Palantir Deserves More (Peers Valuation)

How Palantir's valuation relates to other companies in the Cloud industry? The most effective way to assess it is by looking at the Efficiency Score from the Rule of 40.

Editor: @Emanuele20x

In the latest article, we discussed how appealing Palantir's valuation is related to its cash flow growth.

But how Palantir's valuation at $8 relates to other companies in the Cloud industry?

Rule of 40: how to simply identify superior companies

As mentioned when we compared Palantir to ServiceNow, the Efficiency Score is the most effective way to simply assess the strength of a Cloud company.

Efficiency Score = Revenues Growth + FCF Margin

The idea is that SaaS companies generally have the tradeoff between growth and margin expansion (lower expenses).

In this way, companies offering a better mix of growth and profitability are superior and deserve better valuation.

The Rule of 40 comes from the observation that the Median mix of Growth and FCF Margin is 40%. The Top Quartile companies have an Efficiency Score of ~60%.

We could have different combinations leading to different judgements, for instance:

40% growth; -20% FCF Margin = 20% Efficiency Score = “below average”;

40% growth; 0% FCF Margin = 40% Efficiency Score = “average”;

40% growth; 20% FCF Margin = 60% Efficiency Score = “above average”.

A company growing 40% while having 20% FCF Margin deserves a much higher valuation than a company growing 40% but with 0% FCF Margin.

Comparing the Efficiency Ratio to Price/Sales better reflects the value of a Cloud company than the mere comparison of the multiple against Growth.

Palantir still not recognised as an above-average business

From the chart below, we can see the market rewards companies showing a better Efficiency Ratio with higher Price/Sales (the breakdown between Growth and FCF Margin is shown in the Appendix).

For Palantir I consider the following parameters:

30% Growth: low-end of Guidance;

30% FCF Margin: slightly above the FCF Margin obtained in ‘21.

These bring to a 60% Efficiency Score for Palantir. This number is a “conservative base case” since the score on the ‘21 numbers was 69% and Palantir could choose to “sacrifice” some FCF Margin to boost further growth.

In particular, we can observe that Palantir ranks among the best in the Cloud sector, a similar league of Cloud B2B “champions” like Salesforce ( CRM 0.00%↑ ) and ServiceNow ( NOW 0.00%↑ ).

A couple of further considerations emerge from the chart:

Palantir is currently cheaper than other Cloud companies with a similar mix of Revenue Growth and FCF Margin. In particular, ServiceNow has a similar Efficiency Ratio but a Price/Sales of 10x compared with 7x of Palantir. I believe this is due to the fact ServiceNow is GAAP positive, while Palantir is only FCF positive with a similar ~30% FCF Margin.

Palantir's efficiency ratio is lower than the companies it is usually compared with. Snowflake ( SNOW 0.00%↑ ) and DataDog ( DDOG 0.00%↑ ) have higher Price/Sales multiples, 12x and 13x respectively, due to a much stronger Efficiency Ratio. Since a 30% FCF Margin is already very elevated, Palantir should work on Growth to improve its Efficiency Score.

Therefore, to deserve a higher multiple than its peers, Palantir needs to achieve:

GAAP profitability. This could be obtained by keeping reducing the impact of SBC on Revenues (33% in 22Q1 vs 57% as of 21Q1), which is the main friction to delivering GAAP positive Earnings. According to my previous analysis, Palantir could break even GAAP profitability by 2025 even with dilution above 6% per year. With less SBC or higher growth, this could be achieved sooner.

Higher growth. A boost in growth could come from the expansion of the clients acquired in the past quarters and from the new efforts in offering consumption-based pricing solutions, which is the key driver of Snowflake's rapid growth.

From my understanding of Palantir, these targets are absolutely achievable, but it is crucial to keep monitoring the evolution of SBC and client acquisition/expansion in the coming quarters.

The sector compression can create an opportunity

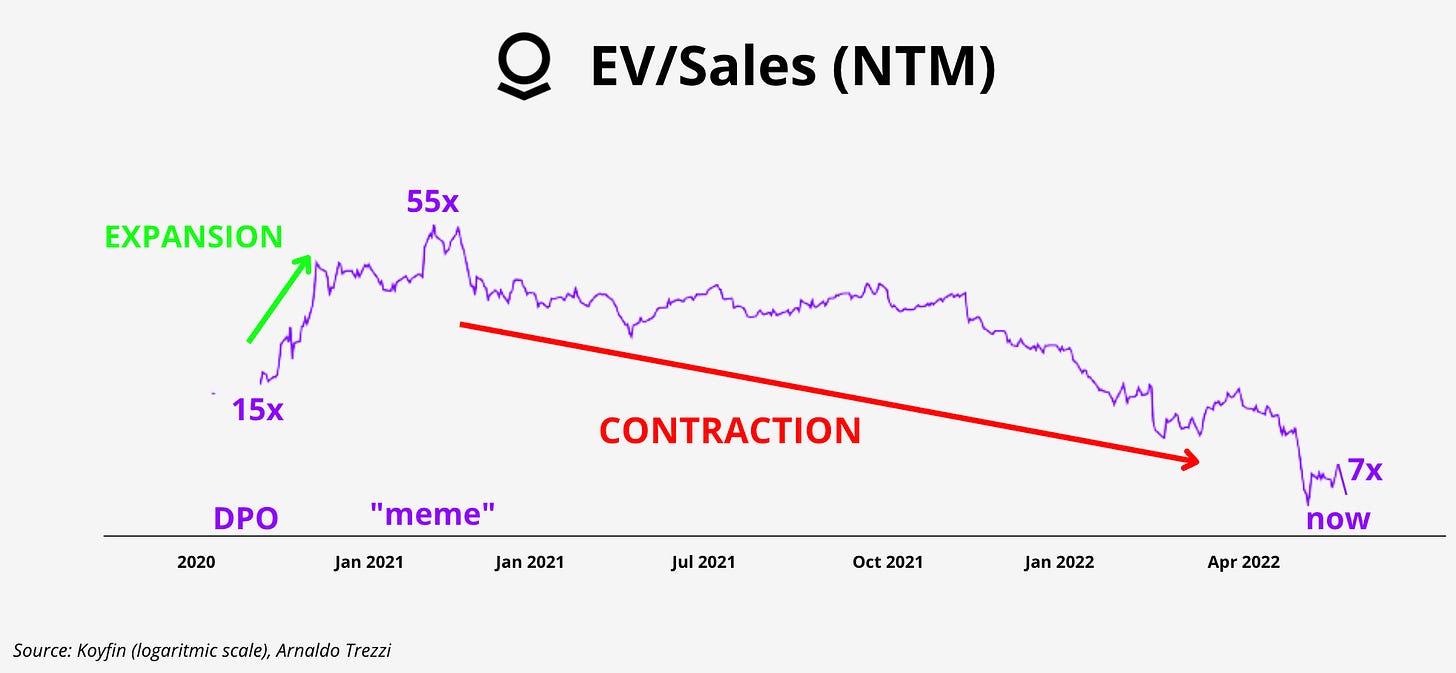

By making one step back, we can notice the entire sector is currently under pressure, so the prices we see now are much lower than what we saw last year.

The Cloud sector has been hammered by the inflation narrative, which has no mercy for companies considered “growth” where basically all the Cloud companies belong.

The current Median multiple of 5x Price/Sales is now at the multi-year bottom, from a peak of 16x as of 21Q1. The multiple previously reached these lows in 2014 and 2016.

This leads us to state that the Palantir multiple compression is not only due to fears of Palantir business (e.g. “Government slowdown”) but is in great part related to an overall sector contraction.

This could change soon.

In a context of fear of a recession, a stream of recurring - high-margin B2B Revenues is incredibly valuable, because while consumer consumption can contract, companies will still need to invest in IT expenditure to:

save costs;

generate new business;

manage complexity.

Therefore, I believe that even in the event of a “consumption crunch” the stickiness of these companies can allow them to keep generating steady cash flows.

This could be particularly true for companies offering crucial products, or “existential” software, bringing a renewed interest in the sector.

“At Palantir, we always talk about working on the world’s hardest problems. And by hardest, we don’t mean […] most technically complex.

We mean the most existential.” -Shyam Sankar, COO

The companies able to strive even in difficult times will be rewarded.

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

View expresses are my own. Do not represent Financial Advice.

I own (many) PLTR 0.00%↑ stocks.

Appendix: Breakdown of the Efficiency Score

With ~30% FCF Margin, Palantir ranks among the best companies in the Cloud sector, with a very similar profile to ServiceNow and superior to DataDog, Snowflake and Salesforce.

Looking at growth, we can notice once again that Palantir has a similar profile to ServiceNow and Salesforce.

DataDog and Snowflake have more than double the growth of Palantir. This supports the idea that Palantir could deserve a higher multiple if it increased its growth.

Well done Arnaldo! Informative and concise 🙏