Palantir: It's Raining

After months of drought, the rain has arrived. A contract rain!

Editor: @Emanuele20x

After months of drought for Palantir’s Government (PLTR Government slowdown: not Palantir's fault), the rain has arrived. A contract rain!

Amid the storm of geopolitical tensions, Palantir has a unique opportunity as a contractor for the Department of Defense (PLTR Government: It’s Now or Never). It seems that after months of absence of news the wind is shifting.

In two weeks Palantir achieved contracts for up to ~$600mn.

The average length of the contracts is ~2 years. Among the contracts, which involve HIS (ICE), NIH, Veteran Affairs, the outlier is clearly the $229mn contract with the US Army Research Lab for 1y.

Thank you @PalantirResearch @PLTRillion @racchikaby @Either_Square (Either’s Substack) @ChadPalantard @TheKameroon for the “intelligence”!

These new contracts should create a record on Palantir’s US Government awards.

We can see from the chart above that the awards have a lumpy nature and can shift dramatically year by year.

The contracting activity tends not to be distributed homogeneously during the year but is heavily concentrated in Q3 and Q4 as the DoD Fiscal Year ends in September as mentioned previously (PLTR Q1 Outlook).

The table below confirms that the Department of Defense (mainly Air Force and Army) is the biggest client of the Palantir Government business.

Interestingly, the US Government Revenues seem to have been growing more than the public awards. The divergence should be due to the prevalence of Classified contracts from the Department of Defense.

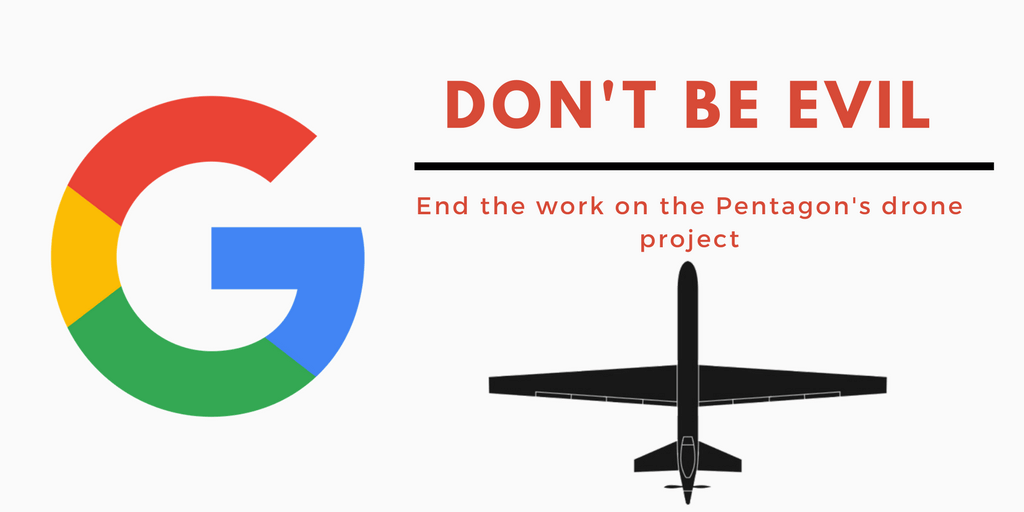

Google leaves. Palantir eats

The $229mn contract Palantir just achieved is highly controversial because it was managed previously by Google under the name of “Project Maven” until 2018 when its employees refused to develop AI systems for the Department of Defense.

Project Maven involves the use of AI and ML to improve existing video recognition software to increase the accuracy of military actions like drone strikes.

What is unattractive to Google, becomes Palantir’s lunch.

Palantir got the contract in 2018 and this expansion is a signal that the relationship is deepening.

This contract, up to $229mn if the DoD exercises it fully, could be the major US. Government award that was hinted at in the last earnings call:

“This revised guidance excludes any new major U.S. government awards, and we believe this to be the base case”. - Dave Glazer, Palantir’s Chief Financial Officer

Does this mean $600mn more Revenues?

These contracts awards are leading indicators for the US government business, which constitutes ~75% of Government Revenues.

However, there are factors to be considered:

some of these contracts are renewals or expansions. This means that the Revenue Growth will be given only by the “surplus” vs. the existing contracts.

$600mn is the total value including the value of the options that the clients can execute. There is no guarantee that clients will execute their contract options entirely.

We will probably see the real signs of these contracts from Q4 since they have just been signed at the end of Q3.

Obtaining up to ~$600mn contract does not automatically mean that Palantir’s Revenues will increase by ~$600mn.

The only certainty is that the recent contract rain is a clear sign that the Government business is everything but dead.

The boost of these contracts should help the Government business return to its ~30% CAGR over the next quarters.

Conclusion

Palantir Government is not dead. It just started.

If you enjoyed this article don’t miss my Palantir’s Government video featured by @Palantir Bite-Sized.

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Instagram: @arnylaorca

Business Email: arnylaorca@gmail.com

Discord Channel

View expresses are my own. Do not represent Financial Advice.

I own (many) PLTR 0.00%↑ stocks.

great structure and compact format with a great ratio of length to insight via research ... keep it rocking!

Where does the 600M figure come from? I see can only see 229 + 95.9 + 20 in the last two weeks on Palantir IR.