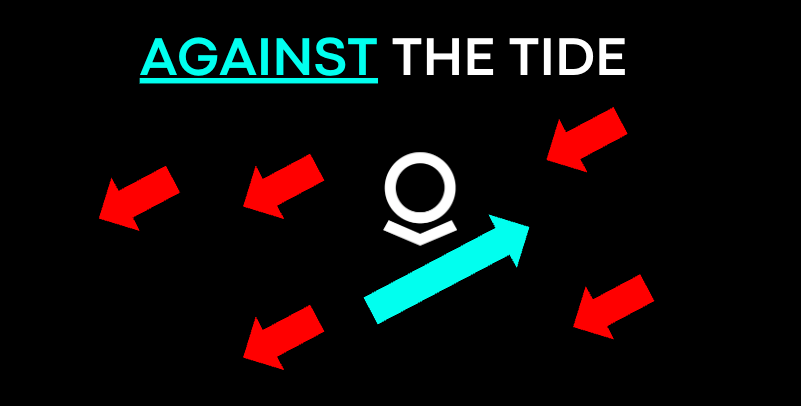

Palantir Against the Tide

Amid the fears of the recession many companies retreat. Others take advantage of competitors' weakness.

Editor: @Emanuele20x PLTR 0.00%↑

Bad times for some are good times for others.

May 26: Karp’s warning: companies relying on Venture Capital money struggle.

Our primary competition are startups invigorated by the hot somehow caustic and addictive fumes of loose venture (capital) dollars. These companies are being cut off from the vapours of those fumes and that affects my business much more than any stock price.

Meaning that I do not lose employees to these companies that are two days before they fail. -Karp, Palantir CEO

End of July: Tech companies are laying off up to 10/20% of the staff:

This Tech Layoff included even many established companies in many different sectors.

Netflix;

PayPal;

Microsoft;

TikTok;

Robinhood;

Also, Mark Zuckerberg seems he realised Meta went too far with the hiring in the recent quarters:

If companies are laying off this much it means that their internal growth expectations were too rosy than what is actually happening. In other words, they grew the Employees count more than the business is set to grow.

Neither the companies with the best companies nor data scientists in the world can accurately predict a recession.

As a “rule of thumb” we can consider “healthy” when Employees grow more or less in line with the Revenues.

Striving amid the storm

Also Palantir hired a substantial amount during the recent quarters:

However, it seems Palantir was much more prudent than the average cloud company with a peak of 23% Employee growth YoY as of 22Q1 while its Revenues always growing +30% from 21Q1.

Now, amid the storm, we could see Palantir is increasing its hiring speed while other companies are laying off:

Please note that the post was on Jun14th. Today 1st July, as the quarter ended, the number stands at 3488, so would be +35% YoY, with still 510 job openings.

LinkedIn numbers could be slightly inflated since often people leaving don’t update immediately their profile, but the direction leaves no doubts.

Cash in a Crisis: the value of optionality

What is happening is a reminder of how valuable the $2bn sitting in Palantir’s bank account is. I had the opportunity to discuss this with @Emanuele20x:

Despite the nominal amount could not change, the intrinsic value of the cash changes according to the situation because it provides the optionality to take advantage of the weaker competitors:

$2bn in a crisis is much more than $2bn in a good time.

Maybe the decade-long work with the Army taught Palantir something about how to benefit from the chaos.

By being FCF positive, Palantir is in a position of strength because Palantir does not need external capital. This allows Palantir to attract the best talents fired by other weak places that fired them.

In particular, I believe Palantir position is enviable:

25-30% FCF margin while growing +30%;

$2bn Net Cash;

55% Revenues from Government.

Cash vs. SBC Dilution

In particular, Cash with no Debt during a crisis not only gives financial stability but also could be used to decrease the dilutive effects of SBC.

As Snowflake CFO shared, they can use Cash to Pay for SBC, from the increase in value of shares, rather than issuing new shares which cause dilution (When Palantir SBC will ease?).

Therefore, having $2bn in Net Cash could be extremely useful to pursue further growth while keeping dilution “under control”.

This is not the same story many companies that followed the “growth at all cost” while having negative FCF will tell.

Who is Palantir hiring?

In terms of where Palantir is hiring we can see from the Tweet below (thank you @AronDhooge) that the main focus is for:

Engineers;

Operations;

Business Development;

Sales.

Inevitably hiring will increase costs and it will take time to really deliver results. As we mentioned (Seeking the Alpha - PLTR vs NOW), it could take 9 months for a Sales person to become fully operating. However, this is “part of the plan” to become a truly dominant platform. From my previous article:

We are investing in Karp’s and management’s ability to choose the best talent to deliver asymmetrical returns.

Palantir as an investor

Palantir is not doing anything different than a disciplined investor. Is patiently waiting for the chaos to bet heavily as the opportunity arises:

Stock market transfers money from impatient to patient - Warren Buffett.

In the same way, the best companies are able to transform bad times into opportunities by deploying the resources accumulated to reinforce their growth trajectory:

The people that should come to Palantir and power a better world don’t go to a startup that’s essentially build consumer products that helps none of us so that’s a massive opportunity for Palantir. -Karp

It seems Karp and management are now executing on the opportunity.

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Discord Channel

View expresses are my own. Do not represent Financial Advice.

I own (many) PLTR stocks.