Analysts are Wrong on Palantir

Expectations move prices. When the expectations diverge from the underlying reality, an asymmetry emerges.

Editor: @Emanuele20x

Hi, I’m Arny 😊 Join more than 610+ fellow Palantir investors spotting asymmetries with the subscribe button below. Research articles are free. You could support my work with a paid sub.

Expectations move prices. When the expectations diverge from the underlying reality, an asymmetry emerges.

Is this the case with Palantir?

Palantir’s “fair value” calculated by analysts dropped in one year from ~$25 to ~$11 per share. This was due to the combination of:

reduced estimates after disappointing quarters;

multi-year low sector multiples (PLTR Sum-Of-Parts Valuation).

The current estimated “fair value” represents a ~38% upside from the current $8 price. What if the real upside is actually higher?

If we demonstrate that the implied expectations are too low, the potential upside increases.

What analysts expect

Analysts currently expect the following results until 2024:

~24% Revenue CAGR;

18-23% EBIT adj. Margins;

GAAP Break-even in 2024.

In this article, we will challenge the Revenue estimates. These are the most important estimates because:

SaaS companies are mainly valued on EV/Sales;

Revenue growth affects the path to GAAP profitability keeping other components unchanged.

To assess the validity of the estimates, we will pursue two lines of attack:

Group estimates;

Segments breakdown.

For the analysis, we will use the Revenue Model that we developed previously (PLTR in 2032: a jump in the future). You can find the link at the bottom of the article.

1) Group estimates

First, a reminder:

Revenue Growth = NDR + Growth from new clients.

As shared previously in the PLTR New Clients are Irrelevant article, in any given year, Palantir's growth is determined by the expansion of the existing clients at the beginning of the period (Net Dollar Retention) and the Revenue coming from new clients acquired in the year.

Therefore, analysts expecting 24% CAGR imply one of the following scenarios:

124% NDR + 0% From New Clients;

120% NDR + 4% From New Clients;

116% NDR + 8% From New Clients.

I believe the second case with ~120% Net Dollar Retention and ~4% from New Clients is the most realistic.

However, this combination seems too conservative compared to the past and reasonable future expectations:

Historically, Palantir’s NDR is ~132%. In 2019 it was slower as the Commercial segment only grew 17%, which was an atypical year as some clients left. NDR for Commercial clients in the last quarters is above +136% (PLTR Q2: Really a Disaster?).

If we assume each newly acquired client generates $1mn/y like the New Clients acquired in 2021, Palantir could easily exceed the 4% implied growth from the New Clients. Palantir can acquire additional clients much more efficiently compared with its past thanks to a dramatic reduction in the time to deploy software and modularization of its offering (PLTR: This Time it’s Different). As of 22Q2, Palantir already has 304 clients, which consists of a +28% increase from 21Q4. By acquiring just ~5 new clients in Q3 and Q4, Palantir would exceed the implied ~30% yearly growth in clients needed to generate 4% growth in Revenues from New Clients.

This is clearly very pessimistic considering the quarterly trajectory of client growth. Client Count in Q1 and Q2, although weaker quarters, grew more than 80% YoY. The previous article states that the number of active links discovered by @Either_Square is growing exponentially (PLTR Q3: What I am looking for).

Any combination of NDR higher than +120% and above +30% yearly increase in Client Count would lead to higher growth than the estimates.

This simple analysis at the Group level shows that Palantir could easily exceed analyst expectations.

2) Segments breakdown:

In the same way, we could assess the 24% Growth as a combination of different growth aspects from the 2 segments:

30% Commercial + 20% Government;

40% Commercial + 9% Government;

50% Commercial + 0% Government.

I choose to focus on the second case (40% Commercial + 9% Government) because it better represents the current developments:

Commercial grew ~46% LTM;

+150% YoY growth in Commercial Client acquisition (+250% YoY in US Commercial): there is plenty of room to grow by expanding existing clients (PLTR US Commercial is the Key).

Assuming a ~40% CAGR for Commercial Revenue is accurate, the Government segment needs to grow at only ~9% CAGR in order to reach ~24% CAGR at the Group level. However, the implied ~9% is likely too low when considering the following facts:

~30-35% CAGR in the last decade;

over +$700mn Deal Value awarded just in the last month (Palantir: It’s Raining);

Palantir solutions, especially Metaconstellation, are heavily used in the Ukraine-Russia conflict.

War tensions increase the Total Addressable Market in the US and NATO countries (PLTR Government: It’s now or Never).

Asia (excluding China) is largely unpenetrated but offers great potential, especially in Japan and South Korea.

The recent success of vaccine distribution, where Foundry has been used, has unlocked the potential achievement of huge Healthcare contracts for digital transformation, especially in the UK.

~9% growth is more in line with the expected growth by Legacy Defense Contractors. Palantir’s business model is far superior.

I believe the ~9% implied CAGR for the Government segment is too low when considering these points. This means that there is considerable upside potential from expectation revision.

What does this mean for the price?

With this analysis, we showed that it is highly likely that analysts will re-adjust their estimates from ~24% CAGR to ~30%, in line with the long-term Guidance. The resulting impact of this ~6% variation would not be significant on the overall Revenue amount. For instance, the estimated Revenues for 2022 would raise to $2bn from the currently estimated $1.9bn.

However, a higher growth projection would impact the “fair” multiples that analysts would attribute to PLTR 0.00%↑ .

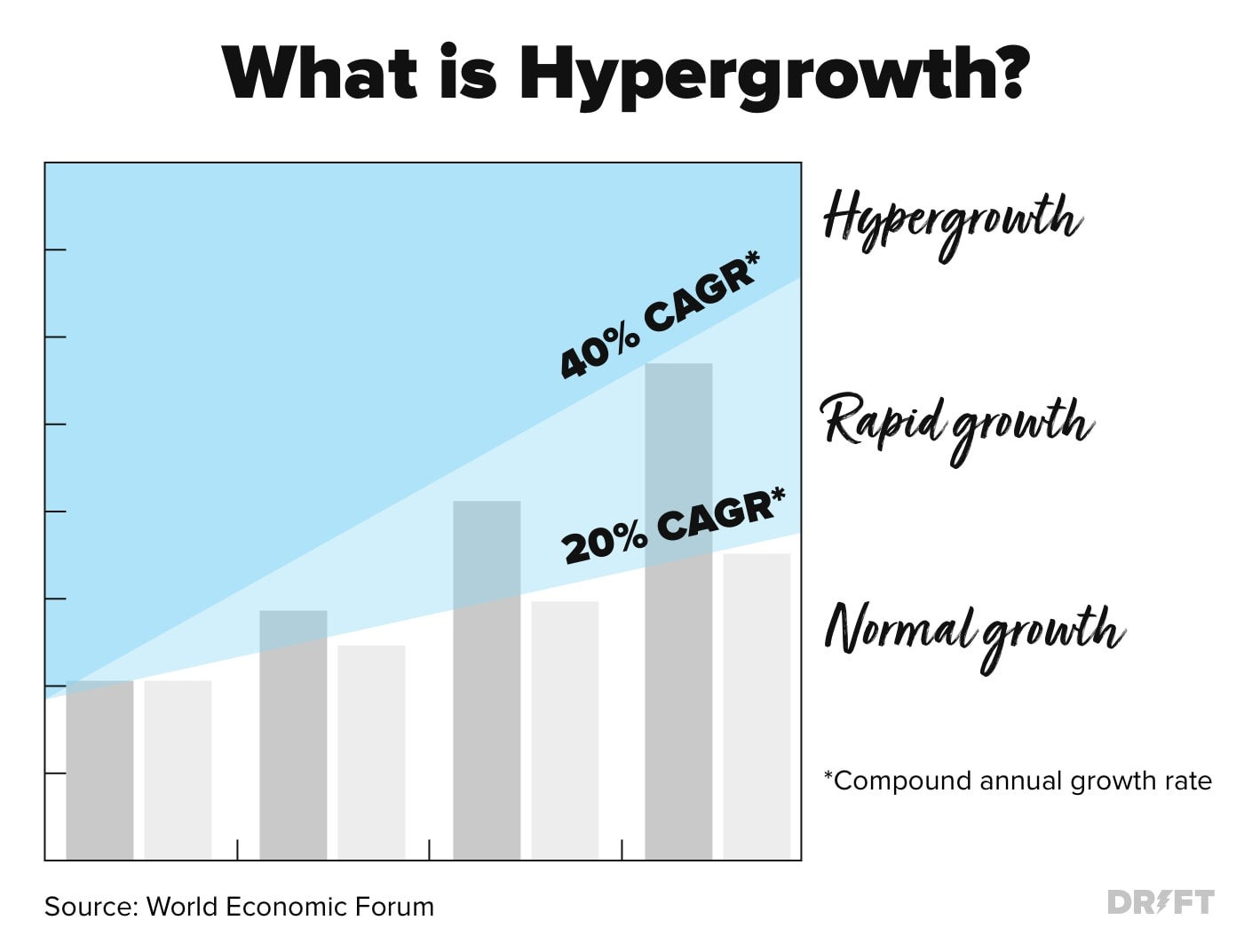

The closer it becomes to 40% CAGR (aka: hypergrowth), the higher the attributed multiples would be. This could be driven by the Commercial segment which is now in “hypergrowth” with ~46% LTM growth and lots of room to sustain growth or possibly even accelerate.

If Palantir can show that it can grow substantially during a macroeconomic downturn like the current one, analysts would be more prone to attribute higher multiples.

Conclusion

Analysts are waiting for a signal to regain confidence in the management’s ability to drive the Group's growth at least in line with the 30% long-term Guidance.

Current expectations are low. If Palantir shows clear signs of acceleration and probable, consistent, future acceleration, with a confirmation of the 30% long-term Guidance, analysts could easily regain confidence in assigning higher expectations. This, in turn, would lead to higher multiples.

“Tough times bring out great leaders. The way you win in tough times is by making an asset more valuable.” - Alex Karp, Palantir CEO

Yours,

Arny

If you enjoyed this article, smash that like button and share it! Grazie.

Join me on:

Twitter: @arny_trezzi

YouTube: @Arny Investing

Business Email: arnylaorca@gmail.com

Join Emanuele20x on:

Twitter: @Emanuele20x

YouTube: @Emanuele20x

Substack: Emanuele’s Notepad

View expresses are my own and do not represent Financial Advice in any way.

I own (many) PLTR stocks.

Great research, full of real insight , thank you!

Thanks to you mate!