Is PLTR Commercial Doomed? [part 2]

Companies are just delaying taking their medicine.

Editor: @Emanuele20x

We showed in the previous article (Is PLTR Commercial Doomed? - part 1) how Forex could play a role in the slowdown of Palantir’s Commercial business.

However, there is another key factor that generated pressure on B2B Enterprise Software sales.

Companies delay taking their medicine

Worried about the potential of a future recession, many companies delayed expenditure on enterprise software, even if essential for their business.

Sales cycles, already long in B2B, slowed as companies are preparing for a recession.

As Bloomberg highlighted, “customers are not willing to cut software spending, but are reluctant to add more”.

Fear of recession is temporarily reducing companies’ appetite in software spending.

Enterprise clients preparing for a recession have multiple implications for Software sales:

unwillingness to close big commitments;

additional layers of approval to close deals.

These factors were underlined by C3.ai CEO:

“Honestly, I think trying to sell $10 million, $20 million, $30 million, $50 million, $60 million transactions in the next year could be pretty tough, Pat. I mean, large chemical companies, manufacturing companies, food companies, I mean these guys are all going to the bunkers, OK? They're preparing for a recession.”

“And people, in this market environment, I'm telling you closing a $50 million deal with any multibillion-dollar corporation, it has to go to the board, OK? So you could play in this game in the last decade, we played it very well, but that game is over.” - C3.ai CEO

The opportunity

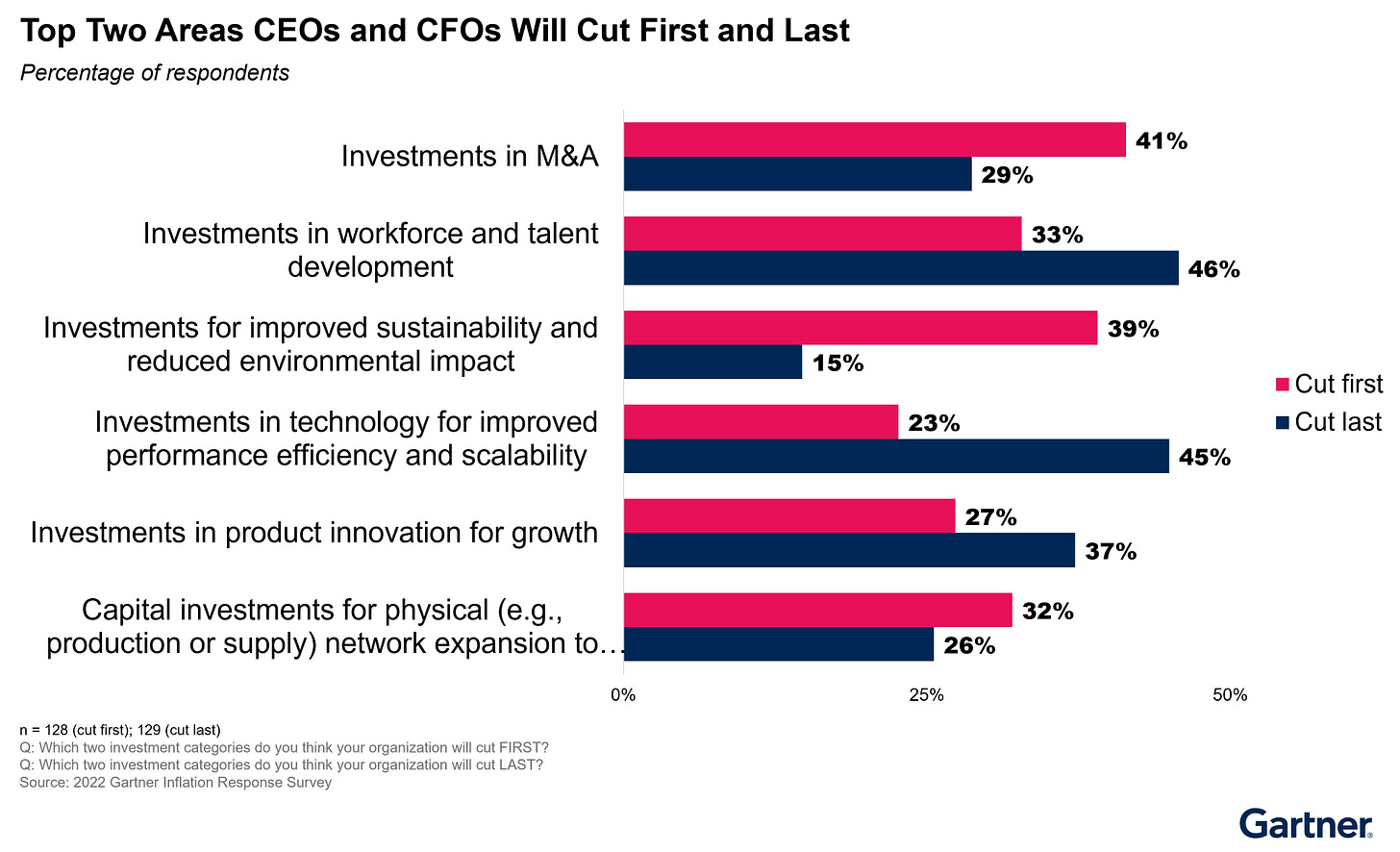

The core trend of digital transformation is still in place and management teams are reluctant to cut expenses in Technology in order to improve performance efficiency and scalability.

However, the current slowdown in software spending is set to make corporate vulnerabilities emerge. This creates an opportunity for the best software companies.

Software is the medicine for enterprise problems. Those who don’t spend effectively, will have more difficulty in dealing with a potential downturn.

More specifically, Karp said:

“As organizations around the world face more pressure and experience more pain, there will be a slowdown in the rate of spending and lengthening of sales cycles, but it will also reveal gaps in enterprises’ operations, gaps our software can solve. In the short term, this means less revenue now. But on longer time horizons, it accelerates our business” - Alex Karp, Palantir CEO

Also, the CEOs of Salesforce, ServiceNow, and C3.ai share the same view. You could find their comments in the Appendix below.

From CEOs’ statements, the keywords emerging for Enterprise software are:

Prioritization: which software really brings value?

Aggregation: how can I deal with fewer companies to cut costs?

Differentiation: how to be better than the competition?

In this context, Palantir seems positioned extremely well to capture this opportunity due to:

their strong offering which could help potentially solve any data problem;

$2.4 billion in cash to support further expansion;

new salesforce, which includes industry veterans.

Interestingly, as we saw in part 1 of the article, Snowflake was not affected by the general slowdown.

Snowflake’s consumption-based model allowed Snowflake to expand usage without paperwork and strive despite the difficult environment.

To tackle the difficult environment C3.ai just announced it is going to pivot to consumption-based pricing.

Palantir announced it earlier this year and started giving relevance to it in the investor presentation.

However, this new paradigm has a slow initial ramp-up, it would take at least 1 to 2 years for the benefits to really kick in as clients expand their usage.

I will write deeply on the consequences of the consumption model in the coming article.

Recognition should facilitate sales

Palantir has been recently introduced as “Visionary” in the Gartner Data Integration Magic Quadrants. Being recognized in Gartner along with Forrester, the most respected ranking for IT vendors, should help facilitate sales, thanks to increased brand awareness (Is PLTR Recession Proof? [Update]).

These rankings should not be taken as “absolute truth” on the strength of the offering, since there are conflicts of interest -companies are Gartner clients-.

However, rankings create real value for companies because they facilitate the adoption of new technologies by reducing the career risk of CIOs (“Chef Information Officers”) who are looking for companies to hire.

As a comment highlighted:

“No one ever got fired for referring to Gartner”.

This recognition is particularly important for Palantir. On the Government side, the software supporting the most critical fields such as the Army, FBI, and CIA is already proof of Palantir’s reliability.

On the commercial side, the Gartner and Forrester recognition should increase brand awareness and reduce perception barriers caused by the negative press depicting Palantir as a “controversial spy company.”

If you are interested in more details of the Gartner report, I encourage you to see @MrDarnton’s analysis:

Conclusion

Palantir’s Commercial was affected by two crucial factors that contributed to the slowdown:

FX headwinds;

Longer sales cycles.

These headwinds put pressure on the short-term results, but don’t invalidate the thesis. The secular trend of digital transformation is untouched.

Palantir has the recurring stream from top clients and has the resources to first survive and push in the most strategic areas. As mentioned in Palantir Against the Tide, Palantir is showing a strong signal by hiring aggressively while the industry is contracting.

Since people are its core asset, Palantir is building future capacity.

While I underestimated the short-term impact of the recession fears (Is Palantir Recession proof?), the big picture remains unchanged, in my view. Software remains critical for companies, despite the fact they are willing to delay its implementations.

With the recent recognitions, Palantir’s Commercial is setting the base to scale adoption.

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Instagram: @arnylaorca

Business Email: arnylaorca@gmail.com

Discord Channel

View expresses are my own. Do not represent Financial Advice.

I own (many) PLTR 0.00%↑ stocks.

Appendix: additional comments from CEOs

Salesforce CEO:

“Sales cycles can get stretched. Deals are inspected by higher levels of management, and all of this, we began to start to see in July. Nearly everyone I've talked to is taking a more measured approach to their business. We expect these trends to continue in the near term, and we reflected this in our guidance.

This resulted in stretched sales cycles, additional deal approval layers and deal compression. In addition, we saw a slowing in our create and close, Slack self-serve and SMB businesses, which tend to be leading macro indicators. Geographically, this behaviour was most pronounced in North America and major European markets, while Japan was relatively more resilient.

And fundamentally, all of our customers are really investing in the secular trend of the digitization of their customer experience, their employee experience and with our portfolio, we're at the top of that list. I think what you're seeing is an increased focus on, I say, three things. One is time to value. The other is ensuring that these projects drive cost savings in addition to customer satisfaction and top-line growth.”

“And then, the third is reducing complexity and vendor consolidation. And if you look at some of the innovations we're bringing out like our Sales Cloud Unlimited edition, or Salesforce Easy, which I mentioned earlier in my script, they are really efforts to enable our customers to do more with less, to enable them to use Salesforce as their sole vendor, take out some point solutions that perhaps aren't getting the return on investments our customers are looking for, and sort of taking advantage of this opportunity to be the most strategic vendor for our customers right now as they look to really hold their technology to high standards, which is to drive top line and bottom line performance.”

ServiceNow CEO:

”Customers are making significant investments with fewer platforms to drive faster ROI. As this process unfolds, while sales cycles can lengthen, deal sizes get bigger as more materials are negotiated into those agreements. And we at ServiceNow, are on the right side of the great reprioritization.”

“One customer summed things up well. She said We have a capacity challenge, not for ServiceNow, but for all the others that want to be like ServiceNow. It's time to standardize the platforms we trust for the long haul. The current macro environment likely will move overnight, and neither will the theme for automation as companies need to make money, save money and differentiate, and they need to do all of that really fast.”

“Time has become the greatest asset of the business. When you look at our results and our opportunity, it's clear evidence that digital transformation is the only way forward. ServiceNow is helping our customers innovate to win. Our ability to execute is another key point of confidence.”

“What you're seeing in certain cases is lengthening deal cycles because I call this the great reprioritization where C-level executives are now looking at their business and they're saying, what are the platforms that we will team up with for the next decade? And they are prioritizing that list along the lines of which platforms make me more productive or I can do a lot more with less because the work isn't going away, even though you might have fewer people doing it. The second aspect is, how I grow and what channels will I need to innovate in to grow my business. And then finally, how do I differentiate from the competition? Every industry has that marquee company that seems to be out front, and lots of times, companies are either playing catch-up or they simply want to have a different level of secret sauce, so they can do something their competitor isn't doing.”

C3.ai CEO:

”The downside has been more lumpiness than we would like to see in bookings, lengthy sale cycles and higher levels of uncertainty associated with individual deal closure in the period. While this elephant-hunting subscription sales model has served us well in establishing C3 AI as a leader in enterprise AI, it is clear but is not well suited to the deliberate decision and approval processes inherent in the current economic environment.”

Snowflake CEO:

”I mean we sort of invert that whole way of thinking because it's actually quite attractive for customers to have a consumption model because they can sign a contract with us but then they can throttle up and down how much they want to use. You can't do that in a SaaS model. You're going to pay no matter what, whether you're using it or not.”

“So this gives customers actually more confidence to contract with us knowing that they can throttle up and down. So we actually think it's an advantage in the type of times that we're living in as opposed to a negative, which is what has been portrayed on the sell side and in the media.”