Is PLTR Commercial doomed? [part 1]

The Dollar matters

Editor: @Emanuele20x

In the previous article (PLTR Government slowdown: not Palantir's fault), we saw that Palantir’s Government business slowdown was partly due to delays in government spending and contract timing affecting the entire defence space.

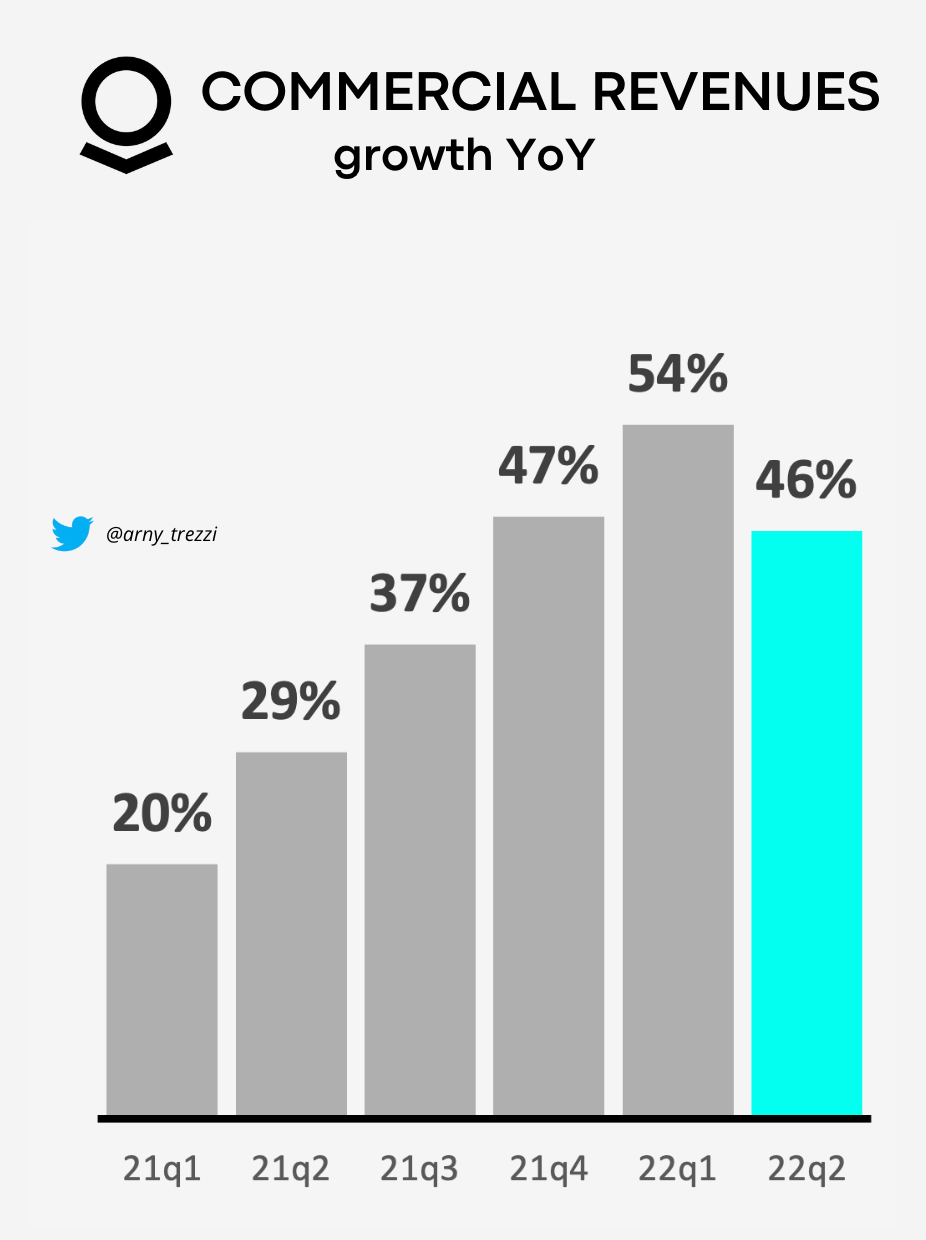

The Commercial business also slightly slowed down, from +54% YoY growth in Q1 to 46% in Q2.

Is Palantir Commercial doomed? Let’s go deeper to find out.

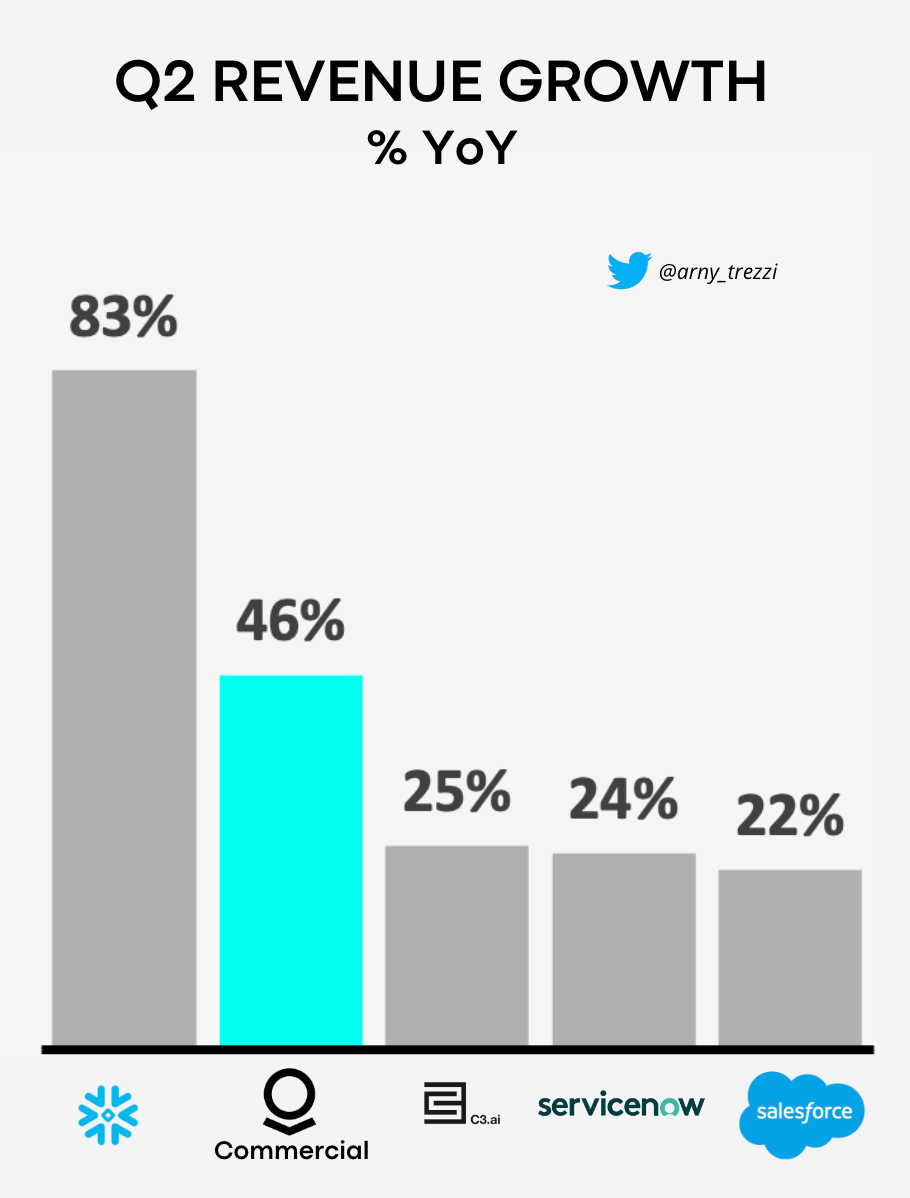

Palantir’s Commercial business grew less than Snowflake with an impressive 83% YoY growth but substantially more than C3.ai (+25%), ServiceNow (+24%) and Salesforce (+22%).

Forex can have a huge impact

By breaking down the Revenues by geography, we see Palantir Commercial has the biggest % of Revenues coming from outside the US.

Palantir Commercial collects 62% of their Revenues from outside the US

Snowflake and C3.ai have ~80% of Revenues coming from the US, therefore movements in Foreign Exchange currencies (“Forex”) don’t impact them significantly.

Conversely, ServiceNow and Salesforce were heavily affected by Forex since ~1/3 of their business is from outside the US, mainly in Europe and the UK.

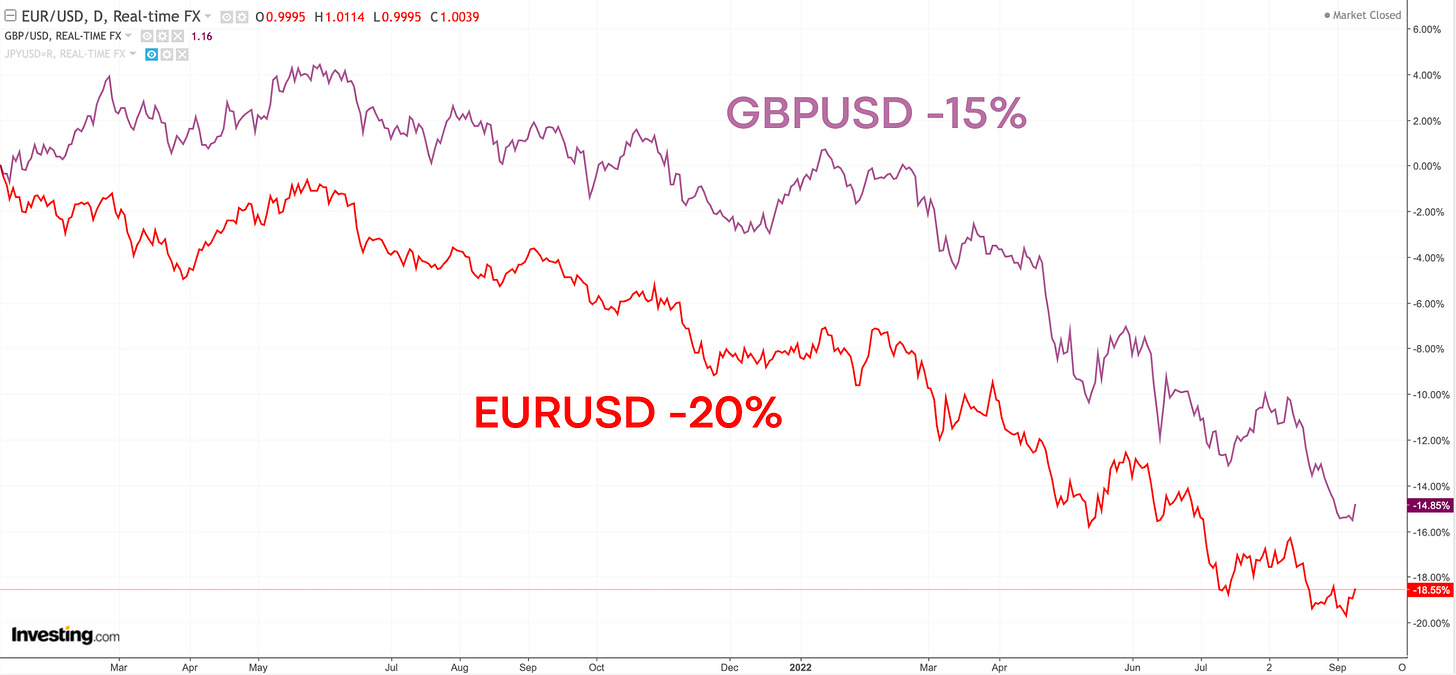

The dollar appreciation of approximately 15-20% YoY generated a negative impact on ServiceNow and Salesforce Revenues.

Since their contracts are denominated in local currencies, the Euros and Pounds they received were “worth less” when they had to record in the Income Statement, which is in USD.

The appreciation of the USD by ~20% generated a ~5% negative impact on the Revenues.

Without the currency impact, ServiceNow and Salesforce’s Q2 Revenue growth YoY would be, respectively:

30% Constant Currency vs. 24% reported;

26% Constant Currency vs. 22% reported.

Constant Currency = growth if the foreign currency didn’t depreciate in value vs. the USD

In other words, if there were no Forex impact, the reported growth would have not been impacted, proving the resilience of these B2B Enterprise businesses also amid a potential recession (Is PLTR Recession-Proof?).

Does Forex impact Palantir in the same way?

Palantir has a different dynamic but is also impacted negatively.

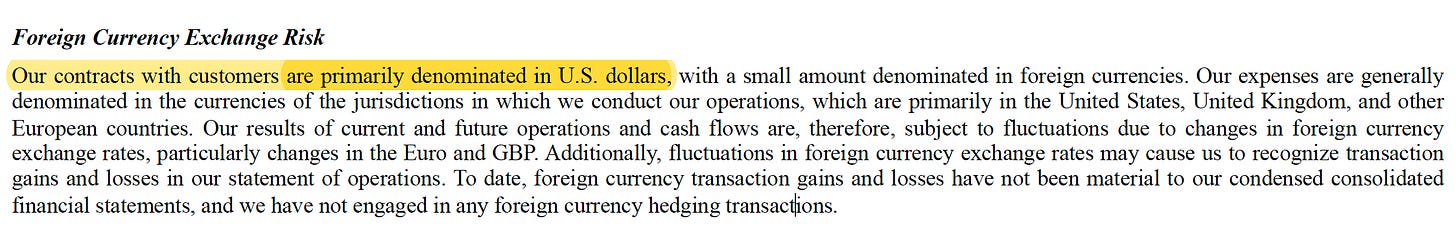

Palantir’s contracts are “mainly denominated in US dollars.”

This means that foreign clients also pay Palantir in dollars, unlike Salesforce and ServiceNow.

As a result changes in Forex, don’t materially change the value of the Revenues collected. However, Forex still plays an important role.

A 20% appreciation of the USD vs. EUR or GBP makes Palantir’s pricey solutions, even more difficult to purchase.

Karp said exactly this in the Q3 Earnings call:

“Almost 40% of our business is outside of America. Every single one of those contracts is being impacted by dollars. Obviously, it's not just that people are paying us in local currency.

If you're paying us in dollars, which many of them are, you're de facto paying 20%, sometimes more, that we can't capture on our balance sheet and can't show to you. Those things are impacting our business.” - Alex Karp, Palantir CEO

Forex explains part of the divergence

Since Forex has been impacting for more than 1 year, it could be helpful to look at LTM (“Last Twelve Months”) figures to understand how Palantir Commercial growth was generated.

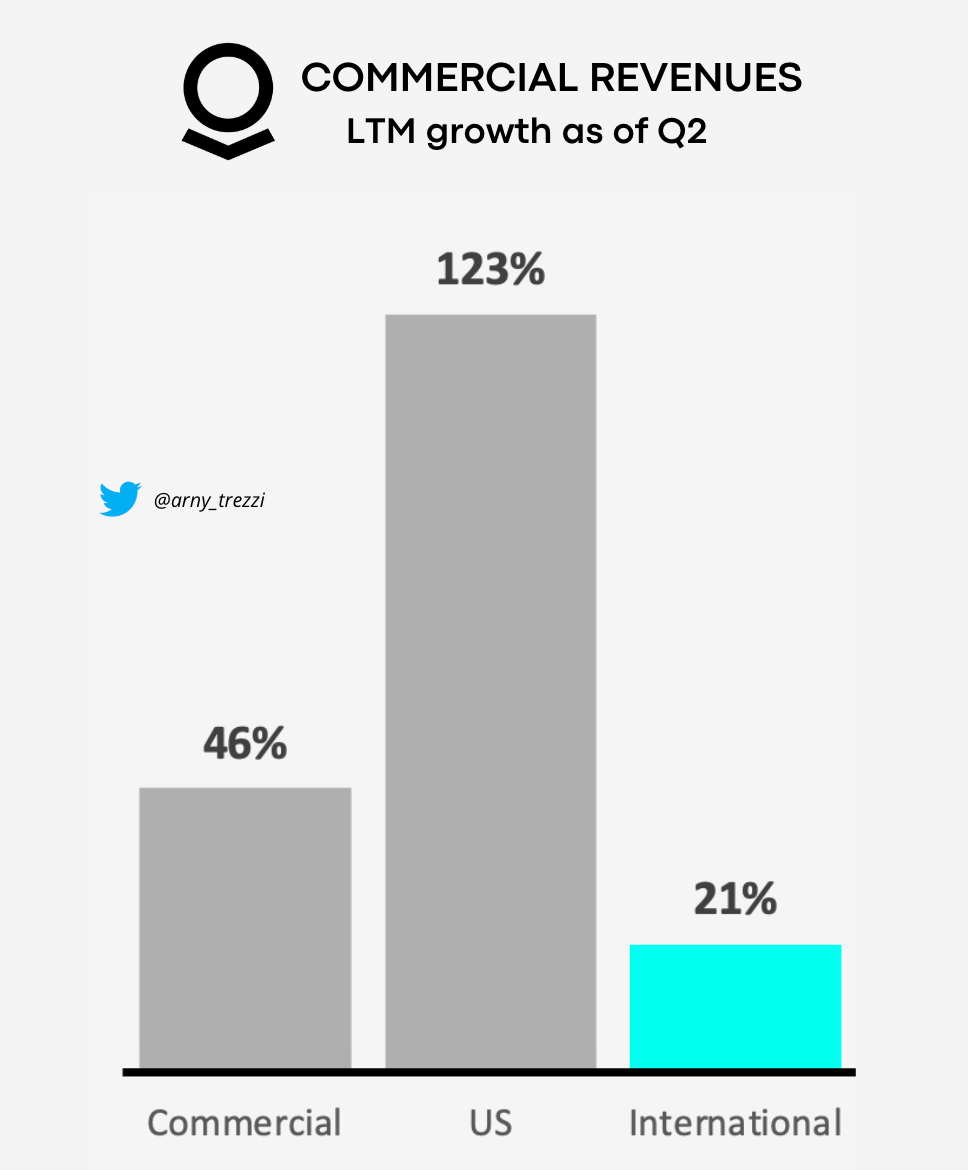

Palantir’s Commercial LTM Revenues grew 46%, but came from a considerable divergence:

+123% growth from US clients;

+21% growth from International clients.

As we mentioned previously, the relative strength from the US comes from the new sales force (PLTR US Commercial is the Key) and from the SPAC contribution (Are PLTR’s SPACs a Scam?) since 14 out of 20 are from the US.

Is Forex a structural problem?

Part of the Commercial slowdown could be attributed to Forex, which didn’t directly impact Palantir’s numbers but made it more difficult for Non-US ones to purchase Palantir’s solutions.

These considerations are also valid for the Government business. However, the impact on Financial numbers is much more limited since ~80% of Government Revenues come from the US.

Despite Forex generates short-term headwinds on International clients, that is not a structural issue for Palantir’s operating machine.

Currently, the USD has been appreciating compared with other currencies because the FED has been faster and more decisive than other central banks in tackling inflation by rising rates, therefore increasing the relative strength of the dollar.

As other central banks catch up to rising rates, the USD's relative strength should loosen and the attrition of International clients should diminish.

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

Instagram: @arnylaorca

Business Email: arnylaorca@gmail.com

Discord Channel

View expresses are my own. Do not represent Financial Advice.

I own (many) PLTR 0.00%↑ stocks. I don't own SNOW 0.00%↑ CRM 0.00%↑ NOW 0.00%↑ AI 0.00%↑