+315% RETURN ON INVESTMENT | Palantir Bullets #15

This week's Palantir developments and the crowned “Tweet of the Week”

Editor: Emanuele Marabella

Hi, I’m Arny. If you are new, you can subscribe to spot Palantir asymmetries with 1.402 investors. Please hit the ❤️ button if you like today’s article.

PLTR 0.00%↑ this week:

Forrester releases a deep study on the impact of Palantir Foundry. In the report, Forrester shows how Palantir Foundry is able to generate for clients a return on investment of 315%, or more than $300mn benefit, over three years. Benefits include 30% in cost savings from better supply chain management and inventory management and procurement process. This proves the thesis we shared in July (Is Palantir recession-proof?) that despite a recession that could initially slow down the business, Palantir is in a position of strength because companies need its solutions to deal with adversity. You can find the full report here.

Palantir partners with Compredict, to develop virtual sensors for future vehicles. Compredict, founded in 2016, is a German startup offering data-driven virtual sensors built to replace hardware sensors across automotive applications. This is no real news as we reported Compredict as a client in Palantir #13 thanks to @TheKameroon. The peculiarity of this announcement is that Compredict enters the Foundry for Builders program.

@TheKameroon found evidence supporting that Focus Brands is now a Palantir client. Focus Brands is an American company owning various brands including Schlotzsky's, Carvel, Cinnabon, and operates over 5,000 stores.

Joe Lonsdale, Palantir co-Founder, highlights Palantir’s strength of empowering human decision-making. He also praised Palantir’s GAAP profitability, which is “the new cool thing in 2023.” In a recent article, I underlined how Palantir is still negative on a GAAP Operating basis (Palantir's GAAP Profits: Fake Yet Good), however, GAAP profitability provides a strong signal to investors and clients (Palantir GAAP Profits: The Cost of Responsibility).

Palantir is working with its partner BigBear.ai and Appian on the Global Force Information Management system (GFIM) system. Appian is a platform as a service (PaaS) company focused on low-code development and process mining. Its services are used by more than 200 government agencies including the Department of Defense. Collaborate to monopolise.

Palantir will participate as an Event Partner for the NHS ConfedExpo this June. Good signal for the NHS contract?

Palantir institutional ownership increases to 34%. This is in line with the ownership shift that I described in my previous article (Palantir in a sinking ARKK). Below you can find the link to access Chris’ amazing dashboard!

Palantir insiders sold RSU-related shares as anticipated in the last Bullets. All regular.

Related Tech trends/Macro:

Palantir is set to capitalize on 3 of the key trends highlighted by Gartner’s Emerging Tech Impact Radar for 2023:

The Biden Administration announced an additional $10 billion aid package to Ukraine on Friday. This came just after announcing another $2 billion in military aid and a new round of sanctions targeting Russia.

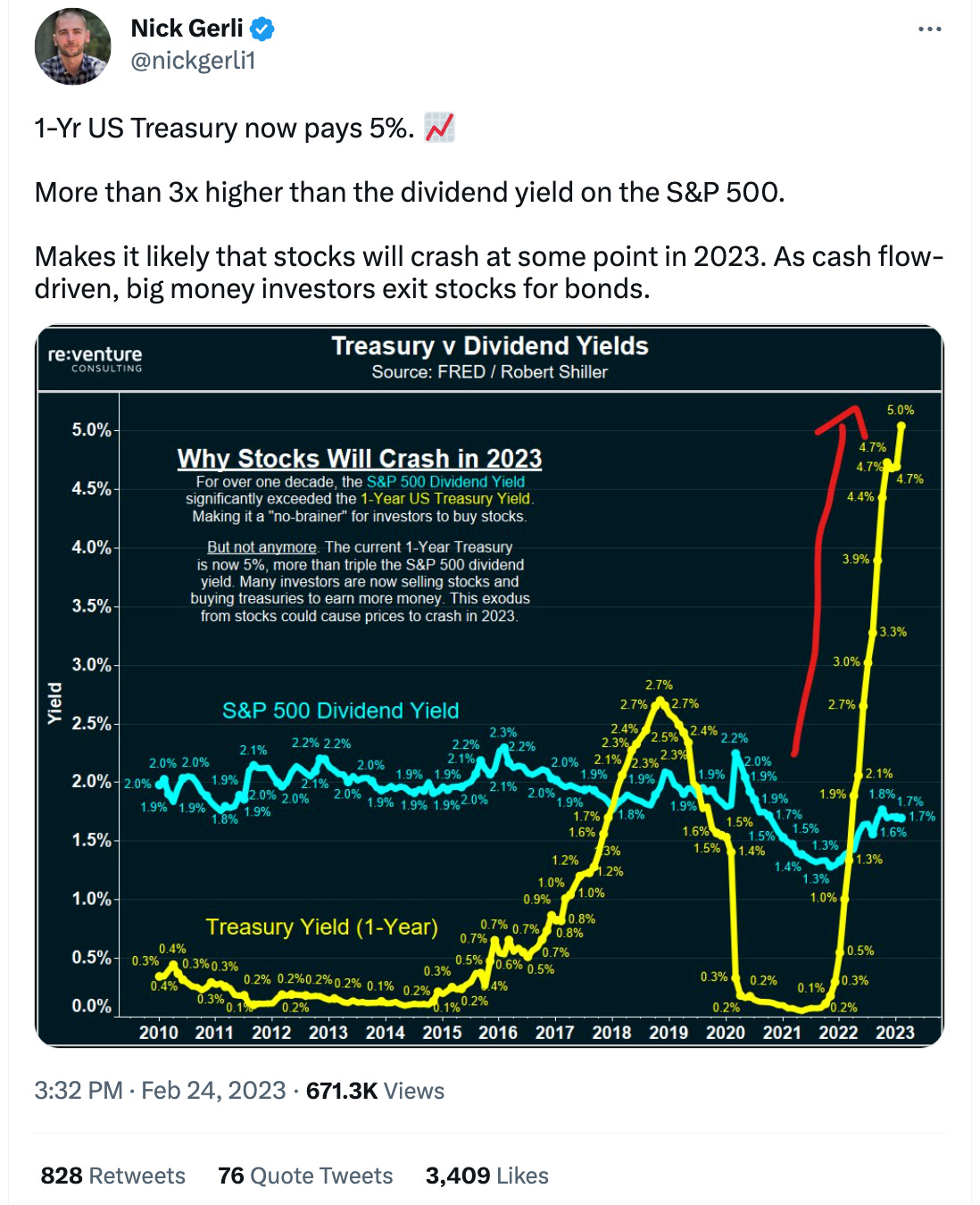

The Yield on the 1y Treasury reaches 5%. At this point, each investor should ask himself: “why should I invest in Equity when I get more return risk-free?” I discussed my portfolio positioning in a dedicated article (Laorca Portfolio Update).

Tweet of the week

Yours,

Arny

This is not financial advice. I own PLTR shares.

great, thank you!