Palantir Q1: better than it seems. Gov. slowdown hides Commercial ramp up

Palantir Q1 results were so appreciated that the stock tanked -20% on the day after an EPS miss, arising concerns to many. Time to wear my analyst hat and share my takeaways

Palantir's Q1 results were so appreciated that the stock tanked 20% on the day after an EPS miss, arising concerns about the business strength.

I am pretty sure if the stock didn’t drop people would not have been pessimistic about the results. However, the lack of proper explanation didn’t help. Karp in “philosopher mode” was the icing on the cake.

I feel it is time to wear my analyst hat and share my takeaways:

Government slowdown is not only a Palantir fault

Declining Net Dollar Expansion hides Commercial strength

Lower Margins could be a good sign

SBC slows down towards “normalization”

Lower Guidance is still in line

Opportunity after EPS miss

Government slowdown is not only a Palantir fault

Government Revenues grew only 16% YoY, an obvious slowdown compared with the numbers we were used to seeing last year.

In particular, 22Q1 compares with a 76%+ as of Q1 last year, when Palantir benefitted from positive abnormal activity from COVID.

+16% on a +76% YoY basis is already remarkable. Therefore, I believe part of 22Q1 slowdown is attributable to a base effect.

Better results would have been appreciated, but could be not “Palantir fault” only. The US DOD budget was enacted only on 25th March so at the end fiscal quarter period, probably due to tensions in Ukraine. This constrained Palantir's ability to capture new contracts in the first quarter.

Revenues YoY of other Defence Contractors suffered from the same reason:

Lockheed Martins: -1.5%

L3 Harris: -5%

Raytheon Intelligence and Space: -5%

Palantir +16% does not look that bad in this context.

The reduced Free Cash Flow could also be to Government side. For instance, L3 Harris reported less free cash flow due to “collection timing” aka “Government hasn’t paid yet”.

Despite delays, the US Government will pay, therefore has no risk of collection. This is why Karp insists on “quality of Government Revenues”.

During the call Shyam shared 2 relevant sentences which could provide clues on Q2:

“We will not deprive our customers with software just because the paperwork is not there”.

“Now the budgeting has been passed we are already seeing Q2 US Government Revenues re-accelerate”.

The management is very confident in a re-acceleration of the Government business.

It must be crucial to see how all of this will be translated into Revenues in the coming quarters.

Up to now, some relevant deals have been announced like the $90mn contract with HHS for 5 years and a $12,5mn contract with the UK Defense for 12 months. Both contracts are above the average Revenues per Gov. Client of $10mn.

Despite Ukraine-Russia is benefitting Palantir, we will probably see the results in Q2 onwards.

A further boost could come from NATO Budget increase to reach the target 2% GDP.

Declining Net Dollar Expansion hides Commercial strength

Many raised concerns about the 126% Net Dollar Expansion, lower than 131% as of Q4. However, Group Net Dollar Expansion hides signs of real strength from the Commercial side.

While Government expanded 16%, Commercial Net Dollar Expansion was +140%, up from 113% in Q4. The commercial side grew +54% to $205mn, with existing clients expanding their commitments to Palantir by 40% YoY. The remaining $18mn Revenues were brought by the new 37 clients.

Why did they hide? The spike could be an abnormal quarter since business contract procurements are not linear.

Palantir can have exponential growth only if there will be a mix of expanding existing clients and getting new clients. I will pay particular attention to NDE in the coming quarters.

Lower Margins could be a good sign

Regarding Operating Margins, a divergence emerged:

GAAP Margin improved to -9% from -14% in Q4, mainly driven by lower impact from SBC.

Operating Margin adj. decreased from 34% to 26% in Q4 due to increased Marketing Expenses excl SBC, which went +65% YoY to $130mn as % of Revenues, going from 26% to 29%.

Lower margins are not necessarily bad. Despite counterintuitive, for a SaaS business like Palantir decreasing margins could be a sign of accelerating client acquisition. Are we in this case?

When Palantir gets a new client, first incurs losses of client acquisition. Revenues will come in the future at a recurring rate.

Therefore, a spike in the client acquisition would create a steep increase in Marketing expenses.

Palantir acquired 40 new clients in the quarter, a record. Therefore, I believe this is the case we see lower margins for higher client acquisition rather than competition. In particular, Palantir tripled its Commercial clients, the most important driver of Palantir's investment thesis. The sales effort is delivering results, especially in the US.

NB: A stop in clients growth could be a thesis breaker.

SBC slows down towards “normalization”

SBC is lower both in terms of % of Revenues and absolute figure, going to $150mn from $193mn last year.

SBC “normalization path” could continue given the lower Unrecognized SBC.

Lower Guidance is still in line

Palantir is generally conservative with Guidance, so I am not worried but the lower guided Revenues of +25% YoY, are below the long-term guidance of +30%.

Punishment for high guidance and underdelivering could be severe, so I see +25% a combination of cautiousness and base effect. If the reasoning above holds, further Margin reduction to 20% Guidance is a positive sign the commercial activity is doing well.

To reach the 30% Guidance for the year, Q3-Q4 should grow 32-35%.

Margins for the full year are also expected to increase from 20% expected for Q2 to 27% in Q3-Q4, similar to Tier1 tech companies. This means they expect the second part of the year to deliver both more growth with higher margins.

Opportunity after EPS miss

As I mentioned in my previous article there were many headwinds against the Q1, mainly the margin compression and the SPAC losses.

I see the current price drop due to EPS miss as opportunity.

Despite the Government's performance, I am optimistic because the Commercial Business is performing well. At this stage, client acquisition is more important than Revenue.

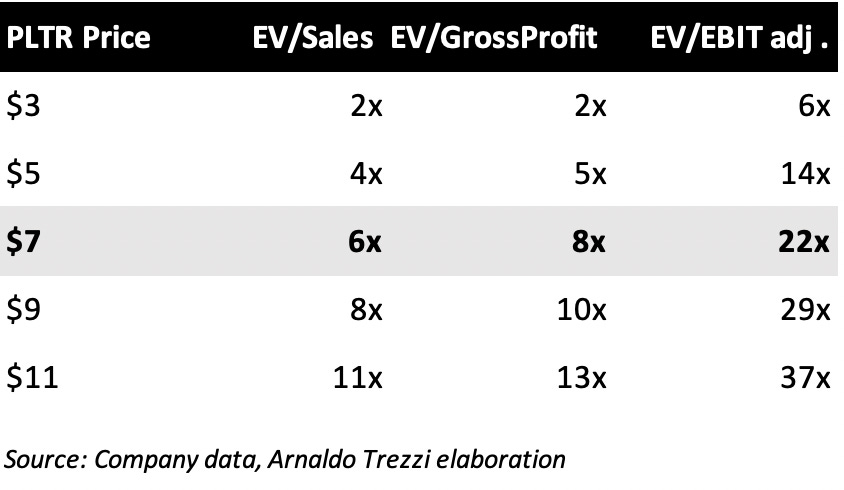

In terms of valuation, at the current price of $7 per share, Palantir is trading at 22x EV/FCF on the FY22 expected number. I consider this price attractive for a company expected to grow +30% with ~30% EBIT Adj. Margins.

Final thoughts

Despite the first sign results are not exciting, there are signs of strength in the Commercial segment, which is the key driver for my investment thesis.

I believe the market has been wrong in assessing the financial results and that is the asymmetry I was waiting for.

On the negative side, I would have appreciated more details shown in the slides, in particular on the strength of the commercial activity and how contributed to Margins compression.

A quarter is a just data point, could provide valuable hints but the trajectory is more important. The direction of both business segments is still great.

I expressed my “concerns” doubling down my position at ~$7. Now Palantir is ~30% of my portfolio.

“I have spent nearly two decades preparing for this moment. This is my time, and I intend to seize it.”

Karp

Join me on Twitter: @arny_trezzi

View expresses are my own. Do not represent Financial Advice.

I own PLTR 0.00%↑ stocks.