Palantir Mistakes: a Matter of Survival

Principles to better deal with Palantir

Editor: Emanuele’s Notepad

Hi, I’m Arny. If you are new, you can join here to spot Palantir asymmetries along with +1.000 investors. Please hit the ❤️ button if you like today’s article.

Would you like to discuss anything directly with me? Book a 1:1 meeting.

Book a meeting with Arny Trezzi

In this article 3 principles to deal with PLTR 0.00%↑ :

Position;

Assumptions;

Time.

When it comes to investing, being conservative is a matter of survival. That is essential to potentially gain much and lose little (Palantir’s Buy Signals: A Dive Inside my Playbook).

Despite I made my best to be conservative in the last year, I was not conservative enough. This led me to make some mistakes, which I’d like to share in order to make us better investors.

Last year I shared a video on 3 mistakes I made with Palantir since the DPO. In a similar line, with this article, I wish to guide you through the principles I learned in 2023.

By avoiding or minimizing these mistakes we could generate better returns.

These principles are worth considering with any stock but become particularly relevant when dealing with a very volatile stock like Palantir.

Avoid greed at all cost

Markets are a perpetual swing between fear and greed, but the strength of the swing is company/sector specific. In order to track the general market sentiment, I follow the CNN Fear Greed index.

Palantir is highly volatile, therefore, the stock swings heavily in relation to the market’s mood.

As a principle, I seek to add only when there is “Extreme Fear” in the market.

While I can’t predict the future, by buying “Extreme Fear” I seek to maximise the conditions of getting a good deal because it means that markets, in aggregate, are very pessimistic.

“Be greedy when others are fearful” - Warren Buffett

While I am very satisfied with my entries in March, when Putin attacked Ukraine, and in May, when interest rates peaked, in November I failed, affected by the enthusiasm of FoundryCon I violated this principle and paid the consequences as the shares added went down ~20% since.

I will wait for Extreme Fear to make future purchases.

I will discuss how I am positioned and the reasoning behind it in a future article.

Assumptions: avoid the peaks

For early Laorca readers, you know that I’ve been quite conservative in my assumptions regarding financial modelling, especially in relation to DCFs (Why 99% of PLTR’s DCFs Fail).

Yet that was not conservative enough.

Despite I didn’t expect Revenue growth to be as strong as in ‘20 and ‘21, which was above ~40%, I failed to see Revenue Growth would have slowed down to just above ~20%. My expectations were set in line with the ~30% Guidance.

20-21 growth has been driven by the Covid contracts contribution and a very positive Forex impact (Is PLTR Commercial Doomed?). This was anomalous against the ~30% long-term CAGR and the ~30% Guided.

Therefore, we could consider using a simple principle:

When making assumptions, stay below Guidance.

If the company is attractive even at lower Guidance results, there is more space for positive surprises.

Similar consideration could be said about margins. Despite I didn’t expect margins to expand as Palantir was entering an “acquisition phase,” I expected EBIT margins would have stayed around ~25%. As of Q3 EBIT Margin was ~17%.

While this is good for the business, as it means they are investing heavily in new clients, markets don’t appreciate margin compressions.

In reality, this is a feature of the business model, when Palantir performs many pilots to acquire new clients or expand existing ones, it incurs expenses first.

While I understood Palantir’s margin would have compressed when they would start investing aggressively to scale, I underestimated the impact on margins.

As highlighted by Palantir's Missing Link, we know that Palantir is running an immense number of pilots. This means high costs and no Revenues.

In addition, Guidance for Q4 expects margins to compress further to ~16%.

This is good for the business, bad for the stock.

Strong commercial activity compresses margins now to obtain future growth.

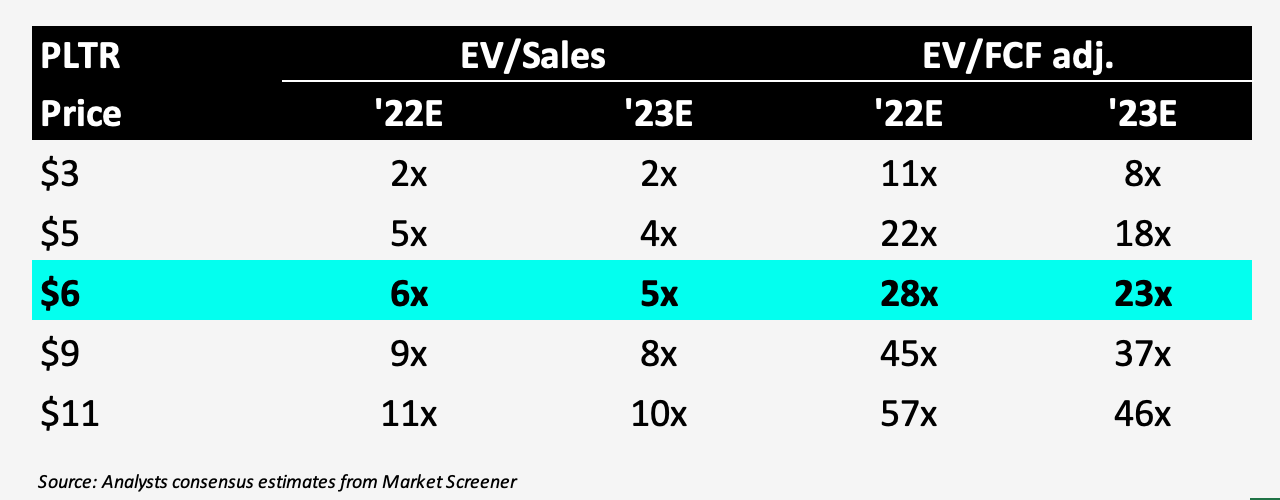

Revenue slowdown and margin compression resulted in strong multiple contraction to ~5x EV/Sales.

As a result of the margin contraction, Palantir now trades at ~23x EV/FCF on ‘23 expected numbers. If margins stayed at 30% that would be 15x EV/FCF.

As investors, we are better off entering a company when the price is already depressed after a Revenue slowdown and the margin is compressed due to investments.

Avoid peak assumptions and margin compression. Find the sweet spot.

The sweet spot is where the market implies permanent slowdown and margin compression, while there are conditions that suggest otherwise.

Time: don’t expect immediate results

As mentioned in our quarterly analysis, Palantir's business is structurally “slow” as Revenues reflect what was achieved months ago.

A good quarter is reflected in the ability to initiate many pilots and close contracts. On the other hand, the quarterly Revenues we see are mainly driven by existing clients expanding their usage of the platform (Palantir’s New Clients are Irrelevant).

Revenues are generated from the gradual recognition of the Deal Value, which comes after a pilot.

Differently, a product company, like Tesla, can attribute the success of a quarter to the number of units sold in that quarter.

A good quarter reflects an operating success.

Given this dynamic, every time we see a new Palantir partnership or contract, we should not expect that the quarter will bring outstanding growth.

Despite being aware of this dynamic, I underestimated the time needed to actually see the numbers flowing into Revenue growth.

For instance, regarding the contribution to the war, I wrote in my Q1 outlook as a result of the war in Ukraine:

“I expect the number of Government clients to slightly increase from the 90s, while revenue recognition should arrive in Q2-Q3 - since Palantir often offers pilot programs before closing contracts.”

In Q3 we just saw a spike in deal value related to Ukraine (Palantir: We Can See the Future), but that has not translated into Revenues yet.

What I expected to take 1-2 quarters, actually is going to take 3-4 quarters.

Therefore, as a rule of thumb, I will now begin to multiply my initial expectations by a factor of two regarding results from events and partnerships.

Conclusion

By understanding how the business dynamics move and the stock price reactions, we can have a better framework to judge future developments.

In the same way, Palantir’s Ontology writes back information to improve future decisions, we need to be aware of mistakes to sharpen our judgement.

With more awareness, we can better solve crucial investing questions.

“Every problem is a data problem” - Shyam, Palantir COO

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Mail: arnylaorca@gmail.com

Join Emanuele20x on:

Twitter: @Emanuele20x

YouTube: @Emanuele20x

Substack: Emanuele’s Notepad

View expresses are my own and do not represent Financial Advice in any way.

I own (many) PLTR stocks.

great coverage and key note, timely!

As always, super insightful content. Keep it up, Arny!