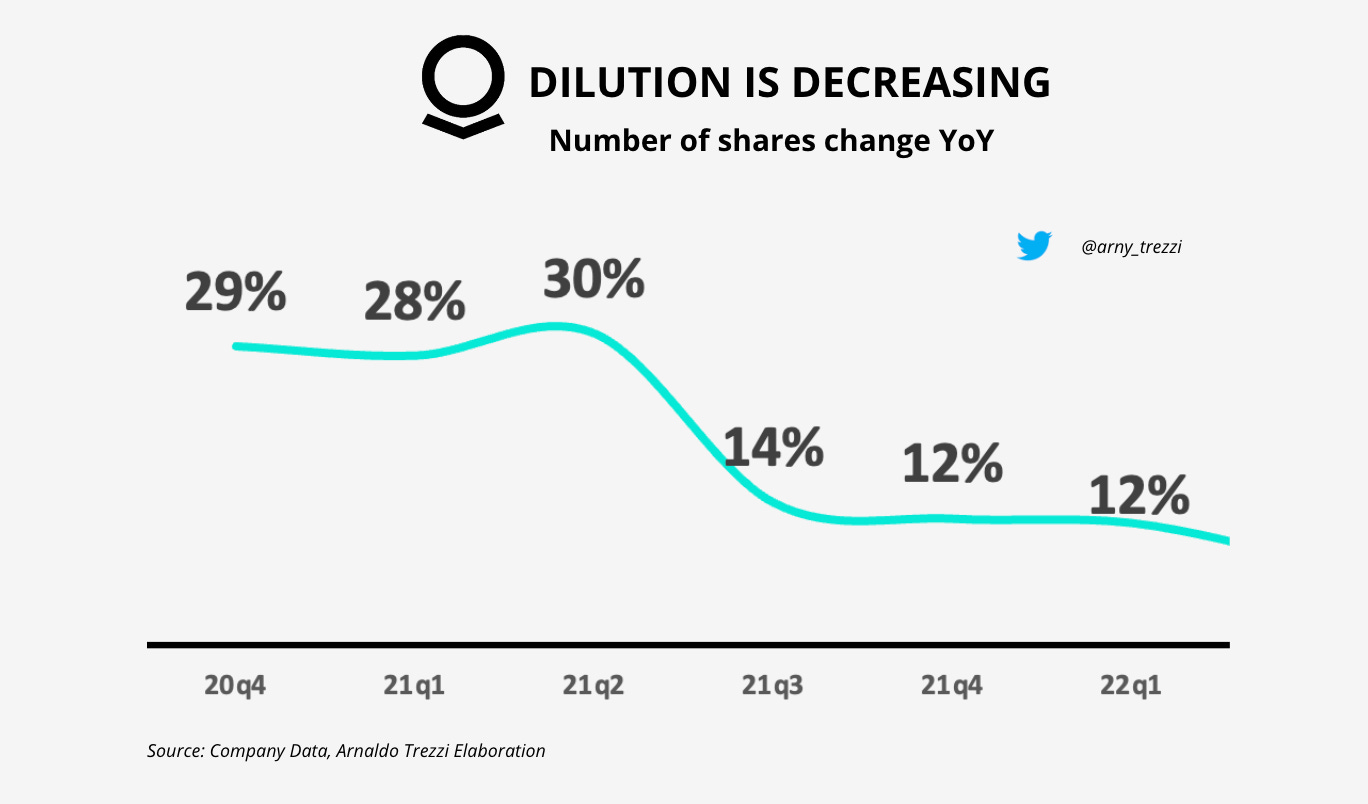

Palantir Cash Could Reduce Dilution

Palantir could reduce the dilutive impact from SBC thanks to Cash.

Editor: @Emanuele20x

Palantir can exploit its $2bn Net Cash position to reduce dilution.

Cash provides optionality.

Specifically, the $2bn Net Cash Palantir could be used to reduce the dilutive impact of the RSU from Stock-Based-Compensation, which I discussed profoundly in a previous article (Palantir - When Will SBC Ease?).

During the Q1 results, Snowflake's CFO said that they are going to use the RSU Cash Settlement to contain the dilutive effects of the newly issued shares:

Going forward, we are using our strong cash position to transition to a net share settlement for vesting of employee RSUs in almost all countries. This will help us further manage dilution, which has already been running below 1% YoY on a fully diluted basis.

From Palantir's 2020 Executive Equity Incentive Plan we can see Palantir could do the same.

Cash settled RSUs give employees the correct cash equivalent relative to the number of shares agreed upon at the grant date (this video explains it well).

In other words, RSU Cash Settlement means that the company could pay employees in cash rather than issuing new shares at the vesting period when the employee is entitled to receive the shares.

Rather than Issuing new shares for $100k ( so 10,000 shares at $10 per share), the company could pay $100k to the employee in cash.

Therefore, at the vesting date with Cash Settled RSUs, there will be:

$100k less Net Cash;

No change in the number of shares from that RSU.

Obviously, a company can do that in a safe way only if it has a strong cash flow generation after all the Cash Expenses for growth are included.

Similar to SNOW 0.00%↑ , Palantir has a solid cash position and generation:

$2bn Cash Position;

Strong ~25-30% Cash Flow marginality.

Therefore, it would be reasonable for Palantir to exploit this option for the newly issued RSUs or any existing RSUs.

There will be a normalization (of dilution) that will get to a range you would see in a software company within the next 18 months, latest 2 years.

That’s going to take a little time, but it is going to happen. - Alex Karp, Palantir CEO

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Discord Channel

View expresses are my own. Do not represent Financial Advice.

I own (many) PLTR 0.00%↑ stocks.

Reference articles:

Sei un fuoriclasse

HI, what is the normal range of dilution in a software company ? thanks