Palantir Bullets #1

This week's Palantir developments and the crowned “Tweet of the Week.”

Editor: Emanuele’s Notepad

Hi, I’m Arny 😊 Join more than 750+ fellow Palantir investors spotting asymmetries. Please hit the heart button if you like today’s newsletter. You could support my work with a Paid sub.

Palantir this week:

Palantir partners with Sonnedix. This is the first partnership with a 100% Renewable Energy client. The use of Metaconstellation to identify misaligned solar trackers proves how Palantir seeks to monopolize the Commercialization of Space. (Palantir’s $140bn Opportunity to Monopolize Space)

Babcock, UK's leading defence contractor is confirmed as a Palantir client. The partnership proves how Palantir empowers Legacy Defence contractors.

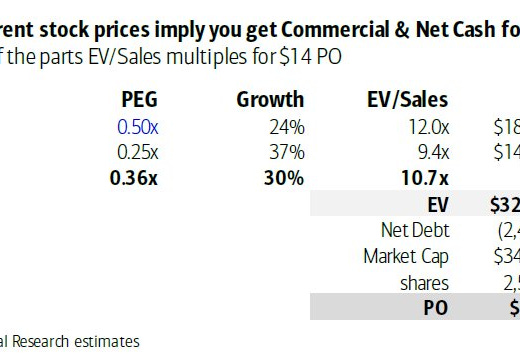

Bank of America raises the target price from $13 to $14: “At current valuation you get Commercial and Cash for free.” This is exactly in line with what we shared previously, Bank of America’s Analyst is the only one capturing the strength of the Government business (Palantir: Data is the New Bullet, but Nobody Cares).

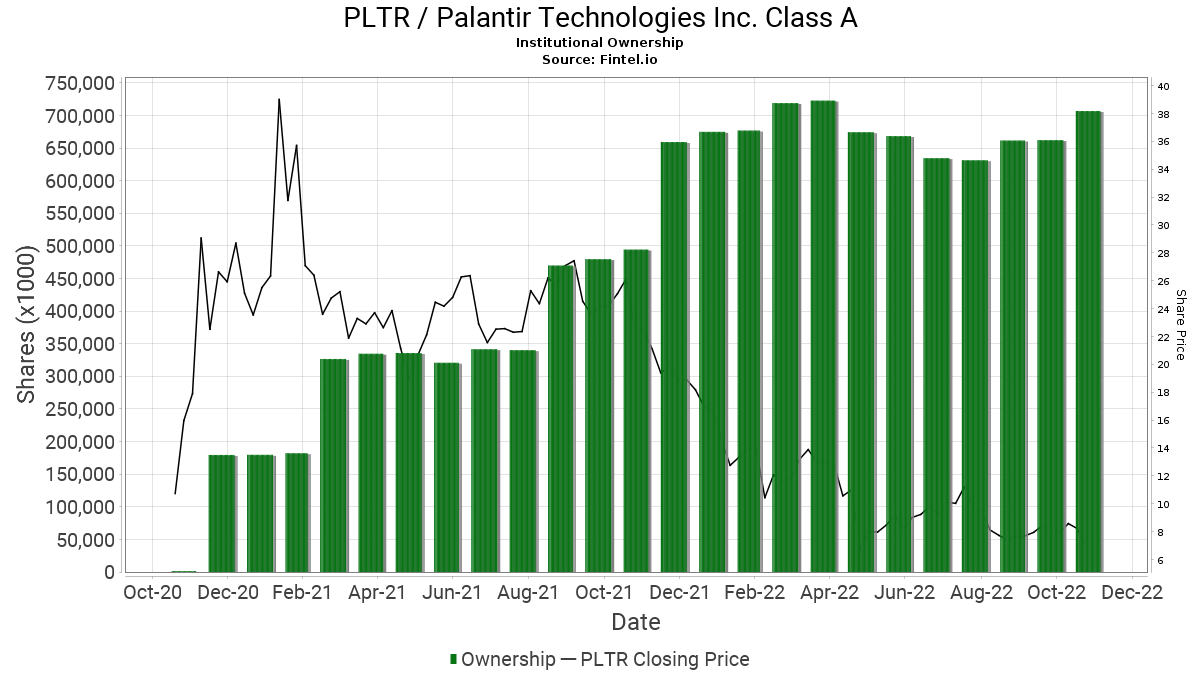

Institutional ownership increases at ~38%. To spot who bought/sold check Chris Jones’ amazing Dashboard.

Palantir sold some SPAC shares. Frankly, I struggle to make my mind up on why they reduced shares at the bottom, I will update you if the situation becomes clearer. Meanwhile, Fast Radius filed for Chapter 11. According to my analysis, SPACs are to be considered as a tool to bootstrap growth (Palantir SPACs’ Crucial Role in the Network), so even if most of them fail, that would not impact my thesis.

Microsoft launches a Supply Chain Platform. This is a clear attack on Palantir. Some competitive pressure could incentivize Palantir to increase execution effectiveness and increase awareness for the purpose of Foundry being needed to deal with macroeconomic stress. Paradoxically, I see it as a net positive signal.

The UK’s NHS contract should be "issued in the coming weeks.” The saga on the $360mn Data Platform contract continues. Palantir is getting obstruction by activist companies backed by George Soros, as Either_Square’s Newsletter reports.

Related Tech trends/Macro:

The Tech layoff saga continues Amazon and Meta employees are the last victims. Palantir on the other hand is hiring aggressively (Palantir: Hunting Season is Open).

Nvidia collaborates with Lockheed Martin to build a Digital Twin of Weather Conditions. Since Lockheed Martin is a Palantir client, it is possible that Foundry is involved as the data foundation platform.

Lockheed Martin works with Microsoft to speed cloud workloads with the Pentagon. The 3y contract should help Lockheed (LMT) to avoid some of the repetitive security compliance processes for each new government project. It will be interesting to track if this is an Apollo integration or a substitution.

Shipping costs fall substantially providing early signs of deflation. A potential decrease in inflation could decrease the Yield of the 10Y Treasury, which could help sustain the valuation of “Growth Tech” companies like Palantir (Palantir Fights vs. a Tough Competitor).

Tweet of the week

Yours,

Arny

Not Financial Advice. I own (many) PLTR stocks.

great, thank you!