Editor: Emanuele Marabella

Hi, I’m Arny. Thank you for joining 1.493 investors who receive the deepest Palantir research. Please hit the ❤️ button if you enjoy today’s article.

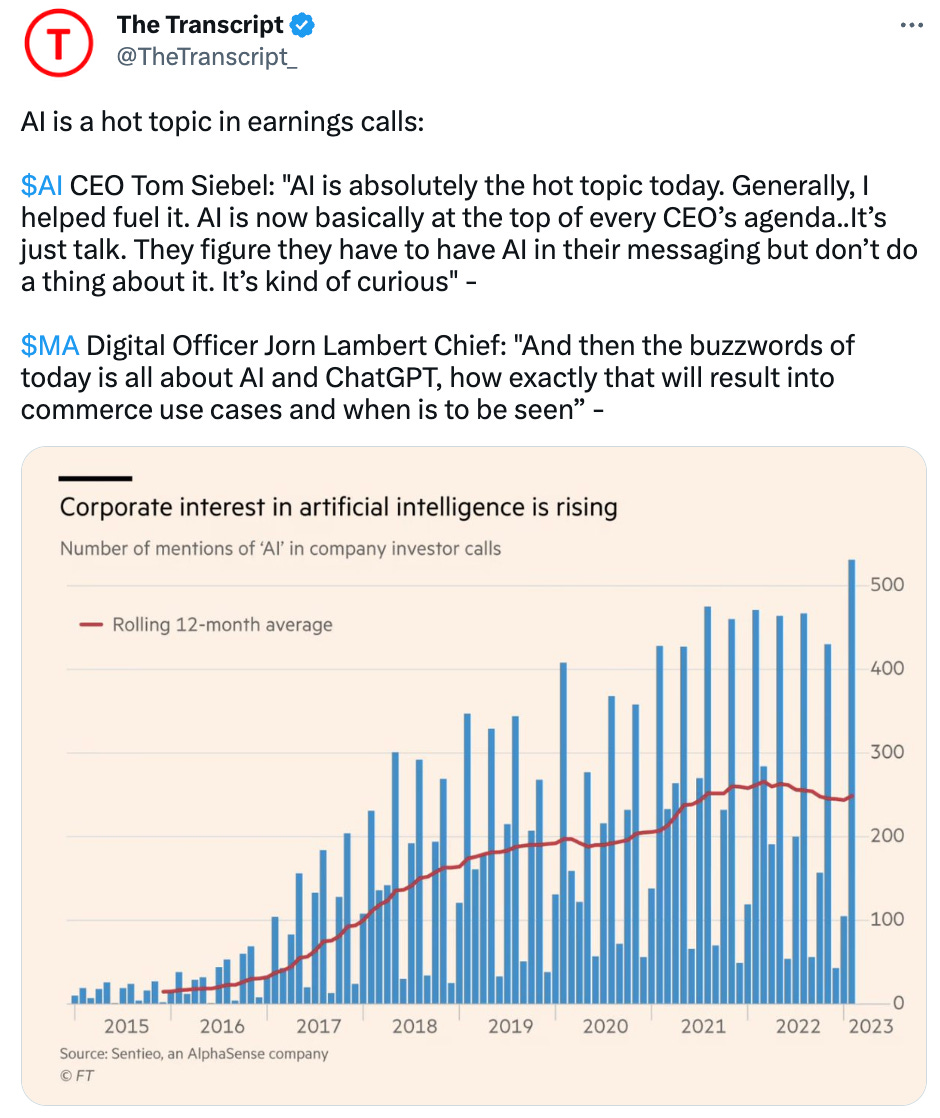

AI is the word du jour: CEOs can’t avoid mentioning these two letters in their earnings calls.

The excitement from the OpenAI’s $30bn valuation from Microsoft’s capital raise sparked an interest in AI that was reflected in the public markets, where having an “AI” ticker is enough to be perceived as valuable, as C3 AI illustrated.

By making one step back, we can see why investors are excited: the size of the AI Software Market is immense and set to grow at a rapid pace.

According to Precedence Research, the AI Software market is already a $140bn market, set to reach $1trn in 2032 growing at a ~23% CAGR.

This coincides with what Alex Karp said in a recent interview.

“Our TAM is north of $900bn” - Alex Karp, Palantir CEO on CNBC

The world’s awakening to AI already has an effect on Palantir, starting from the website.

Palantir changes clothes

Palantir changed its homepage in mid-February clearly concentrating on its AI proposition.

The word “AI” appears now 10x on Palantir’s homepage while there were no mentions in the previous version. This shows a clear intention from Palantir to capitalize on the AI trend as many companies are trying to do. The following question arises:

Is Palantir just window dressing for the hype or is there actually any substance?

Palantir: the small elephant in the room

Public awareness focuses on the consumer side of AI in the form of Generative AI in the like of ChatGPT or the image generator DALL·E. Meanwhile Wall Street focuses on semiconductors companies like Nvidia and AMD or firms with “AI” in the name. Even better if AI is in the ticker! However, Wall Street is missing the small elephant in the room.

Palantir is already an AI leader.

In the last article (Palantir $4.5bn Revenue in 2025: a Mirage?) we showed that the market underestimates Palantir’s growth assuming a ~20% CAGR for the coming years. In other words, Wall Street expects Palantir to grow just in line with its underlying board market rather than the AI-Centric Software, to which Palantir’s offering belongs and which represents the fastest growing category at ~32% expected CAGR.

The certifications Palantir obtained in 2022 will play a crucial role in facilitating its growth:

Forrester named Palantir a “Leader” in AI/ML Platforms thanks to its ability to build data-driven intelligence applications for complex use cases.

Gartner Named Palantir a “Visionary” in the Magic Quadrant for Data Integration Tools, which is a crucial component for AI development.

IDC ranked Palantir #1 in Artificial Intelligence Software Platform Sales with $1.4bn Revenue. In this $14bn segment, which is a subsegment of the broad AI Software market, Palantir is ahead of tech giants with a ~$1trn market cap.

According to these studies, Palantir already covers a leading position in AI.

Interestingly, the $1.4bn Revenue from AI Platforms Palantir generated in 2021 represents ~90% of the Total Revenue for the year. We could hypothesize that the remaining 10% is related to “Professional Services.” This proves a crucial point in Palantir’s investment thesis:

Palantir is a pure AI software company.

The shift from a very “consulting” model towards a “pure software” business is what determined the impressive shift in the metrics that I underscored in the previous article (Palantir: This time is different). Certainly, the internal use of AI has played a critical role in this transition. For instance, Hyperauto is a Software Defined Integration tool that automatically integrates ERP Datasets. This integration usually lasts months or years using intense human effort and has now been reduced to hours of work.

Has Palantir always been a leader? Let’s check how Palantir’s IDC ranking evolved over time.

Palantir “AIvolution”

In the following part of the article, I show how Palantir’s ranking evolved over time and why Palantir is better than just “AI”.

Since 2015 Palantir has been ranked #2 in the IDC ranking for Worldwide Cognitive/AI Software Platform Revenue with almost half the revenues of IBM.

In 2017 Palantir was recognized to have generated $71mn Revenue from “AI Platform sales”. This represented only 13% of Palantir’s FY Revenue meaning that the remaining component included Professional Services and Non-Platform sales (eg. Application Development & Deployment).

In 2018 the competition intensified: Palantir lost ground while generating $75mn Revenue from AI Platforms, representing a modest 5% YoY. On the other hand, IBM led the ranking while growing its AI Revenue by 27%. SAS and Microsoft leapfrogged and obtained the #2 and #3 position more than doubling the previous year's sales.

As of 1H 2020, Palantir appeared in the #3 position in “AI Application Development & Deployment” behind Microsoft and Google. However, Palantir did not appear in the top#3 for AI Software Platforms.

How did the shift to the #1 position happen? I believe 3 main components contributed to Palantir officially becoming the top “AI Software Platform vendor”:

Software-defined data integration (Hyperauto): helps the ingestion of data into days or even hours rather than months/years.

Apollo: helps the continuous deployment of models.

Ontology: helps write back the decisions into the operations.

Palantir is better than just “AI”

While all organizations want AI to assist their operations, the implementation crashes against a harsh reality:

85% of traditional AI and ML projects are set to fail.

This is the staggering statistic Gartner published. According to research, the problem of performing AI/ML projects is not limited to building or developing the models, but to make them part of the operations with correct outcomes.

Models are valuable only if they can generate consistent, long-term business value.

However, the implementation of AI/ML models in operations fails for a number of reasons. Here are the main ones:

Subject matter experts can’t contribute to the development process, which is highly technical unless they are provided with low/no-code tools;

Models quickly become stale and inaccurate if not backed by dynamic real-time data;

Inability to produce proper documentation, process, and structure to understand how AI choices are performed.

Palantir Foundry solves these problems

In particular, Foundry helps the implementation of AI/ML models by providing:

a reliable data foundation;

a representation of an institution’s decisions;

an infrastructure to learn from every decision made.

In other words, Palantir tackles every stage of the AI lifecycle by:

Providing the tools for creating a high-quality data foundation from which to start building models = Data Preparation. This consists of building a digital twin of the enterprise, which is represented by the “ontology.” The data objects integrated into the ontology are used to train the ML models.

Help clients create new models or incorporate existing ones = Model Development;

Incorporate models into the ontology = Model Integration;

Integrate models into operational applications = Model Operationalization. Most projects fail at this point as the models fail to accurately react to reality. Thanks to the ontology, Palantir clients can build models that accurately reflect the operating reality, have high predictive power and can send results to the operations in order for enhanced execution.

A common misconception about Palantir is that it seeks to build AI models. While Palantir provides some template models, this is not its focus. Palantir seeks to become the AI infrastructure player that helps companies successfully operationalize their AI/ML models into their core business.

While most focus on gold, Palantir is providing high-tech shovels.

“We build Iron Man suits, not robots” - ‘21 Foundry Demo

Moving forward, we will dive deeper into what these considerations may imply for Palantir and its projected market share.

Yours,

Arny

great coverage, thank you!