Palantir DCF: 20+20 is not 10+30

Editor: Emanuele Marabella

Hi, I’m Arny. Thank you for joining 1.529 investors who receive the deepest Palantir research. Please hit the ❤️ button if you enjoy today’s article.

Palantir is trading back at $8 after a violent swing down from $10.

With the stock down ~33% YoY and not exciting operating results in the last quarters a question arises:

Is there any upside at the current valuation?

Palantir is top quartile

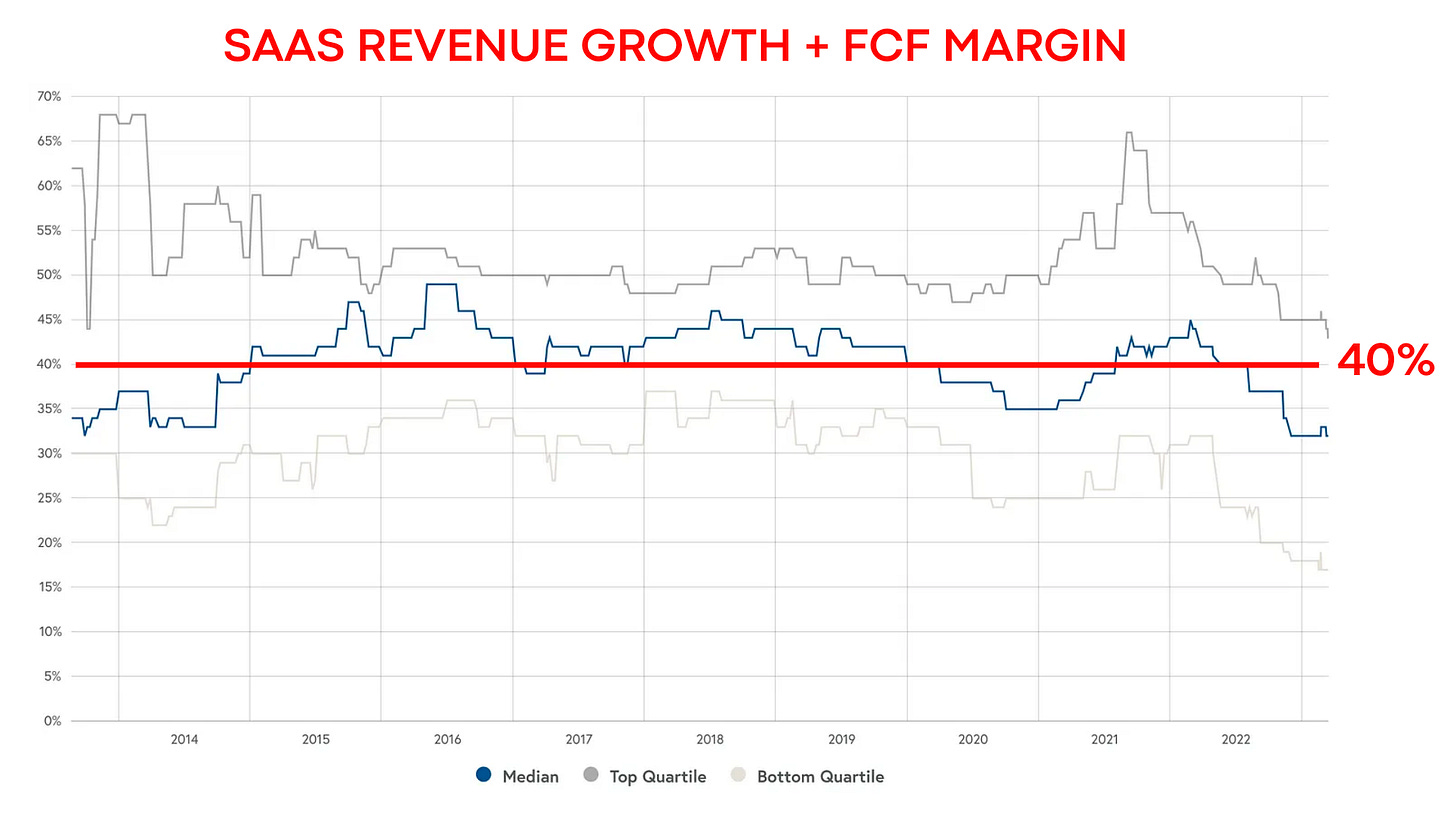

As a reminder, the Rule of 40 Score represents the sum of the Revenue Growth Rate and the FCF or EBIT adj. Margin. This is the key “ingredient” for SaaS valuations.

Before the pandemic Palantir had a negative Rule of 40 Score due to relatively little growth while burning cash. However, the music changed in 2020.

Palantir had a Rule of 40 Score in excess of 40% in the last three years, which hints at a strong financial profile.

After a very strong 2020 and 2021, in ‘22, Palantir’s Rule of 40 Score declined from 72% to 46%. This was the result of both slower growth, from 41% to 24%, and lower EBIT adj. margin, from 31% to 22%.

Despite the relatively weak Guidance for the first quarter of ‘23, Palantir still expects to run at least at the Rule of 40 for the next fiscal year.

“Our combined revenue growth and adjusted operating margin was 40% in the fourth quarter and 46% in full year 2022, our third consecutive full year in excess of the Rule of 40 and a score that we will continue to strive to achieve throughout 2023.” - Dave Glazer, Palantir CFO

Notably, Palantir was not the only company suffering. The entire SaaS Cloud industry suffered.

The SaaS Median Rule of 40 Score has declined to ~35%, below the 40% “equilibrium,” due to a combination of slower growth and lower margins.

The harsh conditions also affected the Top Quartile SaaS whose Rule of 40 Score declined to ~45%, in line with Palantir’s one.

Let’s assess the degree to which these two factors affect Palantir’s valuation with a base case DCF.

Palantir DCF: a base case

To assess how the Rule of 40 affects the valuation and understand how reasonable the current price we can run a DCF Model with some basic assumptions:

20% Diluted Growth. Since Palantir expects to exceed the Rule of 40 we can consider the “excess” to be “eaten” by the dilution, which was ~4% in Q4 and we could expect to stay in that 3-5% range for the coming years. 20% Diluted Growth is equivalent to saying 23% growth and 3% dilution.

20% FCF Margin. This is slightly lower than the 2022 number as Palantir is pursuing client acquisition rather than Revenue maximization.

13% WACC. This is the discount rate used by Bank of America.

3% Terminal Growth.

To download the model and unlock the full article, please consider becoming a paid subscriber.

Under these assumptions, we obtain a valuation of $7.5 which aligns with the current price of $8.

In other words, we can say Palantir is priced for a 20% Diluted Growth and 20% FCF Margin.

Does this mean there is no upside left?

In the following part of the article, I show in detail how each driver affects the valuation to understand where potential upside can come from. To read the remaining part of the article please consider upgrading to a paid subscription.

It’s a matter of perception

The choice of the WACC and Terminal Value heavily affects the valuation.

To demonstrate this we can “fix” the growth rate and the FCF margin at 20% while testing the resulting fair value in relation to different levels of Terminal Growth and WACC. We can observe:

A 1% increase in the Terminal Growth generates a ~10% variation in the fair value.

A 2% decrease in WACC generates a ~30% upside in the valuation.

The terminal growth used in valuations is typically 2% or 3%, which is in line with GDP Growth. On the other hand, the WACC leaves much more space for personal assumption as it reflects the perception of the riskiness of the business discussed (Palantir Costs Less than Coca-Cola).

Currently, Palantir’s WACC is high due to:

Analyst skepticism on Palantir’s strength. This should alleviate once GAAP profitability for the full year is achieved.

10y Treasury Yield Rate being relatively high due to inflation expectations. This is a major headwind for Palantir’s valuation (PLTR fights vs a Tough Competitor).

Growth is more valuable than margins

In the same way, as we did for WACC and Terminal Growth rate, we can test the sensitivity of the valuation on the Growth and the FCF Margin by fixing a 13% WACC and 3% Terminal Growth Rate.

We observe:

Palantir could be worth $12 with a combination of 25% Growth and 25% FCF Margin. This seems reasonably attainable.

Palantir could be worth $4 under the disastrous assumption of 15% Growth and 15% FCF. This supports the idea that at $4-5 the valuation starts to become incredibly pessimistic, and it would provide a very asymmetrical entry (PLTR Buy Signals - A dive inside my playbook).

Growth is more valuable than margins. A 5% increase in Growth generates a ~35% increase in the fair value while a 5% increase in FCF margin generates a ~20% increase in the fair value. This proves that Palantir’s valuation could substantially improve as growth accelerates again (Palantir $4.5bn Revenue in 2025: A Mirage?).

In the last article (Palantir AI AI AI) we discussed how the underlying AI Software Platform market is set to grow by more than 30%. This should provide a strong tailwind for both the business growth and the valuation.

Conclusion

The current price reflects a base case of operating metrics growing at the Rule of 40 (20% Growth + 20% FCF Margin).

However, these assumptions are quite conservative and offer room for upside if:

Revenue Growth accelerates toward 30% while keeping dilution under control.

Perception of the resiliency of the business model improves.

While there is a downside risk if growth further decelerates, the fact that the market already has relatively low expectations leaves more room for positive surprises. This makes me comfortable despite the current numbers don’t scream “undervaluation.”

As long as new customers are acquired and the existing ones expand their usage it is only a matter of time before the perception shifts. In a coming article, we will have a closer look at what’s the analysts’ perception of Palantir’s peers.

“A threshold has been crossed, and this is the start of our next chapter.” - Karp, Palantir CEO

Yours,

Arny

View expresses are my own. Do not represent Financial Advice. I own (many) PLTR stocks.

top coverage, thank you!