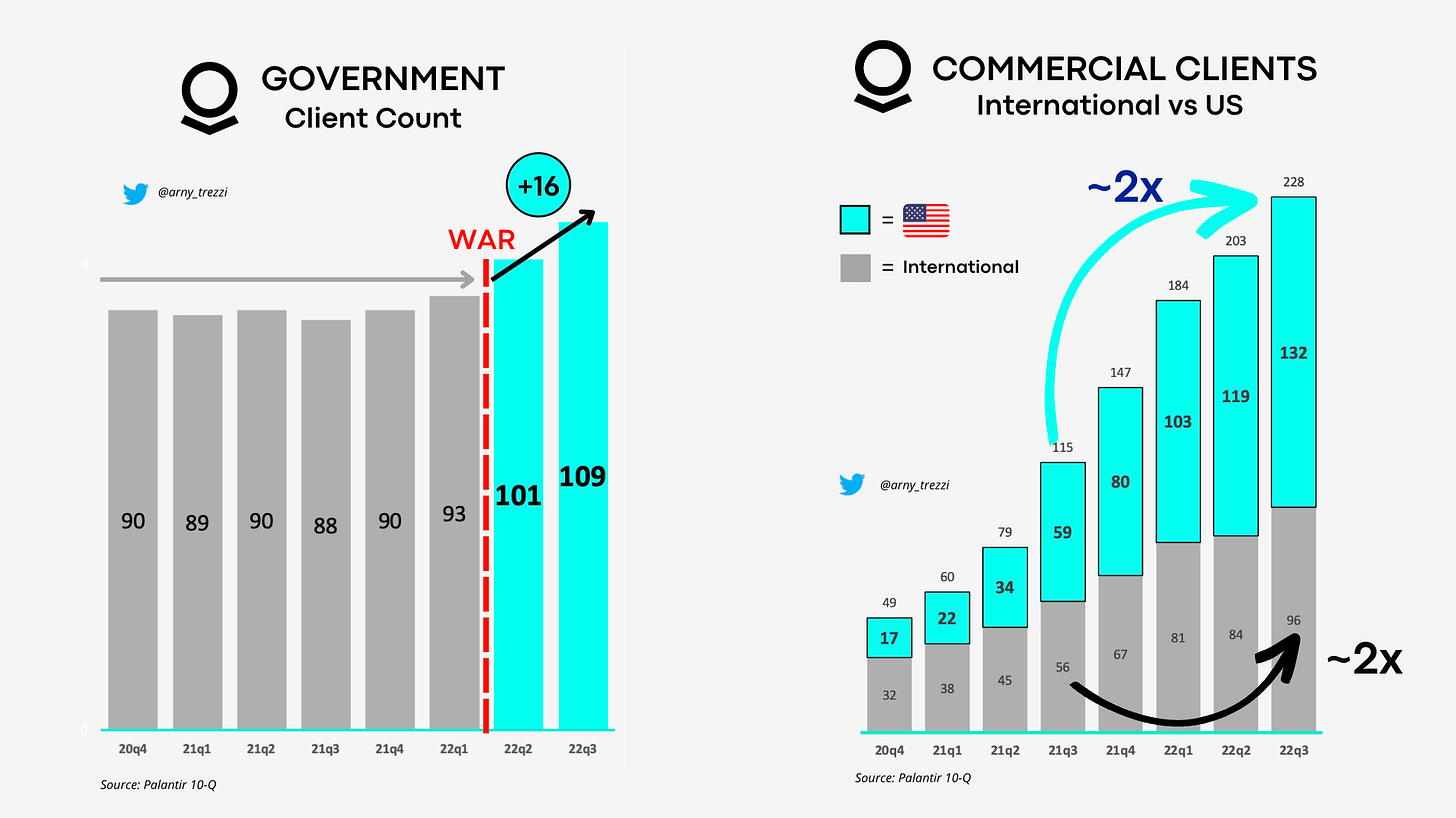

Client Growth

Client acquisition continues to be strong. Palantir acquired 33 new customers in the quarter, less than I expected, but still a number that hints at positive business progression. As long as Palantir keeps acquiring new clients, it is planting the seeds for its future growth.

The macro environment is currently heavily adverse as companies are fearful of a recession which lengthens sales cycles, and the very strong USD creates enormous friction on international clients (Is PLTR Commercial Doomed? [pt 1]).

All segments are growing in terms of clients. The 33 new clients break down as follows:

8 Government: this breaks the stagnant trend of the previous quarters;

12 International Commercial;

13 US Commercial.

Palantir reached 337 total clients, without new SPACs or strategic initiatives in this quarter. Notably the Commercial clients 2x vs the same quarter last year and keep increasing without SPACs. This supports the idea that SPACs were necessary to bootstrap growth (SPAC’s Crucial Role in the Network).

Given Palantir’s land-expand business model, the steady client growth is the most precious hint that the business is healthy and headed in the right direction.

The Commercial business is focused on client acquisition to increase market share rather than maximizing Revenues per client, as the relatively low Revenue per Client suggests.

Despite Commercial clients representing 68% of clients, they only represent 42% of Revenues.

US Commercial: is the slowdown an issue?

US Commercial, Palantir’s most important segment suffered from a steep deceleration from 120% to ~53% YoY quarterly growth. This raised concerns, as most, myself included, expected to see growth around 100%.

Real issue or a “bug”?

As we mentioned above, net client acquisition in US Commercial continues steadily, despite a slowdown.

In terms of Revenues, the US Commercial is still expanding its relevance and now accounts for 18% of the total Revenues. No major disruption seemed to have occurred.

Observing the chart above, the US Commercial side seems healthy. Therefore, I see two causes for the decline in growth:

Consuption-Based Pricing: the change in pricing structure could have a negative impact on Revenues in the short term as clients initially consume little (PLTR Copies SNOW’s Pricing Model);

SPAC distortion: the SPACs inclusion created anomalous growth in the previous quarters.

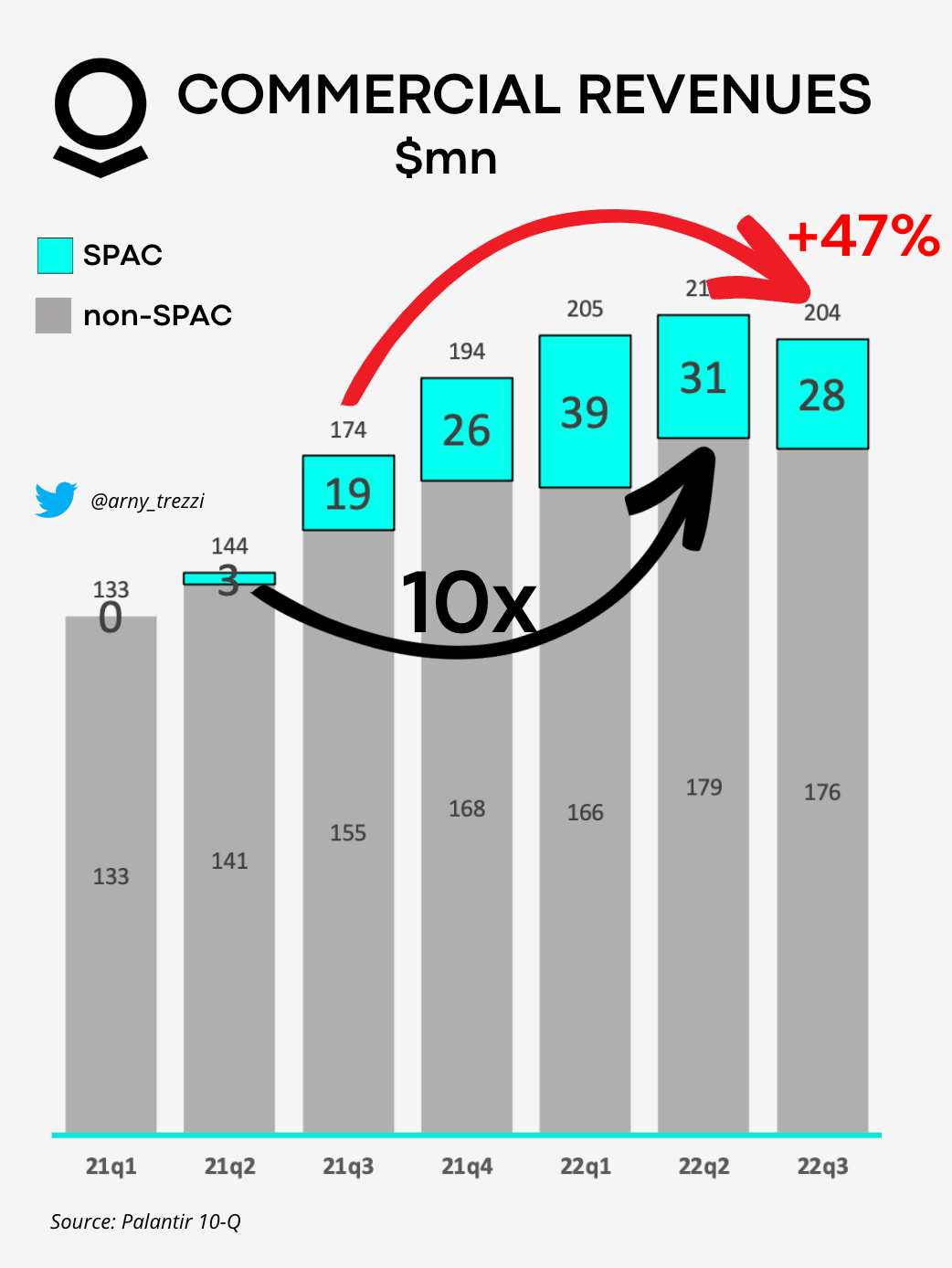

SPACs distortion

As a reminder, 14 out of 20 SPACs are American and each SPAC generates, on avg. ~$6mn Revenues per year.

21Q3 was the first quarter to include a relevant Revenue contribution from SPACs. Previously, SPACs generated insignificant amounts of Revenue as the deals were not closed yet.

22Q2 and 22Q1 growth numbers were inflated because they included significant SPAC Revenues which were not generated in the previous year. The inclusion of the SPAC contribution heavily distorts the base for the growth calculation for the overall Commercial Revenues. SPAC Revenues:

$3mn in 21Q2; $31mn in 22Q2 = ~930% growth contribution to US Commercial;

$19mn in 21Q3; $28mn in 22Q3 = ~47% growth contribution to US Commercial.

22Q3 was the first year that includes a significant contribution of SPAC Revenues in the previous year, resulting in lower calculated growth.

According to my calculations, US Commercial, excluding SPACs, grew 78% LTM which I consider very healthy. LTM Growth stands at 109% when SPACs are included.

Is the Commercial QoQ decline a concern? I will discuss it in a separate article.

Net Dollar Retention

Net Dollar Retention was 119%, which represents a slowdown that I am not happy to see, but still the minimum level I expect the company to expand.

119% NDR is not “great,” but still shows why subscription Revenues are resilient in an environment where even the Big Techs struggle to grow.

Invertedly, we could say:

Existing clients expanded 19% YoY despite the very tough conditions and the difficult comparison to last year.

The IT budget allocations for companies depend on the confidence level of CEOs, which is currently at historic lows. As a consequence, I expect NDR to increase in the future once economic conditions rebound.

For Palantir, this is the time to help partners and clients solve their problems so that their relationships become even stickier.

The Top-20 clients kept expanding by +15% YoY.

Despite the slowdown is not exciting, the steady expansion of mature clients shows Palantir’s stickiness during “bad times.”

Conclusion

By analyzing the key metrics, I don’t see any structural problems in Palantir’s operating machine. There is a slowdown in Revenue, which comes from the combination of:

corporate CEOs’ pessimism, and;

base effects caused by SPACs distortion.

However, the steady client acquisition proves that Palantir is just setting the base to surf the recovery when the macroeconomic environment improves.

“We have at this point essentially captured the market of commercial enterprises and industrial leaders that were first to begin leveraging software to reshape their businesses. And the remainder are now following” - Alex Karp, Palantir CEO

There are many other relevant aspects to discuss regarding Q3 results. Subscribe to discover them together!

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

YouTube: @Arny Investing

Business Email: arnylaorca@gmail.com

Join Emanuele20x on:

Twitter: @Emanuele20x

YouTube: @Emanuele20x

Substack: Emanuele’s Notepad

View expresses are my own and do not represent Financial Advice in any way.

I own (many) PLTR stocks.

Thanks a lot! Very useful!

bravo Arny, bravo Ema, great coverage, have a good weekend!