Palantir Q2: Really a Disaster?

Avoid noise, focus on what matters.

Editor: @Emanuele20x

Palantir Q2 Earnings are out. Priced dropped 15%. Many are calling them a disaster.

Are they really?

Time to update the tracker I shared previously to assess the progress of the key drivers of the business:

The divergence in NDR from the presentation slide is because mine considers the expansion of clients from 21Q4 while the presentation uses LTM data.

Palantir is still an early-stage SaaS company (despite being ~20 years old), therefore these are the key metrics to focus on:

Client growth

Net Dollar Retention

US Commercial

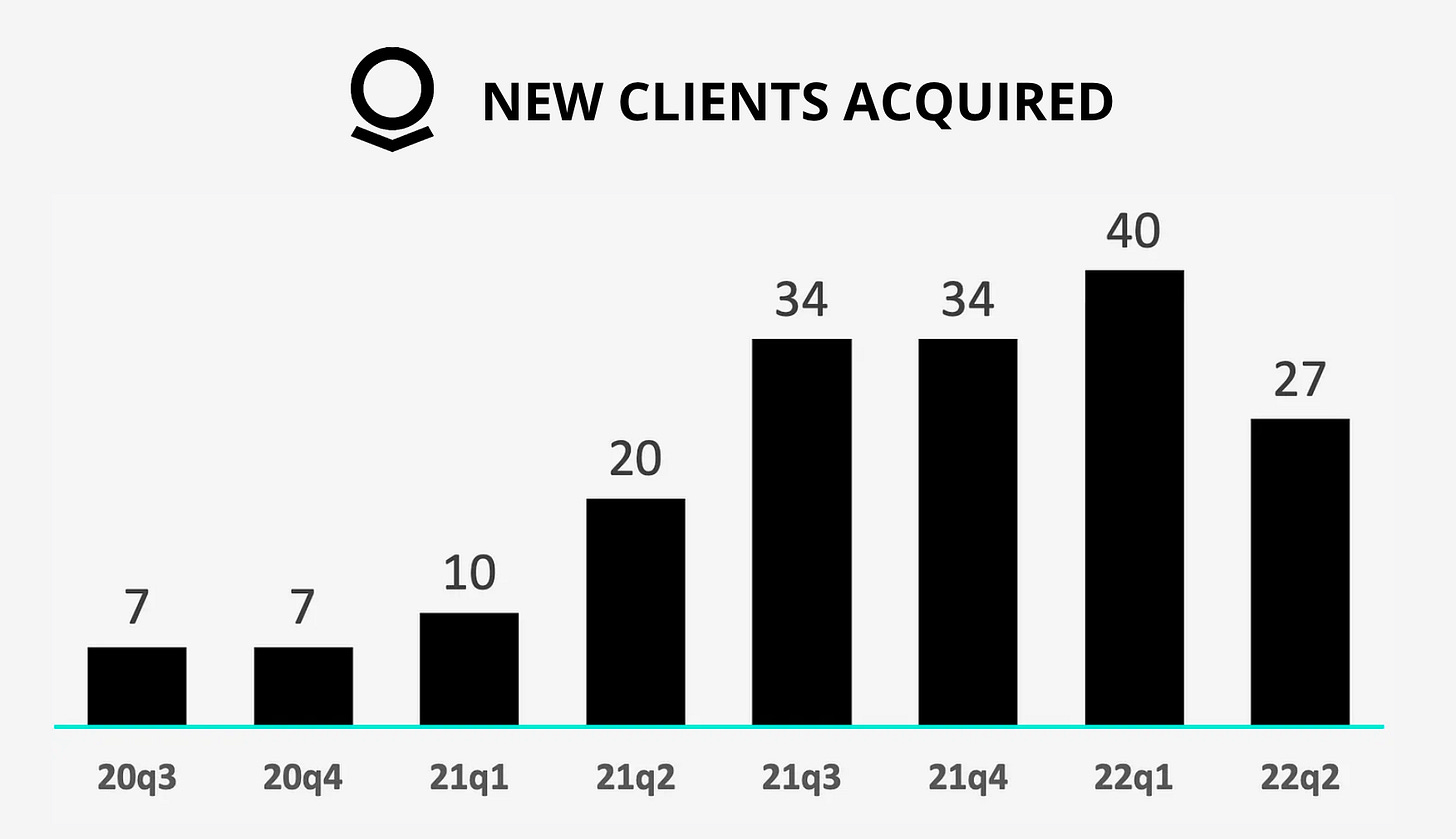

Client growth:

Palantir acquired 27 new clients, 19 from the Commercial side and 8 new Government clients, breaking a stagnant trend.

I would have liked to see at least 40 new clients like last quarter, but this means the previous spike was due to contract timing. The average of "Q1 and Q2 is in line with Q3 and Q4, which should be structurally stronger quarters than Q1 and Q2 due to contract timing.

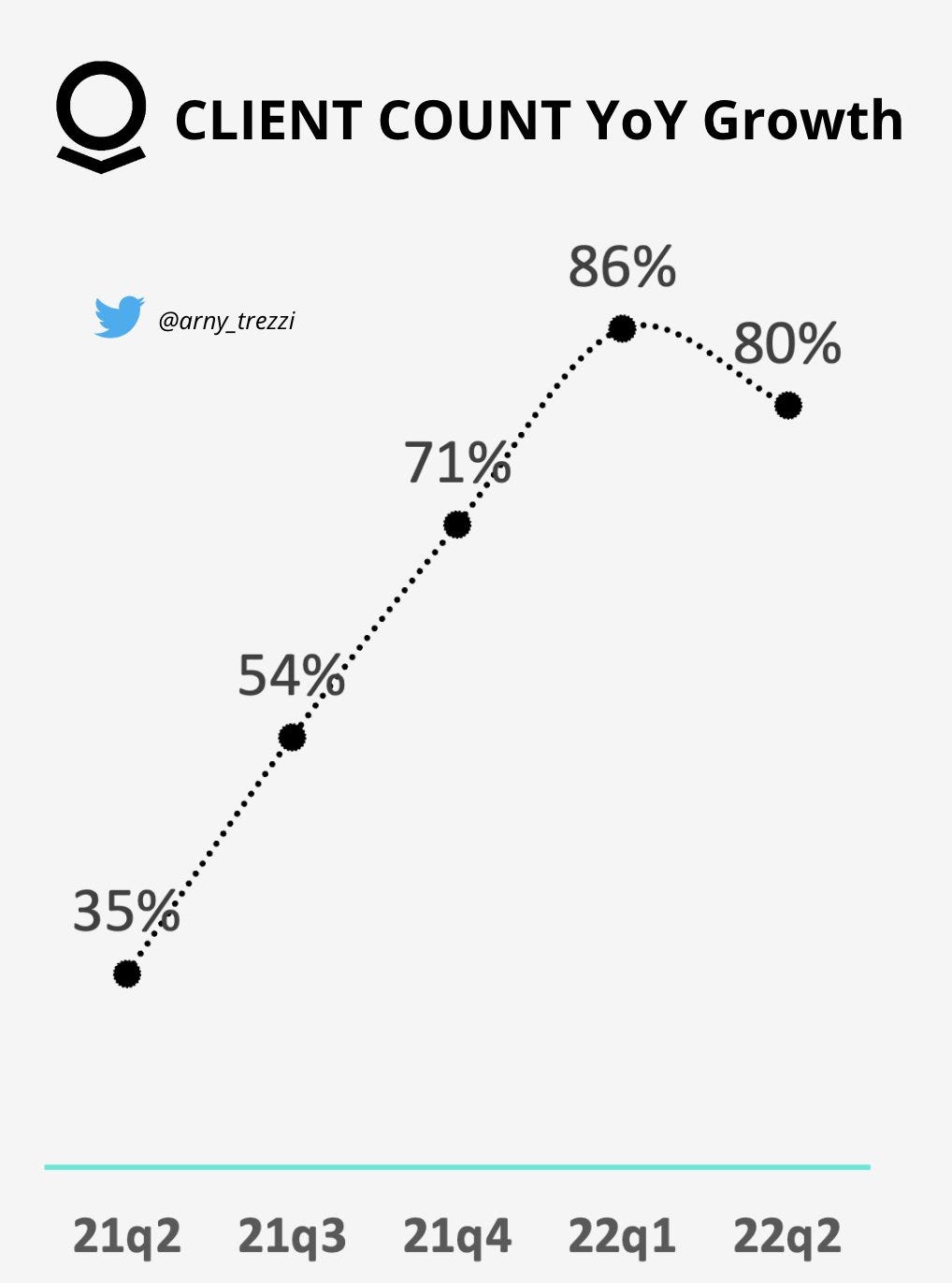

Despite a slight deceleration, the growth in client count remains strong at 80% growth.

Commercial clients are 67% of clients but account for "only" 44% of Revenues (38% last year).

Seeds are planted, and fruits will come later.

I wrote deeply about this crucial aspect in a previous article (Palantir is Planting the Seeds for Exponential Growth)

According to Karp, Palantir CEO, the Commercial side will account for ~70% of Group Revenues in the future. In other words, Karp expects Commercial Revenues to grow much faster than Government Revenues.

Net Dollar Retention:

Net Dollar Retention (“NDR”) decreased from 125% to 119% according to the Q2 presentation. The number seems scary unless we break it into the components:

~113% from Government;

~126% from Commercial.

If Government Revenues are +13% it means that the max Gov. NDR is 113%. Therefore, Commercial NDR expanded by at least ~125%, which is not worrying to me (~136% by my calc.) because it is essential for the Commercial side to keep expanding +20% YoY.

While the Government side relies on Budget releases, the Commercial side is more reliant on Palantir’s ability to reach new clients and make them expand.

The misperception is no different from what happened in Q1:

Net Dollar Retention is a key driver because:

Palantir growth = NDR + Revenues from new clients.

When a client is acquired it starts generating substantial revenues (expanding) after a couple of years (Palantir’s New Clients are Irrelevant), so the NDR shows the avg. rate of growth.

Furthermore, there was a very positive sign from the Top 20 Clients expanding +17% YoY despite their substantial size of +40$mn/y.

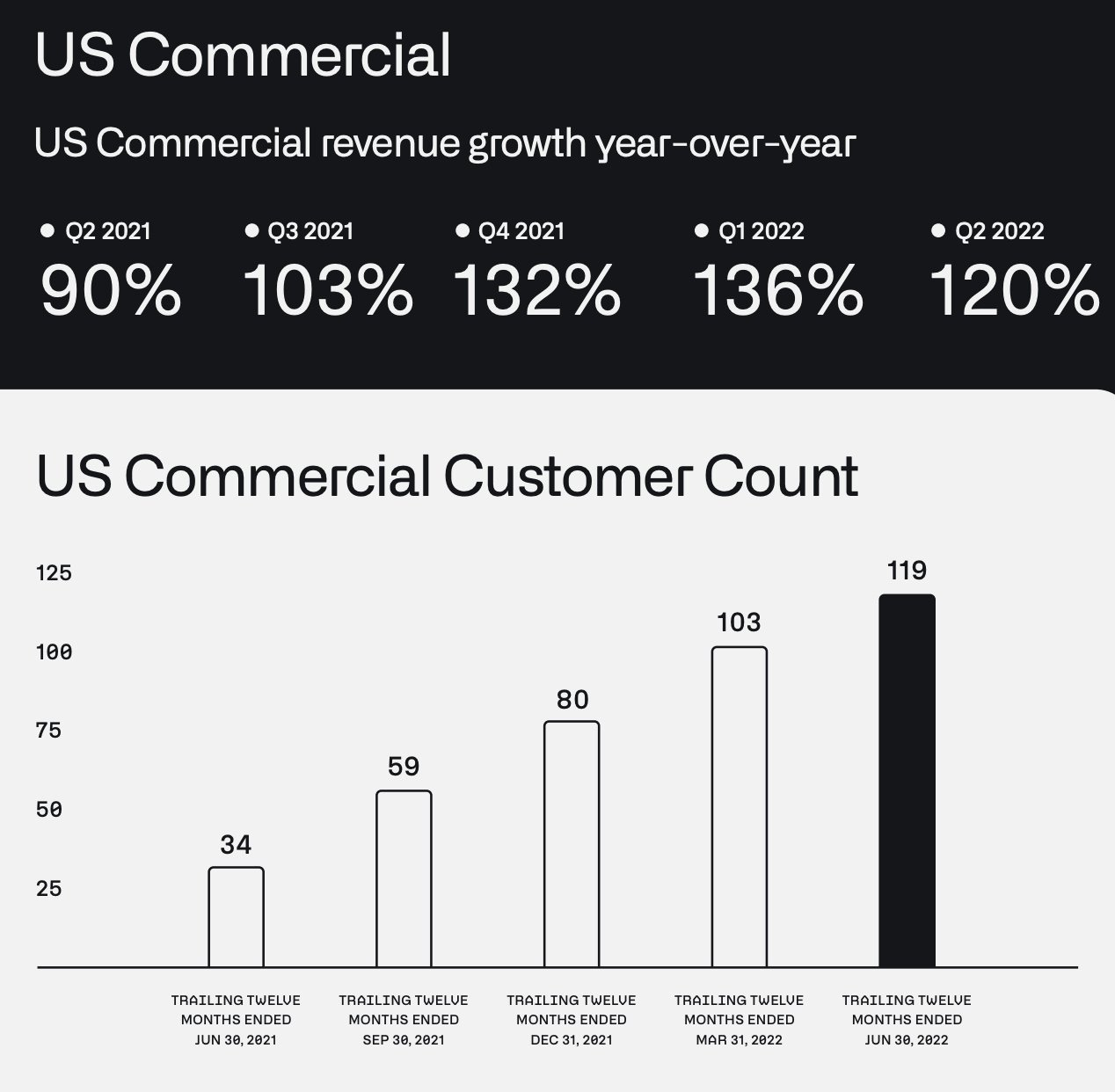

US Commercial growth:

US Commercial Growth grew +120% and acquired 16 new clients, better than I expected. This segment is the most important component of my investment thesis (Palantir US Commercial is the Key);

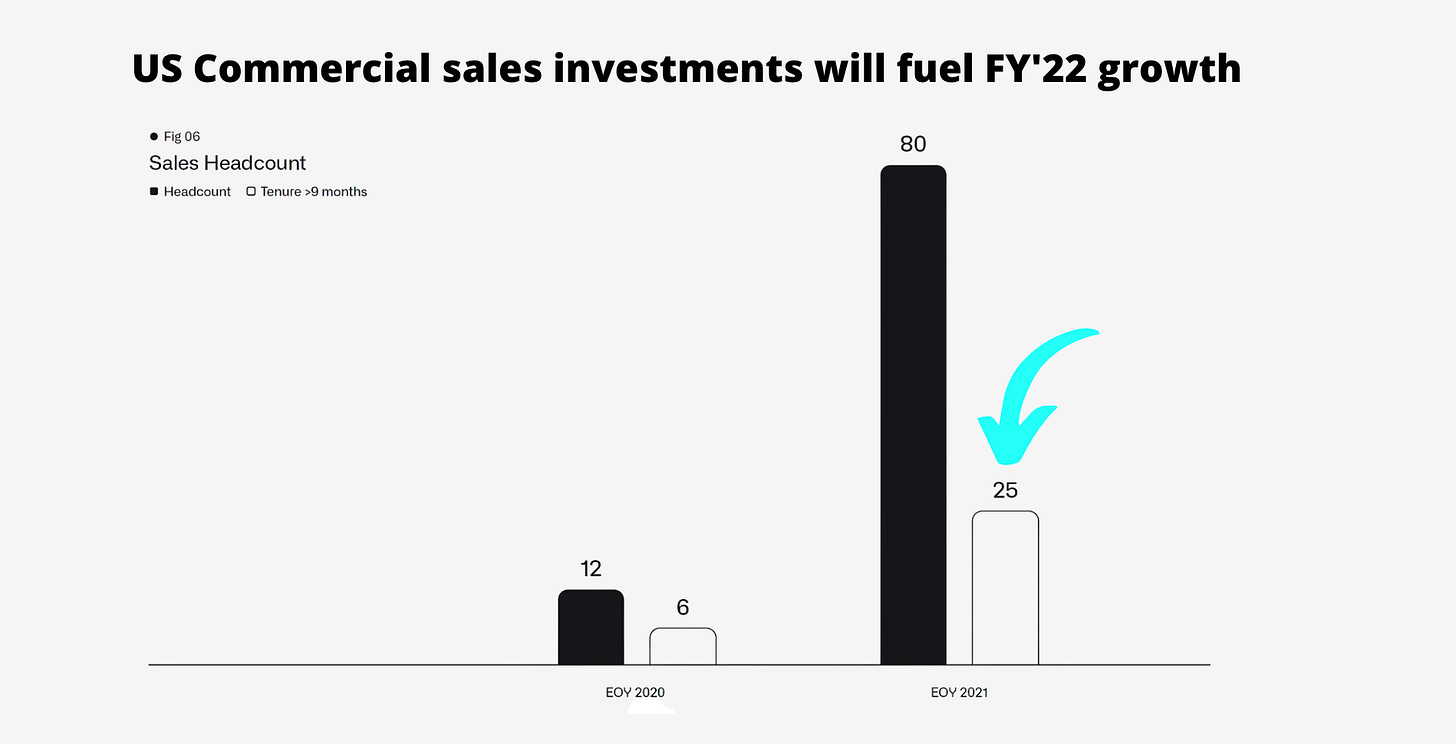

As Karp highlighted, these results were obtained with a tiny salesforce of 42 people.

The new sales investments are delivering.

As of 21Q4 the US Commercial salespeople with Tenure > 9 months were just 25.

By now the count should be close to 80 operative salespeople and should support further growth of the segment.

Is the thesis broken?

The quarter was not exciting but the verification of the variables highlights that nothing has broken my thesis.

I shared my thought with @Emanuele20x:

There are other topics to discuss like the reduced Guidance and the Government slowdown. I will discuss them in future articles.

For now, I underscore the importance of using first principle reasoning:

Is the health of the components that really matter still intact?

If the answer is positive, the other topics are less relevant. The key variables of my investment thesis are untouched, so I am not worried. Actually, I am excited to see them progressing well on the Commercial side.

“Most other companies are targeting small segments of the market.

We see and intend to capture the whole.” - Alex Karp, Palantir CEO

Yours,

Arny

If you enjoyed this article you will enjoy this video too!

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Instagram: @arnylaorca

Discord Channel

View expresses are my own. Do not represent Financial Advice.

I own (many) PLTR 0.00%↑ stocks.

For concentrated portfolios with $PLTR weight of say, in excess of 5%, interim loss of capital would be painful. I do not own PLTR stock, nor have owned it in the past. What is your 3-year PT?