NARRATIVE SHIFT? | Palantir Bullets #14

This week's Palantir developments and the crowned “Tweet of the Week”

Editor: Emanuele Marabella

Hi, I’m Arny. If you are new, you can subscribe to spot Palantir asymmetries with 1.365 investors. Please hit the ❤️ button if you like today’s article.

If you found this article helpful, please consider supporting my research with a paid subscription. Paid subscribers also receive Palantir’s deepest research each Thursday.

Palantir this week:

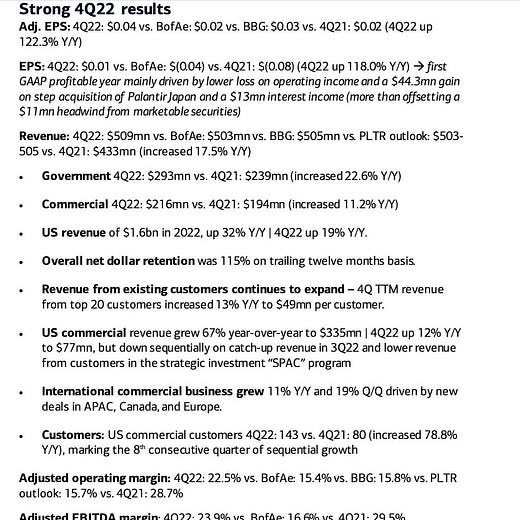

Palantir shocked the market by showing its first GAAP earnings after +20 years proving skeptics wrong. Despite GAAP profitability being mainly driven by a one-off item (Palantir's GAAP Profits: Fake Yet Good) this is a clear sign of strength and could even be helpful in reassuring existing and prospective clients (Palantir GAAP Profits: The Cost of Responsibility). In my coming articles, I will go deeper into the Q4 numbers. Palantir also guided for 2023 to be the first GAAP Profit year.

Backed by the GAAP Profitability narrative, Palantir again reached its $10 range, basically the DPO price. Palantir’s current shape, however, is quite different:

Citi analyst Tyler Radke reiterates his SELL recommendation at $5. Despite admitting Palantir has a “strong value proposition in Government,” he only sees a modest upside from it. I believe the opposite (Palantir Government: It’s Now or Never).

Raymond James sees an opportunity in Palantir’s positioning amid geopolitical tensions with a $15 price target.

Wedbush analyst Dan Ives said that Palantir “is in the right place at the right time” in the AI arms race.

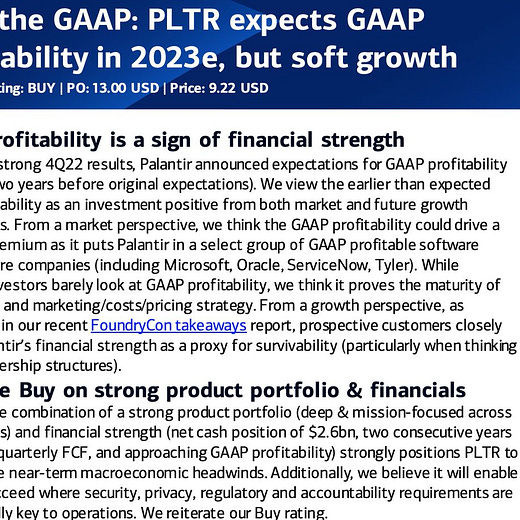

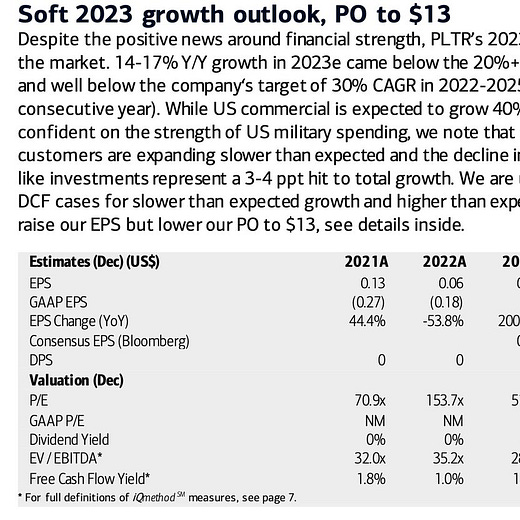

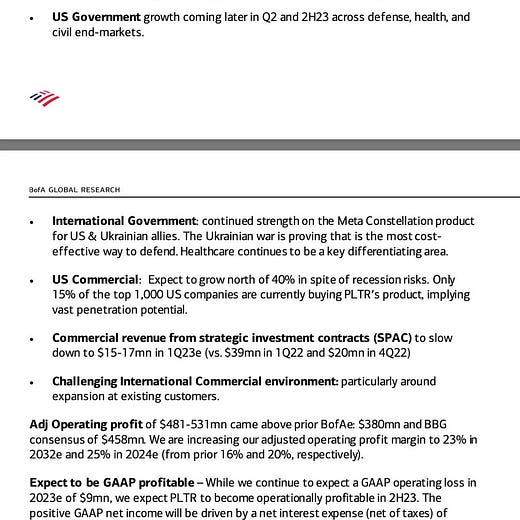

Bank of America reiterates its $13 target price on Palantir citing that GAAP profitability is a sign of financial strength.

Morningstar recognizes Palantir achieved an important milestone and is optimistic about the business outlook. However, it believes the shares are fairly valued.

TheKameroon and Palantir's Missing Link decoded an Intuit active link. Intuit is a $13bn Revenue business software company that specializes in financial software. Its applications include TurboTax's tax preparation application, the small business accounting program QuickBooks, and the email marketing platform Mailchimp. Given Intuit's wide reach, it will be intriguing to see an official partnership in the future.

The Ukrainian military was provided with modern Skykit autonomous intelligence centers, according to French L’Express media. Skykit was officially unveiled in January at CES, but presumably, the Ukrainian military received this system earlier.

The Financial Times (finally) acknowledges Palantir’s effort in Ukraine. Palantir “helps optimize Ukraine’s digital kill chain by providing actionable intelligence drawn from satellite imagery, battlefield sensors, and other open sources."

Hesse’s State Minister of Interior confirmed that Palantir was used in Germany to prevent a coup. This is in line with what Shyam, Palantir’s CTO said in the earnings call: “In 2022, our software foiled a plot to overthrow the German government.”

At the same time, the Constitutional Court restricts the use of Palantir for police, considering it “unconstitutional in its current form.” We discussed this in Bullets #6

Alex Karp attended the REAIM summit in the Netherlands. During his speech, he underlined Palantir’s competitive advantage in having access to the battlefield to build its products. You can see the full event in the video below.

Palantir is mentioned by The Economist along with Anduril as an “AI-wielding firm “giving new shape to modern warfare.”

Alex Karp will take the stage at Ceraweek to discuss geopolitics on March 7th.

Palantir CFO David Glazer and Ryan Taylor CRO sell 210k and 155k shares, respectively. After the sale, Glazer still holds 1509k shares and Taylor holds 281k shares. As a reminder, Taylor has just been appointed Chief Revenue Officer and Chief Legal Officer, from Chief Legal and Business Affairs Officer. According to TJ, “Sankar, Cohen, and Karp have their RSUs vest on Monday so they’ll probably sell during the week.”

Related Tech trends/Macro:

China’s diplomat Wang Yi, who should visit Moscow in the coming weeks, hints that China could play a role in seeking a proposal to resolve the Ukraine-Russia war.

According to UK Prime Minister Rishi Sunak, the war in Ukraine is at an “inflection point” and suggests accelerating weapons supplies. Remember: wars escalate before they end…

Inflation rose 0.5% in January, more than expected and up 6.4% from a year ago.

Tweet of the week

Yours,

Arny

This is not financial advice. I own PLTR shares.

great take, thank you!