Cardinal Health, Azure Marketplace, New FoundryCon | Bullets #11

This week's Palantir developments and the crowned “Tweet of the Week”

Editor:

Hi, I’m Arny. If you are new, you can subscribe to spot Palantir asymmetries along with 1.175 investors. Please hit the ❤️ button if you like today’s article.

Paid subscribers also receive weekly in-depth research on Palantir’s financials and strategy. Do you have questions arising from my research? Please book a 1-on-1 meeting.

Book a meeting with Arny Trezzi

PLTR 0.00%↑ this week:

Palantir partners with Cardinal Health to empower its integrated supply chain. With $180bn Revenue in FY22 Cardinal, as @KrisPatel99 underlined, is one of the three big pharmaceutical distribution players (~25% market share) along with McKesson (~35% market share) and Amerisource (~32% market share). For Palantir, this is an opportunity to deliver value at the core of Cardinal’s operations where a few percentage improvements in operating profits can deliver outsized savings. A huge potential expansion could follow.

Palantir collaborates with Microsoft to make Foundry available on Azure Marketplace. Despite this not yet being a “pay and go” solution yet as Palantir’s team must be contacted for pricing details, this is clearly a crucial step into Palantir’s distribution strategy. Palantir is now an official partner of the four biggest western cloud providers: IBM since Feb-21, AWS since Sept-21, and Google Cloud since Jun-22. For more details, you can refer to the video below from @amitinvesting.

Palantir announced its third FoundryCon on 1st February. At the conference, there will be over 25 customers sharing how Foundry helped improve their operations. The presenters will comprise both small companies like Integry Tool & Mold and industry leaders like PG&E and Tampa General Hospital. Palantir is clearly pedaling on the distribution metal. In addition, Palantir will unveil three new products, one of which is the crucial Foundry Marketplace Developer Suite. I will stream the event live on my YouTube channel. Subscribe and activate the 🔔to get notified!

Palantir released Karp’s interview with Vice Prime Minister and Minister of Digital Transformation of Ukraine Fedorov. Interestingly, at the end of the video, Karp said “But also invest because you might be involved in the next great company like Palantir.” Was this actually a pitch for Ukraine’s future reconstruction? Palantir seems to be already looking at Ukraine 2.0.

Palantir COO Shyam Sankar shared an article underlining the paradox of the US Defence procurement, which is actually communist in nature. The current procurement method incentives “work” rather than “output,” creating huge inefficiencies and discouraging innovation. I went through the article in the reaction video below.

Palantir launched a video showing Secure Collaboration features in Gotham. These capabilities, which include secured chat and collaboration tools are crucial to expanding in NATO countries. For instance, as we showed in the previous Bullets, Palantir works with the Spanish and UK DoD. Starting from the clip, @Either Square and I explored how Palantir is penetrating NATO.

- confirms Molson Coors, one of the main brewery giants with ~10% market share, as a Palantir client. As a reminder, Anheuser-Busch InBev, the leader in the sector with ~50% market share is also a Palantir client.

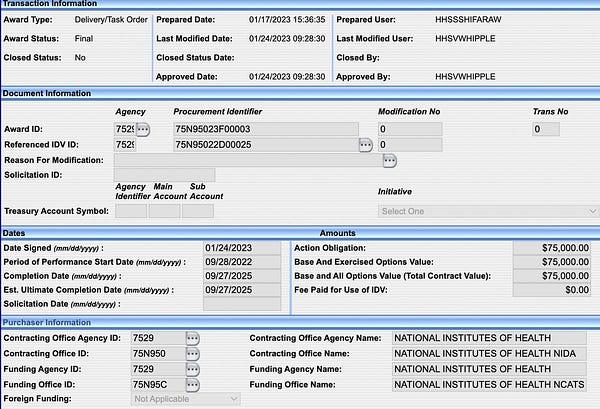

Palantir obtains a $75k contract with the US National Institutes of Health (NIH) for a 10-week pilot. The pilot seeks to assess “Foundry’s ability to support SRP’s selection of peer reviewers.” The SRP is a university-based research program that supports the national Superfund program by addressing a wide variety of scientific concerns.

Palantir officially announced it will release its earnings results on February 13th. From the questions sent to Say Technologies, Palantir shareholders seem impatient about profitability. Karp expressed he expects to see the company becoming GAAP profitable by 2025.

Related Tech trends/Macro:

Core PCE inflation, the Fed’s preferred measure, rose 4.4% from a year ago, its smallest annual increase since October 2021. Despite 4.4% can’t be considered “low,” the inflation slowdown provides support for stocks highly sensitive to interest rates (“long duration assets”) like Palantir. The FED's policy-making committee will meet on January 31-February 1. Tough decision ahead since inflation seems to be dropping while labor markets continue to show plenty of strength in the economy.

Servicenow 22Q4 results show resiliency and confirm a trend of “Great Prioritization” towards software solutions that work. ServiceNow Subscription Revenues grew +22% (+27.5% c/c) and guided for +22-22.5% growth (+25-25.5% c/c) in FY23. The strength of the results supports my thesis that ServiceNow is the yardstick Palantir needs to exceed (Seeking the Alpha: PLTR vs NOW).

Microsoft results also show resilience in Cloud spending with Azure growing 22% in 22Q4 (27% c/c). As for Servicenow, Forex heavily impacted the results. For a deep breakdown, I encourage you to read @Giuliano_Mana’s review:

Tweet of the week

Almost nobody seems interested in Palantir at ~80% drop from the peak. Good signal!

Yours,

Arny

View expresses are my own and do not represent Financial Advice in any way.

I own (many) PLTR stocks.

Thanks to you Mave!

great take, thank you!