#75 Palantir: the ARKK Curse Continues

↳ Curse or opportunity?

Editor: Emanuele Marabella

I’m Arny. Thank you for joining 1.745 investors who receive the deepest Palantir research. Please hit the ❤️ button if you enjoy today’s article.

Palantir is increasingly becoming known as a key defense contractor providing crucial support in the war in Ukraine, yet Mr. Market is not rewarding it.

Mr. Market is actually penalizing Palantir with a “curse.”

While Legacy Defence contractors’ stocks continue to benefit from the war in Ukraine, Palantir is still anchored by ARKK as we discussed previously (Palantir in a sinking ARKK) and is ~30% down since.

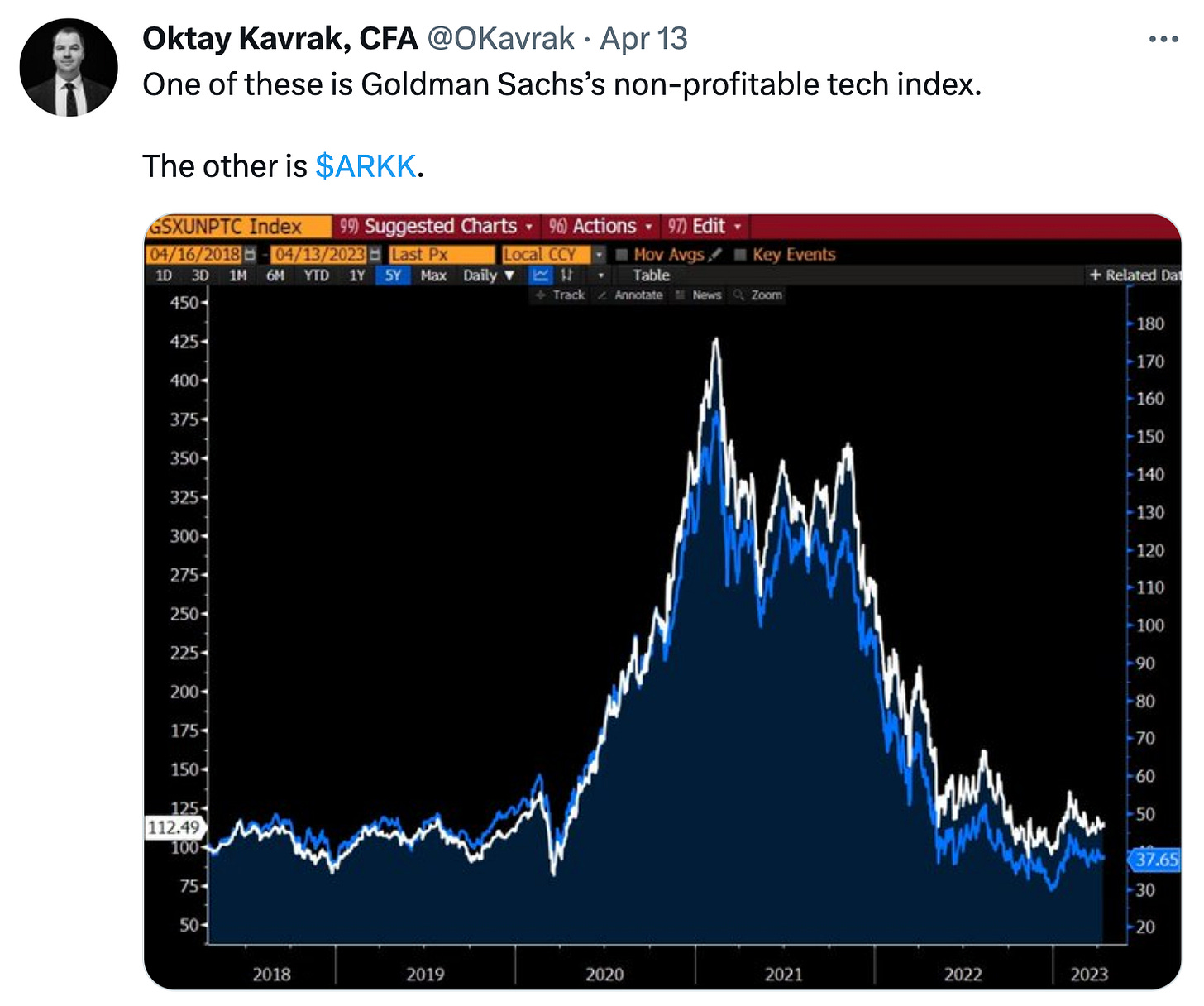

As a reminder, ARKK has become a proxy for the most speculative corner of the market, typically represented by “unprofitable tech” and “MEME” stocks. Its price precisely tracks that of Goldman Sachs’s nonprofitable tech index.

Despite Palantir not being included in ARKK since March ‘22, its price keeps tracking it more closely than its biggest components.

If you are interested in a complete overview of ARKK, I highly encourage you to read "ARK Invest Short & Squeeze" by Maverick Equity Research!

Common interest

The strong correlation seems supported by common patterns of interest for the two in terms of Google searches. Interest in Palantir and ARKK spiked along with stock prices during lockdowns and dropped incessantly since.

Now interest for both Palantir and ARKK is at multiyear lows.

Interestingly, the correlation in interest is extreme even by looking at the narrower time window where it can be noticed that people are more actively searching for “Palantir” and “Arkk” during the working week.

Despite this having nothing to do with the business fundamentals, this dynamic has repercussions in the short term when it comes to stock movements.

The strong correlation with ARKK makes Palantir less susceptible to other themes like “AI” and “Cloud.”

For instance, the other day Microsoft spiked 7% after reporting strong Q1 results for its Cloud division. Snowflake and Datadog increased by 7% while Servicenow followed with a +2%.

Palantir stayed flat, exactly in line with ARKK.

Is ARKK over-penalized?

Given the strong connection in the short term, it could be helpful to have a sense of where ARKK’s valuation stands in relation to the 10y Treasury yield, the key factor affecting its valuation being concentrated in growth stocks like Palantir (Palantir Competes vs. a Tough Competitor). This can help us assess the degree of skepticism of the market around it.

Interestingly, ARKK currently seems over-penalized by the move in the interest rates as it is trading ~30% below the level it was in 2019 when the 10y Treasury was at the same level as today.

Given the considerations above, if ARKK regains the appetite of investors, Palantir could benefit from it too.

Ending the curse

In order to end the curse, Palantir needs a strong narrative shift as correlations are difficult to break once established due to the high presence of algorithmic trading in the market.

I believe the key factor ending the curse could be a series of GAAP profitable quarters that would make Palantir steps closer to entering the S&P500, which now has become a possibility despite the dual-class shares structure.

Conclusion

The “ARKK curse” is still strong and likely to continue until Palantir will prove it can sustain a level of GAAP profits necessary to enter the S&P500.

Until then, I am happy for the opportunity provided by the curse and patiently await for the story to unfold.

“We are the dominant player in pure software defense in the world” - Alex Karp, Palantir CEO

Yours,

Arny

Join me on:

Twitter: @arny_trezzi

Youtube: @Arny Investing

CommonStock: @arny_trezzi

View expresses are my own and DO NOT REPRESENT FINANCIAL ADVICE.

I own PLTR stocks.

Great take, Ark & PLTR are quite a conundrum ... sooner or later it should decouple positively for PLTR.

Ark Short & Squeeze report, 3rd edition coming out soon:

https://maverickequityresearch.substack.com/s/ark-short-and-squeeze

Thank you for your research and have a great weekend!