Palantir Q1 preview - Narrative craft?

↳ The opportunity to surf the AI wave

Editor: Emanuele Marabella

Palantir stock price is still in the $7 range, which is below the price it traded at before the quarter that signed the first GAAP profitable quarter of the company.

Many things have changed meanwhile.

Analysts’ expectations are exactly in line with the relatively low Guidance that Palantir provided for the quarter:

~$506mn Revenue (~13% YoY Growth)

~$94mn EBIT adj. (~18% EBIT Margin adj.)

This would lead, according to analysts, to an EPS loss of $0.01 after factoring in SBC, SPAC losses, and the positive impact of Interest Income.

How the stock will trade after earning results is unpredictable, yet we can have a sense of the key drivers affecting the results to fine tune our expectations.

In this article, I will show what I see as the key contributing factors generating the results and why the management has a remarkable option to craft the narrative.

I’m Arny. Thank you for joining 1.783 investors who receive the deepest Palantir research. Please hit the ❤️ button if you enjoy today’s article.

The bad

Crucial headings are affecting Palantir’s operating performance:

The overall Saas Market is still relatively weak and is delivering its slowest growth of the last decade. As discussed previously, SaaS companies are now focused on profitability rather than “growth at all cost,” which was the previous paradigm.

Palantir SPACs should generate ~$20mn in further market losses and affect Revenues. Pear Therapeutics and Boxed failed, while Bird is close to bankruptcy. While a drop in the market price of SPACs does not affect Palantir’s EBIT adj., when the SPACs fail, they will no longer be able to meet their commercial commitments with Palantir. For more details please refer to @em013L tweet!

According to Glassdoor ratings, part of the commercial salesforce is having trouble selling the product and having attrition with the engineering culture. This unpleasing data point seems contradictory to the positive hints Karp dropped about the strength of the US Commercial.

“For free” means lower short-term headwinds. From a recent interview, we have evidence that Palantir is helping Ukraine in military actions “for free.” Also, the program that helps manage Ukraine and the support to document almost 80,000 war crimes will run without a fee “for now.” These contributions are crucial to make Palantir’s story unfold because they can be granting potential huge government contracts in the future. However, the short-term reality is zero Revenues while costs are being incurred. For the moment we can consider these “Marketing Expenses” to generate awareness and unlock future value.

An increase in Military budgets can face pressure from the debt ceiling discussion. The government is increasing its spending in Defence as we widely discussed, however, the recent discussion about the debt ceiling can limit the further upside from the Government as reported by Bank of America.

The Good

Turning to the positive factors, there are multiple forces that hint that the worst has passed:

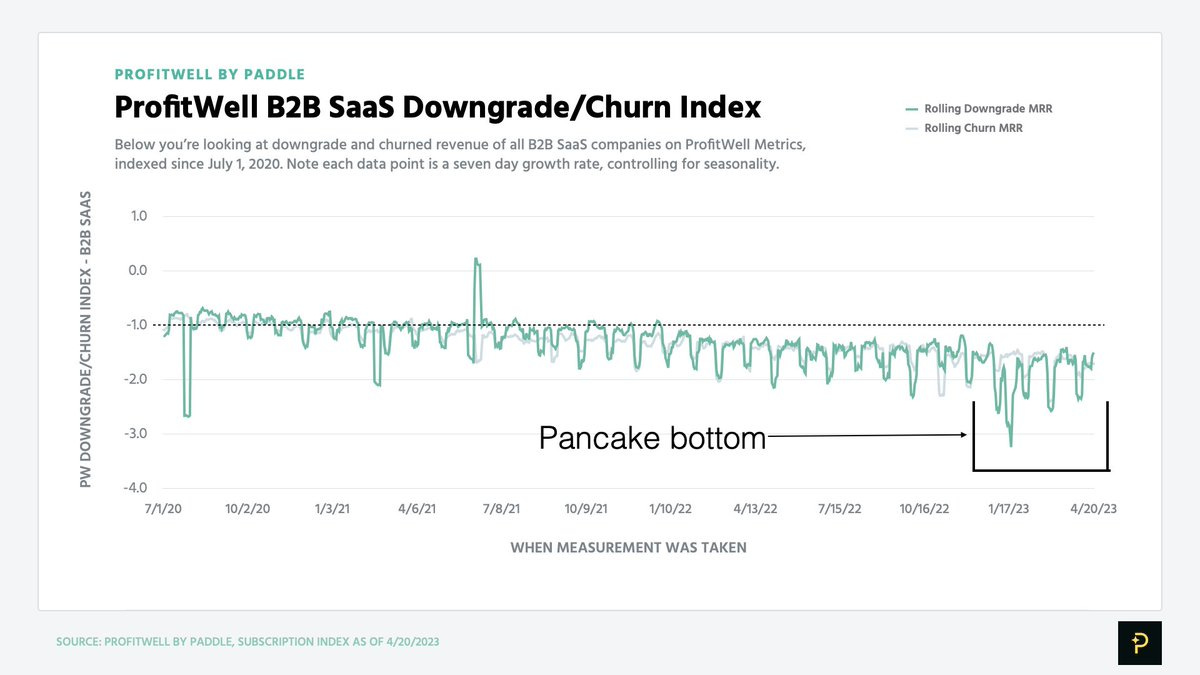

B2B SaaS spending seems stabilizing after a brutal 2022 where companies pursued software expenditure cuts.

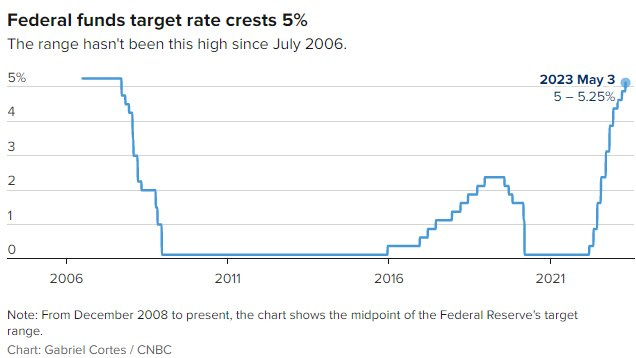

High-interest rates help Palantir support GAAP profitability. In a recent interview CEO Alex Karp disclosed that Palantir has ~$1.5bn in Treasury Bills out of $2.6bn Cash and Cash Equivalents. At the current ~5% Yield, that would mean $60mn in Net Interest per year or $15mn per quarter. In the last quarter, Palantir recorded $13mn Net Interest.

Forex headwind is reducing significantly as the USD weakened. As discussed last year, Palantir Commercial is heavily affected by FX dynamics because most of its Revenues come from outside the US. Despite Palantir’s contracts being mainly denominated in USD, a strong dollar makes Palantir’s solutions more expensive creating friction for international clients. We can have a sense of the FX's negative impact by looking at a slide from Servicenow: in 23Q1 FX generated a ~3% headwind, way lower than the 5-7% of the previous quarters.

Palantir announced layoffs for 2% of the workforce at the end of February. Despite being small in size, I consider this proof that Palantir is pursuing extreme efficiency, which should support its margins.

Palantir is receiving many positive customer reviews on Gartner, the most reputable IT Research provider. In just a couple of weeks, Palantir went from 32 reviews to 58 as of today. Even more interestingly, Palantir ranks among the top players with an impressive 4.7 rating out of 5. If Palantir adjusts its pricing strategy it can perform even better!

The Citi Analyst, a notorious bear, reiterated his Sell rating at $5 as he sees vulnerability on government exposure and decelerating growth. He gives 0 weight to the role Palantir has in the war in Ukraine. Did he miss the memo?

Palantir officially launched FedStart, which is a Certification as Service to help Commercial companies operate in compliance, guaranteed by Palantir, even at DoD classified levels. By collecting fees from consumption, Palantir is de facto seeking to become the “App Store of the US Government.” How big is the opportunity? Early to say, but we can guess it will be big.

Palantir’s management is in a position to opportunistically craft the narrative. This deserves a specific focus.

Narrative craft

Palantir is an AI leader both in the defense and the commercial space, according to IDC ranking and his clients. However, there is still relatively low public awareness of it.

Palantir’s management has now the opportunity to craft the narrative to surf the immense AI wave.

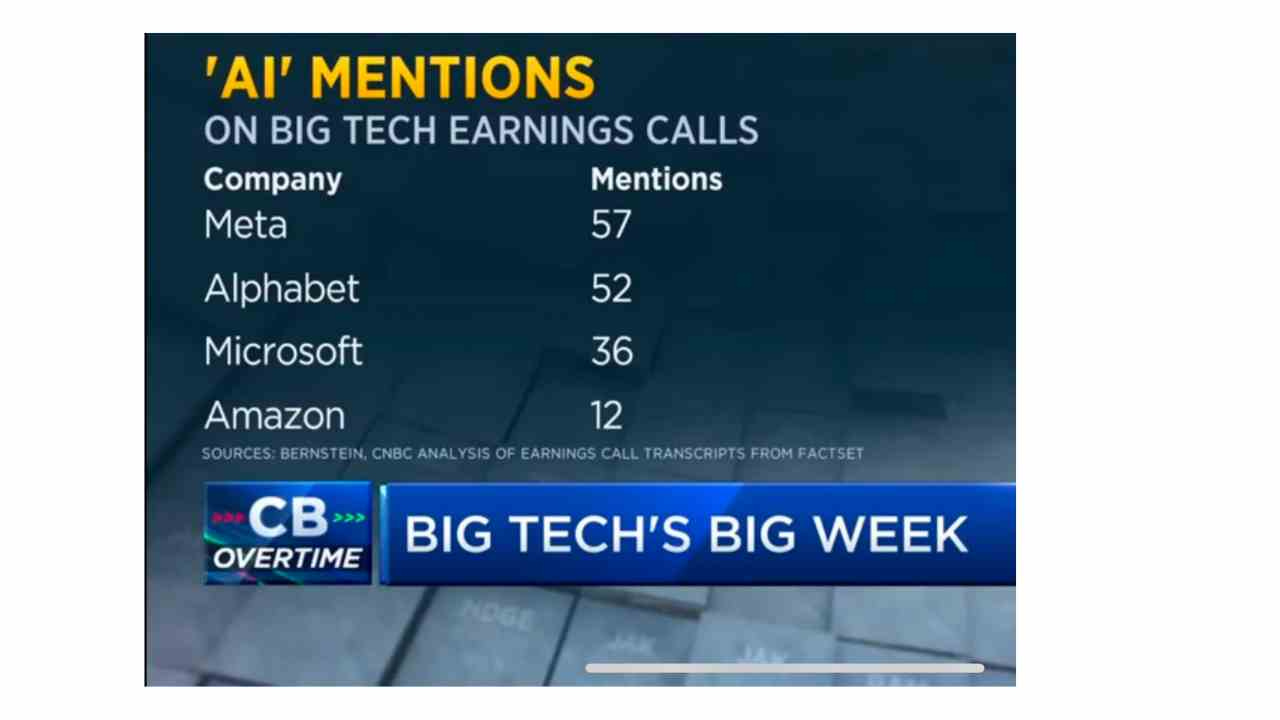

AI is becoming a “must mention” in the earnings call just as, in previous years, ESG was the “word du jour.”

Palantir just launched the AI Platform product aimed at operationalizing Large Language Models, like ChatGPT, both in the commercial space and defense. I have little doubt that Palantir’s management will not capitalize on the opportunity to promote this new product in the earnings call.

Will Palantir beat EPS?

As you could have noticed, I paid very little focus to the numbers.

The harsh truth is that beating EPS is not what matters for long term investors.

The stock price reacts more as a function of the sentiment for the future rather than for the recent past results.

For instance, Amazon went from a +14% spike after the release to being negative, slightly after, as CEO Andy Jassy underscored how clients are seeking ways to reduce their cloud bills, which creates attrition for growth acceleration for its AWS business.

Palantir could be affected by a similar dynamic, where the market will weigh more on signs of future direction rather than reward or punish past results.

Conclusion

I will be unphased regarding a $0.01 GAAP earnings beat or loss. What is important is for Palantir to keep acquiring new customers and expanding the existing ones.

As an investor, what I do care about, is seeing the story positively unfold and I believe we have plenty of evidence to support this.

“We are working towards a broader release of the software and will be accelerating our timelines significantly.” - Palantir CEO Alex Karp, “AIP in action” letter

Yours,

Arny

View expresses are my own and DO NOT REPRESENT FINANCIAL ADVICE.

I own PLTR stocks.

great take, thank you!